I recommended Arista Networks (NYSE:ANET) in May 2023, for around $160. The price has more than doubled since then but is about 6% below its all-time high of $376. The stock has been insanely successful in the past year, with a return of 95%, and in the past decade with a return of 1,779%. Is it still worth buying at 41x earnings and 16x sales? I believe so, it is easily one of the best positioned for Hyperscalers, Cloud Service Providers, and other high-performance low latency networks for enterprises and campuses.

In my first article, the main reasons for buying the stock were as under:

- Arista Networks’ cloud-based, high-speed integrated networks have made significant inroads in cloud networking solutions.

- Its focus on cloud and hyperscalers gives it commanding heft and a huge competitive advantage in that user segment.

- Arista should continue to benefit from spending on AI and the need for faster and low-latency networks.

- While it had tremendous growth in the last decade, growth in the next is likely to be slower.

- Arista is easily the best in its category, overpriced, but definitely worth buying on declines.

As Capex spending and Hyperscaler build-outs for AI continued it isn’t just GPUs that are being bought in the truckloads, networks, also continue to see humongous demand, and while I did provide for growth there was a growing realization that I was too conservative and we were really just at the tip of the iceberg, and that this could see sustained growth for a long, long time.

I believe the company can continue to dominate high-speed integrated networks, without which AI would simply collapse.

Internet V InfiniBand and supplier concentration risk

InfiniBand, which is Nvidia’s (NVDA) connectivity solution is currently the preferred solution for Hyperscalers rolling out AI platforms and cloud services. It is bundled with their GPUs and relieves customers from dealing with more than one vendor, often also being sold as the better solution.

Ethernet is the other solution and Arista and Broadcom (AVGO) are strong competitors among several, ensuring that Ethernet wins its fair share of contracts. Besides, concentrated supplier risk and supply chain risks with Nvidia should continue to power Arista Networks.

What are InfiniBand’s limitations and where does Ethernet score?

More switches needed for scaled operations: There are indications that InfiniBand’s utility peaks at 40,000 nodes or GPUs. However, given there are build-outs planned for 50,000 to 100,000 accelerators, there will be a need for Ethernet, and as the Next Platform indicated Ethernet is about 20% cheaper. It also suggested that clients like Microsoft (MSFT) and Meta Platforms (META) accepted the lack of some multitenancy and security features that came included with Ethernet, which going forward may not be an easy compromise. Despite that, Microsoft spent $1.2Bn in 2023 and Meta spent $1.05Bn in 2024 for Arista’s products and services, demonstrating that Arista is and will hold its own. In the first half of 2024, Microsoft and Meta contributed over 10% each of Arista’s revenue.

Improvements in Ethernet, indicate that Ethernet will be a formidable rival, and over time adoption should increase to 45% of Gen AI workloads by 2028. It may not be the best solution for back-end AI training but it has definite advantages in inference and edge computing:

From an article in the register

The swing will come because Ethernet is improving. Gartner currently rates it as “not ideal” for AI training, but Verma highlighted three innovations she feels will make Ethernet a worthy – even superior – contender against InfiniBand:

- RDMA over Converged Ethernet (RoCE) – will allow direct memory access between devices over Ethernet, improving performance and reducing CPU utilization;

- Lossless Ethernet – will bring advanced flow control, improved congestion handling, hashing improvements, buffering, and advanced flow telemetry that improve the capabilities of modern switches;

- The Ultra Ethernet Consortium’s (UEC) spec in 2024 – is designed specifically to make Ethernet AI-ready

Broadcom, which expects to make 35% of its semiconductor revenue from AI solutions, goes a step further, asserting that Ethernet is a better solution. The $50Bn behemoth, another strong Ethernet player also stated that power efficiency was higher with Ethernet compared to InfiniBand, and like Arista, it was tailoring solutions, but not for enterprises, instead for consumer AI, such as image recognition solutions for tagging on social media. It believes that it is more useful to target well-defined customer needs and use cases instead of broad-scale generative AI. Broadcom’s value is in connecting AI workloads via Ethernet to endpoint scheduled devices, echoing Arista’s claim that as AI becomes more pervasive its real value will be at the front end, which will always be dominated by Ethernet, as a mature and broadly supported and adopted system.

From a Forbes article on Broadcom:

Bluntly stated, InfiniBand represents a somewhat proprietary architecture, despite its ability to deliver high bandwidth, reliability and low latency for supercomputing applications. On the other hand, Ethernet has proven its staying power since 1980 and is a mature, open connectivity technology supported by a broad ecosystem. By improving both bandwidth performance and power efficiency, Broadcom is closing the gap for the even broader application of PCIe switching to AI connectivity. The power consumed by AI workloads is alarming to many enterprises, especially given the focus on more sustainable and greener IT operations.

If you can’t lick them, join them: Nvidia is also ramping up Spectrum-X ethernet to its customers, as many customers insist on Ethernet, clearly indicating that the networking market has room and needs several products to fulfill different needs. Nvidia expects Spectrum-X Ethernet to become a multibillion-dollar product line in a year.

Switching costs

Arista’s client wins are hugely competitive wins against legacy providers, not just looking to move higher with Gig speeds, they are looking primarily to reduce complexity and move on to simpler solutions as a partner. Switching costs for customers who’ve engaged with Arista are going to be high. Here’s Ashwin Kohli, Chief Customer Officer from Arista’s second quarter conference call:

The same customer once again was struggling with extreme complexity in their routing environment, as well with multiple parallel backbones and numerous technical complexities. Arista simplified their routing network by removing legacy routers, increasing bandwidth and moving to a simple fixed form factor platform router.

The third example is the next win in the international arena of a large automotive manufacturer that due to its size and scale, previously had more than 3 different vendors in the data center which created a very high level of complexity both from a technical and also from an operational perspective. The customer’s key priority was to achieve a higher level of consistency across their infrastructure which is now being delivered via a single U.S. binary image and CloudVision solution from Arista. Their next top priority was to use automation, consistent end-to-end provisioning and visibility which can be delivered by our CloudVision platform.

With the AI revolution going on and customers tending to migrate to low-latency networks, switching costs will be a huge competitive advantage for Arista, especially when they’ve resolved customers’ legacy networks with older-generation technology.

Conference call key takeaways

This was an excellent call and I would urge investors to go through the entire Arista Q2 transcript, as there is a lot of transparency, detail, and analysis provided by management, that is very clear in its objectives. In the interest of brevity here are a few.

Jayshree Ullal, CEO re-affirming that Ethernet is going to remain as strong as ever on the front end, inference, and edge markets and also make inroads in the back end.

Well, I think there are a lot of market studies that point to today is still largely InfiniBand. You remember me, Ben, saying we were outside looking in just a year ago. So step 1 is we’re feeling very gratified that the whole world, even InfiniBand players have acknowledged that we are making Ethernet great again. And so, I expect more and more of that back end to be Ethernet. One thing I do expect, even though we’re very signed up to the $750 million number — at least $750 million, I should say, next year, is it’s going to become difficult to distinguish the back end from the front end when they all move to Ethernet. For this AI center, as we call it, is going to be a conglomeration of both the front and the back. So, if I were to fast forward 3, 4 years from now, I think the AI center is a supercenter of both the front end and the back end. So, we’ll be able to track it as long as there’s GPUs and strictly training use cases. But if I were to fast forward, I think there may be many more edge use cases, many more inference use cases and many more small- scale training use cases which will make that distinction difficult to make.

As I’ve often said, it’s more a bus technology. So eventually, where Arista plays strongly both on the front end and back end is on the scale out, not on the scale up. So independent of the modularity, whether it’s a wrap-based design, a chassis or multiple RU, the ports have to come out Ethernet and those Ethernet ports will connect into scale-out switches from Arista.

Jayshree Ullal, CEO on its relationship with Nvidia and its competitive position, emphasis mine.

it’s complicated with NVIDIA because we really consider them a friend on the GPUs as well as the mix, so not quite a competitor. But absolutely, we will compete with them on the Spectrum switch. We have not seen the Spectrum except in 1 customer where it was bundled. But otherwise, we feel pretty good about our win rate and our success.

And so, I think it’s fair to say that if a customer were bundling with their GPUs, then we wouldn’t see it. If a customer were looking for best of breed, we absolutely see it and win it.

CEO, Ullal confirmed that they were getting strong business from the early adopters and fast followers and believed that the risk-averse and a fourth cohort, disillusioned with the public cloud and looking to get back in their own data center were untapped opportunities. There are a lot of trials and pilots in the works, which should translate into sales in 2025 and beyond.

Life beyond the hyperscalers

One of my key concerns in my last article was Arista’s dependence on Hyperscalers (Meta and Microsoft totaled 39% of sales in 2023) and the possible lack of opportunities for rapid growth beyond them. However, enterprise and financial customers (36% of 2023 sales) have grown revenues by 50.5% in 2023. Much faster than the Hyperscaler growth of 25%. These customers too need to build out faster and better networks, and I believe that demand will sustain from them as they increase the move towards low-latency and speed. The chances of these smaller customers who have broader, more widely adopted ethernet, switching to a more complicated InfiniBand is lower than that of the Hyperscalers, which will provide sustainable revenue for Arista in the future.

Jayshree Ullal, CEO from the Arista Q2 conference call, emphasis mine.

Having said that, at the same time, simultaneously, we are going through a refresh cycle where many of these customers are moving from 100 to 200 or 200 to 400 gig. So, while we think AI will grow faster than cloud, we’re betting on classic cloud continuing to be an important aspect of our contributions.

Profitable Growth

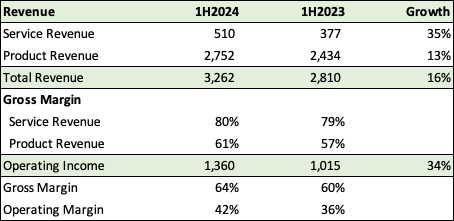

Arista Network Margins (Arista, Fountainhead)

For the 1H of 2024, service revenue, while still a small portion (16%) of total revenues grew much faster at 35% compared to product revenue of 13%, significantly contributing to company-wide 16% revenue growth. Service revenue gross margins are also very impressive at 80% compared to 61% for product revenue, leading to operating income growth of 34%

Gross margins grew to 64% from 60% and operating margins to 42% from 36%.

Arista’s CEO attributed strong margin growth to a renewed focus on efficiency. I’m very impressed with this team, which is focusing on profitability and not unprofitable market penetration. With service revenue increasing as their user base grows, I believe the market will continue to reward them with better multiples.

Weaknesses and Challenges

Growth could slow down: It is difficult to maintain the scorching revenue growth of 36% it has had in the past three years. My forecast calls for an 18% revenue growth from 2023 to 2026, which means we could have a period when the stock goes sideways for a while. Or worse, it could be priced for perfection, and we’ll see a massive drop after a bad quarter.

Competition: Cisco could regain its footing and become Arista’s main competitor, given the new initiatives launched by management and the renewed focus on platformization, switching from a passive lumbering incumbent to a 7 times bigger aggressor. Broadcom is also staring at an estimated AI run rate of $10-12Bn in networking and ASICs.

Consolidation trends within the industry: Cisco acquired Acacia Communications, Broadcom acquired Brocade Communications and VMware, Dell acquired Force10 Networks, and Hewlett Packard Enterprise recently announced the acquisition of Juniper Networks. All these companies are significantly bigger than Arista Networks and will likely gun for the lucrative 34% operating margins that Arista makes now.

Valuation and investment thesis

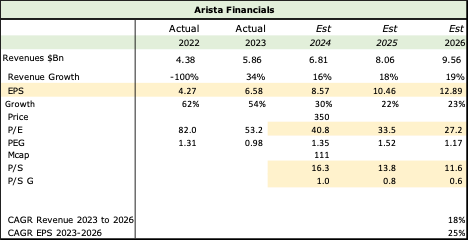

I’ve revised my model from 2023, I do believe that management tends to be conservative, and this is going to continue growing.

Arista Financials (Arista Networks, Fountainhead, Seeking Alpha)

While I do emphasize P/E and P/S multiples as good benchmarks and Arista does look expensive at 16X sales and 41x earnings, I still believe it is a terrific investment, and that the markets will reward high-quality, market leaders and innovators such as Arista for the following reasons:

Its pole position in large-scale network buildouts for its cloud titans that are leading the AI revolution. Besides Microsoft and Meta in the US, Arista also works with Chinese cloud titans. Even if Nvidia is likely price gouging for InfiniBand, Arista’s operating profit margin of 42% indicates that Arista is not suffering either, that they’re not selling at a discount to counter InfiniBand.

Ethernet will continue to get a reasonable share of the networking market, especially in the front end, and not wilt under Nvidia’s InfiniBand in the back end either.

Tremendous faith in the management, which has done an outstanding job taking the most profitable segment of the market away from the 800-pound gorilla Cisco and is strongly poised to grow it.

Very strong operating profit margins of 42%, and a growing services component.

Strong brand recognition outside of Hyperscalers, which will continue to bolster its growth.

Read the full article here