This is my third Outlook Therapeutics (NASDAQ:OTLK) article. As I will discuss, its situation is getting stickier in terms of current liquidity and timing. I am downgrading my Strong Buy rating from 06/2024’s “Outlook Therapeutics: Worth A Good Strong Look After CRL”; instead, I am rating it a Buy. In doing so, I am emphasizing its risks.

Outlook’s Wet AMD therapy’s massive blockbuster potential compared to its current puny market cap presents an unusual opportunity as I discuss. In this article, I rely upon and refer to Outlook’s fiscal Q3, 2024 earnings as reported on 08/14/2024 in its:

- earnings press release (the “Release”);

- earnings conference call (the “Call”);

- 10-Q (the “10-Q”) and

- its latest website presentation (the “Presentation”).

Outlook’s Wet AMD Therapy has strong blockbuster potential if it can overcome its FDA hurdles.

General

Outlook’s sole pipeline asset is LYTENAVA (ONS-8010, bevacizumab-vikg) for the treatment of wet AMD. It is administered as an intravitreal injection. As described in the 10-Q (p. 24), US retina specialists regularly use repackaged bevacizumab off-label. It is one of a number of anti-VEGF therapies.

Such therapies are recognized within the retina community globally as the standard-of-care treatment option. Outlook’s strategy has been to develop bevacizumab for treatment of wet AMD as an approved therapy. It believes this creates realizable value by mitigating risks associated with off-label use of unapproved bevacizumab.

Blockbuster Potential

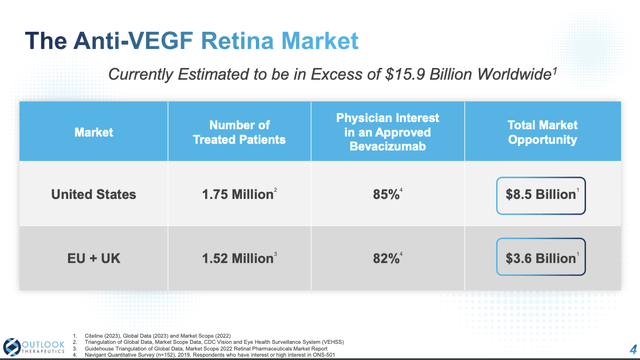

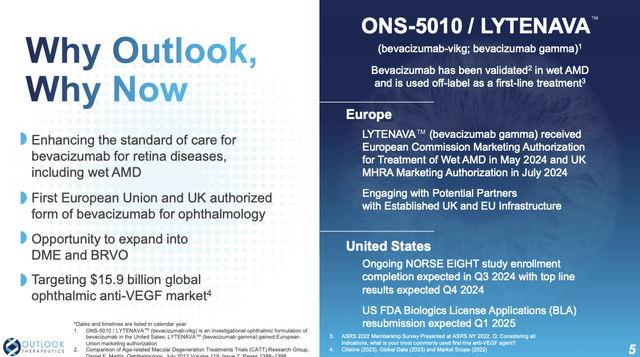

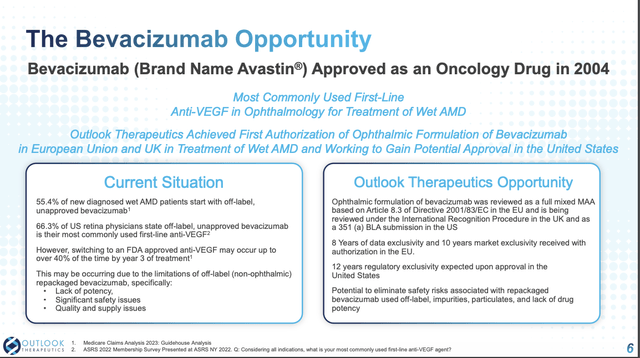

Three Presentation slides describe LYTENAVA’s setup that leads to its blockbuster potential:

slide 4 —

ir.outlooktherapeutics.com

slide 5 —

ir.outlooktherapeutics.com

slide 6 —

ir.outlooktherapeutics.com

Slide 4 shows the potential $15.9 billion market for the anti-VEGF retina universe; slides 4 and 5 show Outlook’s progress in accessing this market. It already has regulatory approval in the EU and as discussed below has long been engaging with the FDA to secure its approval.

Slide 6 is critical for those looking to support a bull thesis for Outlook, particularly its panel labeled “current Situation”. It explains a typical progression of newly diagnosed wet AMD patients. They start with off-label (non-ophthalmic) repackaged bevacizumab, within a few years up to 40% switch to an FDA approved anti-VEGF.

This is where LYTENAVA sees its opportunity if it can snag an FDA approval. Outlook’s latest 10-K (p.13) lists ~7 FDA approved branded and biosimilar VEGF inhibitors. It also explains its strategy of positioning LYTENAVA as an affordable, FDA and EMA-approved bevacizumab option that is safe, effective, and manufactured under proper guidance.

FDA Hurdles

Outlook has performed admirably in securing European approval for LYTENAVA; however, that is small potatoes compared to getting FDA approval. The 10-Q, pp. 23-24, describes Outlook’s on-again, off-again efforts to secure FDA approval.

In 03/2022 it filed its BLA for LYTENAVA in the treatment of wet AMD and other retinal disease. It voluntarily withdrew the BLA in 05/2022 to provide additional information requested by the FDA. In 08/2022 it re-submitted the BLA to the FDA. In 10/2022, the FDA accepted it for filing with a PDUFA date of 08/29/2023.

Instead of the hoped for approval, 08/2023 brought a CRL; the FDA cited a trifecta of:

… several chemical, manufacturing and control, or CMC, issues, open observations from pre-approval manufacturing inspections, and a lack of substantial evidence…

At subsequent FDA meetings, Outlook learned the FDA would require:

…the successful completion of an additional adequate and well-controlled clinical trial evaluating ONS-5010, as well as additional requested CMC data indicated in the CRL to approve ONS-5010 for use in wet AMD.

In 01/2024 Outlook announced a major step forward towards defining its new required clinical trial. NORSE 8, the required new trial, was anticipated to be complete in short order to permit a renewed BLA filing in late 2024. This ambitious timeline has slipped.

During the Call, CEO Trenary announced its latest plans for resolving its CRL issues and resubmitting its BLA as follows:

…Top line results from NORSE EIGHT are expected in the fourth quarter of this year and if positive should provide sufficient clinical data to resubmit our BLA with the US FDA in the first calendar quarter 2025. In addition, we’ve completed our planned Type C and Type D meetings with the FDA and believe we have addressed the open CMC items that were received in the CRL.

Unfortunately, Outlook does not enjoy a financial position which allows it to shrug off such delays, as discussed below.

Outlook labors under a tenuous financial position

Outlook’s 10-Q includes the following daunting advice in its liquidity section relating to its overall financial condition:

Management does not believe that the existing cash and cash equivalents as of June 30, 2024 are sufficient to fund the Company’s operations through one year from the date of this Quarterly Report on Form 10-Q. As a result, there is substantial doubt about the Company’s ability to continue as a going concern…

During the Call, CFO Kenyon put this in more granular terms. He advised that Outlook had a cash balance of $32 million as of 06/30/2024. In terms of cash runway, he indicated that this cash plus the $107 million that it anticipated from full exercise of outstanding warrants should be sufficient to fund operations through 2025.

In terms of cash burn, the 10-Q notes that it used net cash ~$52 million in operating activities during the nine months ending 06/30/2024. There are 18 months between 06/30/2024 and 12/31/2025. It would need ~$104 million to cover operating activities at the same rate of operations.

With $32 million of cash on hand, it needs to generate at least another $72 million. Management hypothesizes generating this from exercise of warrants; there can be no assurance that this will pan out. It is essential that there be a plausible plan B.

The liquidity section partially excerpted above notes that management is actively considering other options for generating cash, such as:

- collaborations of various flavors;

- additional borrowings;

- additional stock offerings.

As it notes, there are no assurances that it will be able to generate additional funds under any of these. The cash on hand is really all it can count on, and this only gives it a runway to the end of 2024.

Conclusion

Seeking Alpha’s Ratings Summary PANEL for Outlook speaks volumes. Analysts such as myself and the 7 Wall Street analysts who cover the stock allow ourselves to be tempted by its outsized upside potential. The Wall Street Analysts covering it have an average price target of $37.43 for a 397.08% upside.

Seeking Alpha’s quant system, on the other hand, depends upon actual metrics. In such an environment, I think, it fails; it rates a “Strong Sell”. I have tempered my optimism, reducing my previous “Strong Buy” to a “Buy”. I have done so because its risks are more pronounced by reason of its reduced liquidity and its extended time to file its BLA.

In doing so, I note that the big picture remains the same. Outlook continues to present a high risk that investors lose their entire stake. On a more positive note, there is a significant chance that investors get to enjoy an asymmetrical gain.

Read the full article here