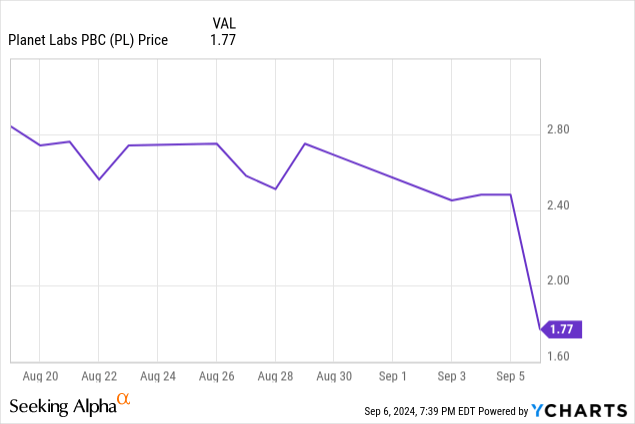

I’ve been looking a lot at companies who make their revenues (or at least plan to) through operations in space. I’m not sure why so many of those have been coming up on my radar lately, but the Q2 earnings release of Planet Labs PBC (NYSE:PL) has me looking at them closely, especially after they dropped in price significantly on revised Q3 guidance.

Today, we’ll be looking at Planet Labs more closely, examining what the company is offering in terms of value as it tests new 52-week lows, how it looks like with prospective growth in years to come, and how their current margins affect the company’s long-term chances.

Understanding Planet Labs

Planet Labs is a company that makes its money by collecting a large data set of high and medium-quality satellite images, covering every point of the surface of the Earth. They supply this data on a non-exclusive basis to commercial and government customers for a fee.

The company supplies customers in the agriculture business, along with energy, forestry, finance, and insurance, along with government at the federal, state, and local level, along with international groups.

Planet Labs also uses artificial intelligence and cloud computing to conduct increasing analysis on daily Earth changes in its satellite imagery, which they are hoping will expand the company’s reach into new customers and new applications for their services.

The Q2 Earnings Report

Just this last Thursday, Planet Labs released its second quarter earnings. The company came in-line with a loss of 6¢ per share, and a slight miss on the revenue side, a revenue of $61.09 million that came in about $700,000 below what was expected.

This probably wouldn’t have led to as much of a market reaction as it did except for the company revising its Q3 revenue guidance downward, predicting revenue from $61.5 million to $64 million compared to a previous consensus estimate of $64.16 million.

Consolidated Balance Sheet

|

Cash and Equivalents |

$148 million |

|

Total Current Assets |

$327 million |

|

Total Assets |

$658 million |

|

Total Current Liabilities |

$140 million |

|

Total Liabilities |

$185 million |

|

Total Shareholder Equity |

$473 million |

(source: most recent 10-Q from SEC)

While balance sheets for growth companies without a history of profits are often dicey, Planet Labs has a very nice-looking balance sheet, especially after the recent sell-off in the stock. The company has a nice amount of cash on hand, and few real liabilities to contend with right now. This gives them a lot of flexibility as they try to grow into a profitable venture.

At current prices, the company trades at a price/book value of 1.44, which is well below the sector median of 2.74. That suggests to me that the company may be oversold at this point, and may warrant taking a closer look at.

The Risks

Planet Labs, like all growth companies, faces a lot of risks that prospective investors need to be aware of. The most obvious and biggest risk is the lack of profitability, and the question remains as to whether Planet Labs will ever achieve sustainable profitability.

The satellite imagery market also sees an increasing amount of competition from both commercial and government entities. While the cost of entry is a bit high for getting satellites into orbit and collecting a large dataset, new competition could do harm to Planet Labs just as they are trying to achieve profitability.

Technology, especially the software that processes the data, is rapidly evolving, and that means Planet Labs has to work hard to remain at the forefront of the industry.

The company’s revenue also depends a lot on various governments around the world, and if the priorities and policies of those governments change, that could reduce the amount of demand there will be for Planet Labs’ services.

Statement of Operations

|

2022 |

2023 |

2024 |

2025 (1H) |

|

|

Revenue |

$131 million |

$191 million |

$221 million |

$121 million |

|

Gross Profit |

$48 million |

$98 million |

$113 million |

$64 million |

|

Operating Income |

($128 million) |

($176 million) |

($170 million) |

($74 million) |

|

Net Income |

($137 million) |

($162 million) |

($141 million) |

($68 million) |

|

Diluted EPS |

($1.72) |

(61¢) |

(50¢) |

(23¢) |

(source: most recent 10-K and 10-Q from SEC)

When looking at the losses for 2022-2024, we might be tempted to conclude that Planet Labs is another typical unprofitable growth company. There are aspects of the operating statements that I think we need to keep in mind, however.

The company has not only growing revenue, but is seeing its gross profit expand year over year. Gross margin is improving every year, and this quarter was at 53%, up from 49% in the previous year. The non-GAAP gross margin in Q2 was reported as 58%, and the company predicted that they will likely crack 60% in that non-GAAP figure next quarter.

While the company has its expenses to keep the operations running, an improving gross profit line will help them to pare away the loss of money and allow them to manage operations with their current cash on hand and not have to dig up new sources of financing any time soon.

Estimates are that the loss is really shrinking as the company grows. In 2025, the company is expected to come in at revenues of $253 million with a loss of 20¢ per share. 2026 is even better, with revenue of $294.5 million, and loss down to 11¢ per share. While 2027 is a bit far away to take the estimates as any more than a rough prediction, it is expected that the company will approach break-even that year, losing only 1¢.

Conclusion

I’m always very skeptical of companies that have no history of ever turning a profit before, and I take promises of future growth with a pinch of salt. Despite this, I feel like the sell-off of Planet Labs is more than was justified by a small revision in Q3 guidance. With improving margins and shrinking losses, I feel like this is a risk that may well be worth taking. I’m rating this a buy, albeit a tentative one.

Don’t get me wrong, I understand that there are still risks Planet Labs has to navigate to become a future company of value, or one whose large dataset of imagery may attract an appealing takeover bid. I would never recommend putting a lot of money into a small, unprofitable company merely on the suggestion that the prices are cheap for something that is rapidly growing toward the break-even point with improving margins. I could see where a small flier on the stock is worth considering, however.

For those looking to invest, I would keep a close eye on the future gross margins, as that is really the key if the company is to reach break-even. Seeing how the market continues to react to the recent negativity also could mean an even better entry point is coming in the near-term.

Read the full article here