Last year, one of the most significant trends was the decline of most mortgage REIT and mortgaged-related corporations. The sharp rise in interest rates and the excessive increase in mortgage rates compared to Treasury rates led to substantial valuation declines for most mortgage-related firms. Higher rates have recently led to significant slowdowns in mortgage financing volumes. High base rates have also caused interest costs for many mortgage REITs to soar, causing many to suffer from chronically negative net interest income – effectively making them into cash-burning machines.

Despite this, many investors remained attracted to certain mortgage REITs due to the allure of depressed prices and seemingly high dividend yields. One notable example is AGNC Investment Corp. (NASDAQ:AGNC), a poster child for most residential mortgage industry issues. I have been a long-term bear on that company, initially having a very negative outlook in 2021 and again last year, with the stock declining considerably over that time frame. Since its previous declines last fall (following my previous analysis), AGNC entered a calmer period as mortgage spreads stopped rising. However, as the company announces its Q2 earnings next week, it may be a good time for investors to consider its position, as I believe a dividend cut may be around the corner.

Mortgage Rate Volatility is Rising Again

AGNC’s business model is fundamentally quite simple. The company invests almost entirely in ~30-year residential agency-backed fixed-rate mortgage-backed securities. These are the most typical mortgages utilized by the majority of American households. Fundamentally, these assets have little credit risk because they are guaranteed by government agencies like Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC). Very few of its assets are backed by “Ginnie Mae,” which is wholly government controlled, as opposed to Fannie and Freddie, which are only partially government controlled.

That is an essential point because it means AGNC’s credit risk is ultimately tied to the stability of Fannie and Freddie, institutions that operate at leverage ratios of around 70-90X – giving them little capacity to guarantee mortgage assets in the event of a sizeable 2008-like credit event. If history repeats, as potentially implied by record home valuations, the government may not bail out Fannie and Freddie again, thus creating an existential risk for AGNC. Of course, most investors expect a mortgage bailout to occur if need be; however, should this question return, mortgage rates may spike and hamper AGNC’s book value even if a bailout eventually occurs.

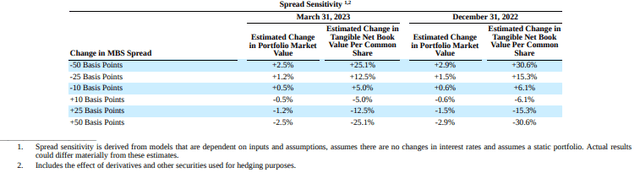

AGNC’s primary risk to its book value is a disproportionate rise in mortgage rates compared to Treasury rates. The company operates at total liabilities-to-assets of around 88%, similar to most banks, so a slight change in the price of its assets compared to its liabilities can have a substantial negative impact on its equity value. Fortunately, the company does hedge against Treasury rates, so it has minimal exposure to a rise in rates, with a 75 bps interest rate hike having a ~-4.1% impact on its book value (10-Q pg. 42). However, a rise in mortgage spreads will still have a substantial negative impact and vice versa. See below:

AGNC Mortgage Spread Risk (AGNC 10-Q Q1 2023)

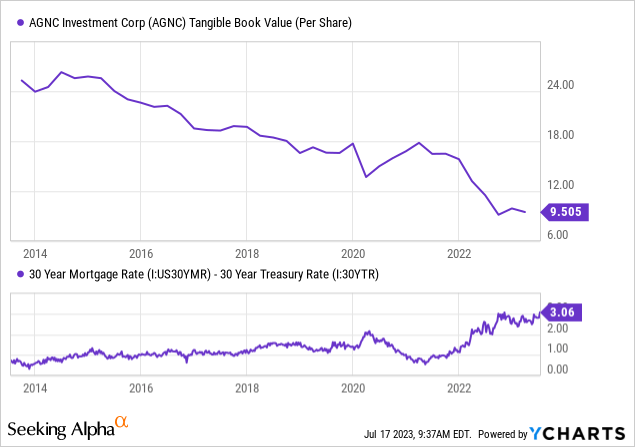

Today, if mortgage rates rise 50 bps faster than Treasuries of similar maturity, AGNC’s book value is expected to decline by around 25%. This risk factor is essentially the same as in many banks that recently suffered significant “off-balance sheet” book value losses due to falling fixed-rate bond securities valuations. In that regard, the critical difference between AGNC and banks is that AGNC’s almost entirely exposed to that ultra-high duration risk asset and, as an mREIT, must post those losses on its balance sheet. As shown below, the rise in mortgage spreads is the primary culprit for its 2022 book value collapse:

AGNC’s book value has declined with a high degree of consistency over time. Recently, its losses are declined to securities value declines; in the past, when rates were lower, its losses were tied to excess refinancing levels associated with low rates – thus, it is in a bit of a “lose-lose” situation regarding changes in interest rates.

In my personal opinion, that trend largely stems from its overly simplified business model, buying publically available securities with significant leverage via short-term borrowing. For the most part, AGNC’s business model could be easily emulated by buying an agency MBS ETF like (MBB) with 5-10X leverage on margin. Hence, the company has only around 50 employees, a tiny figure for being worth around $6B and controlling ~$66B in assets.

In my view, this qualitative point is critical if we consider the theory that companies must add unique creative value to generate a consistent profit. Some mortgage REITs accomplish this by operating unique origination and servicing brands. However, I believe that because AGNC does not offer material creative value to the market, it is best viewed as a speculative trading vehicle (like an ETF) than a true corporation. That does not diminish AGNC’s potential value but illustrates that its business model places its stability entirely in the hands of macroeconomic circumstances, with its managers having essentially no power to improve its circumstances should challenges arise. That fact is apparent today as AGNC is largely stuck with the same strategy even when it is resulting in chronic book value deterioration and unstable cash flows.

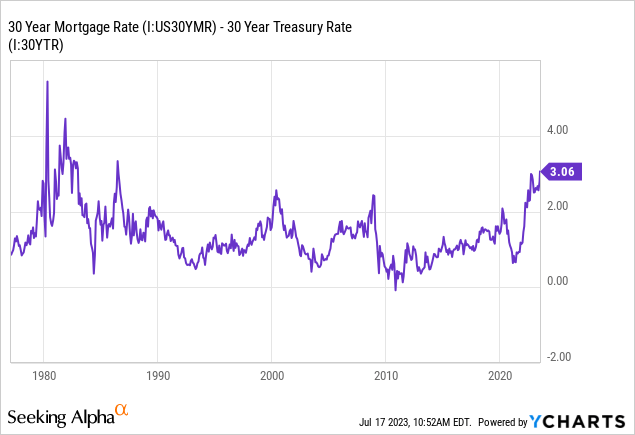

AGNC’s chief risk is a sharper rise in mortgage spreads. Of course, that is also its primary potential reward factor, as a slight decline in mortgage spreads could dramatically improve its equity value. Today, 30-year mortgage rates are around 3% above 30-year Treasury rates. That is a highly high spread that was only nearly matched around the 2000 and 2008 market extremes. However, the spread was temporarily higher in the 1980s stagflationary period, which saw tremendous instability in the mortgage financing industry associated with the savings and loan crisis. See below:

There are relatively strong parallels to the current stagflationary environment and associated banking strains and the 1980s period and its savings and loan crisis. High inflation and low economic stability result in very high volatility in the bond market and larger changes in spreads between mortgages and Treasuries. If not for this macroeconomic regime, I would be more bullish on AGNC, as a significant decline in mortgage spreads would be more likely as mean-reversion kicks in. For example, should the spread fall back to ~1.5% from 3%, that 150 bps fall would likely lift AGNC’s book value per share by well over 50%. Historically, AGNC trades close to its book value, so its stock price would likely match those improvements.

The possibility of a decline in mortgage spreads is large enough that AGNC is not a short opportunity, as it could quickly rise should the mortgage market return to stability. However, I believe it is most likely that mortgage spreads will remain near current levels and possibly rise higher. The recent spread increase points to another potential wave of instability in the market, which could be disastrous for AGNC should this spread figure rise to 4% as it had in the 1980s. For now, I do not believe that risk is necessarily likely. Still, the current banking and mortgage market instability trend seems strong enough to give AGNC a relatively high risk of more significant book value declines.

A Large Dividend Cut Appears Likely

The second major risk for AGNC is much less speculative. Since AGNC expanded during an ultra-low mortgage rate environment, its average asset yield is quite low at ~3.9%. Notably, that is the yield on its assets at market value today, which has increased because the market value of its assets has fallen. AGNC borrows money through the short-term repurchase agreement market, using its securities assets as collateral. Those liabilities are subject to strict covenants, meaning AGNC will need to sell its securities should those assets decline in value sufficiently to push AGNC’s net leverage up too high. That last occurred in April of 2020 when the firm was subject to a margin call amid the MBS market’s temporary meltdown, causing much of those losses to be permanent. A banking or similar risk event that caused a temporary rise in mortgage spreads could cause this issue to recur.

AGNC’s weighted-average cost of funds was ~1% last quarter, up from 60 bps the quarter prior. The company bought interest rate swaps before the interest rate increases last year, with just over half maturing in the next two years (10-Q pg. 15). Should the base rate remain around 5% over the next two years, AGNC will see its net financing costs slowly rise toward that level. In other words, should the yield curve remain inverted or flat, AGNC will fall into chronically negative net interest income. Its hedge portfolio slows the rise in interest costs. Still, it will also slow the decline in interest costs should the Federal Reserve reduce interest rates since it is currently buying longer-dated swaps at elevated levels. Accordingly, unless interest rates are reduced very soon, I believe there is a distinct possibility that AGNC will fall into chronically negative cash flow. In Q2, we will almost certainly see a larger decline in AGNC’s net interest margin as its costs continue to adjust to higher rates.

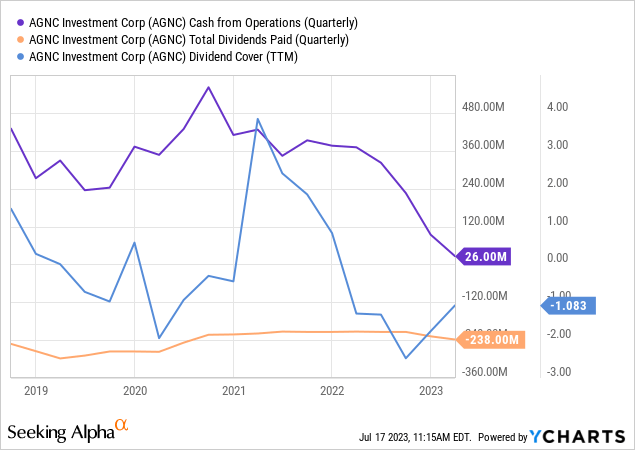

Further, its ability to sustain its dividend appears greatly questionable even by its last metrics. See below:

AGNC must maintain an ample cash supply to remain liquid during volatile periods. The company cannot afford to continue to pay such a large dividend when its operating cash flow is near zero. Further, it cannot substantially increase its debt leverage level at current levels due to its covenants, so it has essentially no capacity to buy significant mortgages at today’s much more attractive rates. AGNC’s only lever is to sell equity and preferred shares.

The company’s outstanding shares have risen by around 13.5% over the past year, meaning investors have been diluted nearly equally to its dividend. Indeed, its net cash from financing over the past twelve months is $3.5B, so it has had a negative “net dividend,” accounting for other means of dilution over the past twelve months. I do not believe this is sustainable since it will hamper its value for shareholders, meaning the company should cut its dividend soon as its cash-flows should trend lower amid higher borrowing costs.

The Bottom Line

Overall, I am bearish on AGNC and believe it will eventually lose its remaining equity value. Of course, there are multiple paths the firm may take depending on macroeconomic circumstances, which could extend or shorten its life expectancy. In an ideal outcome, a larger decline in the inflation outlook and an improvement in economic conditions will cause mortgage spreads to decline and allow the Federal Reserve to normalize rates. That would improve AGNC’s book value per share. Further, considering mortgage rates would still not fall below 4%, refinancing levels would likely remain depressed, allowing AGNC to operate under more ideal conditions. While I believe this outcome is unlikely, it is possible enough that AGNC is not a strong short opportunity.

In a worst-case scenario, banking and property market instability will continue to grow while higher oil prices cause inflation to rebound amid a recessionary economic environment. In this scenario, a potential increase in mortgage market instability causes mortgage spreads to rise while financing costs remain at or above current levels (due to “sticky” inflation), likely leading to a relatively rapid demise for AGNC. As recently detailed regarding inflation-indexed bonds (a potentially strong candidate for that environment), I believe the probability of this “negative” scenario is much greater than the “positive” one mentioned above.

My base case view is that inflation continues to decline at a slower pace, associated with a deterioration in economic growth. In this scenario, AGNC’s book value would likely be stable as mortgage spreads remain near current levels but do not rise. Further, AGNC’s borrowing costs would rise and then moderate and decline, lagging the Federal Reserve’s base rate trend. In my view, this scenario would not save AGNC but subject it to the “slow burn” that steadily erodes its dividend until investors lose confidence, likely over a matter of years. I believe this is the most likely outcome, which should subject AGNC to a slow loss of value, with occasional volatility that could be bullish. Fundamentally, this scenario would continue the pattern seen over most of the past twelve months. For this reason, I am bearish on AGNC but not as overtly negative as I was in 2021-2022 since that was tied to the fast-moving action in mortgage spreads.

Read the full article here