The bitcoin-stock correlation has virtually plummeted to zero. This correlation measures the degree to which the price of bitcoin moves in tandem with U.S. stock prices.

What has made the correlation plummet in value? And why is this an important issue for investors? These are the main questions I discuss in this post.

The short answer to the first question is that rising sentiment has made the correlation plummet in value. The short answer to the second question is that correlation is important because on average, a decline in correlation dampens future returns; however this state of affairs is temporary.

Similar Dynamics Of Correlation And The VIX

Crypto investors have been focusing on the decline to near zero of the 90-day rolling correlation between bitcoin and U.S. stock indices such as the Nasdaq and S&P 500. These correlations are at their lowest levels in two years. In making this observation, the crypto derivatives analytics firm Block Scholes points out that the 2021 trough occurred between two peaks, one in April 2021 and other in November 2021.

Bitcoin

BTC

Behavioral Pricing Models Applied To Bitcoin

Traditional asset pricing models have been unsuccessful in explaining bitcoin price movements. This is largely because these models ignore psychology and sentiment. In contrast, behavioral asset pricing models augment the traditional asset pricing framework by incorporating psychology and sentiment. Some of my research pertains to these models, which have been successful at explaining bitcoin price movements.

There are several indicators of sentiment, one being the VIX and another being a net bullish index based on a survey conducted by the American Association of Individual Investors.

Behavioral asset pricing analysis, applied to bitcoin returns, indicate the presence of at least three main drivers of the predictable component of price movements. The first driver captures information about the degree to which bitcoin’s price changes because of undervaluation.

The second driver is the sensitivity of bitcoin’s price to general market sentiment, where by sentiment is meant general optimism about stocks. This is where the VIX comes in. When investors become more optimistic about stocks, the VIX typically declines; and when investors become more pessimistic about stocks, the VIX typically increases.

The third driver involves the way market sentiment mediates the impact of the fundamental factors that influence individual stock returns. This driver is behavioral, by which I mean it captures how investor psychology alters the way market fundamentals influence security prices.

Actual bitcoin price movements are also impacted by news which is completely unpredictable.

Sentiment Beta

The prices of some assets are more influenced by market psychology than others, and are said to feature high sentiment betas. These assets tend to be difficult to value using fundamental analysis and difficult to arbitrage. The prototypical high sentiment beta assets are the stocks of young companies that, while not yet profitable, have compelling stories to tell.

Here is something to keep in mind. Bitcoin price changes resemble the price changes of high sentiment beta stocks. This is the finding based on behavioral asset pricing analysis.

The presence of at least three different variables driving the predictable component of the price of bitcoin makes for complicated dynamics. Part of the bitcoin dynamic is a statistically significant market beta effect in which bitcoin prices generally co-move with U.S stocks. The higher a market beta, the higher the subsequent expected price appreciation.

Very important to understand is that the market beta effect for bitcoin is heavily modified by sentiment. When sentiment becomes more optimistic, the VIX tends to decline as does bitcoin’s market beta and with it bitcoin’s expected price appreciation. In this respect, correlation is a key component of beta. A declining correlation typically means a declining beta; and a declining beta typically means declining subsequent returns.

This pattern is robust. The same general feature emerges when net bullishness based on the AAII survey is used in place of the VIX.

It is striking that bitcoin price changes become more correlated with U.S. stocks when investors become more pessimistic. This is because pessimism induces investors to focus more on basic fundamentals.

Conversely, during heady, optimistic periods, bitcoin investors appear to get caught up in the froth. Crucially, increased optimism weakens the contribution of all statistically significant fundamentals, not just stocks, to subsequent bitcoin price appreciation. This is why a decline in the VIX reduces subsequent expected bitcoin returns.

In respect to fundamentals, the connection between crypto assets and the real economy is still weak. Sentiment does not just impact the contribution of fundamentals to bitcoin’s subsequent returns. The VIX also impacts the driver associated with undervaluation. Specifically, a drop in the VIX reduces the undervaluation effect.

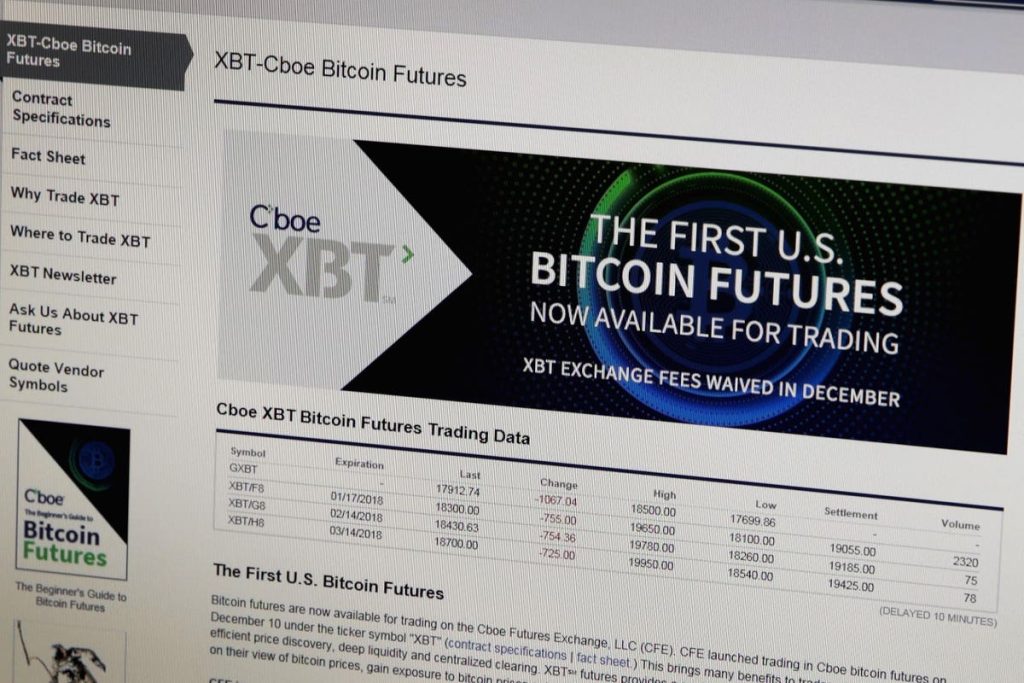

Sentiment is embodied in the way investors react to news. You can see an example in the caption to the image at the top of this article, which relates to the introduction of bitcoin futures on the CBOE in December 2017. A similar statement applies in respect to recent financial institutions’ filings for spot bitcoin exchange-traded funds.

Investors should resist concluding that bitcoin price movements are now independent of the sentiment in U.S. stocks. Rather, it is sentiment that drove down the bitcoin-stock correlation.

Behavioral Model Works Out of Sample

With all of this in mind, think about what has been happening between March and July of this year. On March 7, bitcoin traded at 20,207. On July 11, bitcoin traded at 30,367, a dramatic increase from March. Notably, during this time, the VIX dramatically fell from a peak of 25 to under 15, the same level it reached in July of 2021.

These joint movements are consistent with the behavioral pricing model describing bitcoin returns. The model was developed based on a data sample that preceded 2021.1 Importantly, this implies that the basic features of the model work out of sample. Given the recent drop in the VIX, it is no surprise that the bitcoin-stock correlation has plummeted in the past 90 days.

Bitcoin A Hedge Against Inflation and Market Instability?

Many bitcoin advocates consider it a very positive sign that the bitcoin-stock correlation is near zero. One reason for this belief is advocates’ sense that as bitcoin price movements become decoupled from the stock market, bitcoin becomes a hedge against inflation and traditional market instability.

To assess this belief, it might be worthwhile to consider how bitcoin fared against gold and stocks during the last 24 months, when the CPI rose at an annual rate of 6%. During this period, the price of gold rose at an annual rate of 3.3%, and the S&P 500 rose by 0.3%. However, bitcoin’s price fell at an annual rate of 2.1%. Gold and stocks were better investments over this period when U.S. inflation was higher than at any time in the previous four decades.

As for hedging market instability, during these 24 months the ratio of the maximum price to the minimum price for the S&P 500 was 1.3. In respect to instability, this means that the peak price for the S&P was 30% higher than it was when it bottomed. For gold, the ratio was 1.1, so a bit lower, and therefore a decent hedge. How about bitcoin? Its ratio was a very high 3.8 — not exactly what you would call a hedge against instability.

Perhaps people in high inflation countries like Nigeria and Argentina might find bitcoin to be a decent hedge against local inflation and traditional market instability. Still, gold proved to be a better option during the past two years, as it featured both a higher rate of appreciation and less volatility than did bitcoin.

There is another issue about bitcoin advocates viewing a zero bitcoin-stock correlation as being favorable. This issue relates to the belief that adding low or zero beta securities improves portfolio diversification. There are two points to make in this regard. First, the diversification argument only applies to investors whose portfolios are overly concentrated. For undiversified investors, the question becomes how best to diversify.

Second, sensibly using bitcoin to improve diversification means properly evaluating the tradeoff between less risk and lower expected returns. Remember, when bitcoin decouples from the stock market, its expected return goes down; and in July 2021, the bitcoin-stock correlation was very low.

Key Takeaway

Keep in mind that at some point sentiment will decline and the VIX will go back up. When this occurs, investors will pay more attention to fundamentals, the bitcoin-stock correlation will increase and with it the expected rate at which bitcoin will appreciate.

Read the full article here