FS KKR Capital (NYSE:FSK) is a leading upper middle market business development company or BDC. As a direct lender also providing asset-based or ABL solutions, it has benefited from the dislocation in the recent regional banking crisis as “struggling companies seek alternative forms of capital.”

In its Q1 earnings call in May, management reminded investors that the company remains well-primed in proffering “ABL solutions compared to banks due to [its] corporate shape and capabilities.”

As such, I’m not surprised that FSK has survived the selling onslaught as it formed its mid-March lows. Also, FSK has outperformed its sector peers represented in Financial Select Sector SPDR ETF (XLF) since January 2023, indicating the market’s confidence in the leadership of FS KKR.

Despite that, the market continues to reflect a significant discount against FSK’s average valuation levels, as seen in its forward dividend yields. Management assured investors that the BDC expects to deliver at least $2.95 per share in total distribution to its investors in FY23 (including supplemental dividends).

Relative to its stock price at writing, it indicates an FY23 yield of nearly 15%. In addition, its forward net investment income or NII per share multiple of 6.5x is still well below its average of 8.8x. It also remains below its broad capital market peers’ median of 7.9x (according to S&P Cap IQ data).

As a result, despite the YTD outperformance of FSK against its XLF peers, its valuation remains relatively pessimistic, which is also corroborated by Seeking Alpha Quant’s valuation grade of “A+” (the best possible).

Investors chasing income could have considered it a “no-brainer,” given FS KKR’s market leadership and track record. However, more inquisitive investors would likely ask further questions as they attempt to understand the basis for FSK’s highly attractive valuation.

FSK Bulls would likely point out that the company’s liquidity ($3B as of the end of Q1) should purvey it substantial firepower to make accretive investments. Moreover, its floating rate opportunities should continue to bolster its portfolio yields. Management stressed that it could garner “yields of approximately 12% to 12.5% on floating-rate loans” from the “upper end of the middle market.” Accordingly, these companies are also more “defensive.” Therefore, even as the Fed remains hawkish, given the economy’s resilience, FS KKR is well-positioned to capitalize on the interest rate tailwinds.

Despite that, it’s also critical for investors to consider that the Fed could be at the tail-end of its unprecedented rate hikes. As such, comps in FY24 could get more challenging, which could hamper the growth rate of the company’s NII per share. Based on the revised analysts’ estimates, FS KKR’s NII per share growth could decline in FY24 by 3% YoY.

Astute investors understand that the market is forward-looking as they attempt to price in forward growth estimates. Considering the potential growth normalization, we should try to anticipate whether it makes sense to expect FSK’s valuation to revert toward its averages.

Also, investors must balance their analysis against the prognosis of a possible recession. While the most highly anticipated recession has yet to occur, it shouldn’t be ruled out. Considering that BDCs like FS KKR could be hit worse than its non-BDC peers (given their investment exposure), I believe the market is likely pricing in such headwinds into its discounted valuation.

With that in mind, it also suggests that if we don’t get a hard landing, FSK could find even more support from income and value investors looking for a solid bargain.

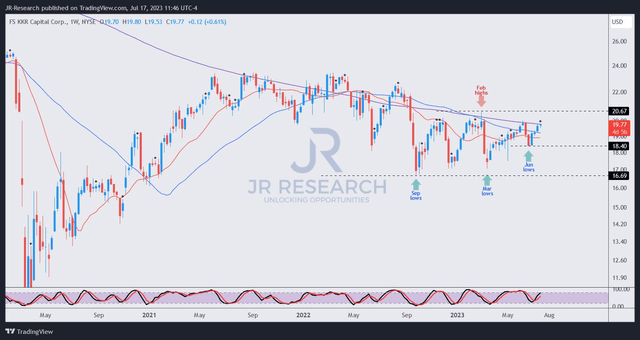

We could glean vital clues by assessing the buying sentiments from FSK’s price chart.

FSK price chart (weekly) (TradingView)

Accordingly, FFK has recovered remarkably from its March lows. I don’t expect those lows to be retaken unless the regional banking crisis worsens further, resulting in a debilitating recession (hard landing scenario).

However, the buying support seen in June from its most recent pullback was robust, indicating that dip buyers and income investors likely defended against the selloff.

With FSK moving closer to its critical resistance zone of $20.5, some caution is warranted. However, with increasingly optimistic macro conditions and attractive valuation (coupled with solid forward yields), I anticipate a decisive break out of that level subsequently.

Therefore, while a pullback cannot be ruled out, I view it as an opportunity for FSK holders to get more aggressive if it arrives. Otherwise, investors should still find the current opportunity appealing to add more positions, as the medium-term recovery in FSK remains intact.

Rating: Maintain Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here