Repligen (NASDAQ:RGEN) offers a comprehensive suite of products, including filtration, chromatography, process analytics, and proteins, catering to both upstream and downstream processes in the field of biological drug manufacturing. They are recognized as one of the pioneering companies in the development of single-use products for biopharma manufacturing processes.

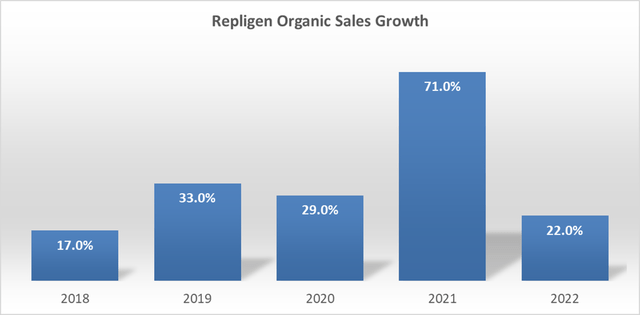

Repligen has demonstrated remarkable growth as a company, with sales increasing from $141 million in FY17 to $802 million in FY22, achieving an impressive average annual organic growth rate of 34%. Their success can be attributed to their long-cycle and highly differentiated systems.

Repligen Annual Reports, Author’s Calculation

Investment Thesis

Single-use manufacturing products penetration growth: There are two primary approaches to biopharma manufacturing: stainless steel systems and single-use systems. Stainless steel has been a longstanding favorite in biopharma manufacturing due to its historical usage, but single-use systems are rapidly gaining traction due to their advantages in reduced cleaning and validation requirements.

Repligen, along with competitors like Sartorius (OTCPK:SDMHF), recognizes the potential of the single-use market. Sartorius forecasts that the penetration of single-use systems will grow from the current 35% to 75% in the future. The adoption of single-use solutions offers several benefits, including reduced capital expenditure for pharmaceutical companies, a lower risk of cross-contamination, and increased flexibility for biosimilars.

Moreover, compared to stainless steel facilities, which require a longer construction cycle and investment starting from the early clinical Phase II, single-use facilities can commence construction in clinical Phase III, thereby reducing investment risks for pharma companies.

Considering all the advantages of single-use systems, it is anticipated that the bioprocessing industry will gradually shift towards the adoption of single-use solutions in the future. This trend is expected to drive Repligen’s future growth in the market.

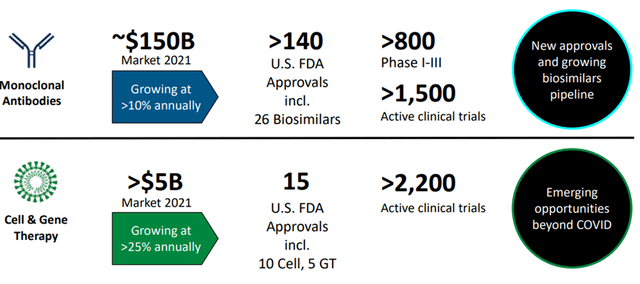

mAbs, Gene Therapy and mRNA fuel their growth: I expect monoclonal antibodies, cell, and gene therapy to catalyze growth in the next few years as new vaccines and therapeutics advance through clinical trials.

Repligen Q1 FY23 Earning Presentation

For example, Moderna has more than 30 mRNA vaccine programs, with 20 of them focused on non-COVID related applications. These prominent developers of COVID vaccines are also progressing with their non-COVID mRNA programs. I firmly believe that as these pipelines continue to expand, Repligen will experience significant growth when these drugs transition into the manufacturing phase.

New Product Innovation: Repligen has made substantial investments in R&D for new products. Their efforts have resulted in strong traction for many of the products they have launched in the last two years, which currently contribute to 10% of their overall revenues. In my opinion, Repligen remains well-positioned with an impressive range of innovative products and a solid foothold in key market areas, enabling them to navigate the next six to nine months successfully.

Repligen is optimistic about the growth potential of their new products and anticipates that they could account for 14% of group sales by the end of this year. This projection reflects the confidence they have in the market acceptance and performance of their innovative offerings.

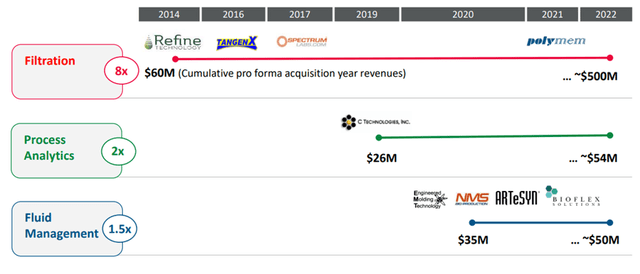

Strategic M&A: Repligen has pursued a strategy of strategic acquisitions to drive its growth. Over the past few years, they have successfully completed several notable acquisitions. In 2019, they acquired C Technologies, followed by ARTeSYN Biosolutions in 2020, and Polymem and Avitide in 2021. These acquisitions have played a significant role in expanding Repligen’s position in the filtration and fluid management sectors.

By combining these strategic acquisitions with organic development, Repligen has achieved remarkable growth in its filtration business. From 2014 to 2022, the filtration business experienced an impressive eight-fold increase. This growth highlights the success of their expansion strategy and the effectiveness of their acquisitions in strengthening their leading position in the industry.

Repligen Q1 FY23 Presentation

Major Headwinds

Reduction in COVID-related demand: Covid-related revenues represent more than 17% of group sales and amounted to around $23 million in Q1 FY23, reflecting a year-over-year decrease of approximately 60%. Currently, the covid-related business still accounts for approximately 13% of group sales.

More specifically, Repligen’s filtration business experienced a 20% decline in Q1 FY23, primarily driven by the sharp decrease in covid-related revenue. However, the company expects their filtration franchise to begin recovering during Q3 FY23 as macro headwinds subside and customers complete their destocking activities.

Weak Chinese sales due to destocking and weak pharma demands: Orders in China saw a sequential decline of 40% and a year-over-year decrease of 60%. China accounted for 10% of group sales in FY22. The order patterns in China appear to be mirroring what was experienced in the US and Europe, with strong growth in 1H 2022, followed by a dip in Q3, a recovery in Q4 2022, and then a significant drop in Q1 2023. This indicates a significant reset occurring in China at present, and it is anticipated that orders could remain weak throughout 2023.

Tight funding environment for small and emerging biotech: The current macroeconomic conditions have exerted considerable pressure on the funding environment for small and emerging biotech companies. While Repligen does have customer exposure in the cell and gene therapy sector, they estimate that slightly over 10% of their group revenue comes from small biotech companies. Given this relatively small exposure, I believe that Repligen’s risk from the funding challenges faced by these companies is manageable.

Outlook and Valuation

Repligen anticipates that their base business will experience a resurgence in growth, exceeding 20%, supported by a broader portfolio of products in FY24. They also expect an increase in orders during the second half of the year, positioning them favorably for FY24.

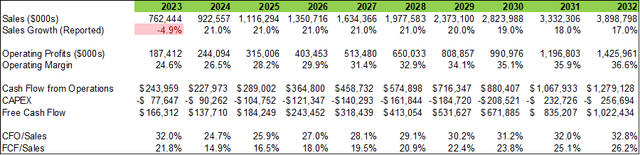

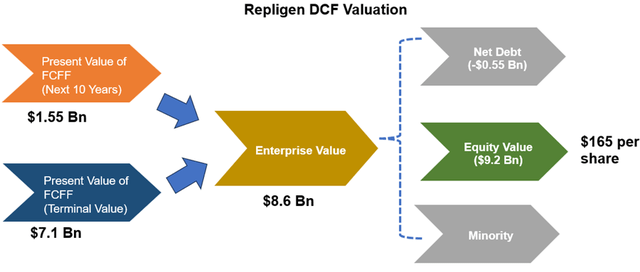

In my model, I assume 20% of organic sales growth and 1% of acquisition growth, and the operating margin will reach 36.6% in FY32. The free cash flow conversion is expected to be 26.2% in FY32 in my model.

Repligen DCF Model, Author’s Calculation

With 10% of WACC and 4% of terminal growth rate, the PV of FCFF over the next 10 years and terminal are $1.55 bn and $7.1 Bn, respectively. Adjusting the debt and cash, the fair value is $165 per share, as per my estimate.

Repligen DCF Model – Author’s Calculation

Conclusion

I believe Repligen is a hidden gem in the single-use solutions for the biopharma manufacturing space, and it is likely that many investors are not yet aware of this company’s potential. I anticipate that Repligen will experience rapid growth driven by the increasing adoption of single-use manufacturing products, the development of new vaccines and therapeutics, and their ongoing investment in product development and strategic acquisitions. Based on these factors, I would give Repligen a “Buy” rating.

Read the full article here