Insperity (NYSE:NSP) is a company that offers human resources management for small- to medium-sized businesses. The company’s offering consists of HR solution platforms, that manage payrolls, employee benefits, risk management, compliance, and other tasks. Considering a possible cooldown in the labor market, and Insperity’s current valuation, I believe the company’s risks outweigh its potential reward; I think the stock is worthy of a sell-rating.

The Business

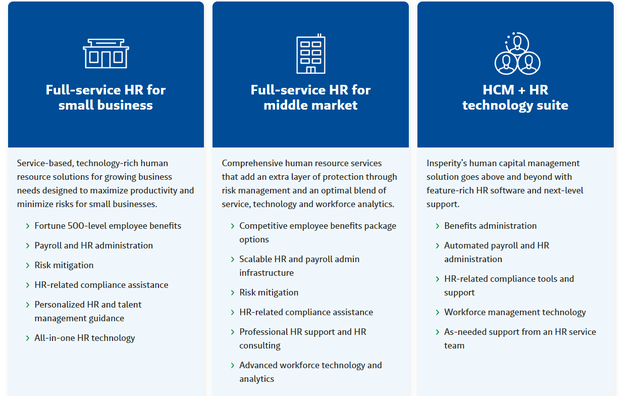

Founded in 1986 in Texas, Insperity has seen moderate growth for a long time. The company has achieved a good share of the human resources management industry in the United States. NSP offers HR suites for customers with three different offerings:

Insperity’s Solutions (insperity.com)

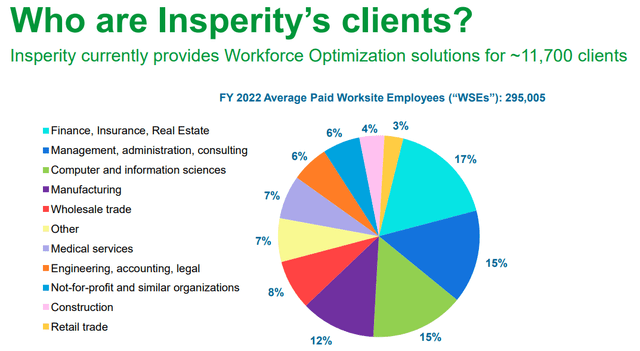

Insperity serves multiple verticals with its HR solutions, as seen from the company’s investor presentation:

Insperity Q1 Investor Presentation

Serving multiple verticals is a positive sign, as the company’s revenues are diversified if a single industry is to face a downward market. As Insperity serves around 11700 clients, the company isn’t faced with a risk of losing a single significantly large customer.

Looming Risks

As the Federal Reserve has been trying to slow down inflation, it has tried to slow down the labor market. This could lead to a short-term slump in Insperity’s earnings. For example, CNN reported that the labor market cooled off in June, as only 209 thousand jobs were added in June compared to 306 thousand in May – the Fed’s rising interest rates could start to have a larger effect on the labor market going forward. This weakening is seen in Insperity’s guidance too, as the company’s CFO Douglas Sharp guided growth slightly down in their Q1 earnings call:

Now let me provide our Q2 guidance and an update to our full year guidance, in which we are refining our forecast to paid worksite employee growth and raising our 2023 earnings expectations. We are now forecasting 7% to 9% worksite employee growth for the full year 2023 compared to our initial guidance of 7.5% to 10.5% growth.”

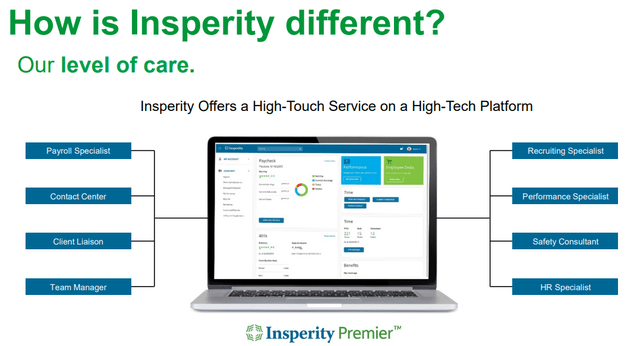

The human resources management industry has lots of established competition, as large companies such as PwC, Accenture (ACN), and Automatic Data Processing, Inc. (ADP) are competitive in the sector. Insperity tries to differentiate itself from competition with a deep platform offering:

Insperity’s Solution (Insperity Q1 Investor Presentation)

As other companies have large capital resources to use on innovation, though, I believe this edge can’t be maintained in the long-term – competition could start to eat away at Insperity’s market share.

Financials

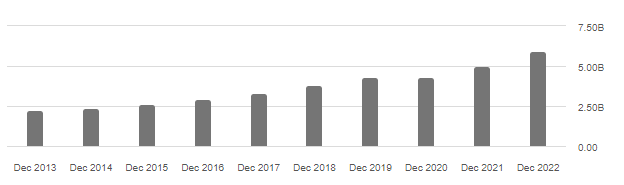

Insperity has had impressive growth in its financial history, as the company’s revenue has a compounded annual growth rate of 11.4 percent in the last 9 years:

NSP’s Revenues (Seeking Alpha)

The company could continue to grow its revenues in the future, as HR needs are growing according to Grand View Research’s report. The company is faced with a ton of competition, as mentioned before, so it isn’t a given that Insperity can take a piece of this growth.

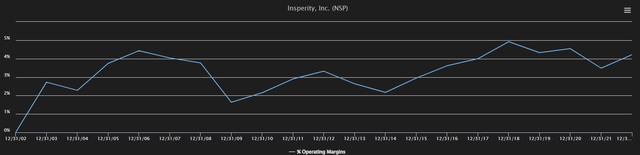

NSP has historically had operating margins between three and four percent, with current trailing margin being above historical levels at around 4.5%.

NSP’s Historical EBIT Margin (Tikr)

I believe the company’s margin could start to come back down to its historical level, as the labor market cools off; this would mean a significant drop in the company’s EBIT. The company has achieved an average operating margin of 3.28% in 2002-2022, a drop of around 27% in the company’s current operating profit if the margin is to fall to the mentioned level.

Insperity has a healthy balance sheet, as the company holds almost $700 million in cash and short-term investments. NSP does hold some interest-bearing debt, as their balance sheet has $369 million of long-term debt. In Q1 Insperity paid around $6.2 million in interest – this would represent an interest rate of around 6.7 percent.

Valuation

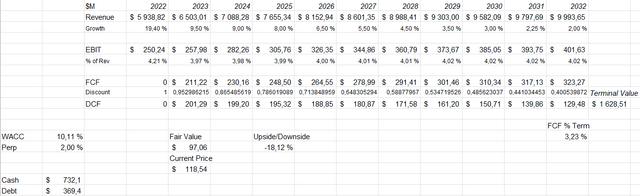

I believe Insperity’s growth is fully priced into the stock’s current price of $118.54 – the company’s current trailing price-to-earnings ratio stands at around 22. It seems that investors are pricing in significant growth in the future.

A discounted cash flow model reveals NSP’s valuation as quite expensive with moderate forecasts – I’m forecasting a growth of around 9%, slowing down into a nominal rate of 2% in nine years. Also in the model, I expect NSP’s EBIT margin to stay at around 4%, above the company’s historical level. With a cost of capital of 10.11%, the stock is given a fair value estimate of around $97, a price that’s 18% below the stock’s current price:

DCF Model of Insperity (Author’s Calculation)

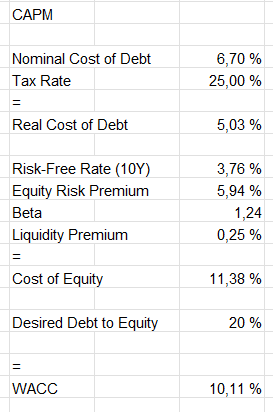

The used cost of capital is constructed with a capital asset pricing model:

CAPM of Insperity (Author’s Calculation)

The cost of debt is an estimate that was mentioned previously, derived from the company’s Q1 balance sheet and Q1 income statement. I expect the company to leverage a bit more debt than it currently has, as the model has a desired debt-to-equity of 20%.

On the equity cost side, I’m using the United States’ 10-year bond yield as the risk-free rate. The used equity risk premium of 5.94% is Professor Aswath Damodaran’s estimate. TIKR estimates NSP’s beta to be 1.24, a figure that’s derived from monthly data in the period of five years. Finally, a small liquidity premium of 0.25% is fair in my opinion, as the company’s shares are quite liquid.

Closing Remarks

Although I believe that Insperity is a good company, I believe current risks aren’t priced into the stock at the P/E of 22, creating a weak risk-to-reward on the investment. If the company proves that it can hold its current margins, and continue to grow at historical levels, I believe the stock could be a more worthwhile opportunity. Before the mentioned figures are proven, I maintain a sell-rating at the current stock price.

Read the full article here