In trading on Friday, shares of Conagra Brands were yielding above the 5% mark based on its quarterly dividend (annualized to $1.4), with the stock changing hands as low as $27.89 on the day. Dividends are particularly important for investors to consider, because historically speaking dividends have provided a considerable share of the stock market’s total return. To illustrate, suppose for example you purchased shares of the S&P 500 ETF (SPY

PY

SPY

Start slideshow: 10 Stocks Where Yields Got More Juicy »

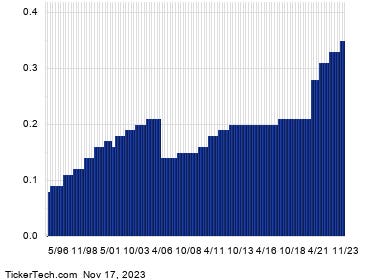

In general, dividend amounts are not always predictable and tend to follow the ups and downs of profitability at each company. In the case of Conagra Brands, looking at the history chart for CAG below can help in judging whether the most recent dividend is likely to continue, and in turn whether it is a reasonable expectation to expect a 5% annual yield.

Free Report: Top 8%+ Dividends (paid monthly)

Read the full article here