Written by Nick Ackerman, co-produced by Stanford Chemist.

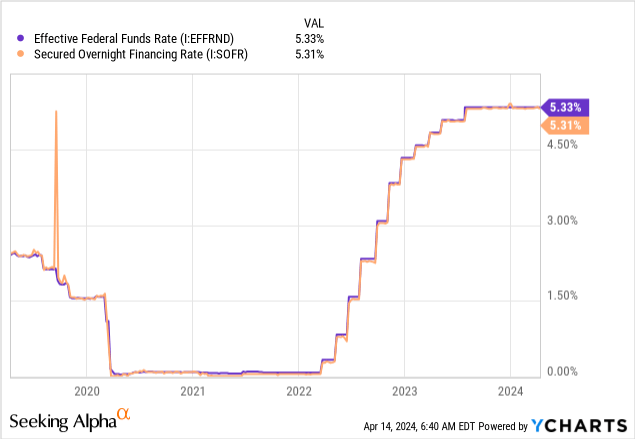

Inflation remains sticky, and that’s pushing off the need for the number of rate cuts from the Fed and pushing back when those cuts are expected to come. We recently covered Blackstone Strategic Credit 2027 Term Fund (BGB) to highlight its benefits as a mostly floating rate-focused fund.

Today, I wanted to give an update and quick look at two more funds for generating even higher income in this “higher for longer” environment. That would be the Ares Dynamic Credit Allocation Fund (NYSE:ARDC) and the XAI Octagon Floating Rate & Alternative Income Trust (XFLT).

As rates stay elevated, with the Fed still having to deal with inflation while the labor market remains resilient, there seems to be little need for any rate cuts. Of course, that will all be dependent on how the data unfolds going forward. That said, with a higher rate environment, funds such as ARDC and XFLT (as well as BGB) can benefit, thanks to their meaningful exposure to floating rate security investments.

Floating rate investments are usually based on some short-term benchmark rate; the 1 and 3-month SOFR is a popular one, then plus a spread on top of the benchmark rate. As the Fed raises its target rate, these short-term benchmarks respond by moving higher. That keeps the income generation in their underlying portfolios relatively higher in this environment.

YCharts

Even with rate cuts expected in the next year or two, we aren’t expected to go back down to a zero-rate environment unless the economy is really taking a dive. Therefore, despite the anticipation of several cuts moving forward, these funds would still be expected to pay out quite attractive yields-even if they have to trim back their payouts some.

Given its mostly below-investment-grade, the portfolios here are on the risky side in a hard-landing scenario. 10%+ yields don’t come for nothing. Being leveraged means downside moves will be magnified, and that’s a key risk for both of these funds we’ll be discussing today.

ARDC 10.05% Yield

- 1-Year Z-score: 1.65

- Discount: -4.10%

- Distribution Yield: 10.05%

- Expense Ratio: 2.58%

- Leverage: 32.66%

- Managed Assets: $513 million

- Structure: Perpetual

ARDC’s investment objective is “to provide an attractive level of total return, primarily through current income and, secondarily, through capital appreciation.”

In an attempt to achieve these objectives, the fund takes a pretty flexible approach – as its name would suggest. Specifically, they state that:

The Fund invests primarily in a broad, dynamically managed portfolio of (i) senior secured loans (“Senior Loans”) made primarily to companies whose debt is rated below investment grade; (ii) corporate bonds (“Corporate Bonds”) that are primarily high yield issues rated below investment grade; (iii) other fixed-income instruments of a similar nature that may be represented by derivatives; and (iv) securities of collateralized loan obligations (“CLOs”).

ARDC is Ares’s traditional closed-end fund offering. Ares Management is a popular and well-respected alternative asset manager, where perhaps most investors may be familiar with their business development company, Ares Capital (ARCC).

The fund also utilizes leverage, which will naturally make the portfolio riskier due to increased volatility. When including the leverage expenses, the fund’s total expense ratio comes to 5%. This is a higher expense than most closed-end funds, but it isn’t out of line when you start investing in CLO exposure.

Unlike many other leveraged CEFs, ARDC locked in most of its leverage costs by issuing mandatory redeemable preferred shares.

The Series A MRP Shares and the Series B MRP Shares have a dividend rate of 2.58% per annum, payable quarterly, with a redemption date of five years from issuance. The Series C MRP Shares have a dividend rate of 3.03% per annum, payable quarterly, with a redemption date of seven years from issuance. The weighted average dividend rate for the MRP Shares is 2.81% per annum.

They also utilize a credit facility based on floating rates; in this case, it is SOFR plus 0.95%. However, this accounted for ~$ $63.5 million of their borrowings, with the MRPS accounting for $100 million of their leverage.

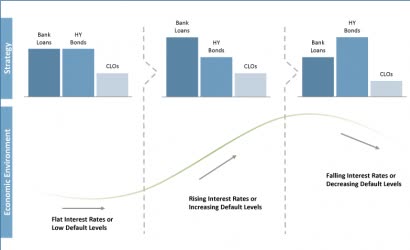

ARDC is a bit unique in its approach thanks to its “dynamic” approach. That provides the fund with more flexibility to take advantage of the different rate environment that they are anticipating. If they anticipate a lower-rate environment, they can shift to more fixed-rate investment instruments. If they expect rates to stay where they are or even head higher, they can keep their allocation to floating rate-based investments relatively elevated.

ARDC Strategy Overview (Ares Capital)

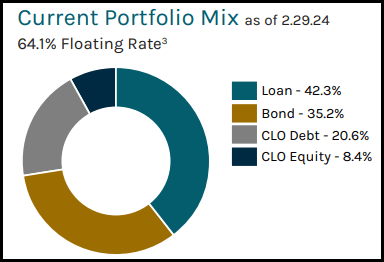

At this time, the fund is tilted toward floating rate-based investments at 64.1% of its portfolio. This is comprised of senior loan investments, as well as CLO debt and equity investments. Bonds then make up the remainder of the portfolio.

ARDC Portfolio Breakdown (Ares Capital)

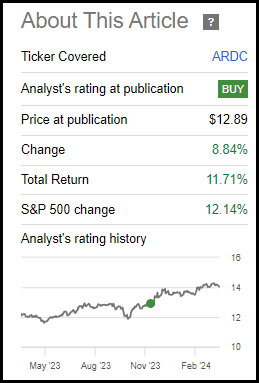

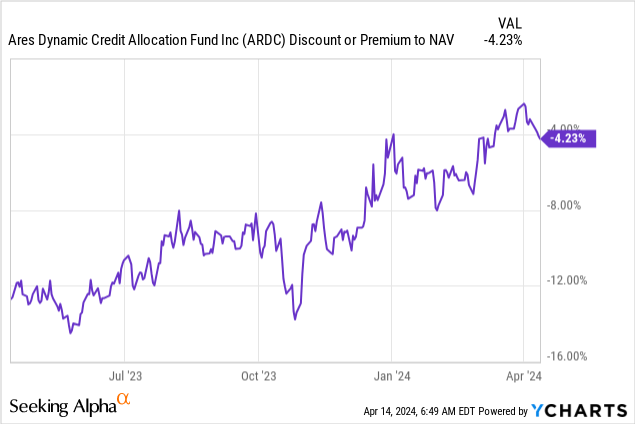

Since our last update, the fund’s discount has narrowed substantially. At that time, it was trading at a double-digit discount, which helped to push up the fund’s performance meaningfully. In this case, the total returns have rivaled that of the S&P 500 Index in a short period of time.

ARDC Performance Since Prior Update (Seeking Alpha)

It might not be the ‘sale’ price it was previously, but it remains a fund that continues to benefit from the current environment. That makes it more than worthwhile to continue to hold and even add through a dollar-cost average approach, in my opinion, waiting for a potentially more lucrative time to pounce more aggressively.

Our ideal target for buying more aggressively would be an 8%+ discount level, with our ‘hold’ level up to parity with its NAV. So, it’s not a screaming buy here, but it also still has some appeal.

YCharts

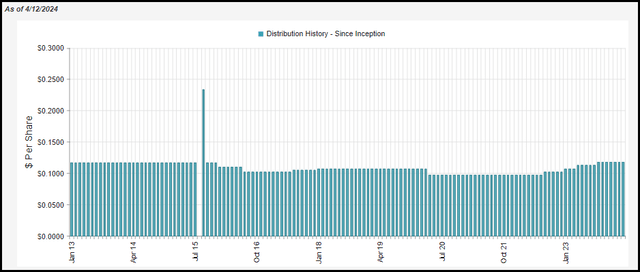

Like many funds with floating rate investment exposure, the fund was able to deliver several distribution increases over the last year. At this time, the fund sports a ~10% distribution yield, with an NAV rate of 9.63% due to the fund’s discount.

Even better, and probably more importantly than a double-digit yield, is that it is being covered by net investment income as well. At the current rate, they pay $1.41 annually, while their last annual report showed an NII of $1.51. This is good for NII coverage of 107%, and that means some cushion for when rates are eventually cut.

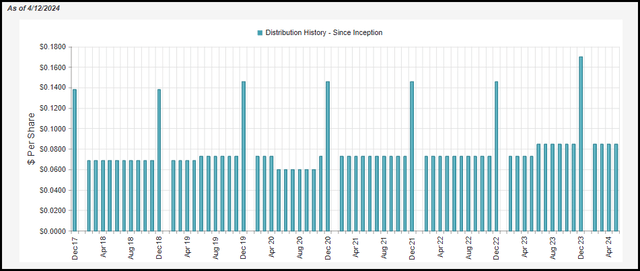

ARDC Distribution History (CEFConnect)

XFLT 14.48% Yield

- 1-Year Z-score: -0.36

- Premium: 3.15%

- Distribution Yield: 14.08%

- Expense Ratio: 4.02%

- Leverage: 39.38%

- Managed Assets: $632.109 million

- Structure: Perpetual

XFLT’s objective is to “seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle.”

They will do this through “a dynamically managed portfolio of floating-rate credit instruments and other structured credit investments within the private markets. Under normal market conditions, the Trust will invest at least 80% of managed assets in senior secured loans, CLO debt and equity.”

Similar to ARDC, XFLT is also heavily leveraged and has a high expense ratio. In fact, the expense ratio here is even higher, climbing to 8.64% when including the fund’s leverage expenses. Again, this is obviously a negative for these funds with higher expenses, but it isn’t out of line for the area of the market they are investing in. The pure-play CLO equity CEFs see even higher expense ratios.

One of the components of their leverage is a publicly traded preferred offering, the XAI Octagon Floating Rate Alternative Income Trust 6.50% 2026 Term Preferred (XFLT.PR.A). This is an alternative for investors who are more risk-averse seeking safer income. It can also be held as a complement to XFLT equity, which is what I do.

The preferred holding may be fixed-rate, which goes against the highlights of this article: investing in floating rates for this higher for the longer environment. That said, the preferred does come with a term. Maturity that isn’t all that far away, either, as it matures on March 31, 2026, when XFLT will pay back face value to investors.

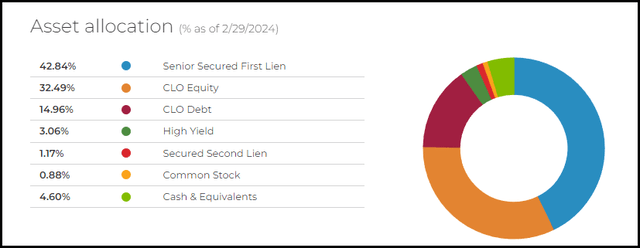

XFLT takes a more hybrid approach, though it is heavily skewed towards having almost its entire portfolio invested in floating rate-focused investment instruments.

In this case, they have a hefty sleeve of nearly 43% invited in senior secured first lien loans, with the second-highest allocation dedicated to investments in the CLO equity tranche.

XFLT Asset Allocation (XA Investments)

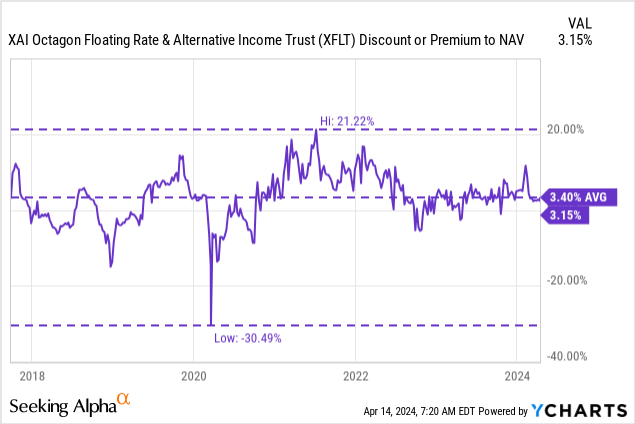

This fund currently comes with a premium, though that premium is somewhat lower than it was at the time of our prior update. It moved from about a 6% premium to around a 3% premium currently.

While a premium for a CEF can often mean a fund is looking expensive, XFLT regularly trades at a premium. In fact, that was probably why the fund easily received shareholder approval to remove its term structure and convert to a perpetual fund.

YCharts

That said, similar to ARDC, we currently view this fund as more of a ‘Hold’ and would be ideally adding if the fund moves to any discount at all. We would be looking to lighten up if the fund’s premium was pushed to 15%+.

XFLT’s distribution increased by over 16% in 2023 due to the higher rate environment, which generated more income in its underlying portfolio.

XFLT Distribution History (CEFConnect)

With an annual payout of $1.02 and the last annual report showing NII of $0.92, we do see coverage at only around 90%. That’s not ideal, as we’d want to see distribution coverage for fixed-income funds at 100% or over.

However, it’s not all bad news, as the latest figures look more promising. We can see in their latest quarterly report for Q4 2023 that the fund was covering its distribution. NII reported that it came to $0.27, putting coverage at nearly 106%. Another way to look at it would be that the latest quarterly run rate would come out to $1.08 annually if the NII were maintained for the next 12 months.

Conclusion

Both ARDC and XFLT offer investors hefty yields with their more dynamic, hybrid and alternative portfolios. When you get into this yield territory, there clearly are risks, but a higher-rate environment isn’t one of them. In fact, a “higher for longer” environment bodes well for these funds to keep pumping out these double-digit yields to investors.

Read the full article here