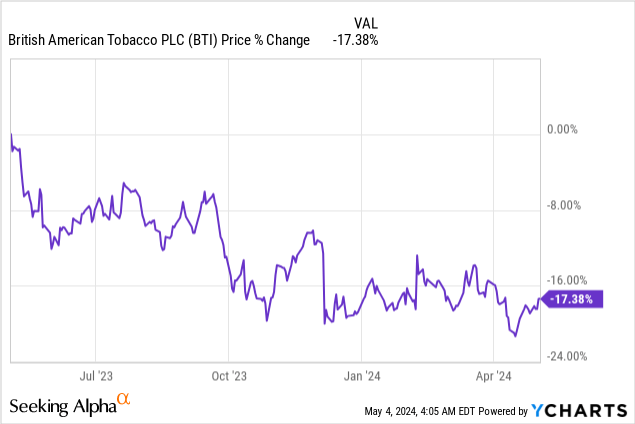

British American Tobacco (NYSE:BTI) (OTCPK:BTAFF), together with the larger tobacco sector, has fallen into a major consolidation in the last year, creating an engagement opportunity for investors with a long-term investment horizon. British American Tobacco’s alternative products categories, Vuse especially, is seeing impressive growth, indicating that the company has considerable revenue and gross profit growth potential here. Additionally, the company’s new categories achieved profit status in FY 2023. With shares trading at a 6.0X P/E ratio, implying a 17% earnings yield, I believe BTI makes a very solid value proposition for dividend investors!

Previous rating

I rated shares of British American Tobacco a strong buy in December due to strong gross margin momentum for the Vuse brand. In December, I recommended BTI as a contrarian buy after the company announced that it would write down the value of its traditional tobacco brands. With continual momentum in alternative product categories, however, I believe the investment thesis is fully confirmed and shares of BTI are still trading at a highly unreasonable valuation.

Strong alternative products momentum

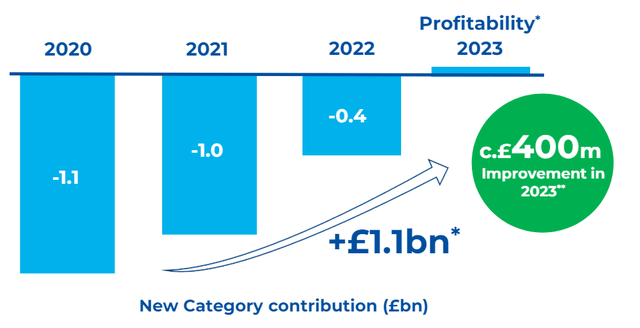

British American Tobacco continues to see growing product adoption of alternative non-tobacco products, which is driving significant upside momentum in earnings. One product that continues to stand out with growing product adoption is Vuse, British American Tobacco’s flagship vapour product. Vuse, but also Velo — BTI’s nicotine pouches — are driving significant earnings growth and are the key reason behind British American Tobacco growing its non-combustible segment to segment profitability in FY 2023. The non-traditional category saw a £1.1B ($1.4B) swing in profitability since FY 2020 and is set to make a positive contribution to the company’s earnings going forward.

British American Tobacco

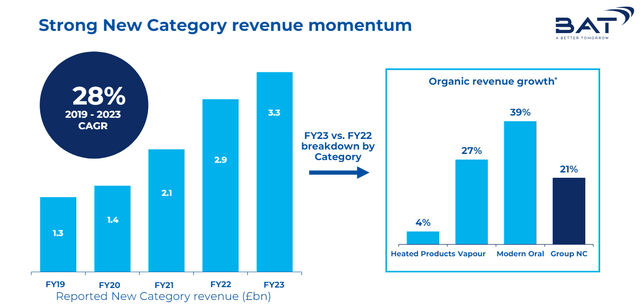

British American Tobacco is seeing considerable revenue momentum across non-combustible categories as well, with Velo taking the lead. In the last year, Velo’s nicotine pouches generated 39% growth, while Vuse came in second with a 27% growth rate. This growth is due to growing product adoption on one hand, and entries into new markets on the other.

British American Tobacco

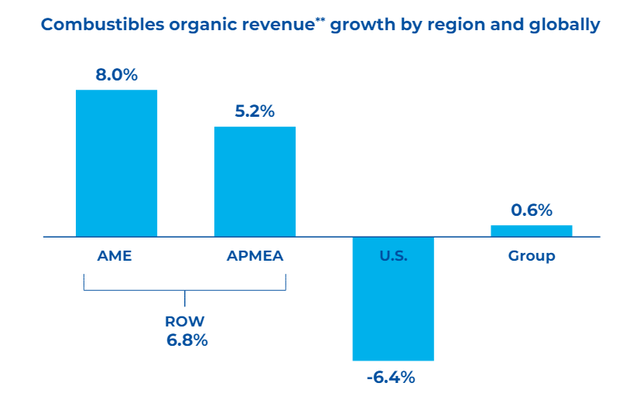

British American Tobacco will increasingly depend on new category revenue and profit growth as the core combustible segment continues to deteriorate. The segment generated only 0.6% growth on a consolidated basis in FY 2023 and was pretty much only saved by non-U.S. markets.

British American Tobacco

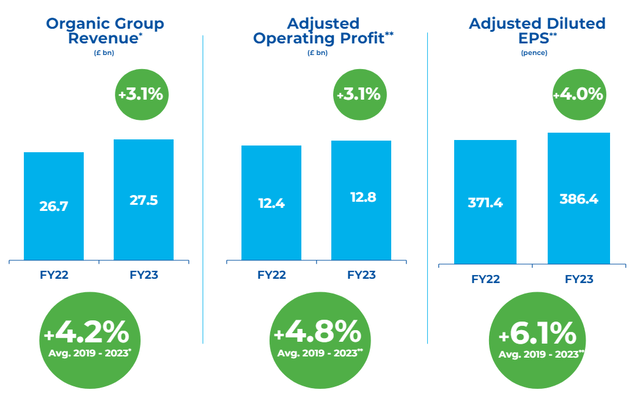

As a result of this decline in the share of traditional smokers in the U.S., British American Tobacco has seen a decline in key revenue and profit growth rates in recent years. Organic revenues in FY 2023, for example, increased only 3.1% Y/Y. Investors are likely going to see only low-single digit growth rates in key metrics, such as an organic revenue and operating income growth. However, they should also expect new product categories to account for a higher revenue share in the future: in FY 2023, non-traditional revenues represented almost 17% of consolidated group revenues, showing an increase of 170 basis points year over year.

British American Tobacco

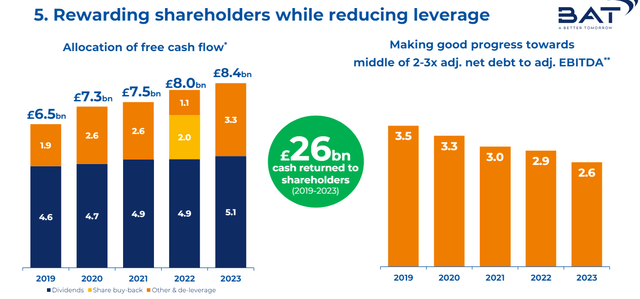

Favorable deleveraging trend

British American Tobacco has used some of its excess FCF to lower its debt, which has resulted in a consistently down-trending leverage ratio. At the end of FY 2023, British American Tobacco had a leverage ratio of 2.6X, which represented a 26% decline compared to the 2019 level. With growing shareholder returns (dividends + buybacks), I believe BTI remains a top holding for investors that want to focus chiefly on income generation. The decline in leverage obviously also reduces financial and investment risks for investors, especially those that rely on BTI’s dividends during retirement.

British American Tobacco

BTI’s valuation

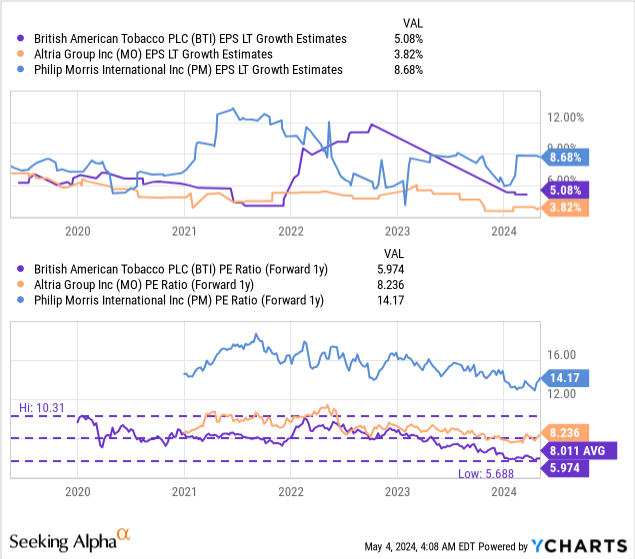

British American Tobacco is currently valued at a price-to-earnings ratio of 6.0X, which implies an earnings yield of 17%. For context, Altria Group (MO) is trading at a price-to-earnings ratio of 8.2X (implying an earnings yield of 12%) while Philip Morris is valued at a 14.2X P/E ratio.

As I explained in A Top Income Stock With A 6% Yield, Philip Morris is chiefly focused on emerging markets, which is why the tobacco firm is expected to see much stronger earnings per-share growth than both Altria and British American Tobacco. From a valuation point of view, I believe that British American Tobacco provides excellent value for dividend investors: if shares revalue simply to the 3-year average P/E ratio of 8.0X, shares could have 34% upside revaluation potential, implying a fair value of $40. This upside potential, of course, comes on top of the current 10% yield that British American Tobacco pays its shareholders.

As catalyst for an upside revaluation, I see 1) A growing new category revenue share, 2) Positive earnings contributions from Vuse and Velo and 3) Continual progress in reducing the company’s leverage ratio.

Risks with BTI

British American Tobacco is facing long-term declines in its core business, which I believe is already fully reflected in the company’s valuations. Revenues associated with the combustible segment are going to shrink, and the company is going to receive a lower profit share from its traditional tobacco segment as a result. If British American Tobacco fails to grow its alternative product categories in order to offset declines in the tobacco segment, British American Tobacco may have to rethink its capital return strategy.

Final thoughts

British American Tobacco sees growing product uptake for its core alternative tobacco products which has led to a milestone event in FY 2023: new product categories, led by Vuse and Velo, drove the new segment to profitability. British American Tobacco’s new category products are set to account for a growing revenue and earnings share going forward, which helps offset weakness in the combustible segment. I believe the risk profile for British American Tobacco remains extraordinarily appealing for dividend investors, and the firm’s low P/E ratio of 6.0X implies a decent valuation safety margin as well!

Read the full article here