Introduction

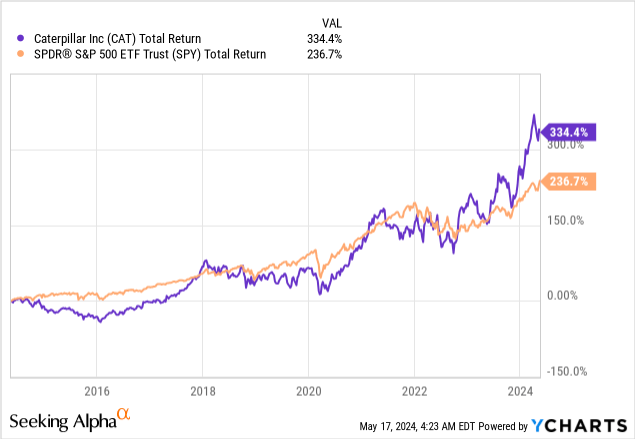

It’s time to talk about Caterpillar (NYSE:CAT), which is one of my most successful dividend (growth) investments.

Excluding dividends, I’m currently up roughly 170% on my investment, which I initiated after the pandemic to add inflation protection to my portfolio.

This performance has pushed the ten-year total return to more than 330%, almost 100 points better than the already stellar performance of the S&P 500.

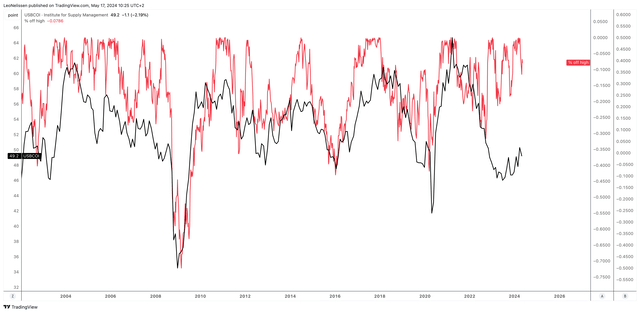

In fact, Caterpillar has defied a lot of weakness, as its stock price has diverged from major economic indicators, including the ISM Manufacturing Index.

The chart below compares the distance (in %) CAT shares are trading below their all-time high to the ISM Manufacturing Index (the black line).

TradingView (CAT, ISM Index)

Usually, when economic growth expectations weaken, CAT shares weaken substantially. That makes sense. After all, the company produces construction and mining machinery, which have a very cyclical demand profile.

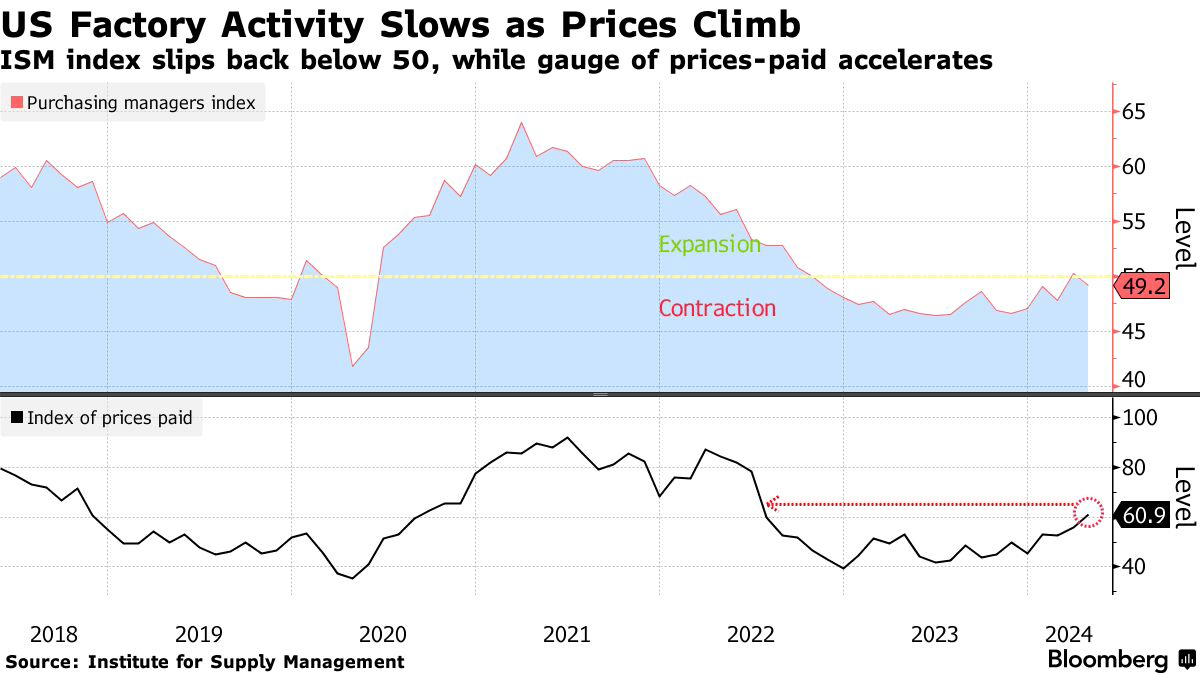

With that said, using the chart above, we see that CAT shares have been disconnected from the ISM Index, which failed to remain in expansion territory last month, as reported on May 1, when Bloomberg wrote the following:

The readings indicate US manufacturing is struggling for traction after some optimistic signs earlier this year for the industry’s outlook. Producers continue to battle headwinds of higher interest rates, elevated input costs and sluggish overseas markets. – Via Bloomberg

Bloomberg

The machinery industry was one of the seven industries that saw contraction.

My most recent article on CAT was written on February 12, when I went with the title “Yellow Machinery, Green Investments – The Bull Case For Caterpillar In Today’s Market.”

Since then, shares have returned 11%, beating the 5% return of the S&P 500.

In this article, I’ll revisit my bull case, use new economic developments, the company’s latest earnings, and long-term tailwinds that could provide lasting support for this Texas-based machinery giant.

So, let’s get to it!

Strong Earnings & Shareholder Returns Despite Headwinds

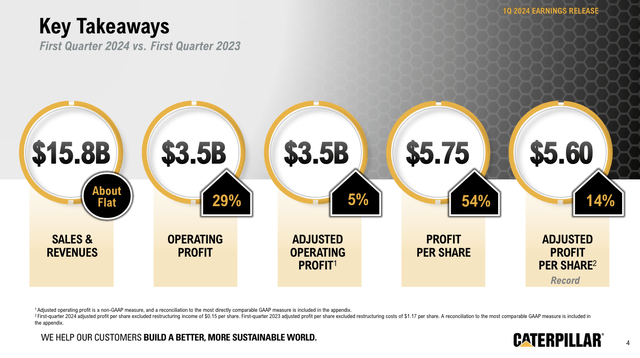

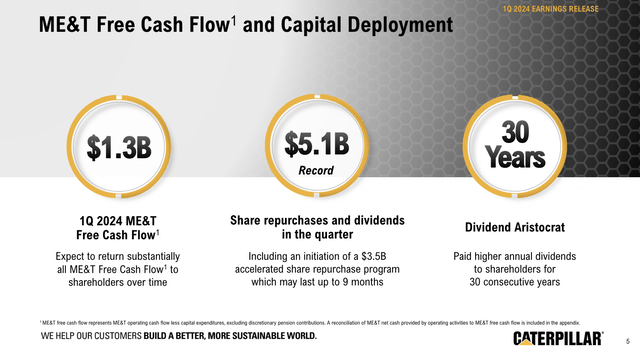

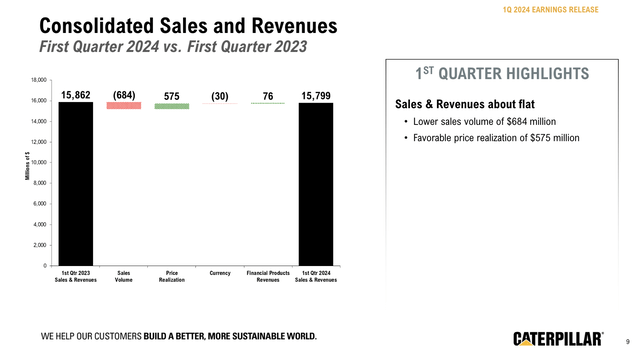

On April 25, Caterpillar reported its 1Q24 earnings. Although this was a while ago, it’s still worth mentioning how upbeat the company was, as the earnings call started with CEO Impleby praising the team for delivering higher operating margins, record adjusted profits per share, and strong ME&T (machinery, energy, and transportation) cash flows.

Caterpillar

This was a fantastic performance, as the company turned flat revenues into significant profit and free cash flow growth.

In the current environment of elevated rates, that’s not something investors take for granted.

Moreover, as a result of these numbers, the company deployed a record $5.1 billion for share repurchases and dividends during the quarter, which translates to roughly 3.0% of its current market cap.

Caterpillar

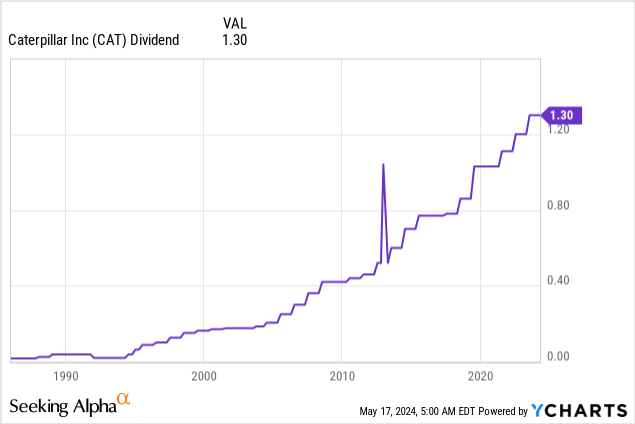

- With 30 consecutive annual dividend hikes, CAT is a Dividend Aristocrat.

After hiking its dividend by 8.3% on June 14, 2023, it currently pays $1.30 per share per quarter. This translates to a yield of 1.5%. The five-year dividend CAGR is 8.6%.

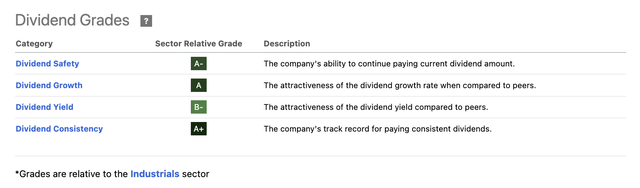

The dividend is protected by a sub-25% payout ratio, which is extremely healthy. It also benefits from CAT’s A-rated balance sheet.

Using Seeking Alpha Quant ratings, we see that CAT has a highly favorable dividend scorecard, with A-range scores in all segments but yield.

Seeking Alpha

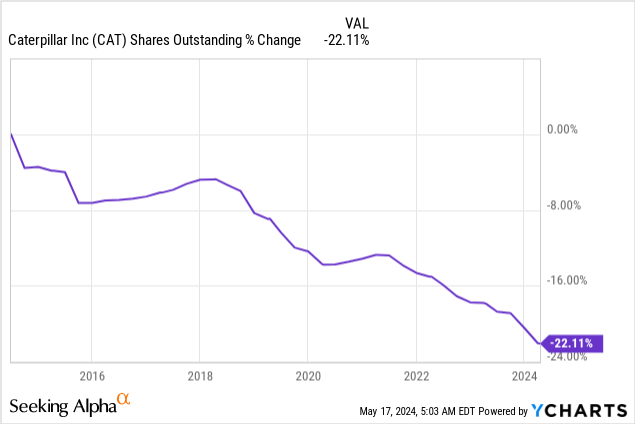

- CAT has been a big proponent of buybacks, as it improves the per-share value of the business and allows the company to distribute money more flexibly.

Over the past ten years alone, CAT has bought back more than a fifth of its outstanding shares!

Going back to its financial performance, as we can see below, demand weakness was the main reason why it was unable to grow total revenues in the first quarter.

Lower sales volumes were a $684 million headwind, partially offset by the company’s pricing power.

Caterpillar

While the company’s energy sales were up, resource industries and constructions saw headwinds, pressured by lower sales volumes due to cyclical headwinds.

However, sales in areas like autonomous mining vehicles remained strong, which is an area I’m very bullish on.

It also invested in sustainable solutions, including an agreement with CRH, North America’s largest aggregates producer, to advance the development of zero-emission solutions. This includes the deployment of 70-100 ton-class battery electric off-highway trucks.

The company also launched a hybrid energy storage solution for oil and gas operations designed to reduce fuel consumption, lower the total cost of ownership, and decrease emissions.

Caterpillar

With all of this in mind, let’s take a closer look at what CAT expects for its future – and what this means for (potential) investors.

The Future Could Be Bumpy

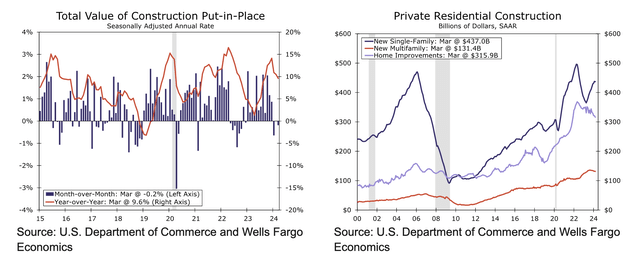

After a strong performance in 2023, demand in North America is expected to remain healthy for both nonresidential and residential construction.

- Nonresidential construction is expected to remain steady or see a slight increase, driven by ongoing projects and government infrastructure initiatives.

- Residential construction demand is expected to be flat to slightly down, yet strong compared to historical standards.

These comments make sense, as the Inflation Reduction Act and ongoing supply chain infrastructure investments provide a healthy environment for demand – even against tough comparisons in 2023.

Even better, these comments are confirmed by the latest macroeconomic numbers.

Total construction spending declined 0.2% in March, the second drop in three months. Overall construction spending has gotten off to a slow start in 2024 with monthly readings of -0.6%, 0.0% and -0.2% in the first quarter. Residential spending weakened in March with pullbacks across both single-family and multifamily segments. Nonresidential spending eked out a 0.2% gain, fueled by spending on the public side, particularly for infrastructure projects. – Wells Fargo (emphasis added)

Wells Fargo

With that said, looking at the other side of the Pacific and Atlantic Oceans, according to Caterpillar, economic conditions outside China are softening, and demand in China for above 10-ton excavators remains low.

Meanwhile, weak economic conditions in Europe will continue, although strong construction activity in the Middle East offers some balance.

These developments are also expected in the company’s resource industries portfolio, as it expects lower machine volumes due to poorer demand for off-highway trucks. This includes lower expected dealer inventories.

Moreover, the good news is that its services revenue is expected to rise, supported by a high utilization rate and aging fleets, which stimulate the adoption of newer products, including advanced products like autonomous solutions.

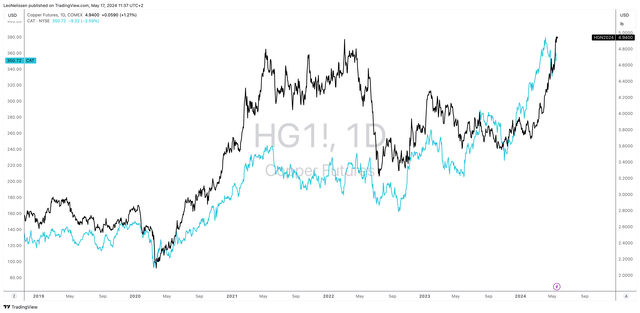

In general, it needs to be said that demand developments remain favorable as long as major commodity prices like copper (pictured below – compared to CAT), gold, silver, and other metals remain in a strong uptrend.

TradingView (COMEX Copper, CAT)

Speaking of commodities, oil and gas demand also remains high.

CAT remains upbeat about demand for reciprocating engines and services in oil and gas and intends to aggressively invest in large engines to support demand for data centers, oil and gas, large mining trucks, and distributed power generation.

At rival engine maker Caterpillar, sales of diesel engines for power generation grew to $6.4 billion in 2023, a 29% increase from 2022, driven by data-center sales. Sales of power-generating engines rose by another 26% during the first quarter of 2024.

Caterpillar plans to invest $725 million in its Lafayette, Ind., plant to expand production of large engines used to generate electricity.

“We see electric power as a growth business within Caterpillar. A big driver of that is the data-center business,” said Jason Kaiser, president of energy and transportation for the construction and mining-equipment company. – The Wall Street Journal (emphasis added)

With regard to the bigger picture, the company expects full-year ME&T free cash flow between $7.5-$10.0 billion, which is 5.0% of its current market cap (midpoint).

This protects its dividend and leaves a lot of room for aggressive buybacks.

Even better, analysts have become increasingly upbeat since my February article.

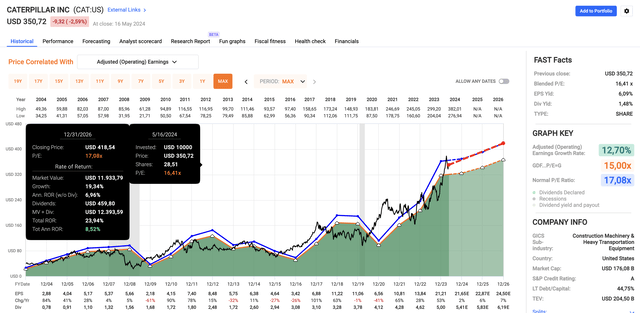

Back then, analysts expected the company to generate $23.15 in 2026 EPS. Now, that number is $24.50, using the FactSet data in the chart below.

FAST Graphs

This year, EPS is expected to increase by 2% instead of remaining flat. Next year, growth is expected to be 6%, potentially followed by 7% growth in 2025.

While all of these numbers are subject to change, they show the company’s potential in an environment where secular tailwinds offset cyclical headwinds.

If we get a situation of stronger economic growth in the U.S., Europe, and Asia, I expect these EPS numbers to improve substantially.

Valuation-wise, CAT trades at a blended P/E ratio of 16.4x, which is below its long-term normalized P/E ratio of 17.1x.

It has a fair price target of $419 based on a 17.1x multiple and $24.50 in expected 2026 EPS. That’s 19% above the current price and above the $396 target I highlighted in February.

As such, I remain bullish on Caterpillar.

However, due to cyclical risks and recent gains, I would not start a large position at these levels, as I believe gradually adding to a CAT position is the way to go in this economic environment.

If the stock weakens a bit due to cyclical headwinds, investors can average down. If the stock continues to take off, investors have a foot in the door.

Takeaway

Caterpillar has proven to be a stellar performer in my portfolio, with impressive returns and elevated shareholder distributions despite economic headwinds.

The company’s strong earnings and consistent dividend growth highlight its resilience and strategic excellence.

While the machinery sector faces cyclical challenges, CAT’s investments in sustainable solutions, new engines for rising electricity demand, and autonomous technologies offer promising long-term opportunities in secular growth areas.

Although I remain cautious due to potential cyclical headwinds, Caterpillar remains a compelling investment for those looking to blend stability with growth potential in their portfolios by buying industrial exposure.

Pros & Cons

Pros:

- Dividend Growth: With 30 consecutive annual dividend hikes, CAT is a reliable Dividend Aristocrat.

- Resilient Earnings: Despite economic headwinds, CAT has shown strong earnings and free cash flow growth.

- Strategic Investments: The company’s focus on sustainable solutions, electricity generation, and autonomous technologies positions it well for future growth.

Cons:

- Cyclical Risks: The machinery sector is highly cyclical, and CAT’s performance can be impacted by economic downturns.

- Valuation Concerns: While trading below its long-term P/E ratio, recent gains have priced in a lot of good news.

- Economic Headwinds: Weak demand in key markets like China and Europe could impact future growth.

- Market Sensitivity: In general, CAT’s stock price tends to be volatile, which is important to keep in mind before initiating a position.

Read the full article here