Here are three things I think I am thinking about this weekend. I kid. It’s all one thing, but here are three thoughts on that one thing:

1) The Labor Report Was…

I’ve often joked over the last 3 years that the Covid economy created a “tell your own narrative” economy. And that situation is very much intact. In fact, you might argue that the narratives are becoming more divergent. And Friday’s employment report was a perfect example, as the labor surveys told dramatically different stories about the state of the US economy.

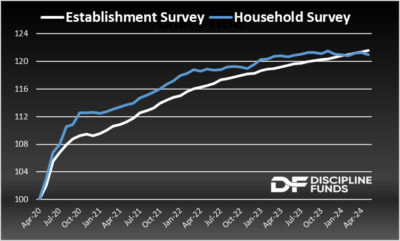

So, the way these reports work is that there are actually two different surveys being done. There’s the establishment survey (which is basically a survey of firms) and there’s the household survey (which is a survey of households).

They attempt to capture different things based on differing demographics and overall employment figures. The establishment survey, which is the headline job figure you read in the news, is much more reliable at measuring the level of employment.

The household survey is a better measure for demographics and many microeconomic aspects of the labor market. The household survey is also where we get the unemployment figure from since it captures the number of people leaving the workforce.

Now, the thing about this report and many of the prior reports is that the level of employment reported in these surveys has been pretty different. For instance, the level of employment reported in the Establishment Survey was 272K, but the Household Survey showed a 408K drop in employment.

The Establishment Survey is widely acknowledged as being more reliable because it’s broader and gets a cleaner understanding of pure employment gains from firms.

The Household Survey is much more volatile because it’s a smaller dataset. So the Establishment Survey is the better data to use, but that doesn’t mean the Household Survey is worthless. And given the slowdown in the Household Survey, I think it is irrational to dismiss that data outright.

The other thing about the Household Survey is that despite being much more volatile, its long-run trends tend to converge with the Establishment Survey. And if you take the average change in both surveys, you get a current average rate of change of just 0.99%, down from 2% growth a year ago. So no matter how you cut it, the rate of change in employment growth is slowing.

2) Is the Labor Market Tight or Not?

What we’re really trying to gauge here is whether the labor market is tight or not. The headline figures are always noisy, but what we’re trying to gauge is whether the trend in those headlines is consistent with a tight economy or a soft economy.

And this is where the unemployment rate comes into play. When we’re trying to gauge the tightness of the economy, the unemployment rate will best capture that as it’s measuring how many people are permanently falling out of the labor force.

When we look at labor market tightness it’s not enough to just look at the level of employment gains because a 200K gain in June of 2020 could be dramatically different than a 200K gain in June of 2024.

The level doesn’t tell you the whole story. What matters is the level of gains relative to other factors like the population change and the number of people who are permanently out of work. That’s where the unemployment rate can fill the void in these surveys and give us more information about the true tightness of the labor market.

The unemployment rate ticked up to 4%. It had been as low as 3.4% in 2023. Now this is where the Household Survey becomes more interesting. We aren’t actually losing jobs every month, but the labor market is definitely softening.

The question going forward is whether it’s softening enough to bring inflation down a lot. Well, we already know it’s been soft enough for inflation to slow meaningfully. But inflation is also sticky enough that the Fed needs to do more work. So, we’re softening, but not soft enough.

3) What’s the takeaway for the Fed and Potential Rate Cuts?

As I noted, the evidence is mixed. Economic optimists will point to the Establishment Survey headline figure and say the labor market is robust. Economic pessimists will look at the Household Survey and the unemployment rate and say the economy is soft and potentially much softer than the Establishment Survey wants us to believe.

But let’s keep things in perspective here – an unemployment rate of 4% is still a relatively tight labor market. There are many signs of loosening including a rise in the UNRATE, declines in full-time employment, declining hours worked, etc. But it’s also not falling apart. It’s all just gradually slowing down.

If you’re the Fed, then all this uncertainty is more reason for pausing. There’s no reason to overreact to any of this, and as I’ve noted in the past, they probably can’t cut before November anyhow because they are too close to interfering with the election at this point.

There’s only a June, July and September meeting at this point and they’re definitely not cutting at the June or July meetings. And September is just a few weeks from the election, so unless something is collapsing, we shouldn’t expect action then. So the Fed can just patiently observe the data and if they need to jump on an emergency, then that’s always an option. But there’s really no reason to overreact to any of this.

In short, I don’t think this labor report changed much. The bond market was starting to get a little overly excited about cuts after the Bank of Canada and ECB cut this week, but their economies look much weaker than the US economy does at this point. So a November rate cut remains my baseline and bond investors waiting on rate cuts should just relax, be patient and avoid overreacting to headlines.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here