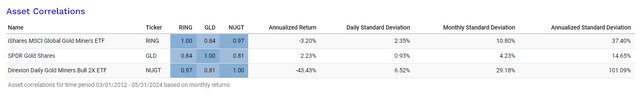

The Direxion Daily Gold Miners Index Bull 2X Shares ETF (NYSEARCA:NUGT) is a daily resetting leveraged ETF focused on an index of gold miners, positively correlated to the performance of gold. The underlying index is well captured by the iShares Gold Miner ETF (RING) for the correlation heat map, but is formally the NYSE Arca Gold Miners Index (GDMNTR). The weights are a bit different.

Correlations (Portfoliovisualizer.com)

Asian currency reserve buying has been the major factor for gold momentum lately. But the US Fed data also matters. Longer term, higher for longer is mitigated by more buying of gold to be able to later intervene in the market and keep their own currencies up to sustain USD denominated debt. But we think the CPI data next week would be the next event to focus on for NUGT.

Note

Firstly, leveraged ETFs are mostly for short burst investments due to the process of value erosion. Returns of these ETFs start to diverge from the underlying index somewhat quickly over longer periods, and will reflect the evolution of the underlying factors less. Value erosion happens because the sequence and relative size of daily movements in the underlying index actually make a difference, it’s not just the total move that matters. If you don’t fully understand this, leveraged ETFs are not for you. Regardless, refer to a financial advisor.

Also, links for reference:

They are good for getting relatively cheap access to this special, daily leverage. Expense ratios are only 1.18%, compared to the higher borrowing costs.

NUGT Thesis

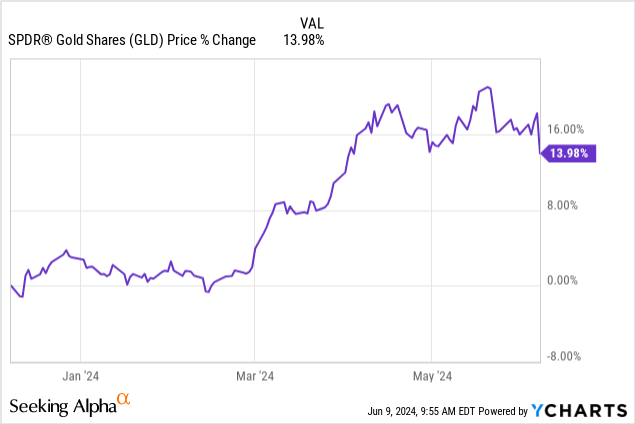

Lately, gold has been on a tear, partly because the major factor of buying by Asian central banks concerned with the valuations of their own currencies in the face of a structurally strong dollar. Emerging market economies tend to be indebted in USD terms, and therefore a strong dollar is an issue for their sovereign balances. Gold hoarding now allows them to hold and later intervene to sustain their own currencies.

However, the rate situation in the US also matters. Currently, we are seeing continued adding of jobs in the US and continued wage inflation MoM and YoY, which led to the recent retreat of gold. The bottom line is the economy is not cooling, and therefore neither will inflation. Rate expectations also remain above target. There is no chance (without a deleveraging event, which is becoming less likely with the breakdown of maturity walls) for inflation to fall, so higher for longer it is. This is bearish for gold since its relative non-productivity becomes an issue compared to USD that will yield nicely. Jobs data is more important these days than the actual CPI, but the CPI data does come out this Wednesday, and this could be another catalyst for movement in NUGT. We make a relative consensus call that CPI will, of course, be above 3%. The fact that longer-term inflation expectations are annualising at above 3% both reflects, and due to self-fulfilling prophecies, assures that it will be the case.

Bottom Line

Longer term, we are bullish on gold. Higher for longer expectations could bolster more gold buying by vulnerable emerging market central banks, before their currencies take hits from their own rate cutting policies as inflation in select geographies starts to see some downtrending.

There is also the more remote risk around the USD as a reserve currency. Use of the USD is falling, and blocs are forming that are inclined to use a common currency with trading partners, such as the Yuan, to do trade with. This may not be a dramatic evolution, and the Chinese central bank still needs to do a lot of dollar buying to keep the Yuan nice and low to support their workshop economy, and wouldn’t want to tank the dollar either considering how large their exposure is to USD denominated assets, but it’s still something to think about, and gold is hedged to this risk.

However, a leveraged ETF is not the right way to approach a long term gold thesis. Since there could be new disappointing data in the short term solidifying higher for longer expectations, which is bearish for gold and the gold miners, we’d stay away from NUGT right now.

Read the full article here