YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY) is an ETF that touts a 51.45% trailing distribution rate. Does that mean you can hold the fund for two years and get a free ride after your capital is returned? What are the risks of holding TSLY as opposed to just owning TSLA? Let’s dive in.

Fancy Execution For A Simple Idea

TSLY is a one-stock covered call fund. Instead of buying shares of TSLA and writing call options on it, they use options to create a synthetic long position. The other difference in this synthetic covered call fund as opposed to a traditional covered call strategy is that they hold short-term Treasuries as collateral which can also generate income.

For the sake of simplicity, let’s use a traditional covered call example to highlight the risks and rewards of this fund.

Writing Short-Term Covered Calls

Most people are familiar with covered calls but let’s break it down just in case. Suppose you own 100 shares of TSLA. You sell an out-of-the-money call option which is up to 15% higher than the current share price. Expiration is one month away.

You have the potential of the following:

- 15% capital gains

- 1.76% options income

That is a 16.76% potential return in a month. If prices go down, your loss is offset by the 1.76% income. Sounds like a win-win right? Well, not so fast. You are capping your monthly returns at 15%. If the price goes up 30% in a month, you will still only make 16.76%. Do you see where this could get ugly?

Suppose the stock went up 30% one month and down 30% the next (relative to the starting value). And it did this repeatedly. Now, we are not expecting a stock to do so, but this is to highlight the risk of using covered calls in a volatile stock.

- The investor holding the stock will have a 0% return as he made 30% and then lost it.

- The covered call writer will make 16.76% in month one and then lose 28.24% in month two. He is down net 11.48%.

A volatile stock is the killer of covered call holders. Your option income is not a free lunch. It increases your risk of substantial losses when prices whipsaw up and down between months. But it gets worse.

A Yield You Cannot Eat

But what about that whopping big yield of over 50%? Don’t be fooled into thinking you are getting blue chip dividend income. This is a distribution yield, and it is not being generated from sustainable profit. The money you receive in a distribution is made up of options income (selling 1 month away OTM call options) as well as the equivalent of selling shares to make up the shortfall. It is easier to explain if I use a traditional covered call strategy.

- You have 100 shares of TSLA and you generate 1.76% in options income.

- You want to generate 4.5% income every month.

- If prices go up, you may only need to sell a couple of shares.

- If prices go down hard, you need to sell a few more shares.

Either way, you need to sell shares to make up the rest of the income you want over and above the 1.76%.

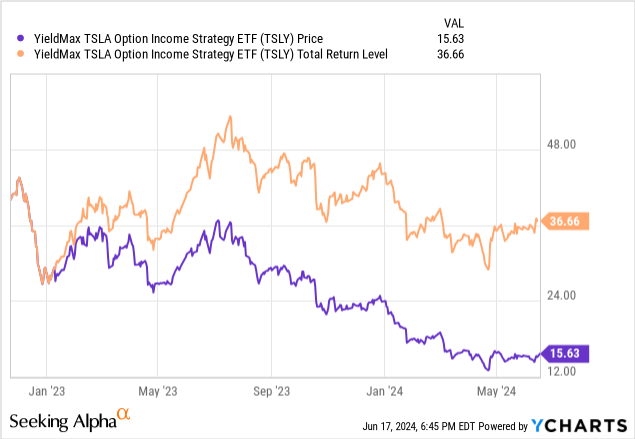

The synthetic version is doing the same thing, although it appears less obvious due to the use of options. But the net effect is the same as shares being sold off to provide income in our traditional covered call example. This is obvious when you look at the share price return of TSLY vs the total return. Much of the return is simply the fund giving you back your capital and calling it a distribution. It is the total return you should care about.

And that 51.45% distribution rate? That’s the rate you would get if you invested today and the current monthly distribution remained the same. But guess what? That’s challenging at best because they are returning your capital to you. You wouldn’t expect your dividends to be the same in a stock where every month you sell shares for extra income.

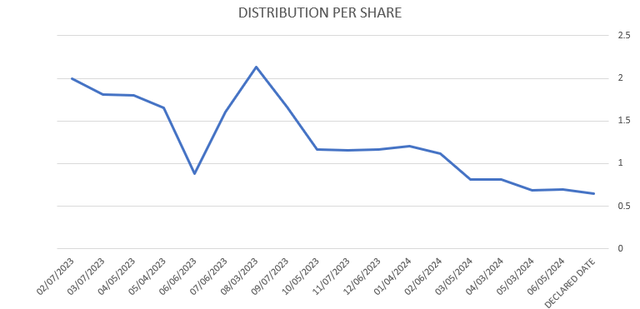

Over the past year, distributions have fallen by 40%.

YieldMax Website

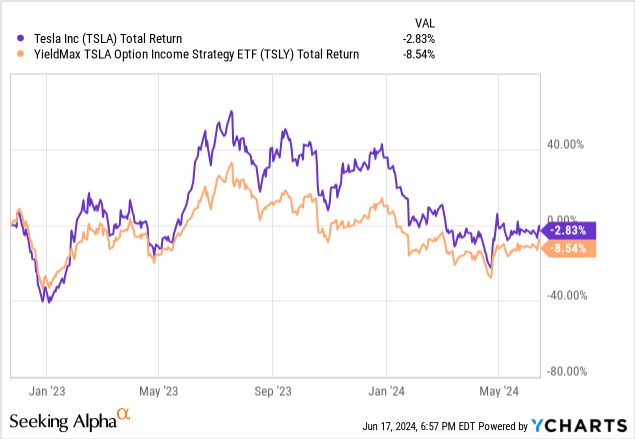

TSLA share price has fallen only 31.68%. And even in January 2023 to July 2023 while TSLA soared over 100% in price, the distribution barely moved up. The point? Long-term holders of this fund can rightfully expect their distribution per share to dwindle over time.

But what about that 50% distribution rate?

That’s not a yield you are likely to eat. Consider, the price for TSLY (adjusted for splits but not dividends) was around $36.50 a year ago. The distribution over the past 12 months was $13.25 or 36.5% distribution rate. Yet, the monthly distribution was around 4-4.5%. Doesn’t that work out to 50% yield? It would if the distributions didn’t shrivel every month. If you buy today, don’t count on that 50% distribution rate. That’s based on this month’s payout. It will likely be much less by the time you are paid up in 12 months.

Who TSLY Is For

If you want high dividend income, and you fully understand that you are getting your capital handed back to you, this might be a product for you. You also receive a small amount of call option income in return for capped upside gains. If you forecast a stock to trade with low volatility, the options income might give you higher total returns than just holding the stock.

Risks of TSLY

- You have a single stock risk which means zero diversification.

- You have volatility risk in that if prices move up and down to extreme levels from month to month, you may lose even while the share price is flat.

- Depending on what account you have this fund in, you may pay a lot of unnecessary taxes from the fund just returning your own capital to you.

- You have the risk of dwindling distributions due to an eroding asset base.

Conclusion

If, for some reason, this fund appeals to you, please look at a total return chart. And compare it to TSLA. At least you will see what the fund is doing on a net basis. Forget about the distribution yield. That’s not a sustainable figure you can bank on.

Read the full article here