The Fund

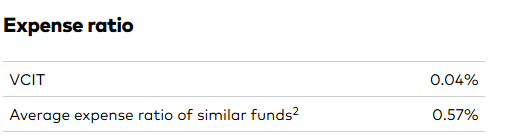

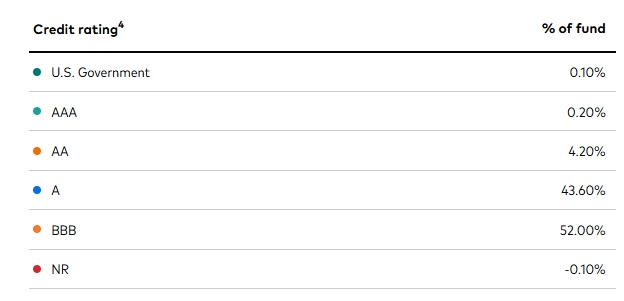

Vanguard Intermediate-Term Corporate Bond ETF (NASDAQ:VCIT) invests in investment grade corporate bonds, which at the portfolio level have a weighted average maturity between 5 and 10 years. Since the issuances are backed by a good credit rating, i.e. investment grade, the earning potential is limited. This makes sense since there is less credit risk involved in holding the securities. Taking this into account, VCIT aims to “provide a moderate and sustainable level of current income” as stated on its website. Annually, the fund costs a low 0.04% to its unitholders.

VCIT

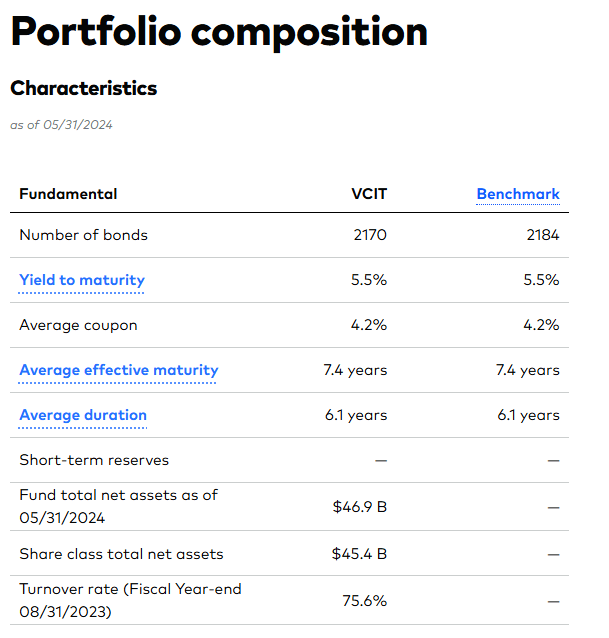

The nominal cost has less to do with the economies of scale that the Vanguard name brings and more to do with the passive nature of this fund. VCIT tracks an index, with the management sitting on the sidelines as far as maneuvering the market is concerned. The benchmark beacon for VCIT is the Bloomberg U.S. 5-10 year Corporate Bond Index. This index comprises USD denominated investment grade securities having fixed rates. At least 80% of VCIT’s portfolio is invested in the index incumbents, and these are selected by sampling. The ETF has done a good job with its tracking and at the end of May was in lockstep with its index.

VCIT

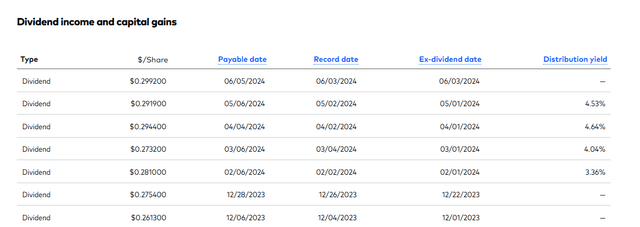

While the average coupon of the portfolio was 4.2%, the yield to maturity was higher at 5.5% owing to the decline in the portfolio value. Rising interest rates tend to have that effect on a fixed income portfolio. Duration plays a role in the extent to which the bond prices decline and with 6.1 years in average duration, the VCIT portfolio moves to a modest extent. What the duration number signifies is the extent to which the portfolio value will rise or decline with a 100 basis points change in the interest rates. The relationship between the two is inverse. ETFs, unlike a few closed end funds we have covered, do not tend to overdistribute. The payout to their unitholders is more or less what is earned by their portfolio, net of expenses. VCIT distributes monthly, and the last payout was 29.92 cents, which based on the most current price of $80.31 calculates to a yield of around 4.47%.

VCIT

As we saw earlier in this piece, the yield to maturity at May 31 was higher at 5.5%. The YTM is generally a leading indicator of the distribution yield, and so we can expect further upward movement in the payouts in the next few months.

Performance

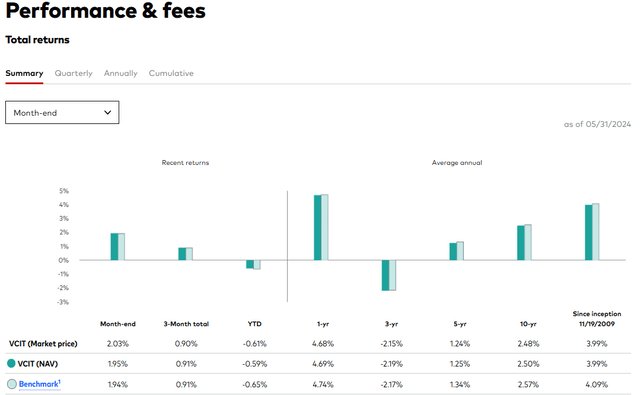

Indices do not have expenses, whereas ETFs most definitely do. In VCIT’s case, that number is negligible and does not materially impact its goal of pursuing the performance of the index.

VCIT

We can see above that VCIT has kept up with the benchmark and in a few time periods has even surpassed expectations taking into account its 0.04% in annual expenses.

Outlook & Verdict

Our primary outlook here comes from the fact that equities are very expensive and bonds offer a better return profile. This is true at least as far as the broader market averages like the S&P 500 (SPY) are concerned. The reason equities don’t look even more expensive is because margins are bloated at the latter stage of the cycle. Those have been buffered by some of the widest peace time deficits we have seen. So bonds, at least medium term ones, where you can skip defaults, offer a solid source of returns that SPY is unlikely to provide over the medium term. If you accept that, then VCIT is an easy way to play this ride.

If you are getting 5.5% yield to maturity over the next 6 years, and you have a standard default cycle, you are likely to materially outperform the AI mania. The reason we don’t play this is because we are fairly certain there is alpha to be had in this sector, and buying ETFs is not the way to go. With equities, alpha realization is more complex and does not always pan out over timeframes you would like. With bonds, you need to find a bond with a higher yield that does not default over the same timeframe, and you got your alpha. Of course, since we expect some serious turbulence when the budget deficit normalizes or when the treasury yields spike enough to force a normalization, one cannot get too boisterous with lower quality. Ideally, to outperform something like VCIT you don’t want to use anything below investment grade.

VCIT

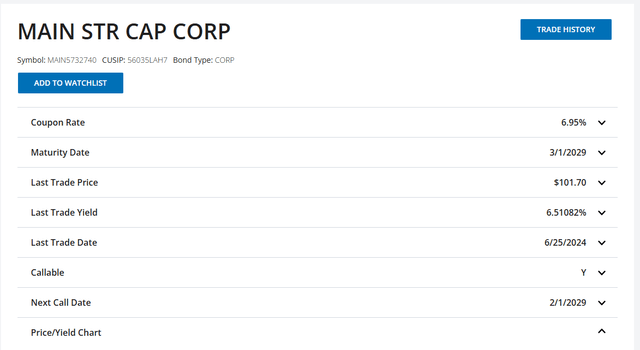

The good part is that there are solid choices with investment grade rating that give you the extra oomph. Our favorite way to play this in a defensive manner is currently Main Street Capital’s (MAIN) 2029 bonds.

FINRA

But it offers a 100 basis points premium and comes with an investment grade rating. What is not built into that rating though is the fact that MAIN stock trades at a huge premium to its NAV. This offers an easy deleveraging route if ever MAIN needs it. Of course, for diversification purposes you would need more than just one bond, but a collection of 6.0% to 7.0% yielding medium term bonds would do quite nicely to beat VCIT, assuming you pick the right ones.

For the longest time, one major bond we liked was a non-investment grade company that had more cash than debt. We are referring to the Alliance Resource Partners, L.P. Common Units (ARLP) bonds, which we got for a 7.6% yield to maturity. Unfortunately, those got called and will be exiting our portfolio on June 28, 2024. But we are sure we can find plenty more fish in the sea in the next selloff. That is essentially what we do for our portfolios, and that has played a key role in beating the 60:40 ETFs over time. We rate VCIT a hold, and we would only buy it as a quick way to get broad-based exposure in a panic selloff.

Read the full article here