CrowdStrike (NASDAQ:CRWD) is going from strength to strength at the moment, with growth stabilizing and profitability improving, despite the soft demand environment. CrowdStrike’s share price is front-running fundamentals, though, and the valuation now looks extreme.

I really like CrowdStrike’s business and have felt for a long time that it is head and shoulders above most SaaS companies. I would still like to have a position, but it is difficult to envision strong forward returns given CrowdStrike’s current valuation and growth prospects.

The last time I wrote about CrowdStrike, I suggested that its valuation left little room for error, exposing investors to modest upside potential and significant downside in the event of a negative development. The stock is up around 20% since then, although I don’t really see how CrowdStrike’s current valuation can be maintained.

Market Conditions

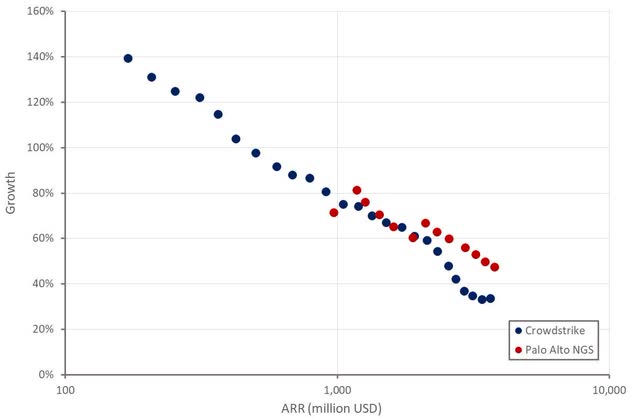

As strong as CrowdStrike’s business still is, the company has been negatively impacted by the demand environment over the past few years. CrowdStrike’s ARR growth actually looks fairly soft in comparison to Palo Alto Network’s (PANW) NGS ARR growth. I think that most of this is the result of Palo Alto shifting larger firewall customers onto its SASE solution, though, which creates a lot of uplift. Prism SASE is the largest part of Palo Alto’s subscription business and is also the fastest growing part of the business.

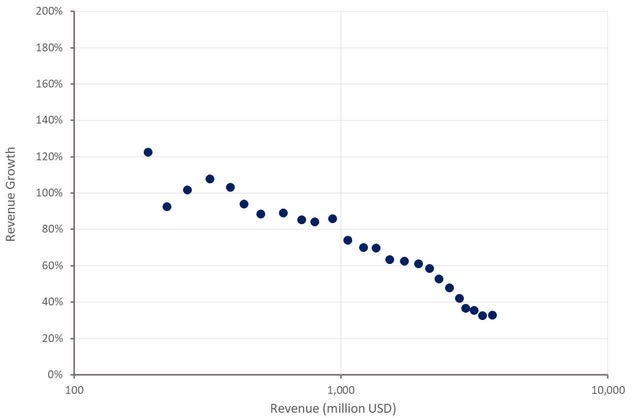

Figure 1: CrowdStrike ARR Growth (source: Created by author using data from CrowdStrike)

While CrowdStrike’s business is performing well, the company has suggested that it is still operating in a challenging environment. Macro weakness appears to be overlooked at the moment due to the economy remaining fairly resilient, cost-cutting efforts easing and AI hype boosting investor expectations.

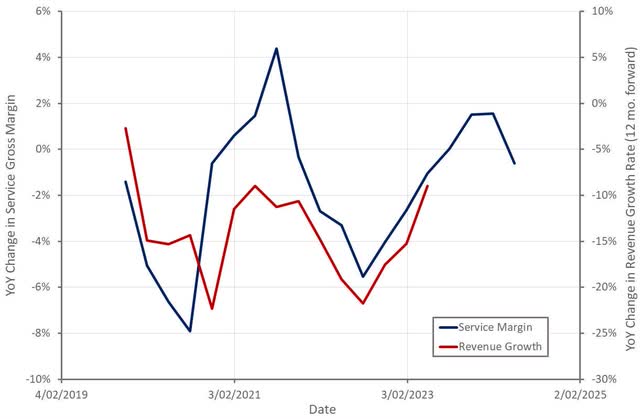

The demand environment is far from normal though, and I think there is a reasonable chance of conditions deteriorating later this year, or sometime next year. I tend to view service gross margins as indicative of the demand environment. When conditions are soft, services are more likely to be used as a customer acquisition tool, depressing margins. While it is too early to say definitively, CrowdStrike’s service margins appear to be under pressure again, which could indicate that growth will deteriorate sometime in the next year.

Figure 2: CrowdStrike Service Margin and Revenue Growth (source: Created by author using data from CrowdStrike)

There is a general trend towards consolidation in cybersecurity at the moment, which is likely due to a combination of customers preferring to deal with less vendors and synergies between certain products. Increasing competition and soft demand are also causing vendors to resort to incentives to help drive sales.

CrowdStrike is likely to be a winner in this consolidation process, but there is a risk that increased competition will cause issues in the short run. Offering endpoint protection for free as part of a bundle could theoretically put pressure on CrowdStrike’s business. CrowdStrike has best-in-class products, though, and cost-cutting in cybersecurity is generally not a good idea. A recent IDC report estimates that for every dollar customers spend on Falcon solutions, they save six, despite CrowdStrike’s premium pricing.

CrowdStrike is pursuing its own methods of encouraging platform adoption, although this appears to be based more around reducing friction. This includes Falcon Flex licensing, where customers have the freedom to pick and choose products as needed, and also receive volume-based discounts.

CrowdStrike Business Updates

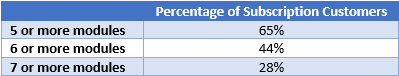

CrowdStrike’s lightweight agent is a data ingest engine and the heart of the platform. CrowdStrike continues to leverage its agent to expand into new areas of cybersecurity and now IT, supporting growth at scale. CrowdStrike has 28 modules and is successfully driving adoption of these modules. The number of deals involving Cloud, Identity or SIEM more than doubled YoY in Q1 and deals involving eight or more modules increased 95%.

CrowdStrike has fully integrated ASPM into its Falcon Cloud security solution. This part of the business continues to perform well, with CrowdStrike suggesting that AI is beginning to drive cloud utilization, a sentiment shared by Palo Alto. CrowdStrike also recently acquired Flow, providing runtime DSPM and securing data at rest and in motion. Something that is becoming increasingly important with the rise of LLMs.

LogScale is another growth driver for CrowdStrike, although the business is still small relative to its potential. At the end of 2023 over 1,000 customers were using the product, which is a small figure relative to CrowdStrike’s 20,000+ total customers. While LogScale is a differentiated product that is compelling from a technical perspective, it should also benefit from consolidation and the recent acquisitions of Splunk, Exabeam and QRadar.

Falcon for IT is also exceeding CrowdStrike’s expectations, with organizations using Falcon for enterprise search, patching, deployment and device health. CrowdStrike’s pipeline for this business is already in the eight figures. Outside of financial considerations, it is an important product as it demonstrates CrowdStrike’s ability to expand beyond security.

Table 1: Subscription Customer Module Adoption (source: Created by author using data from CrowdStrike)

CrowdStrike recently introduced Falcon for Defender, which helps to protect from attacks that bypass Microsoft Defender. CrowdStrike’s agent is deployed alongside Microsoft’s to provide an additional layer of protection. This is a bad look for Microsoft and could help CrowdStrike to win new customers and eventually displace Microsoft.

CrowdStrike’s MSSP business is one of its fastest growing segments, with CrowdStrike suggesting that partners are approaching it as they migrate customers off legacy and sub-standard products. MSSP’s are counted as an individual CrowdStrike customer but represent many end customers, meaning CrowdStrike’s customer growth may be more robust than it seems.

Financial Analysis

CrowdStrike generated 921 million USD revenue in Q1, an increase of 33% YoY. Subscription revenue growth was 34%, while professional services revenue growth was 18%.

Net new ARR was 212 million USD in Q1, which was a record for the quarter. Despite this, I actually viewed this as a somewhat soft result that suggests that the business isn’t really accelerating. ARR at the end of the first quarter was 3.65 billion USD, an increase of 33% YoY. While this was a slightly higher growth rate than the prior quarter, most of this was due to an easier comparable period in the prior year.

Second quarter revenue is expected to be between 958 and 961 million USD, representing a 31% YoY growth rate at the midpoint. Full-year revenue is expected to be 3,976-4,010 million USD, an increase of 30-31% over the prior year. While this guidance is likely conservative, I don’t expect CrowdStrike’s growth to accelerate meaningfully in coming quarters and believe there is a risk of further deceleration in 2025.

Figure 3: CrowdStrike Revenue Growth (source: Created by author using data from CrowdStrike)

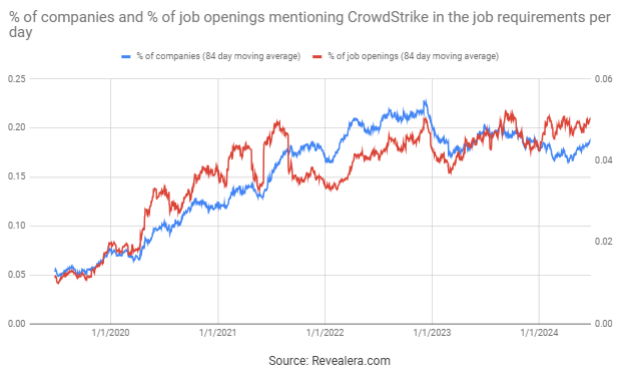

The number of job openings mentioning CrowdStrike has been fairly flat over the past 18 months. I don’t think this is a particular problem, but it also doesn’t suggest that growth is about to accelerate meaningfully.

Figure 4: Job Openings Mentioning CrowdStrike in the Job Requirements (source: Revealera.com)

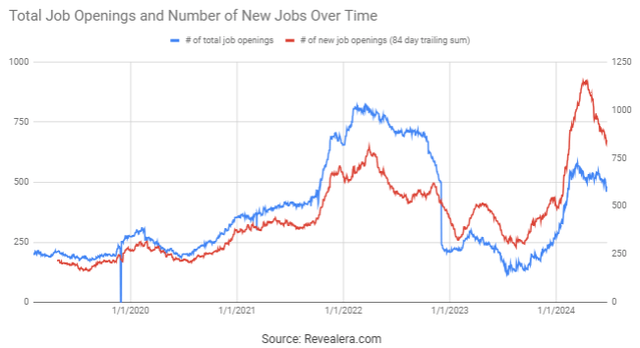

The number of CrowdStrike job openings is down significantly in recent months, after increasing sharply in late 2023 / early 2024. This could indicate that the demand environment isn’t improving to the extent that CrowdStrike expected it to.

Figure 5: CrowdStrike Job Openings (source: Revealera.com)

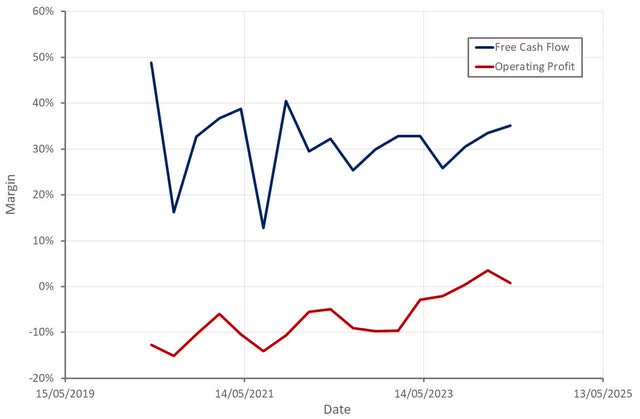

CrowdStrike’s gross profit margins continue to improve on the back of a mix shift towards subscription and improving subscription margins. A consistent pricing environment, along with data center investments and workload optimization are behind this. Service margins deteriorated meaningfully in the quarter, though.

CrowdStrike also continues to realize operating leverage as its business scale. Given the recent surge in hiring (15% YoY headcount increase), further margin gains are likely to be modest in the near term, particularly if growth doesn’t improve.

Figure 6: CrowdStrike Margins (source: Created by author using data from CrowdStrike)

Conclusion

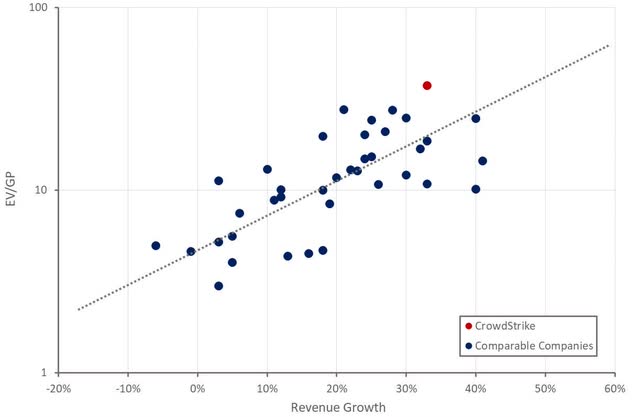

While I believe that CrowdStrike is going to be one of the dominant software platforms in the future, the company’s revenue multiple is looking extreme, particularly given the level of interest rates and the fact that demand appears to be wavering again.

I don’t believe that this will matter in the short term though, as CrowdStrike has momentum, and investors appear to be more focused on the rate of change of growth rather than the absolute level. This is understandable to some extent, but is a mistake when taken too far. There is a reasonable probability that growth drops below 30% in the near future, which could turn investor sentiment. In addition, investors need to be prepared for at least a 50% drawdown in the event of a recession.

Figure 7: CrowdStrike Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here