Elections can have consequences when it comes to rates

After watching last Thursday’s presidential debate, many thoughts circulated both traditional and social media. Some of the thoughts were polite and some were not so polite. Being the apolitical stoic that I am, I’ll spare my thoughts and just say that the odds of Donald Trump becoming the next Grover Cleveland have increased.

While history will tell us that Democrat or Republican presidencies don’t have much differential when it comes to market trajectories, policy as it pertains to taxes and rate cuts can have effects on certain segments of the market. In Trump’s previous presidency, he was very straightforward regarding his opinions on whether rates should be cut and when. The answer was usually yes and now.

President Biden, on the other hand, has been very hands-off regarding rates. I frankly can’t remember him uttering a peep about the current interest rate environment. Should Trump become President for a second time, we can expect that to change.

Constituents in commercial real estate

External influence in politics is a debatable subject. We Americans live in a Democratic society where political donations are required in order to run an effective campaign. With Trump being a real estate developer himself and having a wide constituency in commercial real estate, we can only imagine that Trump is far more in tune with what is happening with commercial real estate and the refinancing crisis.

Should those owners of large commercial buildings make their issues clear to a new Trump administration, I am assuming that Donald Trump would be more active in stating that rates need to be cut than would Joe Biden. In anticipation of this, I’m now even more eagerly looking for stocks with some convexity.

Convexity of stocks

With convexity being a term used almost exclusively in fixed income and bonds, stocks that act as hybrid fixed income proxies do exist and should react to rate cuts. In layman’s terms, the security’s measurement of reactivity to a rate cut or increase will normally be inversely correlated. The strongest candidates in my opinion would be Dividend Kings and Aristocrats in the larger market cap spectrum and REITs.

Common stock Dividend Aristocrats with owner earnings in excess of the risk-free rate

When trying to pit a stock with a growing yield against the 10-year Treasury risk-free rate, making sure that the discounted owner earnings result in a current yield over this number is of the utmost importance if we’re trying to gauge the reactivity of rate cuts.

Owner earnings in my opinion is a better measurement of true yield versus the risk-free rate than free cash flow as it takes into consideration interest and income tax expense using net income as item one and adding back only depreciation and amortization while subtracting CAPEX.

This is the most popular valuation metric used by Warren Buffett.

Two of the best candidates that came to mind were International Business Machines (IBM) and Medtronic plc (MDT).

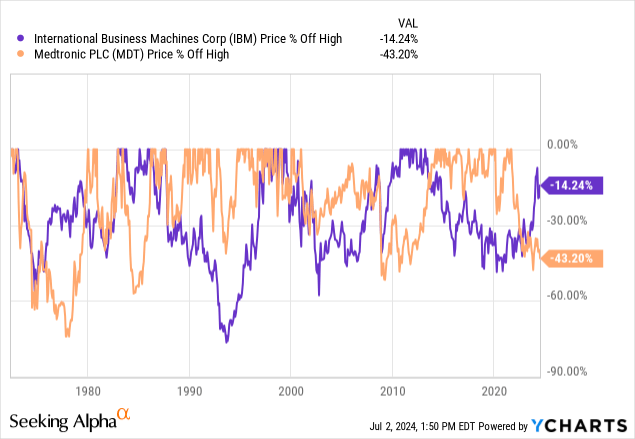

Both are trading off of their all-time highs, with Medtronic being in near-fire sale territory.

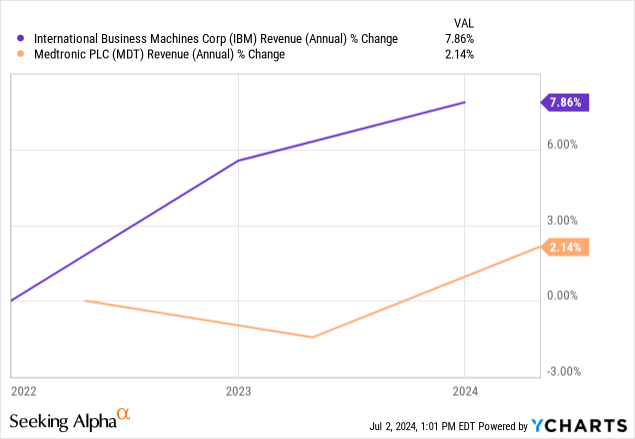

IBM has been an efficient financial engineer but has seen top-line shrinkage over a ten-year period which seems to be turning around.

IBM

IBM has had top-line growth stagnated for years. Finally, as we’ll see later in this article, we see a perking up and actual top-line growth over the trailing 3 years. Let’s not forget the charts of Microsoft (MSFT) and more recently Dell (DELL). Long periods of slow to no growth and then all of a sudden, a parabolic leg higher as the company narrative began to fall in line with headline positivity and a return to growth.

IBM has been in the artificial intelligence game for longer than most, yet this enterprise-centric business has had a hard time selling practical applications of its quantum computing products.

An excellent summation of the synergies and differences between AI and Quantum Computing was neatly summed up here on oodaloop.com:

Even though many people and companies are starting to combine quantum and AI into a single term, the two are very distinct technologies. AI is the training and use of neural network models developed and run on classical computing platforms powered by CPUs, GPUs, NPUs, DSPs, FPGAs, and other traditional binary-processing logic elements. Quantum computers use alternative compute architectures, such as superconducting transmon qubits, to solve very complex problems using quantum physics. While the two require different hardware, software, and support systems, the integration of the two is moving forward, especially for the benefit of quantum computing. IBM is one of the companies paving the way for AI to complement quantum computing development.

If and when these two technologies merge into one essential hybrid is a compelling growth opportunity as advancing technology may finally make this very old IBM project a new growth engine.

Medtronic

Medtronic is an essential medical equipment maker that provides a wide array of surgical equipment. At the center of the portfolio, the company provides cardiovascular and diabetes solutions. Among these are pacemakers and insulin pumps. Knowing a couple of individuals with pacemakers, both have Medtronic devices, and this is a segment where Medtronic is a leader.

Both are non-cyclical Aristocrats, and both have owner earnings yields over the current risk-free rate of 4.49%.

All numbers TTM and courtesy of Seeking Alpha in millions

|

Stock |

Net Income | + Depreciation and Amortization | -CAPEX |

= Owner Earnings |

SHARES | OE/SHARE | SHARE PRICE | OE YIELD |

| IBM | 8155 | 4453 | 1184 | 11424 | 918.6 | 12.43 | 172 |

7.23% |

| MDT | 3676 | 2647 | 1587 | 4736 | 1282 | 3.69 | 78 | 4.7% |

Payout ratio of free cash flow

| STOCK | TTM FCF/SHARE | FWD DIVIDEND | PAYOUT RATIO |

| IBM | $13.80 | $6.68 | 48% |

| MDT | $3.92 | $2.80 | 71% |

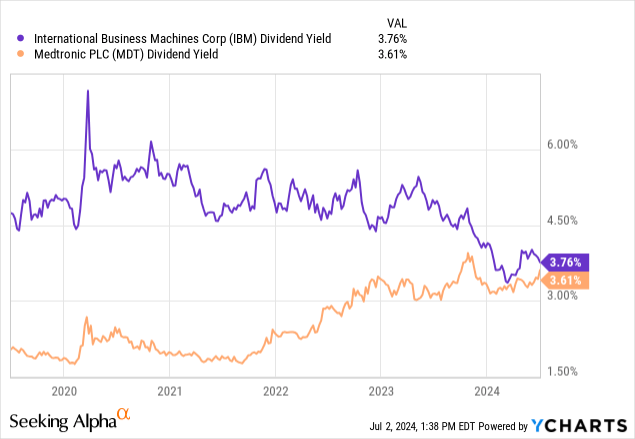

Dividend yield history

IBM has actually been a high dividend payer for years. Only now that the AI narrative has entangled IBM into a positive uptrend do we see the yield dropping below its trailing 5-year median line. Medtronic is at a 5-year-high. Both are yielding nearly thrice the market average dividend yield.

Top line growth, finally

Going through many of these dividend aristocrat and king candidates, it was quite difficult to find the three important elements of:

- a covered dividend by free cash flow.

- an owner earnings yield currently over the risk-free rate.

- a 3-year trailing trend line showing renewed revenue growth.

You can currently find a slew of aristocrat dividend payers trading -30/-40% off their all-time highs, but few of them tick all the aforementioned boxes.

REITs with covered yields and higher FFO than the risk-free rate

Now we come to REITs. The Convexity of REITs should be higher than dividend-paying stocks and may rival bonds once rate cuts ensue. The below portfolio I am currently buying cuts out redundancy of the commercial real estate sub-sectors and combines what is, in my opinion, all the healthy CRE asset classes with one singular S&P 500 large cap component.

- Realty Income Corporation (O)- Brick and mortar net lease retail- S&P 500 constituent.

- Mid-America Apartment Communities (MAA)- Rental apartments- S&P 500 constituent.

- VICI Properties (VICI)- Gaming and hospitality- S&P 500 constituent.

- Prologis, Inc. (PLD)- Logistics and warehouses- S&P 500 constituent.

- Alexandria Real Estate Equities (ARE)- Life Science Office REIT- S&P 500 constituent.

- American Tower Corporation (AMT)- Communications & Cell towers- S&P 500 constituent.

| STOCK | TTM FFO/SHARE | TTM DIVIDEND/SHARE | PAYOUT RATIO |

| O | $3.97 | $3.16 | 79% |

| MAA | $8.24 | $5.88 | 71.30% |

| VICI | $2.52 | $1.66 | 65.80% |

| PLD | $6.20 | $3.84 | 61.90% |

| ARE | $7.82 | $5.20 | 66.50% |

| AMT | $10.42 | $6.56 | 62.90% |

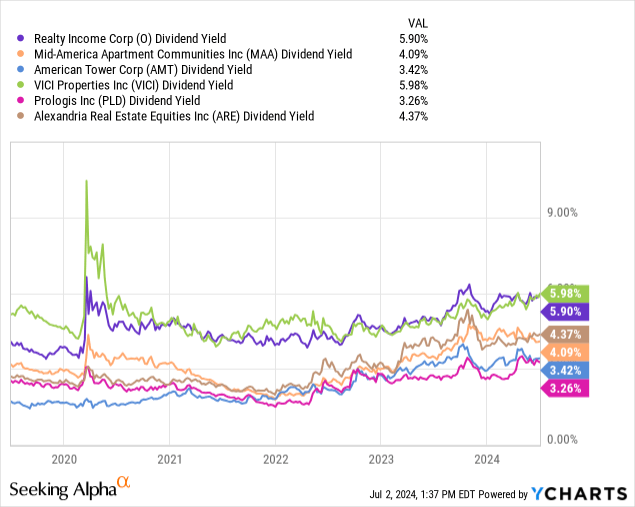

Dividend yields:

It’s no secret on Seeking Alpha that REITs are cheaper than they have been in a decade, both from an FFO & dividend yield perspective. The sector is the absolute worst of the 11 and that is always a great place to hunt.

When a sector is obliterated, I don’t like to get fancy in my purchases. I want the best and well-known blue chips of the bunch. The above selections all serve different segments of commercial real estate that are still profitable, and all are large S&P 500 constituents (SP500). That is simply my comfort level when it comes to sector calls where every name is on sale.

Risks and summary

Having played the rate cut buys too early, I surely have missed out on some NASDAQ (QQQ) growthy upside by allocating some of my funds to dividend and income-centric equities too early. Again, the risk to this thesis is how long we have to wait for a reaction in the rate-cut play. The longer, the more opportunity costs we are forfeiting to the market.

The Presidential outlook has me more positive than ever that 2025 may be a year with more rate cuts than analysts could have anticipated should Trump return and pressure or replace Jerome Powell in search of economic stimulus. It happened during his first term [the vocal advocation for rate cuts] and I can imagine it happening again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here