Danske Bank A/S (OTCPK:DNSKF) has reported a positive operating performance in Q2, plus its excess capital position allows it to distribute significant dividends over the next couple of years.

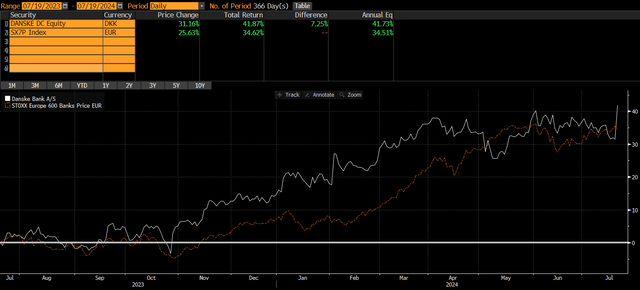

As I’ve covered in previous articles, I see Danske as one of the best European banks and a good income play, due to its high-dividend yield that is sustainable over the long term. Not surprisingly, its shares are up by more than 40% over the past year, outperforming the European banking sector during the same period, as shown in the next graph.

Share price (Bloomberg)

As the bank has reported today its Q2 2024 earnings, I think it’s now a good time to analyze its most recent financial performance and update its investment case, to see if it remains a good income pick in the European banking sector.

Danske’s Q2 2024 Earnings

Danske has reported its financial figures related to Q2 2024, beating market expectations both at the top and bottom-lines. On top of that, it also announced higher capital returns than expected, leading to a positive share price reaction with its shares up by more than 7% on the day.

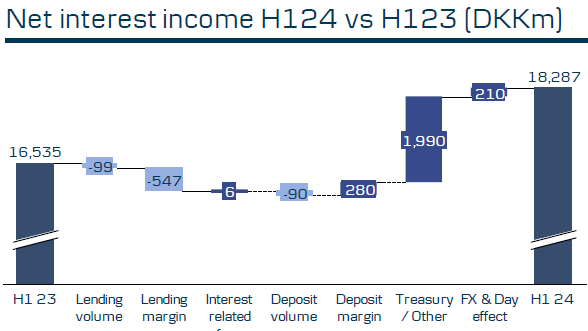

During the first half of 2024, Danske continued to benefit from the high-interest rate environment, leading to a net interest income (NII) of nearly $2.7 billion, up by 11% YoY. This positive performance was mainly supported by its treasury segment, while lending volume and lower deposits had a slight negative impact on the bank’s NII.

Net interest income (Danske)

In the first half of 2024, NII represented some 67% of total revenues, which shows that Danske has a significant gearing to rates, even though is not among the European banks more exposed, which usually have an NII contribution between 75-80% of total revenues.

Given that the European Central Bank has started to cut rates recently, which was followed by the Danish central bank due to the currency peg to the Euro, and the outlook is for further cuts ahead, this should lead to NII headwinds in the coming quarters and, most likely, Danske’s NII has probably reached a peak in Q2 2024. Indeed, on a quarterly basis, NII was flat supported by lending and deposit volumes, but going forward its NII is expected to decline due to lower rates.

Despite that, its revenues are expected to maintain a positive trajectory in the coming quarters, being supported by higher fee income. During the first half of this year, its fee income amounted to more than $1 billion, up by 13% YoY, justified by higher customer activity in the banking segment and strong debt capital market performance. Net income from the insurance business also performed well, with customers moving money from deposits to savings products.

The only revenue line that reported lower revenues in H1 2024 was trading income, which amounted to only $200 million (-38% YoY), but Danske is not much reliant on trading income and the overall impact on revenues was not much material.

Due to higher NII and fee income, total revenues increased to more than $4 billion in H1 2024, up by 9% YoY. For the full year, the bank’s guidance is just to grow revenues, which seems quite conservative given its positive operating momentum in the first semester, while the street expects revenues to be around $8.2 billion (+8% YoY).

Regarding costs, Danske reported operating expenses of $1.87 billion in the first semester of 2024, up by just 1% YoY. This is quite good considering the inflationary environment and wage growth pressure in Denmark and across other Nordic countries, showing that Danske was able to offset these pressures by reducing costs elsewhere.

Its cost-to-income ratio was below 46% in H1 2024, below its mid-term target of about 50%, which means its efficiency is already quite good, allowing the bank to continue to invest in technology and digitalization to improve its efficiency in the near future.

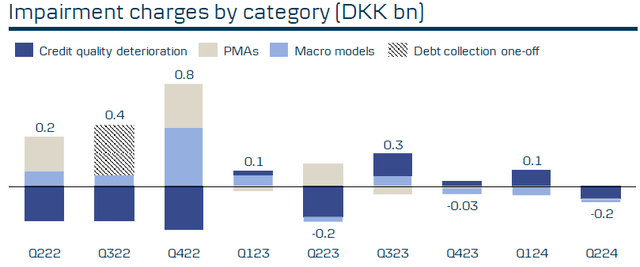

On the asset quality side, Danske has maintained a superior credit quality in the European banking sector and, despite higher rates in recent years, consumers and corporate have maintained strong solvency levels throughout this period. Indeed, in H1 2024, Danske reported provision reversals of $14 million, showing that credit quality across its loan book remains at very healthy levels.

Provisions for credit losses (Danske)

For the full year 2024, Danske’s guidance is for risk levels to increase somewhat due to macro and geopolitical uncertainties, expecting risk provisioning to be about $87 million, which is still quite low and is not expected to have a significant impact on its earnings.

Due to higher revenues, good cost control and resilient credit quality, Danske’s net income in the first semester of 2024 increased by 13% YoY to more than $1.6 billion and its return on equity (ROE) ratio, a key measure of profitability in the banking sector, was 13.1%. For the full year, its net income guidance was upgraded and is now expected to be between $3.1-3.3 billion, while previously Danske was expecting a net income below $3 billion, showing that its operating momentum in the first half of the year was better than expected and the pace of interest rate cuts will be likely moderated in the second half of this year.

Regarding its capitalization, the bank has a very strong position given that its CET1 ratio was 18.5% at the end of June, being one of the best capitalized banks in Europe. Given that its goal is to have CET1 ratio above 16% by 2026, Danske has a significant excess capital position and does not need to retain much profits ahead, allowing to return significant capital to shareholders over the next few years.

Indeed, considering this strong capital position and the recent agreement to sell its retail business in Norway, which is expected to close until the end of 2024, Danske has plenty of capital available to return to shareholders.

This is a significant difference from the previous years, when uncertainty about its anti-money laundering (AML) issues in Estonia and the cost of settlements with different authorities and regulators led to small payouts to shareholders from 2018 to 2022. As this issue was settled in 2022, Danske is now in a different phase and can focus on capital returns as one of its most attractive features of its investment case.

Indeed, Danske surprised by announcing an interim dividend to be paid in the coming days of DKK 7.50 ($1.09) per share, representing some 56% of its H1 2024 earnings. Investors should note that Danske has historically only paid one dividend per year, thus an interim dividend was not expected, showing that Danske clearly has excess capital and does not need to retain earnings.

Furthermore, the bank also intends to distribute a special dividend of about $800 million when the sale of its retail unit in Norway to Nordea (OTCQX:NRDBY) closes in the coming months, as there isn’t any need to boost its capital ratio following this disposal.

Related to its 2024 earnings, it wants to distribute the full remaining net profit in 2025, while after that it will again resume an annual dividend frequency. However, considering the bank’s strong position and organic capital generation capacity, there is some possibility that Danske will pay more special dividends or perform share buybacks in the next couple of years, enhancing its total capital return policy.

According to analysts’ estimates, its total dividend related to 2024 earnings, not considering its ‘special’ dividend related to proceeds from the sale of its personal customers business in Norway, is expected to be DKK 15.2 ($2.22) per share, representing an increase of 5% YoY. At its current share price, this leads to a forward dividend yield of around 7%, which is quite attractive to income investors and is above the average of the European banking sector.

Regarding its valuation, Danske is currently trading at 1.02x book value, a similar valuation compared to when I last analyzed the bank. While this represents a premium to its historical valuation over the past five years (0.7x book value), investors should consider that due to its AML issue its valuation was quite depressed compared to its fundamentals and has significantly re-rated since the end of 2022.

Despite that, compared to its Nordic peers, such as Nordea or Swedbank (OTCPK:SWDBY), Danske continues to trade at a discount given that its peers trade, on average, at more than 1.2x book value. This discount does not seem to be justified, as the bank already has settled its historical issues related to AML, which means its valuation seems to be attractive at current levels.

Conclusion

Danske has reported a positive operating performance in the first half of the year and surprised the market with an interim dividend to be paid in the coming days, plus ambitious plans to return excess capital to shareholders over the coming year. This clearly shows that Danske can distribute a large part of its earnings to shareholders in the future, making it dividend yield of 7% sustainable and quite attractive to income investors. On top of that, its current valuation also seems to be undemanding, making Danske an interesting pick in the European banking sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here