Investment Thesis

ServiceNow (NYSE:NOW) (NEOE:NOWS:CA) delivered an earnings report that was met with cheer from investors, as its stock jumped 6% premarket. But details matter. I assert, as I’ve done before, that ServiceNow is on the path toward becoming a megacap stock, a household name.

Indeed, I argue that investors are getting a very fair entry price right now while paying 35x next year’s free cash flow. ServiceNow is not only delivering +20% premium growth, but it’s capable of sustaining this growth in the medium term. What’s more, its balance sheet has substantial financial resources, which provide this stock with an added margin of safety.

All in all, I remain steadfast in my opinion that ServiceNow is a buy.

Rapid Recap

Last month, I said,

This is a large cap, on the path towards being a mega-cap. Investors are not going to find this type of stock on sale. ServiceNow is a company with strong prospects, that offers investors peace of mind. And that comes at a high price.

Author’s work on NOW

And that succinctly explains my thesis. ServiceNow is going to become a megacap stock. I’m a strong believer in this statement. There will be minor blips along the way, but this stock won’t go on sale for long. Consequently, on the back of this earnings report and improved guidance, I reiterate my stance on this name.

ServiceNow’s Near-Term Prospects

ServiceNow provides cloud-based software solutions designed to help businesses manage digital workflows. It enables organizations to streamline operations across various departments such as IT, human resources, and customer service by automating routine tasks and processes. ServiceNow’s platform incorporates GenAI to enhance efficiency and productivity, making it easier for businesses to handle complex workflows.

In the near term, ServiceNow’s prospects appear strong. The company reported solid growth in subscription revenue and notable success in new product launches, particularly its AI-driven solutions like Now Assist. With increased adoption across diverse industries and impressive performance metrics, ServiceNow is poised for continued expansion.

However, ServiceNow faces challenges too. The enterprise software market is highly competitive, with numerous players vying for dominance across various segments such as cloud computing, AI, and workflow automation. Major competitors include tech giants like Microsoft (MSFT), Salesforce (CRM), and Oracle (ORCL), which also offer comprehensive suites of enterprise solutions.

Given this balanced background, let’s now discuss its fundamentals.

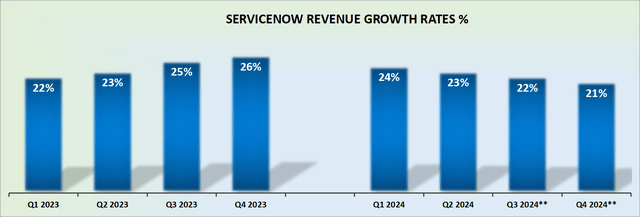

Revenue Growth Rates Point to 23% CAGR in 2024

NOW revenue growth rates

ServiceNow has upwards revised its guidance for 2024 by $10 million out of $10 billion, or a morsel. But it’s enough to confirm to investors that ServiceNow has what it takes to deliver premium growth. Premium growth means steady, consistent, predictable, and reliable growth of more than 20% CAGR.

To be clear, it’s not so much that ServiceNow raised its guidance here that matters, but rather that it didn’t pull back on its guidance, as many IT-related SaaS companies have been making noises about the tough macro environment and struggling to meet the guides they set out earlier in the year.

Evidently, that’s not the case with ServiceNow. And this has implications when it comes to the premium investors who are willing to pay for the stock. A stock with a strong positive narrative, with a plan to reach $15 billion while delivering +20% CAGR, is few and far between. In fact, in my mind, I count fewer than 5 names (but I may be wrong). Given this context, let’s now discuss NOW’s valuation.

NOW Stock Valuation — 35x Next Year’s Free Cash Flow

Earlier this month, I wrote,

Supposing ServiceNow can expand its free cash flow margin by 100 basis points next year, to 32%, this would see ServiceNow delivering approximately $4.3 billion in free cash flow [next year].

Given that we are halfway through 2024, and ServiceNow has already raised its full-year guidance for its operating income by 50 basis points, this implies that the back end of 2024 will be more profitable than investors previously expected.

Hence, this confirms my contention that ServiceNow is more than likely to expand its adjusted free cash flow margin by 100 basis points next year.

Therefore, here are my rough assumptions, ServiceNow grows its top line next year by 22% while expanding its free cash flow margin to approximately 32%, this would see about $4.3 billion on the cards showing up at some point in 2025. Even if this figure isn’t hit in 2025, ServiceNow will assuredly be on this path through 2025 into 2026.

On top of that, ServiceNow holds roughly $4 billion of net cash, not including the approximately $3.5 billion of long-term investments. In other words, investors have a high free cash flow generating business, with a rock-solid balance sheet, in a well-positioned area of the market. Paying 35x next year’s free cash flow for ServiceNow strikes me as a reasonable entry point for new investors to this name.

The Bottom Line

Paying 35x next year’s free cash flow for NOW makes sense for new investors due to the company’s strong growth trajectory, robust financial health, and ability to sustain +20% premium growth in a highly competitive market.

With its solid balance sheet and substantial financial resources, ServiceNow provides a margin of safety that enhances its attractiveness. Moreover, the company’s strategic position and innovative AI-driven solutions set it on a path toward becoming a megacap stock. Thus, entering at this valuation offers a fair opportunity to invest in a high-potential, industry-leading enterprise software provider.

ServiceNow’s growth trajectory ensures that investors will “now” be in the service of impressive returns.

Read the full article here