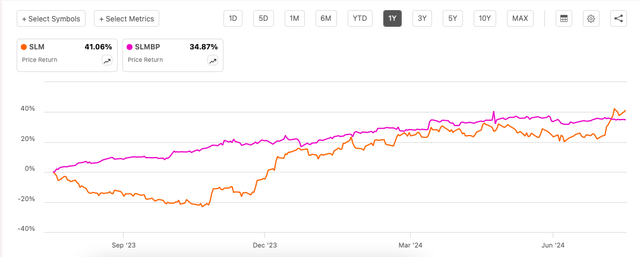

What a difference a year makes. When I first wrote about the preferred share listing for education loan provider SLM Corporation (NASDAQ:SLMBP) in August last year, its price returns were positive even as the stock’s main listing (NASDAQ:SLM) was dropping. While SLMBP’s returns over the past year are still healthy, the main listing has done even better (see chart below).

Price Returns, SLMBP and SLM (Source: Seeking Alpha)

There’s a very good reason for this. SLMBP’s unique selling point is its dividends, which are based on the three month LIBOR. So, with a softening in the LIBOR and with further expected interest rate declines expected, there’s no more dividend upside. This was already beginning to show up in the relative price trends for SLMBP and SLM, when I last covered it in January. With market multiples not convincingly pointing to further price rise either, I had gone with a Hold rating on the stock.

However, with delays in the rate cut cycle in the US and the release of the company’s Q2 2024 results yesterday, here I look at whether the prospects for the stock have changed.

Q2 2024 results are a mixed bag

First, a look at the results, which were a mixed bag. In terms of the positives, SLM Corporation saw a 6% year-on-year (YoY) increase in private education loan originations. Also, the provisions for credit losses also declined by 5.6% YoY to USD 17 million.

However, the net income attributable to common stock declined by 5.4%, YoY, which was to be expected at a time of softening interest rates. This is evident from the fact that the net interest margin fell to 5.36% in Q2 2024 compared with a 5.52% level in Q2 2023. In fact, the figure has dropped even sequentially from 5.49% in Q1 2024. This reflects in the net interest income too, which saw a 3.9% decline on both a YoY and sequential basis.

Even with an income decline, however, as a result of a proportionally higher contraction in shares outstanding by 6.7% YoY, the GAAP diluted earnings per common share [EPS] still saw a ~1% YoY increase.

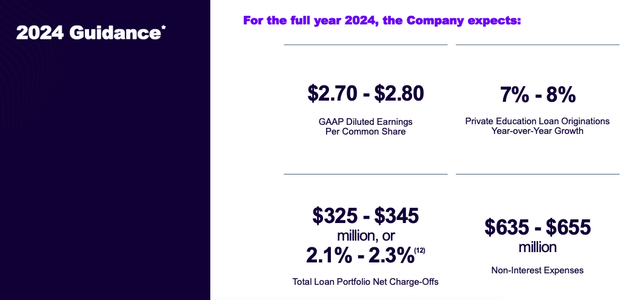

EPS outlook for 2024 raised

In an even more encouraging development, for the full year 2024, the company has actually raised its EPS guidance range to USD 2.7-2.8 now, from the earlier USD 2.6-2.7 earlier. At the midpoint of the guidance range, this represents a 14.1% YoY increase, compared to the earlier expected 10% YoY rise.

Source: SLM Corporation

Presumably, much like as observed in Q2 2024, this would be on account of further stock buybacks, since it’s hard to fathom the outlook on the key variable of net interest income would have improved at this time.

The company does indeed have a share repurchase plan underway, with USD 650 million worth of buybacks expected between January 2024 and February 2026. That this amount is a notable 12.5% of the current market capitalisation puts it into perspective. So far, SLM has already bought back 2.9 million shares, and it has a capacity of USD 562 million still remaining.

Stock metrics

There are two derivations for the SLMBP stock from the discussion on fundamentals. The first is about its dividends. Even though SLMBP’s dividends aren’t earnings-dependent, it bears reiteration that they aren’t mandatory either. So, as long as the company’s EPS is healthy to rising, dividends for the preference shares are expected to continue to sustain.

In fact, the stock’s forward dividend yield is at a strong 9.7%, only 10 basis points lower than the trailing twelve months [TTM] yield of 9.8%. In fact, it’s also higher than the stock’s five-year average of 7.3%.

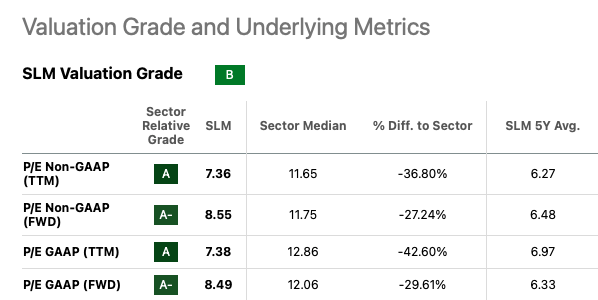

If the price declines, however, the forward yield can rise even higher than the TTM levels. This brings me to the second derivation, the market multiples. The closest proxy to assess the stock price potential is through the market multiples for the main stock listing. Much like the last time, all the multiples continue to remain above the stock’s five-year average (see table below).

Source: Seeking Alpha

With a 17.5% increase in SLM’s price since, this was to be expected. But the real question is, why has the stock risen despite its relatively elevated multiples? The answer can be found in a comparison with its peers Nelnet (NNI) and Navient Corporation (NAVI). Their TTM GAAP P/Es at 30.1x and 9.89x respectively are higher than SLM’s at 7.4x. Similarly, their forward GAAP P/Es at 18.2x and 9.2x are ahead of SLM’s ratio at 8.5x.

The average of the downside indicated by the stock’s present versus past levels, and the upside indicated with the peer comparison indicate a 30% price upside.

What next?

Even if the expected gains don’t materialise in price, the fact that SLMBP’s dividend yield still looks good and is expected to remain high is a positive. This is especially so since the stock’s market multiples compared against its past levels don’t indicate any significant downside.

That its supported by fundamentals is another positive for SLMBP. Despite the expected decline in interest rates moving forward, so far, the contraction in net income is contained and its share buyback program indicates that the EPS can continue to rise. To this extent, the upgrade in its EPS guidance is particularly heartening, and suggests dividend safety moving forward. Also, the come off in interest rates has also been quite slow.

While it’s possible that the SLM main listing can continue with its lead on SLMBP going by the scope for capital appreciation indicated by the analysis of market multiples, that doesn’t mean SLMBP isn’t attractive in its own right. It hasn’t shown the kind of weakness in either dividend yield or price as I had feared the last time around. On the contrary, it has seen price gains of 8.4% and total returns of 14% over this time. Even if the price gains slow down and there’s also a drop in the dividend yield on lower interest rates, it’s still a strong dividend stock. I’m upgrading SLMBP to Buy.

Read the full article here