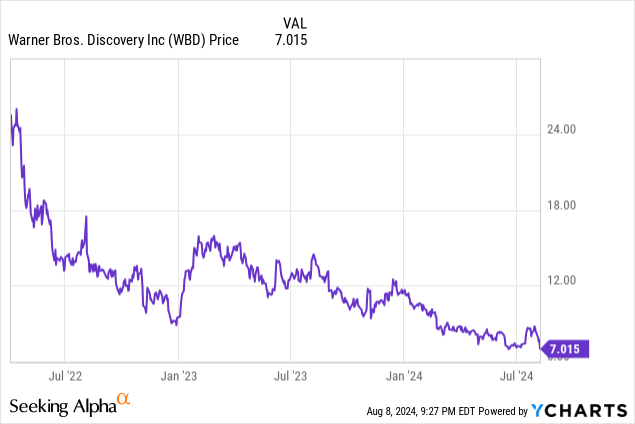

Warner Bros. Discovery (NASDAQ:WBD) has significantly underperformed the market over the past few quarters. The company has experienced major headwinds on many major fronts, from declining linear television revenues to struggling theater revenues. These headwinds have translated to a sizable revenue and profitability miss in Warner Bros. Discovery’s latest quarter. In fact, WBD took an enormous $9.1B impairment charge, causing the stock to collapse after it reported earnings.

Despite these challenges , WBD is well-positioned for growth in the coming years. The company is successfully capitalizing on its unparalleled IP, reducing debt at an impressive rate, and implementing attractive bundling packages. WBD has much to look forward to as its most successful franchises are starting to gain momentum.

WBD continues to underperform as a result of a linear network business in secular decline.

Top-Notch IP

WBD owns some of the most popular franchises in the world in nearly all of the most popular genres, which include heavy-hitters like DC, Harry Potter, Game of Thrones, and Dune. The company is finally starting to fully leverage its incredible IP with the recent success of Game of Thrones spinoff House of the Dragon, Dune, and Harry Potter.

WBD’s upcoming television and movie slate is also the most promising it has been in years, with releases like Dune Prophecy, The Penguin, Joker 2, and Superman Legacy scheduled to be released all within the next year or so. Such a stacked lineup rivals and arguably even surpasses that of Disney (DIS) or Netflix, which is impressive given the fact that these companies are valued at an order of magnitude larger than WBD.

With the declining interest in Disney franchises like Marvel and Star Wars, evident in viewership numbers of box office numbers, WBD is in a great position to take Disney’s throne as the holder of the most valuable IP. In fact, some of the biggest theater releases have been from WBD over the past year, from hits like Barbie and Dune raking in billions of dollars.

Bundling Strategy Comes at a Perfect Time

WBD is starting to bundle its streaming service Max with Hulu and Disney+. This bundle will likely prove to be a winning strategy as it will likely decrease churn rates, which have proven to be a major issue for many of the smaller streamers. Only Netflix (NFLX) has been able to keep its customer retention rates at an acceptably low level.

By bundling its content with that of Hulu and Disney, WBD will make it harder for customers to justify cancelling the service given the plethora of content on the bundle. It will also put WBD on much firmer footing to compete with the likes of Netflix and even Amazon Prime, which has unparalleled resources at its disposal. Moreover, this bundling strategy helps increase exposure to Max’s premier content like Game of Thrones or House of the Dragon, which are arguably some of the best in the industry.

Linear Network Business Remains a Challenge

Despite the fact that WBD still makes a huge chunk of its revenue from its linear network businesses, which boast margins of ~40%, it is a segment in decline. In fact, its own streaming service has only accelerated the downturn of its linear business given the overall trend towards streaming. Given that its streaming margins are only at about 20%, this trend is troubling.

WBD is unlikely to see a revitalization of its linear businesses as the entire linear network industry continues to decline. The NBA rights fiasco will only serve to accelerate the downturn of WBD’s linear business, especially considering how much money the NBA has brought in for WBD in the past. Unfortunately for WBD, there is no clear way out of its linear business woes with the rise of newer technologies like online streaming.

Financials Remain a Large Burden

WBD still has a huge pile of debt, which has hampered the company’s ability to invest in its IP. The company has had to be extremely selective in which projects to invest large resources to. This strategy is not optimal in an environment where customer churn is higher than ever. A few large projects every year are not enough to keep consumers around as long-term customers.

On the flip side, WBD has paid back ~13B in debt over the past few years, reducing its debt pile by ~25%. Furthermore, the company has strong cashflow that will allow the company to continue paying down debt for the foreseeable future. If WBD can keep its debt under control and continue investing in high-quality projects, the company could see its shares jump.

Conclusion

WBD appears to be undervalued at its current valuation of ~$19B given its relatively large TTM revenue of ~$40B. As a comparison, Disney and Netflix are valued at ~$156B and ~$270B while having TTM revenues of ~$90B and ~$34B respectively. This means that WBD only has a P/S ratio of .42 compared to Disney’s 1.75 and Netflix’s 8. However, WBD continues to lose money and is being dragged down by a linear network business is rapid decline.

Despite the company’s unparalleled IP and promising streaming business, WBD should be considered a hold at its current levels, especially after its underperformance in Q2. The future of WBD may rest upon the success of a few projects, making it a risky play despite its promising portfolio of assets.

Read the full article here