Investment overview

I give a hold rating to Howmet Aerospace (NYSE:HWM). I am bullish on the fundamentals of the business, given the strong underlying secular tailwinds and the potential for enhanced capital returns. However, the stock is trading at a high valuation, which provides little margin of safety to investors today. Hence, I believe investors should wait for a better entry point.

Business description

HWM is in the business of providing engineered solutions for the aerospace and transportation industries. The business focuses on jet engine components, aerospace fastening systems, and titanium structural parts, as well as forged wheels for commercial transportation. The primary business units (segments) are Aerospace Commercial; Aerospace Defense; Commercial Transportation; and Industrial & Other. Of the four segments, Aerospace Commercial is the largest (49% of total revenue), followed by Commercial Transportation (21%). Collectively, commercial aircraft are HWM’s largest growth driver (70% of total revenue).

2Q24 earnings (announced on 30th July)

In the quarter, total revenue saw $1.88 billion (a 14% y/y growth), driven by engine products revenue of $933 million (14% growth), Fastening Systems revenue of $394 million (20% y/y growth), Engineered Structures revenue of $275 million (38% y/y growth), Forged Wheels revenue of $278 million (7% y/y decline). The common trend for the segments that saw positive growth was strong demand in the commercial aerospace market. Solid revenue performance drove adj EBITDA margin up to 27% (a 350bps y/y expansion vs. 2Q23), and this led to adj EPS of $0.67 vs. 2Q23’s $0.44.

Commercial segment has long growth runway

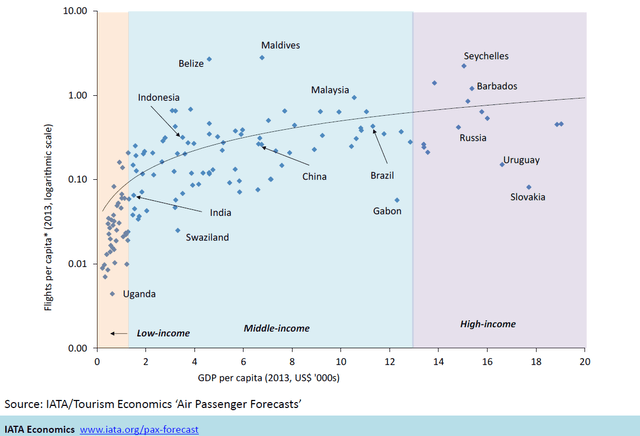

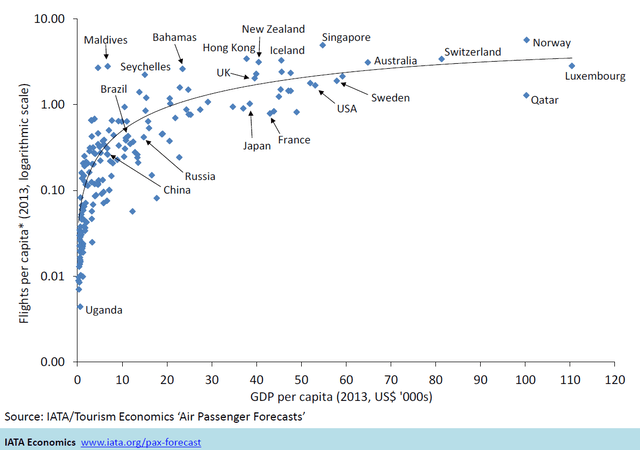

I am very positive about the long-term growth outlook for HWM, as the commercial aerospace market benefits from the strong secular trend of a growing number of air passengers. According to the IATA, the number of air passengers is expected to grow at a 4.2% CAGR through 2040 from 2023 levels, and I believe this makes sense as more countries transit from developing status to a developed one, which means higher GDP/capita.

IATA IATA

If we look at the IATA analysis, GDP/capita has a strong correlation with flights per capita, with developed countries having substantially higher flights per capita. Based on IMF data, developing countries have an average GDP/capita of $6.7k, and these countries experience GDP growth at ~2.5x the rate of developed countries. What this means is that we are going to see periods of accelerating growth in the number of flights as these developing countries move up the curve (note that the rate of flight per capita growth increases sharply when GDP per capita grows from 0 to $20k).

With this huge number of passengers coming online, the world needs more commercial airplanes. And this is in line with Boeing’s estimates that the number of commercial airplanes will almost double over the next 20 years.

HWM to benefit from aftermarket demand

A positive aspect of investing in HWM is that it also gives investors exposure to aftermarket demand, which I expect will be another solid growth driver for HWM. From a long-term perspective, the growing number of new planes will mean more demand for aftermarket parts as they reach an age that requires more maintenance (aftermarket parts are cheaper). This would mean that HWM can participate in the first leg of growth (the production of new planes) and recurring growth when the plane gets older. From a revenue quality perspective, aftermarket sales also reduce the volatility of the HWM revenue stream over time as it has higher visibility (as the plane ages, they will need new parts). The recent production problems with airplane OEMs also illustrated the importance of aftermarket parts as demand for older planes surged (another report link for reference).

Capital allocation

The potential for an increase in capital returns to shareholders has also gotten a lot higher, as the HWM leverage ratio has gone down to <2x (net debt to EBITDA ratio) for the first time ever. As of 2Q24, leverage is around 1.7x net debt to EBITDA, and if HWM continues to benefit from the secular tailwinds I identified above, the leverage ratio should continue to trend downward. This is music to shareholders’ ears, as it means that HWM has more flexibility to buyback shares or payout more dividends—and yes, this is exactly what management did. HWM’s board of directors has authorized an increase in the company’s share repurchase program by $2 billion to $2.487 billion of its outstanding common stock; authorized a 60% dividend increase from $0.05 to $0.08 beginning in 3Q24; and approved the establishment of a 2025 dividend policy at 15% plus or minus 5% of net income, excluding special items.

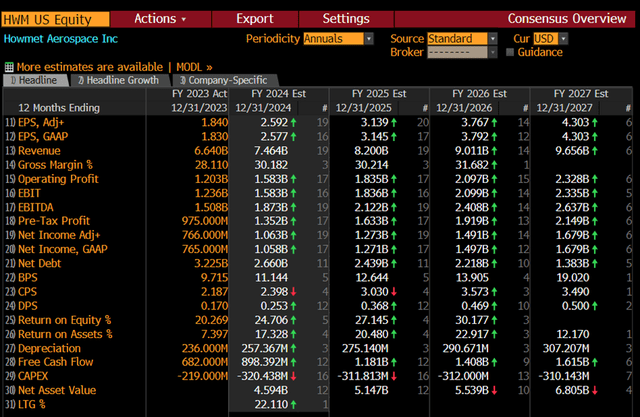

I believe HWM can easily fund these capital return policies. Assuming HWM continues to grow adj EBITDA as per consensus estimates, generating a total adj EBITDA of $2.1 billion in FY25, alongside the $1.6 billion of FCF (2H24e + FY25e, as per consensus estimates), this implies the HWM leverage ratio to fall to <1x. Recall that management’s leverage ratio target is between 1.5x and 2x, which means HWM will have “extra capital” that can be returned to shareholders.

Valuation

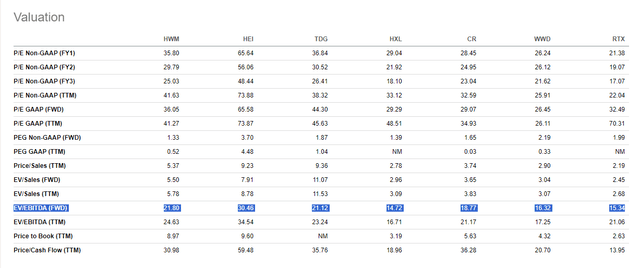

The only problem I have with the stock is that it is trading at 20x forward EBITDA, which is multiple turns above its past 3-year trading history (range was 12x to 17x). While I get the growth story (and am supportive of it), I am not a fan of the lack of margin of safety here. It is pretty evident that a lot of expectations have been embedded in the stock, and multiples have to stay at this level in the near term for the upside to be attractive.

Bloomberg

For instance, assuming the consensus FY26e adj EBITDA estimate is accurate ($2.4 billion) and the stock trades at the high end of the past 3-year valuation range (17x) (note that HWM trades at a premium to peers as well), it implies an enterprise value of ~$40.8 billion (or ~$38 billion market cap) and a share price of $93, which is where the stock is trading today. Hence, I am giving the stock a hold rating until the valuation gets cheaper.

SeekingAlpha

Risks

Near-term risk includes a slower production timeline by the OEMs (take Boeing for example), and longer than expected macro weakness that pressures consumer discretionary spending. These two are concerning because of the valuation that HWM is trading at today. If growth disappoints, we could see a sharp valuation derating. Longer-term, depending on how advance airplanes can be, the size of aftermarket sales may not be as large as I think if they require lesser maintenance.

Conclusion

I give a hold rating for HWM. I don’t disagree that the business is set to benefit from the robust secular tailwind in the commercial aerospace industry. However, the current valuation is just too much for me to get comfortable with as it provides little margin of safety for investors. While the long-term fundamentals remain sound, I believe a more attractive entry point is necessary to justify a buy rating.

Read the full article here