Cinemark Holdings, Inc. (NYSE:CNK) recently reported the company’s Q2 results, showing a notable year-on-year decline in revenues and earnings as the box office remains slow. Still, with the box office pipeline remaining strong for upcoming years, the company’s longer-term outlook remains good.

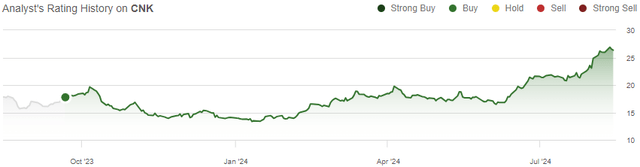

I previously wrote an article on the stock on the 21st of September in 2023, titled “Cinemark: Rebound Potential Still Left“. In the article, I rated Cinemark at a Buy rating due to the company’s then-ongoing Covid pandemic recovery in the cinema industry creating an attractive valuation. Since, the stock has now appreciated 53% compared to S&P 500’s return of 25% in the same period.

My Rating History on CNK (Seeking Alpha)

Q2 Tracks 2024 Box Office Weakness

Cinemark’s Q2 report showed incredibly weak financials – revenues came in at just $734.2 million at a wide -22.1% year-on-year decline, and the adjusted EPS of $0.33 missed prior year’s $0.89 Q2 adjusted EPS by nearly two thirds. The revenue decline sharpened by a wide margin from just a -5.2% slump in Q1. The 2023 strikes in Hollywood increasingly contributed to a slow box office performance, which Cinemark experienced the effects of.

Underneath the weakness, revenues from admissions declined -23.5% and concession revenues declined by a slightly lower -21.6%, showing Cinemark’s ability to still sell food, drinks, and other side products at a good rate to the coming traffic.

While the dramatic decline in admissions inevitably pushed profitability down, the $82.9 million in operating income was still at a surprisingly good level as Cinemark had good flexibility in salaries and wages, utilities, and other costs.

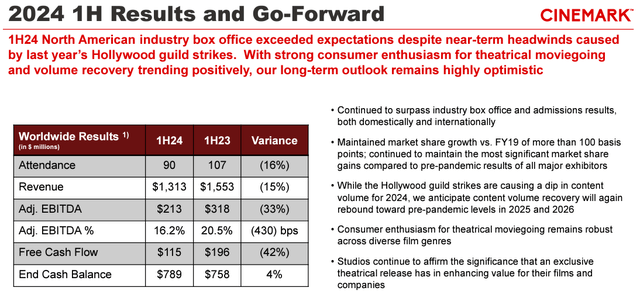

CNK Q2 2024 Investor Presentation

While the results were irrefutably bad, the Q2 financials aren’t likely to cause long-term harm to earnings. Movie admissions were already known to be weak during the period prior to Cinemark’s results, as the company even managed to beat Wall Street’s revenue estimate by a wide $44.9 million margin, and the adjusted EPS estimate by $0.20.

AMC Entertainment (AMC) has also shown similar trends, as the competing company’s revenues declined slightly more sharply at -23.5% in Q2, also way sharper than AMC’s -0.3% Q1 decline – overall, Cinemark still seems to have held quite a stable market share in the recent weakness, with a recovery depending on a box office performance improvement.

Upcoming Box Office Activity Is Exciting

Although exciting releases have been slower in the box office, the pipeline for new movies remains at a good level, posing great growth catalysts for the industry in 2025 and forward. The fourth quarter already has anticipated releases such as Joker Folie a Deux and Gladiator II, but 2025 releases look to accelerate admissions more with Avatar 3, Moana, Jurassic World Extinction, and a number of other releases.

Well-anticipated releases are continuing into 2026 with a new Avengers movie, Toy Story 5, Shrek 5, The Batman Part II, and others, providing a platform for Cinemark and the industry to grow back from the current box office slump.

Cinemark anticipates volume recovery to rebound towards pre-pandemic levels in the next two years as a result of the releases, and I believe that good growth in 2025 and forward looks likely.

Updated Valuation: CNK Is Now Fairly Valued

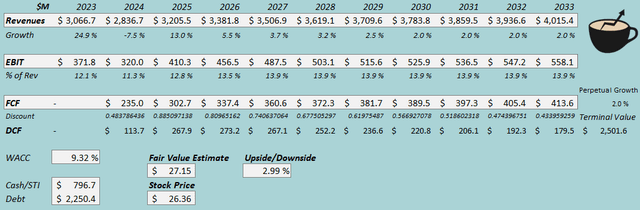

I updated my discounted cash flow [DCF] model on Cinemark, essentially pushing the revenue recovery back amid the slow 2024 box office activity – I now estimate a good 13% growth in 2025 and 5.5% growth in 2026, but a -7.5% decline in 2024. Afterward, I estimate a few years of slightly elevated growth again, slowing down into 2.0% perpetually.

I again estimate the EBIT margin to reach 13.9% in the next few years, representing Cinemark’s 2003-2019 average operating margin.

The cash flow conversion outlook remains good, better explained in my previous article.

DCF Model (Author’s Calculation)

The estimates put Cinemark’s fair value estimate at $27.15, 3% above the stock price at the time of writing – with the stock performing very well since my previous article, I believe that the stock has now run its course, especially with the currently weak box office activity.

The fair value estimate is up from $23.75 previously, primarily due to a lower used WACC.

CAPM

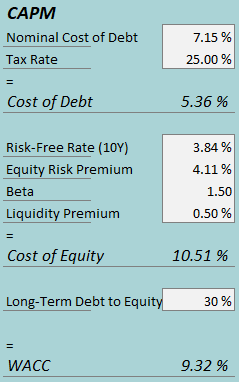

A weighted average cost of capital of 9.32% is used in the DCF model, down from 10.55% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Cinemark had $40.2 million in interest expenses, making the company’s interest rate 7.15% with the current amount of interest-bearing debt. I now estimate a slightly lower 30% debt-to-equity ratio in the long term.

To estimate the cost of equity, I use the 10-year bond yield of 3.84% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at 1.50. With a liquidity premium of 0.5%, the cost of equity stands at 10.51% and the WACC at 9.32%.

Takeaway

Cinemark’s Q2 results showed a significant industry slowdown as the 2023 Hollywood strikes had an adverse effect on box office activity. Cinemark still performed well in the quarter with a comparable performance to AMC, also managing to vary costs effectively and being able to sell concessions at a good level compared to traffic. The accelerated box office release pipeline in 2025 and 2026 looks to rebound cinema traffic very well, but as the stock seems to have corrected the undervaluation from my prior article, I downgrade Cinemark into a Hold rating.

Read the full article here