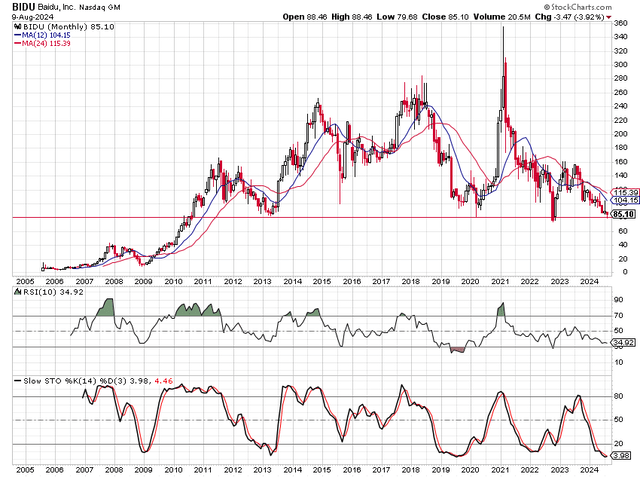

Baidu, Inc. (NASDAQ:BIDU) (OTC:BAIDF) has been one of the most promising tech stocks for going on a decade now. Despite large stock gains at times, the Chinese Search leader now trades back to levels seen in early 2011. My investment thesis is ultra-Bullish on the Chinese tech giant due to the strong growth catalysts and the technical support around the current price on a long-term chart.

Source: StockCharts.com

Big Quarter Ahead

Baidu is even more interesting here, with the company reporting Q2’24 results before the market opens on August 22. The biggest question is whether Apollo Go robotaxis and AI can help the tech company start producing real revenue growth after a few years of sputtering around.

The consensus analyst estimates aren’t predicting the company generates much in the way of growth. Baidu only grew Q1’24 revenues by 1% with the core non-online marketing revenues growing just 6%.

Baidu has to boost these growth rates in order for the stock to gain some traction. ERNIE is supposed to be a leading Chinese generative AI model and growth should start showing up in the results with boosts in areas like Cloud and Search benefitting from increasing AI demand.

The company only reported a 23.5% operating margins in the quarter for a business regularly topping 30% in the past due to the high margins in the Search business. Baidu has the opportunity to boost margins via the maturing of the robotaxi and AI business.

In Q1, Apollo Go completed 826K rides to the public, though only up 25% YoY. When last reporting, Baidu had doubled the size of the autonomous area in Wuhan and moved to 24/7 operations.

Apollo Go had reached a driverless status of 70% of rides by April. According to reports, Baidu also plans to increase driverless vehicles from 300 in early May to 1,000 units in Wuhan by year-end.

The company apparently signed a Lidar deal with Hesai Group (HSAI) worth an estimated $200 to 300 million based on Baidu’s plans to deploy 100,000 robotaxi vehicles in China. Appollo Go is apparently paying $200 to $300 per Lidar sensor.

Due in part to this cheap technology, Baidu’s 6th generation vehicle, the RT6, has seen costs drop by 60% compared with the previous generation. The company faces heavy competition, but the price point of only around $28,500 and no driver will make the Apollo Go trips cost competitive.

The valuation of other startups makes Baidu even more compelling. Pony AI was recently valued at $8.5 billion, while WeRide eyes a U.S. IPO with a $5 billion valuation.

The WeRide IPO aims to raise a limited $119 million selling 6.45 million ADRs at a price of $15.50 to $18.50 despite WeRide reporting limited revenues of $150 million yuan in the last 6 months, or the equivalent of just $21 million. The advantage for Baidu is a strong IPO, while WeRide is looking to raise a minimal amount.

On the AI side, firms such as Baichuan are valued in the billions. The Alibaba, Tencent-backed AI startup recently got funded at a $3 billion valuation. At the same time, Moonshot got a valuation topping $3 billion in another sign of how Baidu is a better investment.

Reversion To $80

The $80 level has provided huge support for Baidu going all the way back to 2013, again in 2020, and just below $80 in 2022. The stock recently hit a low of $79.68 on August 5 leading to a solid bounce over the next week.

Back in late 2022, Baidu immediately bounced off the sub-$80 low all the way to $160. The Chinese stock doubled in only a few months after some of the delisting fears disappeared.

A big key to $80 is that Baidu isn’t just historically appealing at this level, the key is that the stock is absurdly cheap. The Chinese search leader moving full speed into robotaxis and generative AI trades with a $30 billion market cap and a far lower enterprise value due to a massive cash balance of nearly $27 billion, only offset by ~$11 billion in debt.

Even the with extra costs for the startup units, the stock trades at ~7.5x EPS targets of $11.40 for 2025. Baidu could generate up to 30% in additional profits from just returning to 30% operating margins in the future.

In essence, investors in Baidu get the robotaxi and AI businesses for free. Or in reality, all of the profitable Baidu core businesses generating $4+ billion in annual profits currently are free with the net cash of $16 billion and startup units combined worth nearly $30 billion.

For this reason, Baidu easily hit strong support at $80 again. The stock has bounced to $89 on the week heading into earnings. Any signs the AI and robotaxi units are pushing the Chinese tech company back into growth mode, and the stock could repeat the $80 to $160 rally of a couple of years ago.

The big risk is that Chinese growth doesn’t materialize like the last couple of decades and regulations in the AI and robotaxi space limit growth and/or profits. In addition, the U.S. government continues trying to crack down on China’s access to advanced GPUs from NVIDIA (NVDA) to limit their competitive position. Baidu could face a tough time building a generative AI business without modern GPUs.

Takeaway

The key investor takeaway is that Baidu is too cheap at $80. The stock just bounced off very long-term support at $80 for a very good reason, though any close below this key threshold would quickly turn Bearish.

Investors should continue loading up on Baidu sub-$90 heading into a big potential catalyst with Q2 earnings.

Read the full article here