Readers of my last article on Lifco (OTCPK:LFCBY), published in March this year, already know that this Swedish role model for the serial acquirer business model is among my favorite personal holdings and a high-performing compounder. Since the time of writing the update on Lifco’s financial performance in 2023, the stock appreciated about 17%, compared to 10% for the S&P 500. The outperformance is even more impressive considering the current macroeconomic uncertainties and the company’s dependency on challenged industries. Especially during these times, we are able to see serial acquirers shine as they’re able to offset organic weaknesses with profitable acquisitions.

Therefore, I wrote this article to further explore Lifco’s ability to maneuver successfully while increasing shareholder returns.

Business Performance

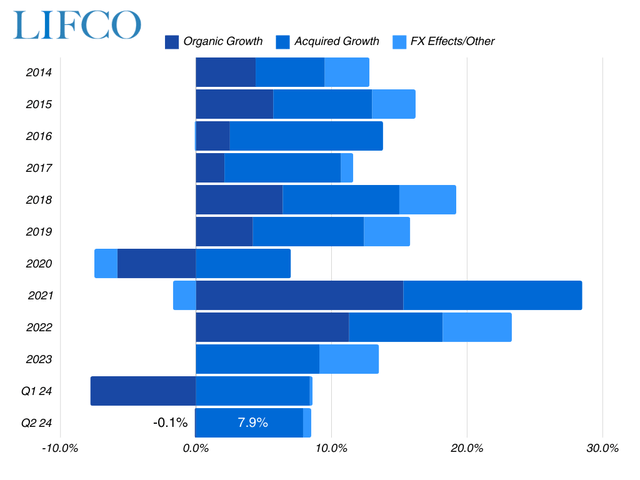

In the first six months of 2024, Lifco reported net sales of SEK 12,731 million, an increase of 4.6% compared to the year before. While this may seem moderate, the quarterly view shows the even more volatile path to this performance. In my last article, we discussed that Lifco’s subsidiaries already faced slowing demand and a challenging business environment, thereby reporting 0% organic sales growth for 2023 after double-digit growth in the two years prior. The start to this year came in even worse as total sales decreased by almost 8% organically in the first quarter, particularly due to the weak construction market that pulled down Lifco’s Demolition & Tools segment by almost 18%. However, a moderate performance in Dental and further acquisitions offset the weakness, which vividly demonstrated the resilience of M&A-agnostic businesses.

Sales Growth (Lifco, Chart @pauldutz)

The second quarter then already presented a less dramatic picture, as overall sales grew by 8.4% year-over-year. Lifco’s M&A machine is up and running, contributing 7.9% to the mix, while the existing group companies reported overall flat sales growth despite ongoing tough market conditions for some of these businesses.

Dental

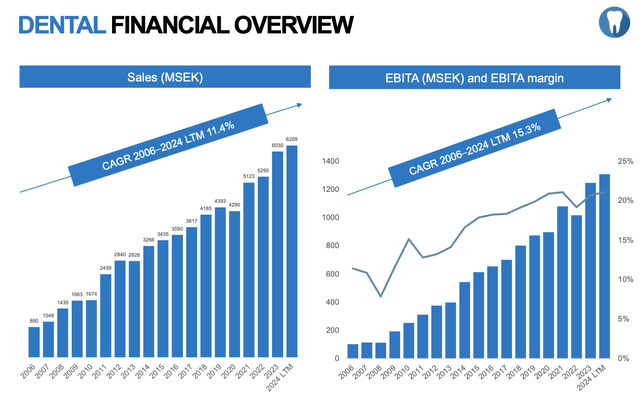

Responsible for 22% of Lifco’s total EBITA, the Dental segment is a prime example for other serial acquirers. Since 2006, Lifco was able to constantly grow the segment organically, while also adding profitable companies that enabled a double-digit annual growth rate and increasing margins.

While the first quarter for the division started with more restrained results due to the early Easter holiday, the companies now benefit from a bounce-back, which was underlined by the management with regard to the year-over-year comparison. Overall, the segment reported sales and EBITA growth of 6% and 10%, respectively, thereby further increasing the operating margin to 21.5% (20.8%). CEO Per Waldemarson commented on the segment’s increased profitability as follows:

If we then maybe look a little bit more on the 6-month period, we are growing sales with around 6%, helped by acquisitions. And then margin is obviously growing a bit more and better EBITA growth of almost 10%. And that has part to do with relatively better performance in the higher-margin companies, which typically would mean the old products [prosthetics] and/or software companies compared to the distribution business where we have slightly lower margin, obviously.

| Consolidated from Month | Acquisitions | Net Sales | % of LTM Sales | Employees |

| July | Pro-Dental | DKK 17 million | 0.10% | 12 |

So far this year, Lifco only announced one acquisition to the Dental segment. The Danish company Pro-Dental is a dental laboratory that manufactures prosthetics for Danish dentists, thereby adding to the higher-margin businesses in this business area.

Dental Segment, Sales & EBITA (Lifco Presentation)

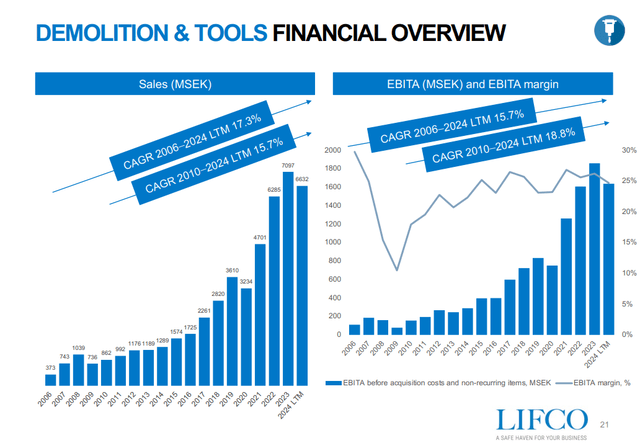

Demolition & Tools

As I’ve mentioned already, the weak construction market in Europe is still challenging the second largest contributor to Lifco’s cashflow, namely the Demolition & Tools segment. During the time of my last article, we ended the fiscal year on an impressive EBITA margin of 26%. However, the cyclical exposure and a deteriorating top-line of -18% caused a significant operating deleverage effect in the first quarter and margins then closer to 20%. The situation remained challenging in Q2, yet we see the deterioration slowing down to now -7% and -15% for the division’s sales and EBITA, respectively. During the latest earnings call, Waldemarson commented on the operating performance and current environment as follows:

We are obviously facing a tough construction-related market around — especially around Europe, where we have the majority of this business. And we saw that the early signs of that decline started already more than 2 years ago, and there’s been a slow — it was a slow sort of negative change — directional change up until about Q3 last year when we were seeing the market on this lower level condition now for some time. Then any given quarter can, of course, be slightly different depending on deliveries from certain companies and all that. But the feeling of the underlying market is still the same at low levels as we’ve been mentioning now for some quarters.

Nevertheless, we should note that Lifco’s most cyclical group companies are still spotting operational stability, with a margin of 24.7% in the last twelve months. And while the ongoing performance of the segment should be monitored, these short-term headwinds are no cause for concern from my perspective, also due to the well-diversified portfolio of Lifco, which was additionally strengthened by two acquisitions so far this year.

| Consolidated from Month | Acquisitions | Net Sales | % of LTM Sales | Employees |

| April | Brevetti Montolit | EUR 18.5 million | 0.84% | 36 |

| July | Eurosteel | EUR 16.8 million | 0.76% | 49 |

In April, Lifco consolidated the Italian niche manufacturer of high-end professional tile cutting tools and accessories, Brevetti Montolit, adding about 0.8% to the LTM sales. Additionally, the Dutch company Eurosteel adds further expertise to the field of attachments and tools for excavators, wheel loaders as well as other construction machinery.

Demolition & Tools Segment, Sales & EBITA (Lifco Presentation)

Systems Solutions

Lastly, Lifco classifies the remainder of specialized companies under the segment Systems Solutions, which contributed about 50% of the group’s EBITA in the last twelve months. Although some of these businesses are also impacted by the weak construction market, the business area performed extraordinary, both due to organic growth and acquisitions.

In the first half of 2024, Lifco reported a sales growth rate for the segment of 15.6% year-over-year, while the EBITA even increased by 18.7%, causing an enhanced margin of 24.3% (23.6%). In addition, Lifco announced three acquisitions for Systems Solutions since the start of 2024.

| Consolidated from Month | Acquisitions | Net Sales | % of LTM Sales | Employees |

| April | CFR | EUR 38.5 million | 1.75% | 100 |

| June | Cardel Group | GBP 16.5 million | 0.88% | 74 |

| August | Expand Media Group | SEK 196 million | 0.78% | 64 |

The largest consolidation so far, CFR, approximately adds about SEK 438 million or 1.8% of R12 sales. The Italian company is a niche manufacturer of electric drive systems for industrial applications, e.g. e-mobility, logistics and hydraulics. In contrast, the acquisition of Cardel Group adds a niche provider of lamination plates for products with high-quality requirements such as ID, bank and SIM cards to the portfolio of Lifco. These are great examples to underline the heterogeneity across this business area’s companies and further diversify the cashflow of the group. Lastly, Lifco announced the acquisition of Expand Media Group, which designs, produces and sells portable event display and print solutions to customers globally.

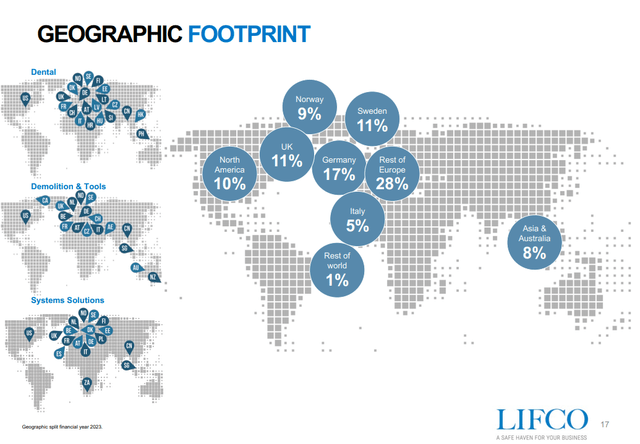

Overall Thoughts on Acquisitions

In the first 8 months of 2024, Lifco announced six acquisitions, which are expected to add about SEK 1.28 billion in annual sales or 5% of the sales in the last twelve months. While none of these consolidations will be significant for the group’s results, I particularly like that Lifco still acquires these small companies as they’re not overexposing the group to an individual business risk and maintain relatively low multiples paid compared to larger companies. Another interesting note is that only one out of six acquired companies is Swedish, which further increases the geographical diversification and proves Lifco’s ability to find attractive niche companies all around Europe. In 2023, only 11% of the total sales were contributed by Sweden, which is quite unique among the peers of Swedish serial acquirers.

Sales by Geography, 2023 (Lifco Presentation)

Best-In-Class among Swedish Serial Acquirers

Over the last years, Lifco experienced a rising interest from investors all around the world, not least due to its exceptional performance. However, I frequently mention that there’s a rising group of Swedish companies that are passionately following the footsteps of successful serial acquirers, but are seldom mentioned here due to the low international coverage. Thus, I compiled a little overview of a handpicked peer group, which hopefully can be of help to you.

| Organic Growth | Lifco | Addtech | Lagercrantz | Volati | Teqnion | Momentum Group |

| Q2 | -0.1% | 2% | -3% | -11% | -6% | 1% |

| Q1 | -7.8% | -7% | -6% | -15% | -1.5% | 5% |

As we can see, the organic growth of almost all serial acquirers were negatively impacted by the weakened economic environment, with 4/6 posting declining organic sales in both quarters. Of course, these results and their causes are very significant among the group, while we can clearly see that some of them have already been at the bottom, while others are still struggling.

| Total Sales Growth | Lifco | Addtech | Lagercrantz | Volati | Teqnion | Momentum Group |

| Q2 | 8.4% | 7% | 10% | -2% | 4% | 41% |

| Q1 | 0.8% | -3% | 6% | -8% | 8% | 32% |

Now, including the company’s growth via acquisitions, we obtain a similar picture yet with a higher variance. While Lifco was able to offset even the deteriorating results from the first quarter, others are lagging behind – although the meaningfulness of a quarterly comparison is very limited to this extent as the winners are determined over time.

| EBITA Margins | Lifco | Addtech | Lagercrantz | Volati | Teqnion | Momentum Group |

| Q2 | 23.9% | 13.1% | 17.1% | 11% | 11.7% | 10% |

| LTM | 22.9% | 14.7% | 17.5% | 9% | 10.6% | 9.9% |

Truly outstanding in this peer group analysis is the EBITA margin of Lifco, which remained resilient at around 23% in the last twelve months, thereby significantly outpacing its peers. Especially, as all sector-acnostic serial acquirers are buying from a more or less similar pool of companies, I find it impressive that Lifco is continuously able to buy high-quality companies without diluting these top-tier margins.

Overall, we can conclude that the industry-exposed group companies of all Swedish serial acquirers are experiencing headwinds at the moment, while companies with a large exposure to the construction market are probably impacted the most. To this regard, Lifco clearly benefits from an increasingly diversified portfolio that consists of highly profitable niche businesses across the board. Therefore, one could argue that in particular these companies should be able to benefit from a growing market share once the overall industry recovers. The gap towards its peers further underlines the best-in-class management and M&A abilities of Lifco, which additionally increase the company’s attractiveness as a potential buyer.

Cashflows

In order to analyze a company’s ability to generate cash from operations, I focus primarily on its free cash flow. Despite the usual calculation (OCF – CapEx = FCF), I adjust the operating cash flow for changes in net working capital. Using this approach, I try to get closer to the actual and sustainable cash generation of the business through the perspective of its owners.

For Lifco, the calculation looks like this:

| in million SEK | |

| Operating Cash Flow | 4,655 |

| – Changes in Working Capital | 139 |

| = Adjusted Operating Cash Flow | 4,516 |

| – CapEx | 481 |

| = Free Cash Flow | 4,035 |

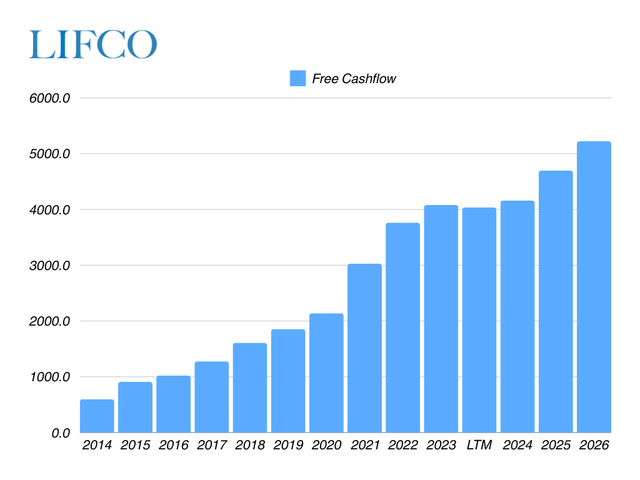

Over the last 12 months, Lifco spots a FCF conversion of 63%, which is slightly below the historical average of about 69%. After adjusting the operating cash flow by the changes in working capital, we derive at an almost flat growth rate compared to 2023, which seems in line with the operating performance that we’ve discussed earlier. According to the analysts’ estimates, we’re likely to see the company’s FCF being constant in 2024, before re-accelerating in the following years. Using a conservative FCF conversion rate of 64% (close to 2023) for 2024-2026, we derive at an expected CAGR of 8.6% for the next three years. From my perspective, this seems very reasonable given the observations drawn from the latest quarters and the current pace of acquisitions. That said, let’s see how these numbers are reflected in the current valuation.

Free Cashflow, 2014-2026e (Own Illustration)

Valuation

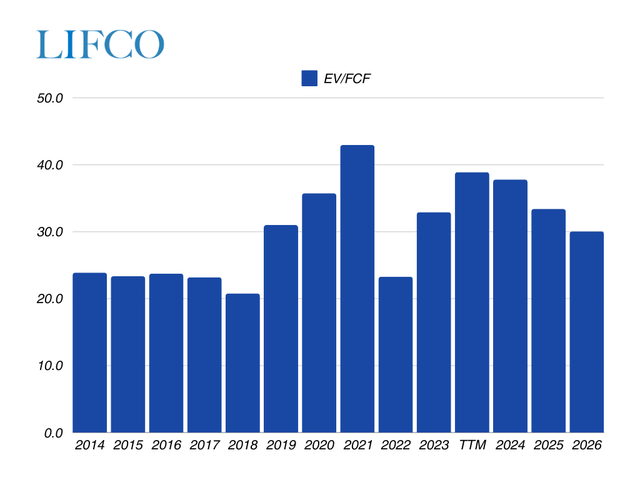

At the time of writing this article, Lifco trades in Stockholm at SEK 319 per share, reflecting a remarkable YTD performance of 29% (S&P 500: 17%). Reminding ourselves that the company’s earnings power is expected to stay flat over the course of this year, we can already guess that the recent share price appreciation was mostly driven by further multiple expansion. And indeed, using the unchanged number of shares outstanding and the LTM results, we derive at a current EV/FCF and EV/EBITA multiple of 38x and 27x, respectively.

EV/FCF, 2014-2026e (Own Illustration)

Seeing this rapid increase in the company’s valuation almost reminds of the record multiples in 2021, where every company tagged “serial acquirer” was trading 2x its historical average. Over the last 10 years, the average EV/FCF and EV/EBITA multiple for Lifco is 28x and 21x, respectively, indicating a 30% overvaluation at the moment.

The reacceleration of the company’s growth rates and further contribution by acquisitions are expected to reduce the forward-looking multiples back to about 30x FCF, which is still rather optimistic. I would argue that Lifco certainly earns a premium over its peers due to the successful M&A track record, the best-in-class group companies and relatively low downside risk. However, the current valuation by Mr. Market is definitely running ahead of the company’s fundamentals, thereby increasing the likelihood of multiple contraction in the future.

Conclusion

Similar to its peers, Lifco’s performance in the first half of the year suffered from a weak construction market and the overall economic slowdown in Europe. After stating an organic decline of -8% in the first quarter, however, it seems like we’ve already seen the worst as Q2 came in almost flat. Simultaneously, Lifco ran its acquisition machine, consolidating six new businesses since the start of 2024. These developments, especially in the second quarter, relieved the market of tension and lead to a remarkable rally of +30% YTD. Accordingly, we recognize a significantly higher valuation level and an increasing risk of multiple contraction in the future.

From my perspective, Lifco certainly deserves a premium due to the constant demonstration of best-in-class management and operations, but seems a bit too hot at the moment. Therefore, I will definitely hold my position and would wait either for the company’s fundamentals to catch up with the current valuation or for the market sentiment to change before stacking up my position. Long-term oriented investors who want to buy at the current price, should include a contracting multiple into their total expected returns. Thus, I hope this update on the current situation and Lifco’s peer group was of help to you.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here