Last month the Government Accountability Office (GAO) released 401(k) Retirement Plans: Department of Labor Should Update Guidance on Target Date Funds in response to a May 2021 request from Senator Patty Murray (D-WA), Chair of the Health, Education, Labor, and Pensions (HELP) Committee, and Rep. Bobby Scott (D-VA), Chair of the House Education and Labor Committee.

The GAO report was 3 years in the making. At $4 trillion and growing, TDFs are very important. The GAO report has the potential to improve the industry.

Congresspersons Murray and Scott wrote:

“…we write to request the Government Accountability Office (GAO) conduct a review of target-date funds (TDFs). The employer-provided retirement system must effectively serve its participants and retirees, and we are concerned certain aspects of TDFs may be placing them at risk.

…According to The New York Times, “many of the major target-date-funds tailored for people retiring in 2020, for example, have 50 to 55 percent of their investments in stock funds…. Meanwhile, the Thrift Savings Plan 2020 Lifecycle Fund had more than 60% allocated to the G Fund (short-term U.S. Treasury securities) for the two years prior to its retirement.”

They single out the Federal Thrift Savings Plan (TSP) as an example of a plan that has defended well in market turbulence. With six million beneficiaries and $800 billion in assets, the TSP is the largest defined contribution plan in the world.

And as a Federal plan, Congress should at least consider the TSP target-date funds, called “L Funds.” Importantly, GAO employees are participants in the TSP.

The GAO recommends that the DOL heighten its scrutiny of TDFs as follows:

GAO is recommending that DOL update (1) its 2013 guidance for plan sponsors and (2) its 2010 guidance for plan participants on selecting TDFs. DOL disagreed with both recommendations. GAO continues to believe both are warranted, as discussed in the report.

The following are five critiques of the GAO report that are specific recommendations to all TDF regulators, including the DOL.

1) Risk near the target date is much higher than it should be

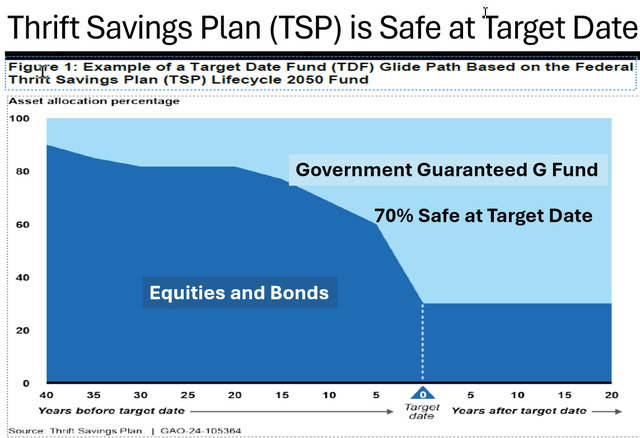

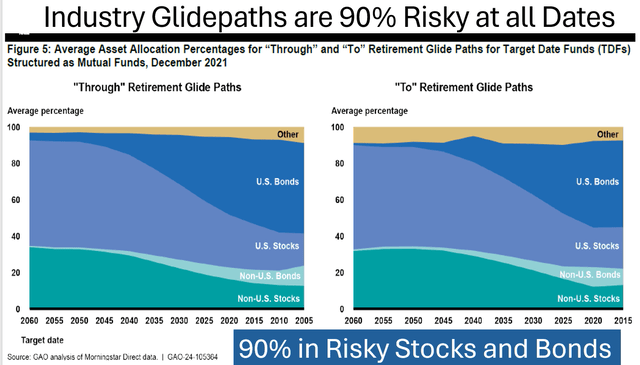

As requested, the GAO contrasts the risk of the TSP to that of the TDF industry, as shown in the following 2 graphs. TDFs say they follow academic lifetime investment theory, but most do not follow the theory as explained in this article. The theory is 80% risk-free at the target date, but the industry is 90% risky throughout (at all ages) in risky equities and long-term bonds.

The TSP does follow the theory. It is very safe at the target date, with 70% of the risk-free G fund guaranteed against loss by the US government.

Regulators should know that academic theory is very safe for those near retirement, and they should confront the industry for lying about following the theory. This departure from theory has been rewarded for the past 15 years because US stocks have enjoyed their longest bull market ever, but that will change. High risk will suffer high loss in the next stock market crash; that’s the nature of risk.

Congresspersons Murray and Scott expressed concern about the level of risk in TDFs. The study accepts industry risk without questioning why it is greater than the TSP and academic theory. An important opportunity to improve TDFs should not be missed.

GAO GAO

2) There’s a more meaningful distinction than “To” versus “Through”

The GAO report uses the “To” versus “Through” distinction throughout. Even though this is a popular approach, it is a distinction without a difference. Safe versus Risky at the target date makes much more sense as explained in A More Meaningful Target-Date Fund Choice Than ‘To’ or ‘Through’.

3) Collective Investment Trust TDFs should be scrutinized

The GAO report is focused on mutual fund TDFs, but it opines that CIT TDFs might not be as well understood as they should be. The GAO report says:

“Without guidance on reviewing collective investment trust TDF disclosures, including written plans and collective investment trust fact sheets, plan sponsors may not understand the applicable collective investment trust disclosures they should use as part of their TDF selection and monitoring process.”

Also, in Commentary: Target-date funds’ fiduciary risks, Chris Tobe warns:

There is a general assumption that CITs are regulated by the federal Office of Comptroller of the Currency. Some CITs are regulated by the OCC, while most used in 401(k)s are regulated by one of 50 state bank regulators. This allows CITs to choose their own state regulator, who may or may not have lax oversight. While SEC-mutual fund regulations are not perfect, they do control for a lot of risks and provide a good amount of transparency.

Fiduciaries should scrutinize CIT TDF reporting and understand details. They are not regulated by the SEC. For example, reported expense for underlying funds should be examined and evaluated.

4) There’s only one workforce demographic that actually matters

The GAO reports that advisors place heavy emphasis on workforce demographics in their selection process, but there is only one demographic that all defaulted participants have in common – lack of financial sophistication – and that demographic makes them like our dependent children. The Duty of Care is like our responsibility to protect our young children from avoidable harm. Defaulted participants deserve and need protection.

5) Participant interests are not aligned with the interests of those who were interviewed for the study

The GAO interviewed management companies and advisors. Both are happy with the status quo, but the current structure is not the best for participants as outlined in DOL Final Fiduciary Rules Could Resolve Conflicting Interests in Target Date Funds.

The GAO did not interview participants. Other surveys that interview participants report that participants want to be protected as they enter retirement, and most believe they are protected. Defaulted participants do not choose TDFs; their fiduciaries choose for them. Also, remember that GAO employees are participants in the TSP, and that the TSP’s TDF actually follows academic theory — it protects.

There are three interest groups in TDFs. Investment managers create TDFs for profit, which is, after all, their business. Fiduciaries choose TDFs, presumably for the benefit of participants, but that’s not what is happening. Beneficiaries want to be protected, especially as they enter retirement, but they are actually exposed to substantial risk.

Conclusion

78 million baby boomers will spend this decade in the Retirement Risk Zone, when losses can devastate the rest of life. Many are invested in the $4 trillion TDF industry and will be significantly harmed by a crash in this decade.

Recommendations for greater oversight should be taken seriously and done soon.

Read the full article here