Introduction

A.G. BARR (OTCPK:BAGFF) is a British soft drink producer that appears to be flying under the radar of most investors outside of the UK. Its best known brand Irn-Bru (“Iron Brew”) was created more than 100 years ago and still is seen as Scotland’s second best known drink. While extremely popular in Scotland (and other parts of the U.K.), there’s virtually no brand recognition outside of those very specific regions, so although the customer base is rather sticky and loyal to the brand, A.G. BARR should be seen as a local or regional player in the soft drinks (and energy drinks) market.

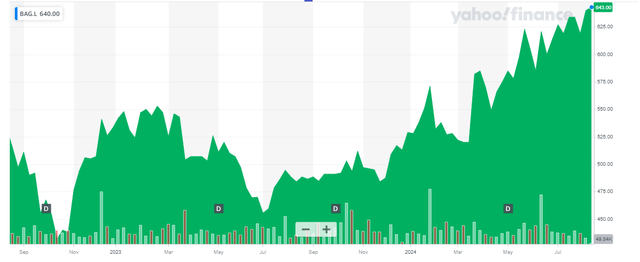

Yahoo Finance

A.G. BARR should be traded in London, where the company’s primary listing is. The ticker symbol in London is BAG, and the average daily volume is approximately 150,000 shares and this makes the LSE listing for sure the most liquid listing to trade in BARR shares (US-listed ADRs do not show any trading volume, so avoid the US listing). The current market cap is just over 700M GBP.

FY 2024 was strong, and FY 2025 has started well

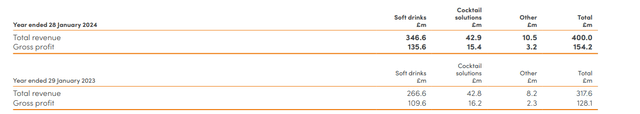

During the financial year 2024, A.G. BARR reported a total revenue of 400M GBP, which represents an increase of in excess of 25% on a YoY basis. Of course, the COGS also increased and although the expenses increased at a faster pace, the gross profit jumped from 128M GBP to 154M GBP, a 20% increase. As you can see below, the entire revenue increase was generated in the soft drinks segment.

A.G. BARR Investor Relations

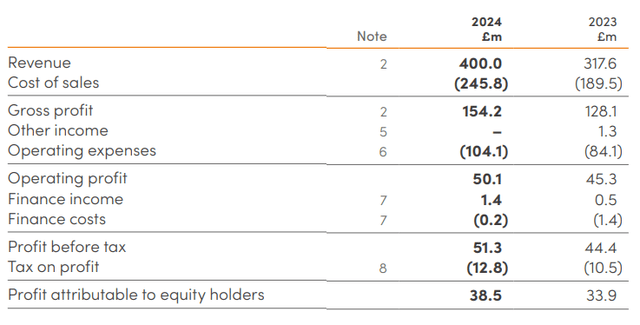

Going back to the company’s income statement (shown below), A.G. BARR had to deal with other operating expense increases as well as the normal overhead expenses increased by almost 25% and this caused the operating profit increase to be a low double-digit percentage: Of the 82M GBP in revenue increase, only 4.8M GBP actually ended up as an increase to the operating profit.

A.G. BARR Investor Relations

Fortunately, A.G. BARR is also benefiting from the high interest rate environment and its net finance cost of 0.9M GBP was converted into a net finance income of 1.2M GBP, and this boosted the pre-tax income to 51.3M GBP while the net income was approximately 38.5M GBP. This represents an increase of 13.5% and resulted in an EPS of 34.6 pence per share. This means the stock is currently trading at approximately 18-19 times its net income. And although the company has a strong brand name recognition and reputation in its local markets, it’s not a Coca-Cola or PepsiCo, brand wise. An earnings multiple in the high teens is perhaps a bit high, although there are two other elements I needed to check. First of all, I’m fine with paying a high earnings multiple if the cash flow results are equally strong (or preferably, even stronger). Secondly, A.G. BARR already provided a trading update for FY 2025, which I will also discuss.

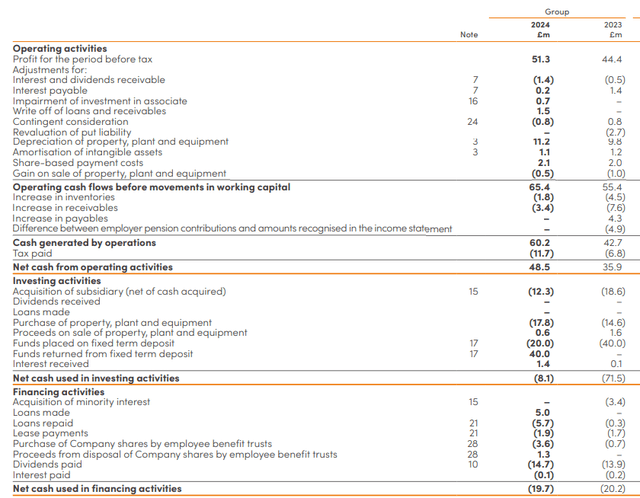

But first, let’s have a look at the company’s ability to convert the profit in actual free cash flow. As you can see below, the total operating cash flow was 48.5M GBP, but this included a 5.2M GBP investment in the working capital position while it underestimates the total tax pressure by 1.1M GBP. Additionally, I think we should also deduct the 1.9M GBP in lease payments and add the 1.3M GBP in net interest payments.

A.G. BARR Investor Relations

That results in an adjusted operating cash flow of 52M GBP. The total capex was 17.8M GBP and this results in a net free cash flow of around 34M GBP. While that’s lower than the reported net income, keep in mind the total amount of depreciation + lease payments of 19.7M GBP is more than 50% higher than the combined depreciation and amortization rhythm as that totaled just 12.3M GBP during FY 2024.

At the end of last month, A.G. BARR reported a trading update on the 26 weeks that ended in July. According to the interim update, the total revenue increased by 5%, once again under the impulse of a strong soft drinks segment where the revenue increased by approximately 7% and A.G. BARR mentioned it remains on track to meet its guidance for this year.

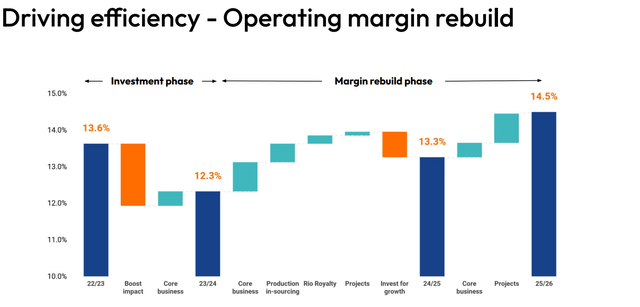

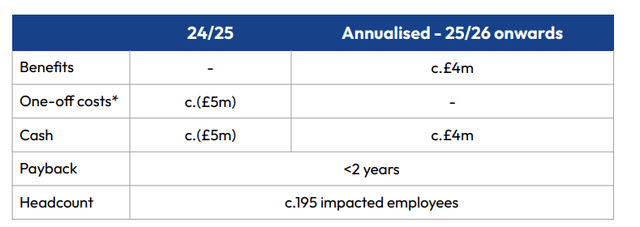

As a reminder, the company will focus on its operating margins, but will also incur approximately 5M GBP in non-recurring cash items, which will mainly consist of the budget required to reduce the headcount.

A.G. BARR Investor Relations

This should save the company approximately 4M GBP per year, resulting in a payback period of less than two years for this strategic decision.

A.G. BARR Investor Relations

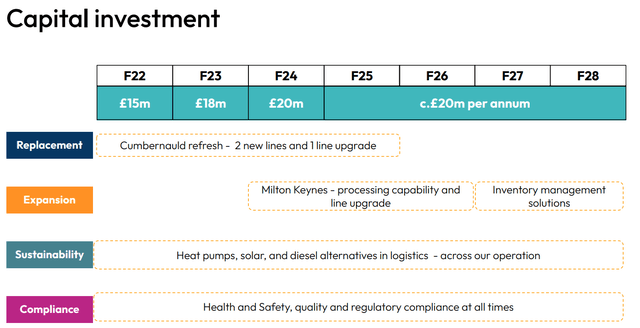

Also keep in mind, the capex will increase toward 20M GBP this year as the company continues to invest in growth. Two new lines are being installed at Cumbernauld while A.G. BARR has also kicked off its investment program at Milton Keynes where it will increase its processing capability and capacity.

A.G. BARR Investor Relations

Investment thesis

Fortunately, A.G. BARR’s strong cash flows will be more than sufficient to cover the anticipated capex-related cash outflow. And those investments should also result in a direct return, as the consensus estimate for the 2027 EBITDA result is approximately 84M GBP, which would be just over a third higher than the EBITDA recorded in FY 2024. Meanwhile, the EPS should increase to 45 pence, resulting in a forward P/E of 14. That’s definitely still not cheap, but the EV/EBITDA ratio should drop toward 7.5 thanks to A.G. BARR’s strong (and increasing) net cash position. AG ended FY 2024 with a net cash position of 54M GBP (approximately 50 pence per share), and this will likely double by the end of calendar year 2026 despite the growth investments.

So from a P/E perspective, A.G. BARR is expensive. But the company has a loyal customer base and continues to hoard cash, which makes the EV/EBITDA multiple very palatable.

I currently have no position in A.G. BARR as I’d like to see the stock getting a little bit cheaper, but now I understand the company’s strong share price performance. While the stock optically looks expensive, there’s more than meets the eye.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here