Investment Update

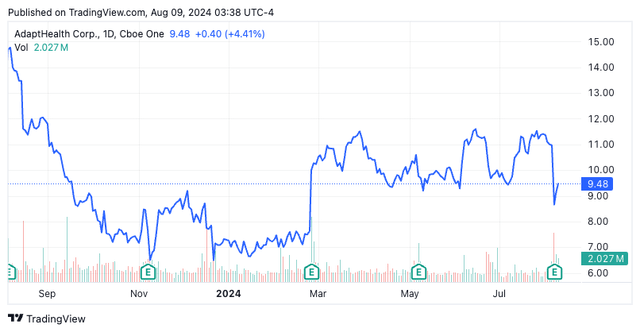

Following my last publication on AdaptHealth Corp (NASDAQ:AHCO) in August last year, where I reiterated a hold rating (after revising this lower in June), shares are 20% in the red and trade at ~10x trailing earnings. That report, titled “A 4% return on capital doesn’t sing undervalued” covered the relevant points and challenges to AHCO’s investment debate, namely:

- AHCO is a capital-intensive producing <10% return on capital, and “this has translated into an erosion of value for shareholders given cash pays ~4-5%, long-term rates are at the same level, and corporate high yields are offering 8-9% starting yields.

- The company’s gross return on assets is only 9%, indicating that its asset base is not pulling its economic weight.

- Valuations supporting a hold based on a multitude of value assessments.

Following the company’s Q2 ’24 numbers this week there are several updates to the investment debate that will be discussed in detail here. Net-net, I continue to rate AHCO a hold.

Figure 1.

Tradingview

Investment Thesis

AHCO provides healthcare-at-home solutions, specializing in home medical equipment (“HME”) and medical supplies. The company’s portfolio spans markets such as 1) sleep therapy, 2) diabetes management, and 3) respiratory care. Its service network spams ~670 locations across 47 states, servicing >4mm patients per annum. In particular, the company’s continuous positive airway pressure (“CPAP”) and bilateral positive airway pressure (“BiPAP”) divisions have potential in my view given they sell predominantly to the obstructive sleep apnea (“OSA”) market. Estimates point to ~1Bn undiagnosed cases of OSA globally, with severe under-penetration of the treatment market. AHCO’s major competitor in this market is ResMed Inc (RMD) which has taken large market share following Philips’ recall of its CPAP devices in 2021.

I remain hold on AHCO due to – 1) embedded expectations are low, which is a plus [price momentum is flat, valuations are compressed], but 2) quality is low [ROICs <10%, shedding capital vs. reinvesting], and 3) valuations do not support a compounding machine with the current state of operations. My view is the business is worth ~$11–$12/share today, little headroom on the current price. Net-net, reiterate hold.

Q2 FY’24 earnings breakdown

I’ve updated my modelling and valuation assessments to reflect the company’s Q2 numbers. Sales were +160bps YoY to $806mm, underscored by +6.5% growth in sleep therapy sales. Management now calls for $3.2–$3.3Bn in FY’24 sales on adj. EBITDA of $700mm at the upper end of range. Consensus is at the upper end of sales guidance and views +5% sales growth in FY’25 and ~+6.5% in FY’26. It also eyes aggressive earnings growth of this, hitting +20% in both years – but, this is off a low base, so I’m not sure it’s that attractive or ‘authentic’, let’s say.

Notably, my numbers [see: Appendix 1] are ahead of this estimate at $3.7Bn for FY’25 and still I get to a valuation of only ~$11-$12/share [discussed later].

Key takeouts from the quarter include the following:

- Critically, the major headwind to all respiratory care businesses at present is the “threat” of GLP-1 weight loss drugs. I emphasize “threat” as it’s difficult to ascertain the full impact of these on the end-market, nonetheless, investors have punished names in the segment with lower multiples as a result. The question is if it’s unfounded or not. Management said this on the call (emphasis added)”[O]ur sleep resupply census reached a new milestone in the quarter and now stands in over 1.6 million patients. Over 30% of new patients responded to our GLP one survey in the quarter, which showed that approximately 12% of those patients were prescribed GLP-1 therapy, up a touch from the first quarter……we have not detected any notable difference to date.”

- Alas, this is good news and aligns with my findings on other companies like RMD that have been punished on multiple exchanges (the ASX for instance). I’d suggest watching this very closely moving forward because the thinking is, that 1) lower obesity rates equals less OSA prevalence, meaning 2) a smaller addressable market for AHCO, and ultimately 3) a smaller profit pool for the business. Again watch closely I’d say.

- Meanwhile, diabetes sales were $151mm, as the company and management projected ~$10mm compression in pump supplies sales in H1, but this came in behind expectations “as some patients held off on new tubeless pumps, pending CGM compatibility...”. The segment continues to face headwinds as 1) new sales reps are under a 100% pharmacy reimbursement system as of ’24, meaning 2) the reimbursement channel is far more benign for the company.

- The business threw off ~$117mm in FCF vs. $94mmm expected and left the quarter at ~3x net leverage (net-debt/EBITDA).

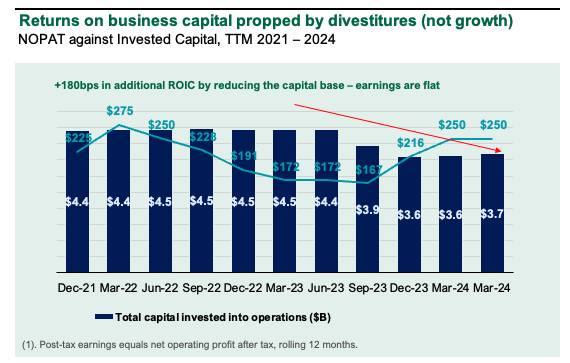

One of the factors I’ve noted is AHCO’s business returns stretching up by ~180bps vs. FY’21 to ~7% in the trailing 12mo (Figure 2). This is due to neither 1) earnings growth, or 2) successful reinvestment of earnings. Instead the business has been shedding capital via divestitures + stock buybacks. Hence it is a denominator effect (ROIC is calculated as NOPAT/Invested capital = ROIC, so it’s the invested capital part that’s been changed to drive ROIC higher – again, this isn’t a change in the fundamental economics of the business).

Figure 2.

Company filings, author

My thoughts on the company’s earnings are that they came in as expected. Hence the muted post-earnings drift in market value – investors likely priced in the results beforehand. It has lagged growth in its core market of sleep, respiratory and diabetes. In my view, this looks to be a combo of 1) sales force utilization and 2) the operational structure of the business. It now runs on ~$3.7Bn if capital employed into operations (vs. $4.4Bn in FY’21), but the declines are due to 1) amortization of goodwill + intangibles by not reinvesting any more into these classes, and 2) working capital work-thru. If there’s no opportunities to reinvest the capital to (a) maintain a competitive position and/or (b) grow the enterprise, it suggests to me that AHCO likely deserves to be trading at discounted valuations to higher-quality peers. This supports a neutral view.

Fairly valued with no reward asymmetry

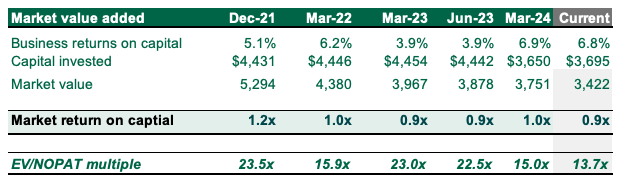

AHCO is valued ~1x EV/IC (Figure 3) which is fair in my view given the factors raised above.

Valuation insights

- My view a business that can throw piles of cash back into its operations, produce decent returns on these investments, then reinvest the proceeds, are compounding machines. AHCO doesn’t exhibit these characteristics. It has been winding down capital intensity instead. Capital turns are +0.3x vs. FY’21 at 0.9x, but post-tax margins are -200bps to 7.7%. As such ROICs are <10%. As such 1x EV/IC appears fair.

Figure 3.

Company filings, author

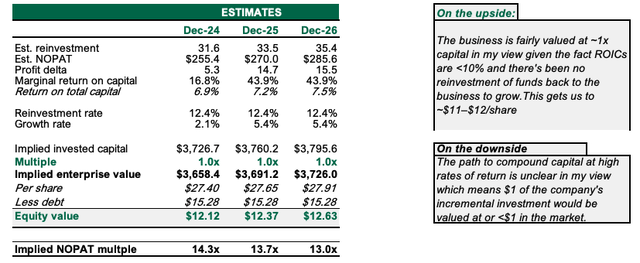

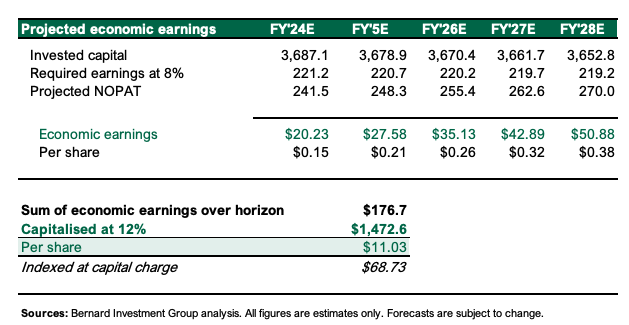

- The business is fairly valued at ~1x capital in my view, given the fact ROICs are <10% and there’s been no reinvestment of funds back to the business to grow. This gets us to ~$11–$12/share (Figure 4). The path to compound capital at high rates of return is unclear in my view which means $1 of the company’s incremental investment would be valued at or <$1 in the market.

Figure 4.

Author estimates

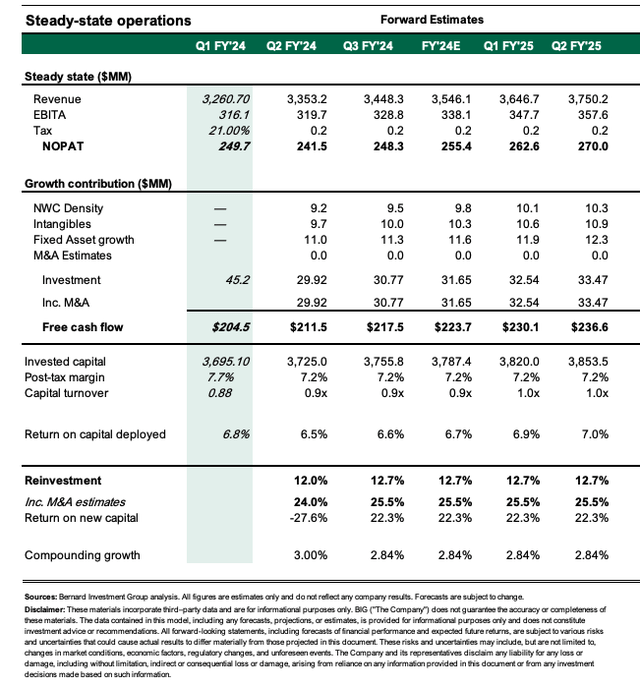

- Finally, the discounted value of freely available cash flows derived from my FY’24-’26E estimates derives a present value of ~$11/share, corroborating other valuation assessments. Here I am only interested in that cash produced above an investment of comparable risk but with yield, i.e. the starting yields on most investment-grade corporates right now. Compared to an investment compounding at our 12% threshold rate, that can reinvest 100% of its earnings (much like the reinvestment of coupons on the bond) yields $68/share, leaving an opportunity cost of 6.2x.

Figure 5.

Author’s estimates

Risks to thesis

Upside risks to the thesis include 1) AHCO sales growth +10%, with margins >10%, 2) market paying higher multiples than 1x capital, and 3) rates coming off earlier than expected as this is a tailwind to equity valuations.

On the downside, the business can come in behind expectations and this would compress multiples further in my opinion. I give this a 50% probability at this point.

Investors must know these risks in full before proceeding.

In short

AHCO remains a hold in my view as 1) even though expectations are flat, 2) quality is low [thus the distribution of outcomes is unfavourable], 3) justifying tight valuations. The company’s Q2 numbers and updated modelling/projections from the same do little to change the economic picture in my opinion. My view is the business is worth ~$11-$12/share today. Reiterate hold.

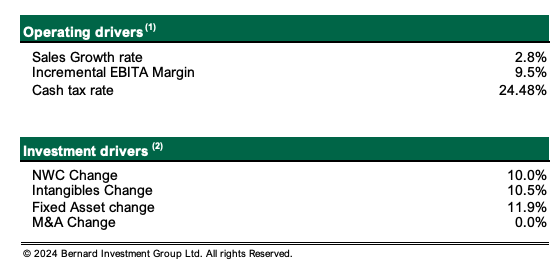

Appendix 1.a. Value drivers to modelling

Author

Appendix 1.

Author’s estimates

Read the full article here