Chinese online retail has been a once-in-a-generation growth opportunity. Not only was e-commerce penetration increasing, but the income of Chinese consumers has also been soaring and boosting demand for discretionary goods. The Chinese e-commerce market has grown by double digits for years.

The golden age of Chinese e-commerce has ended though and retailers are now having to struggle for market share to continue growing. Alibaba (NYSE:BABA) is the largest retailer in China, but its growth potential at home is capped by innovative new market entrants. As competition intensifies, Alibaba is increasingly looking beyond Chinese retail to drive growth.

Alibaba has always been a peculiar type of retailer. They never owned inventories of the items they were selling and neither did they need considerable logistics operations. Alibaba has been running an online marketplace, a tech platform. Alibaba is a tech company that applied itself in the e-commerce market.

Alibaba’s retail business excels at AI machine learning and big data analytics to break down user data, optimise search results and manage logistics. They also own considerable cloud and international supply chain management infrastructure. The company is now looking for new areas of considerable growth to apply its tech expertise and infrastructure.

Fortunately for Alibaba, considerable new markets have opened up recently. A strategic pivot towards International E-commerce and AI-driven cloud solutions could position Alibaba for substantial future growth, offering considerable upside potential for investors.

Chinese e-commerce is slowing but other growth areas are emerging

Alibaba Group has been facing challenges due to a slowdown in its Chinese e-commerce business. Since 2020, the revenues from its Chinese commerce operations, which include TMall and Taobao marketplaces, have only been growing at an average rate of 5%, significantly below longer-term averages.

However, the overall group revenues appreciated by 17% on average annually over the period as the company developed new business areas. The new businesses are still being scaled and not delivering profits, and therefore are largely ignored by the markets.

We do like the market positions established by Alibaba’s new ventures and consider them to have a very significant value as well as growth potential.

As a consequence of the rapid new ventures’ growth, the share of Chinese commerce revenues has declined, dragging down the overall profitability of Alibaba. The EBITDA margin of the business has declined from 27% to 18%, however, the business strength did not deteriorate.

Chinese commerce continues to be profitable and generate attractive margins, while International Commerce as well as Cloud Intelligence offer significant top-line growth as well as margin expansion prospects.

|

Alibaba segments, RMB million |

2020 |

2021 |

2022 |

2023 |

2024 |

Cagr, % |

|

Revenues |

509,711 |

717,289 |

853,062 |

868,687 |

941,168 |

17% |

|

China commerce |

351,977 |

501,683 |

592,705 |

413,206 |

434,893 |

5% |

|

Revenue share, % |

69% |

70% |

69% |

48% |

46% |

-10% |

|

International commerce |

33,917 |

48,851 |

62,185 |

70,506 |

102,598 |

32% |

|

Cainiao Smart Logistics |

22,233 |

37,258 |

66,808 |

77,512 |

99,020 |

45% |

|

Cloud Intelligence Group |

40,301 |

60,558 |

102,016 |

103,497 |

106,374 |

27% |

|

Local Services Group |

29,660 |

35,442 |

44,890 |

50,249 |

59,802 |

19% |

|

Total segment adjusted EBITA, RMB million |

||||||

|

China commerce |

184,815 |

213,562 |

192,218 |

189,140 |

194,827 |

|

|

Margin, % |

52.5% |

42.6% |

32.4% |

45.8% |

44.8% |

0.0% |

|

International commerce |

(4,340) |

(4,932) |

(8,614) |

(4,944) |

(8,035) |

|

|

Cloud Intelligence Group |

(3,406) |

(2,251) |

3,744 |

4,101 |

6,121 |

|

|

Cainiao Smart Logistics |

(1,884) |

(813) |

(1,465) |

(391) |

1,402 |

|

|

Local Services Group |

(15,017) |

(16,276) |

(20,059) |

(13,148) |

(9,812) |

|

|

Consolidated adjusted EBITA, RMB million |

137,136 |

170,453 |

130,397 |

147,911 |

165,028 |

5% |

|

Margin, % |

27% |

24% |

15% |

17% |

18% |

Alibaba Annual Reports, our estimates

Alibaba is losing share domestically, but still growing as the market expands

Alibaba maintains a leading position in the Chinese retail market with a 40% share of total e-commerce GMV and a 930 million active user base. Alibaba’s TMall and Taobao platforms have unrivalled reach, with 93% market penetration, and are essential to many merchants as well as consumers.

The retail market is dynamic though and new formats are continuously being developed. As of late, PDD’s (PDD) Pinduoduo low-cost direct group buying model has been gaining traction, especially as consumer confidence has deteriorated. Consequently, Alibaba has been losing market share and has underperformed the overall market growth.

The e-commerce market itself has slowed due to already high penetration but continued growing. As of late Chinese economic issues have harmed consumer confidence. Taobao and Tmall platform sales have been rocky as of late, though they came back to growth. In its latest earnings, Alibaba reported 5% year-on-year Customer management revenue growth, with a double-digit GMV growth.

Revenue growth slows (S&P Global)

In an attempt to compete with Pinduoduo, Alibaba launched its Taobao Deals platform in 2020. This platform focuses on offering generic goods directly from manufacturers, providing savings to customers. However, Taobao Deals has struggled to gain significant traction and hasn’t matched PDD’s impressive growth rates.

One of the main challenges faced by Taobao Deals was the lack of scale. The platform’s average Gross Merchandise Value wasn’t high enough to provide significant scale advantages for merchants. Additionally, merchants found the fees on Taobao Deals to be excessive, significantly higher than those offered by PDD. Alibaba seemed hesitant to aggressively promote Taobao Deals, fearing it might cannibalise sales of its main platforms. In the international markets, it does not face such a challenge.

AliExpress’ Choice has significant revenue and margin growth potential

International Commerce sales of Alibaba have accelerated at an average rate of 32% per annum over the last three years, driven by AliExpress, Trendyol and Lazada. Revenue from the International Commerce Retail business, which excludes Alibaba’s B-to-B platform, increased by 60% in 2024 alone. The strong order growth at AliExpress’ Choice platform was the main culprit of this impressive rise. Choice now represents around 70% of AliExpress’ orders.

Choice is an internationally focused manufacturer-to-consumer platform targeting the same market segment as PDD’s Temu. The service was launched only in March 2023 and achieved impressive growth already. The “Choice” tab is integrated into AliExpress apps and aims to leverage existing user base and traffic. The new service also utilises international logistics capabilities that were developed to service international Alibaba and AliExpress orders.

Manufacturer-to-consumer platforms such as Temu, Shein and Choice deliver Chinese manufactured goods at close to wholesale prices. Their secret sauce is efficient logistics management, customer preference analytics and large-scale manufacture. They also benefit from tax advantages but these are quite marginal compared to the supply chain efficiencies delivered. Choice and its peers can offer very significant cost savings and therefore will continue gaining market share in the West.

“Choice” is a retail platform and not a direct merchant, just like Taobao and TMall. The platforms usually generate considerable profit margins as their revenues consist of commission rates and service fees and not merchandise GMV. However, platforms do have a high fixed cost base and in the beginning stages of being scaled, profits tend to be low.

The International Commerce division was a consistent loss-maker throughout this period of rapid growth. As the business scales their profit margins will rise considerably.

Cainiao will continue growing along with Choice

Cainiao Smart Logistics business, handling domestic and international orders of Alibaba has also been growing rapidly. For the quarter ended March 31, 2024, Cainiao revenues grew 30% year-over-year primarily driven by revenue from cross-border fulfilment services of AliExpress.

Cainiao is striving to improve delivery speeds and reliability to help Alibaba stay competitive domestically and internationally and therefore is investing in automated warehouses in key logistics hubs as well as logistics tech. Cainiao uses logistics partners and independent couriers for last-mile delivery services but has been investing in a network of parcel lockers in China.

The logistics industry does not tend to be particularly profitable, though is an important growth enabler of the retail platforms. Cainiao will continue growing as the international order volume of AliExpress’ Choice continues to expand.

Alibaba Cloud still has not reached its full earnings potential

Alibaba Cloud Intelligence has also grown rapidly over the last four years, though has decelerated as of late as the industry matures and the pricing is becoming more competitive. Artificial Intelligence adoption, on the other hand, could present considerable new growth opportunities for cloud providers.

Artificial Intelligence requires a lot of computing power, and will likely utilise the cloud for the deployment of various innovative services. During the last quarter, AI-related revenue recorded triple-digit growth year-over-year.

The core public cloud offering of Alibaba, which includes elastic computing, database and AI products, has also recorded a strong double-digit year-over-year growth. Overall cloud revenues have stayed flat, though, as the business was rolling off low-margin project-based contracts.

Alibaba Cloud has also been facing challenges as of late. Chinese cloud players have been recently reducing prices in order to gain market share in anticipation of considerable industry growth. The US advanced chip export restrictions have also made it more difficult for the business to grow.

Alibaba Cloud is troubled by temporary obstacles, but most importantly the market demand is growing considerably. Once the issues are resolved, the business could break out.

The Cloud Intelligence business achieved an EBITDA of $0.8 billion with a 6% margin during FY2024. Despite this modest performance, the unit was valued between $40-$60 billion before its planned IPO. The cloud business has substantial fixed costs, but as revenues increase, the margins are expected to grow significantly, supporting the high valuation multiples. For instance, Amazon Web Services generates operating profit margins of around 25%. As Alibaba Cloud continues to scale, its profit margins will also rise substantially.

Alibaba is currently trading at only ~10X projected earnings, despite strong growth prospects

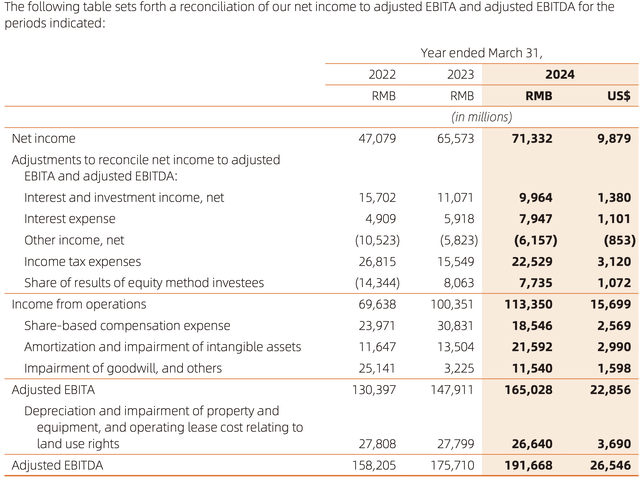

During FY2024, Alibaba generated close to RMB 165 billion of adjusted operating profit. After interest expenses and taxes, the earnings would have been ~RMB 135 billion, or $7.8 per ADS. Alibaba is currently trading at ~10X FY2024 adjusted earnings.

Alibaba Annual Report

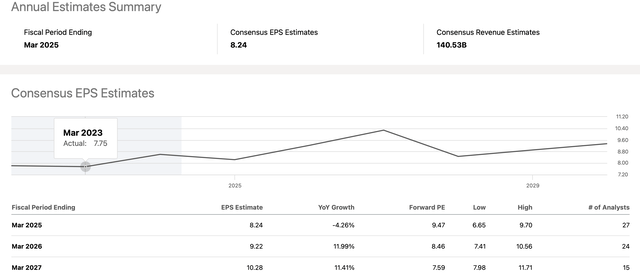

According to data collected by Seeking Alpha, Alibaba is projected to grow earnings gradually over the next 3 years. The growth expectations are muted, which explains the rather poor stock price performance as of late.

Seeking Alpha

There could also be a considerable upside to the earnings projections if Alibaba manages to improve the profit margins of International Commerce and Cloud Intelligence business units. On top of this, Alibaba has another important lever to pull to drive EPS growth, – share repurchases.

Share buybacks will also be a considerable EPS growth driver

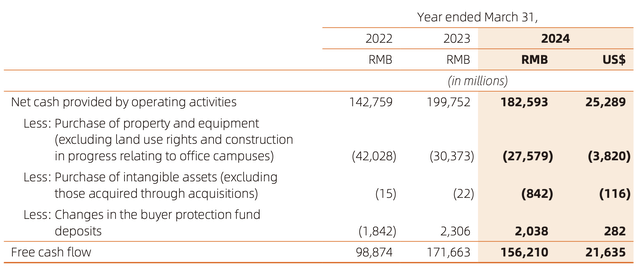

During FY2024 Alibaba generated $21 billion of Free Cash Flow, ~$14 billion of it was returned to shareholders through share repurchases and dividends. During FY2024, the share repurchase program resulted in a 5.1% net reduction in outstanding shares.

Alibaba Annual Report

The remaining amount of board authorisation for buybacks is US$31.9 billion, equivalent to ~17% of the market cap. Alibaba can therefore drive significant EPS growth by simply repurchasing shares at these depressed price levels.

Alibaba has a significant net cash position of ~$45 billion, enabling the business to implement quite an aggressive repurchase program. The company is also quite cash-generative, therefore buybacks can also be funded from an ongoing free cash flow.

The company faces restrictions as its cash flows are primarily in RMB, while its stock is denominated in USD and HKD, with limited currency conversion options. However, Alibaba can go around the capital restrictions by issuing USD-denominated debt overseas. Buyback will therefore continue boosting EPS growth.

Uncertainty is high but Alibaba is very likely to continue growing

Chinese economy and governance issues have been discussed extensively over the last few years and the Chinese stocks have underperformed considerably because of the increasing uncertainty.

We are bullish on the long-term economic growth prospects of China, having said that, periods of stagnation or even decline are entirely possible. Alibaba is now having to operate in China with an increasing level of uncertainty, however, it does have strategic levers to pull even if the core domestic market becomes more challenging.

For one, International Commerce business growth has accelerated with the launch of the AliExpress Choice platform. The factory-to-consumer retail format has been the most dynamic segment of the market and has resonated with consumers as economic woes put disposable incomes and consumer confidence under pressure. We believe this format has a lasting appeal though, as these platforms can deliver generic goods at significant price discounts compared to retailers in the West. Temu, Shein and Choice are all likely to experience considerable growth going forward.

The cloud business has also not reached its full potential and generative AI will likely provide a further boost. AI will likely enable new services which will require considerable additional computing power, driving structural industry growth. The industry growth should help the business increase revenues and margins even as competition intensifies.

Share buybacks are also an important driver of earnings growth, especially at the currently depressed price levels. Alibaba has considerable liquidity reserves and continues generating a good level of free cash flow and the board has approved a buyback scheme of considerable size. Alibaba has the authorisation and the means to increase EPS by over 17%.

We are Bullish on Alibaba as it trades at a low adjusted PE multiple of 10X and is highly likely to continue growing even if the core Chinese Commerce business becomes more challenging.

Market growth and management performance are the two key risk factors

Retail is a dynamic industry where format innovation is continuous in most of the segments. Taobao and Tmall have a strong market position in China due to their unrivalled reach, however, new market entrants are gaining market share with innovative formats. Alibaba will continue losing market share, but as long as the loss is gradual and the e-commerce market itself is growing, the company’s top line can continue increasing. Market stagnation could lead to declining business revenues though.

Retail is still the core business of Alibaba and as the old saying goes “retail is detail’. Good management is needed for any retailer, especially in the fiercely competitive and increasingly regulated Chinese e-commerce market. It takes quite a skill to navigate the Chinese market these days. Alibaba is currently run by a new CEO who has held the position only since 2023 and has a limited track record. Jack Ma, the founder of Alibaba, stepped down from the board in 2020 and it is uncertain if he still is involved in the running of the business unofficially.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here