Investment Thesis

Amazon (NASDAQ:AMZN) stock was up more than 40% in the past year as it headed into this earnings report. Investors had wanted to be blown away. And what they were left with was a mixed report, that led to its stock falling slightly over 6% after hours.

To be clear, there was nothing outlandishly bad with this earnings report, but it wasn’t overly rosy either.

In sum, investors are asked to pay approximately 29x my next year’s estimated operating income, for a business that’s growing at around 11% to 12% in the near term.

Altogether, it’s difficult to be too bullish given where investors’ expectations find themselves.

Amazon’s Near-Term Prospects

Amazon’s near-term prospects look solid, driven by the robust growth from AWS and the strategic expansion of their advertising and retail operations.

AWS continues to see accelerating revenue growth, up from 17.2% in Q1 to 18.8% in Q2, fueled by a shift from on-premises infrastructure to cloud solutions and the burgeoning demand for AI capabilities.

What was rather interesting was to hear the commentary around Nvidia (NVDA):

We have a deep partnership with NVIDIA and the broadest selection of NVIDIA instances available, but we’ve heard loud and clear from customers that they relish better price performance.

The development of custom silicon, like Trainium and Inferentia, is expected to enhance cost efficiency, attracting a wider customer base.

Additionally, Amazon’s advertising segment has added over $2 billion in revenue y/y, indicating significant untapped potential in video advertising and further opportunities within their Prime Video offerings.

Furthermore, Amazon’s focus on enhancing customer experience in their stores business is paying off, with North America and international segments experiencing 9% and 10% year-over-year growth, respectively. Initiatives such as faster delivery speeds, expanded Prime benefits, and innovative uses of AI in shopping are resonating with consumers.

The recent fee adjustments and improvements in the logistics network are expected to further reduce costs and enhance delivery efficiency. These efforts, combined with investments in automation and regionalized inventory management, aim to continue driving down costs and improving service, positioning Amazon favorably for sustained growth.

Nonetheless, Amazon faces challenges too. Consumer behavior shifts are impacting discretionary spending, particularly on higher-ticket items like electronics and computers.

Additionally, the company’s substantial investments in areas like AI, custom silicon, and new ventures such as Project Kuiper, while potentially lucrative in the long-term, may not be delivering as high a return as expected.

Ultimately, Amazon’s prospects look rather than more mixed than they have for a while.

Given this balanced background, let’s now discuss its fundamentals.

Amazon’s Growth Rates Moderate To Around 11%-12% In the Near-Term

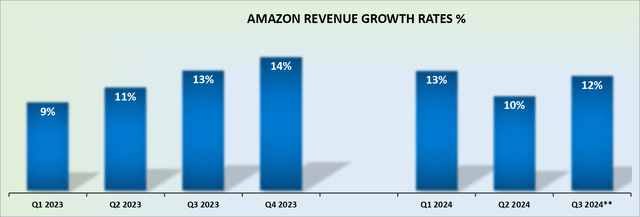

AMZN revenue growth rates

Amazon’s Q3 2024 guidance at the high end points to approximately 11% y/y growth. Nevertheless, I’ve assumed that Amazon has been conservative with its forward guidance because, after all, that’s what these sorts of management guide for, right?

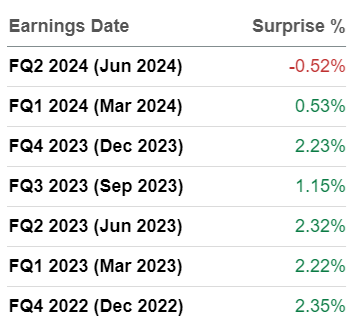

AMZN SA Premium

As it turns out, the size of Amazon’s revenue beats has been decidedly shrinking over the past several quarters. Consequently, when Amazon guides for up to 11% on the top line, I don’t believe it makes sense to forecast a whole lot more.

Furthermore, Amazon has just reported against its easiest comparable quarter. As we look ahead, its comparables will become more challenging hurdles, which will mean that in all likelihood, Amazon’s revenue growth rates will stabilize around 11% to 12%. For investors who still buy into the idea that Amazon is a rapidly growing business are going to be disappointed, particularly in light of its valuation.

AMZN Stock Valuation — 29x Forward Operating Income

Amazon’s guidance points to around $15 billion of operating income, which puts it on a path toward $50 billion of operating income in 2024.

If we presume that Amazon’s operating income will improve next year by 20% y/y, this would mean that Amazon will deliver about $60 to $70 billion in 2025.

Now, to be clear, for H1 2024, its operating income has already jumped by 141% y/y. Also, the high end of its guidance for Q3 implies an approximate 40% improvement relative to Q3 of last year.

In other words, I believe that in 2023-2024, Amazon has already seen a substantial improvement in operating leverage. Thus, I caution investors from presuming that in 2025, its operating income can continue to dramatically outpace its topline growth rates by a wide margin.

Therefore, I believe that looking out the midpoint of my 2025 estimate, AMZN is priced 29x next year’s operating income.

And yet, on a positive note, Amazon carries nearly $30 billion of net cash and marketable securities or nearly 2% of its market cap is made up of cash and marketable securities. Not a significant amount by any stretch, and considerably less than other Mag 7 players, such as Alphabet (GOOG)(GOOGL) or Meta (META)

In short, I don’t find Amazon’s valuation all that enticing and believe its stock is already fairly priced.

The Bottom Line

After analyzing Amazon’s current valuation, I believe paying 29x next year’s forward operating income leaves its stock fairly valued.

Despite impressive growth in AWS and advertising, and efforts to enhance efficiency and customer experience, Amazon faces moderating revenue growth and significant investments that may not yield immediate high returns.

The outlook is mixed and its stock is fairly valued, limiting its upside potential.

It’s clear that for investors, this is a “prime” stock, but with no next-day delivery!

Read the full article here