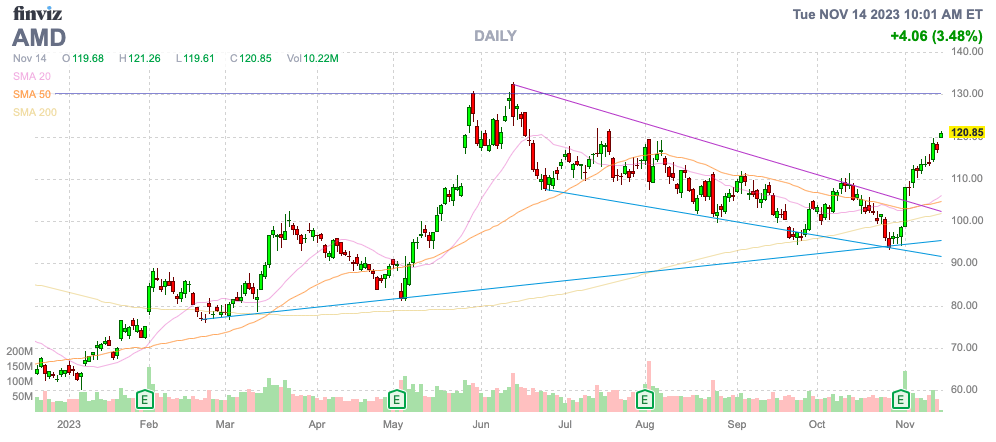

After the market initially didn’t like the Q3 results and guidance from Advanced Micro Devices, Inc. (NASDAQ:AMD), the stock has suddenly rallied to multi-month highs. The launch of AI chips could send the stock to all-time highs similar to peer stocks. My investment thesis remains ultra bullish on AMD, with investors best to focus on future numbers, not short-term hiccups around product launches.

Source: Finviz

AI GPU Chip

The MI300 AI GPU chip is the big story for the end of 2023. A lot of rumors suggested the chip was delayed and questioned whether AMD would have a competitor chip to NVIDIA (NVDA), but the market is finally catching onto the “Advancing AI” event for December 6.

Source: AMD Sr. Director Twitter/X account

On the Q3 ’23 earnings call, AMD CEO Lisa Su appeared to squash the fears with solid projections for the AI chip as follows (emphasis added):

Based on the rapid progress we are making with our AI roadmap execution and purchase commitments from cloud customers, we now expect datacenter GPU revenue to be approximately $400 million in the fourth quarter and exceed $2 billion in 2024 as revenue ramps throughout the year.

The market was initially disappointed with Lisa Su only suggesting 2024 AI chip revenues of $2+ billion. The key is that a lot of emphasis should be placed on the “exceed” portion of the statement considering the CEO said the business would ramp throughout the year. The company placed a $400 million quarterly target for Q4 and the amount would only reach $500 million to reach the $2 billion goal. The annualized revenue rate wouldn’t grow much in 2024, and that doesn’t qualify as a revenue ramp.

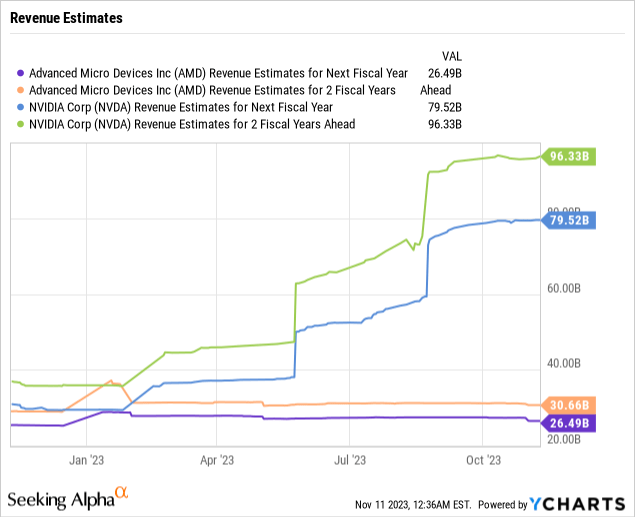

Nvidia has already produced AI GPU revenue boosts in the $6+ billion range back in FQ2 alone. The chip company guided to a further revenue boost in the current quarter, with total sales reaching $16 billion now, up over 100% from the $7 billion in revenues reported just 2 quarters ago in FQ1’24.

The MI300X accelerator version might already be shipping to customers, and Microsoft (MSFT) is already an AI chip partner. AMD suggests the company has multiple hyperscaler customers, leading to the biggest question of whether the company can package enough chips to meet demand.

Back on the Q3 ’23 earnings call at the end of October, CEO Lisa Su already discussed the key MI300X GPU accelerator the company has heading out the door in weeks, not months:

Production shipments of Instinct MI300A APUs started earlier this month to support the El Capitan Exascale supercomputer, and we are on track to begin production shipments of Instinct MI300X GPU accelerators to lead cloud and OEM customers in the coming weeks.

The MI300X version is poised for large-scale LLM inferencing. The market is set to reach a $150 billion total opportunity in a few years while all the growth will have suddenly shifted away from the $25 billion server market where AMD was previously gaining a lot of market shares.

2025

AMD now forecasts 2023 sales in the $22.7 billion range after the PC inventory correction and slower data center sales on the shift to AI. Total sales are set to dip slightly this year compared to 2022.

The big question is the sales upside potential, with AI GPU chips contributing $2+ billion in revenues next year after only ~$0.4 billion worth in Q4. AMD would see GPU sales boosted by $1.6 billion in 2023, leading to sales reaching $24.3 billion before accounting for higher PC sales in the client segment and growing data center sales.

AMD growing nearly 17% in 2024 to reach $26.5 billion appears very doable and is actually below expectations for 2024 when the year started. The upside potential is probably several billion dollars considering the AI GPU growth appears only limited by the CoWoS packaging capacity the chip company can obtain from Taiwan Semiconductor (TSM).

The consensus estimates have AMD ramping sales another 16% in 2025 to reach $30.7 billion. Again, this revenue target appears very pedestrian in what has to be a strong economy after a current weak period in late 2023 and early 2024 leading to projected rate cuts by the Fed.

Considering Nvidia revenue targets for FY25 (January) have surged by over $30 billion since 2023 started to reach a massive $80 billion, the numbers would appear very conservative for AMD with no additional growth added for AI chips. With just a slight bump to 2025 targets, AMD would generate the following financial model as follows:

- 2025 Revenue = $32.0B

- Gross Profits @ 56% = $17.92B (peaked at 54% in Q2’22)

- OpEx @ 23% = $7.36B (24% of revenues in Q2’22)

- Operating Income = $10.56B

- Taxes @ 13% = $1.37B

- EPS = $9.19B/1.63B shares = $5.64.

This 2025 model assumes the AI chips are sufficiently ramped up in 2025 for premium margins and the operating expenses more in tune with long-term financial targets. The model has gross margins and operating expenses topping the peak 2022 levels before the PC slowdown impacted financials.

Takeaway

The key investor takeaway is that AMD is back on pace for a base case 2025 EPS in the $5 to $6 range. The number would appear very conservative considering the projections for AI chip demand and the boost already produced by peer Nvidia. The big question is how quickly TSM can supply these AI chips, causing our research to focus more on 2025 numbers where capacity likely isn’t constrained.

AMD stock only trades at 20x the base case EPS target, while the upside potential appears substantial by 2025.

Read the full article here