Buster Is Shocked That Yield On Cost Falls When NAV Keeps Dropping. Buster Failed Fourth Grade Math.

Diversification. It has been called one of the free lunches in the market. It reduces volatility and increases your ability to sleep at night. It makes sure you can stay with your ultimate winners and that you don’t panic near bottoms. After all, who could have held even Amazon Inc. (AMZN) in 2000-2002 through a 92% drawdown, if that was the only security they owned? Of course it has been called “Diworsification”. Yep, that is an actual word in finance.

Diworsification is the process of adding investments to a portfolio in such a way that the risk-return tradeoff is worsened. Diworsification occurs from investing in too many assets with similar correlations that add unnecessary risk to a portfolio without the benefit of higher returns.

Source: Investopedia

Today, we will look at Amplify High Income ETF (NYSEARCA:YYY), which employs the diversification concept in a different way and give you our take whether this gives you the extra yield you have been seeking.

The Fund

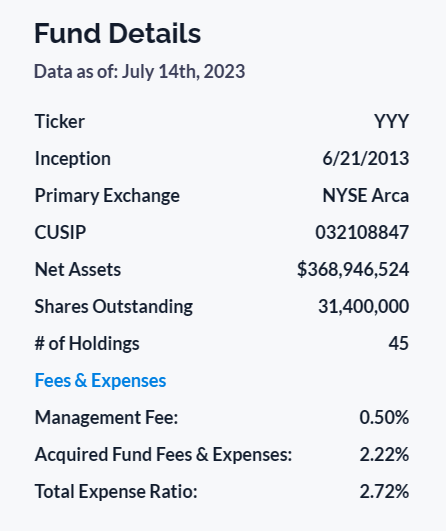

YYY is a rules based ETF with a modest size of $368 million. The fund in turn invests in CEFs of all shapes and sizes and clarifies its rules as follows.

YYY is a portfolio of 45 closed-end funds based on a rules based index. The ISE High Income Index selects CEFs ranked highest overall by ISE in the following factors: Yield, Discount to Net Asset Value (NAV), and Liquidity. This investment approach results in a portfolio which contains a variety of asset classes, investment strategies and asset managers.

Source: YYY

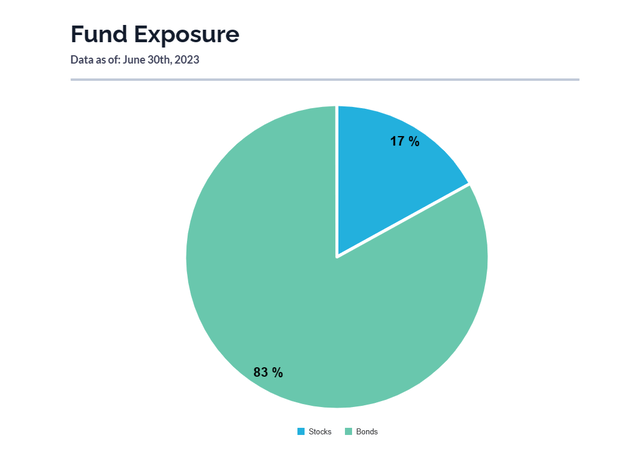

The fund is primarily exposed to bonds via its underlying holdings with stocks making up about one-sixth of the total.

YYY Fund

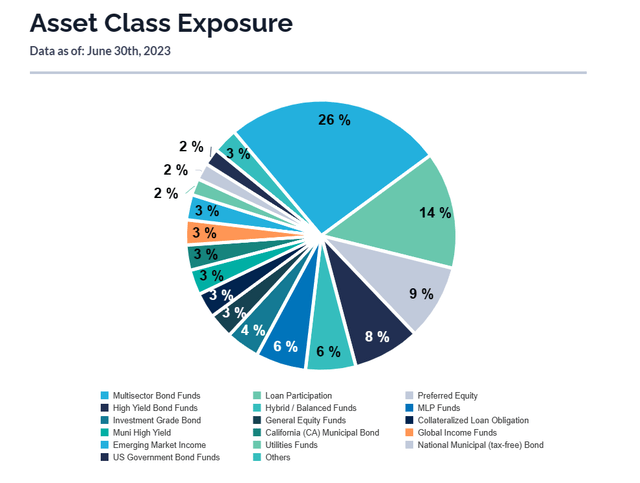

With bonds, the largest subsector is for multisector bonds. It also has exposure to some CLO funds, preferred equity and some tax advantaged muni funds.

YYY Fund

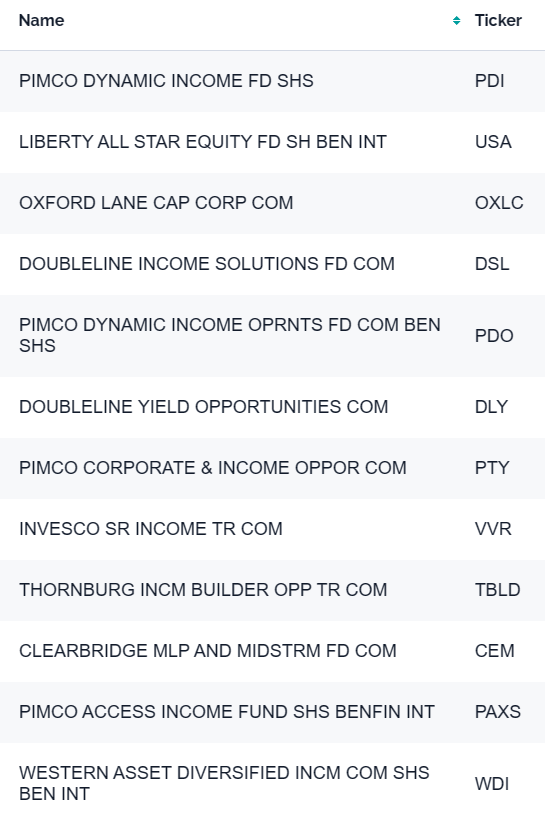

YYY was holding 30 different funds till June 2021 when the number was increased to 45. Currently the top holdings include some rather famous PIMCO funds like PIMCO Dynamic Income (PDI), PIMCO Dynamic Income Opportunities Fund (PDO) and PIMCO Corporate & Income Opportunities Fund (PTY).

YYY Fund

Liberty All-Star Equity (USA) is right at the top as well and that is a popular choice for equity investors seeking a managed distribution. You can also find two funds from Jeff Gundlach’s DOUBLELINE series in here. CLO Fans will instantly recognize Oxford Lane Capital (OXLC). Each of these funds holds a lot of different investments. With a fund of funds approach, YYY effectively holds thousands of investments and takes diversification to a whole new level. This is true even if there is likely to be significant overlap between the holdings. Is this Diversification or Diworsification? Well you can decide that by the end.

The fund charges a 0.5% management fee but this bloats to 2.72% in total when the underlying expense ratios are considered.

YYY Fund

Performance

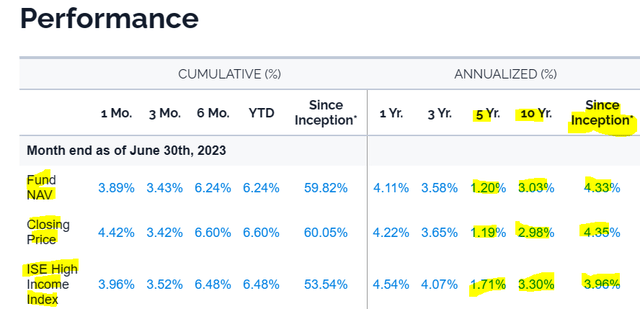

If you went by the giant yield that was being doled from this fund, you might have expected a high double digit return performance. As it often happens, total returns tend to lag severely. YYY has managed about 1.2% annually on NAV over the last 5 years, trailing even starting 5 year treasury yields in June 2018.

YYY Fund

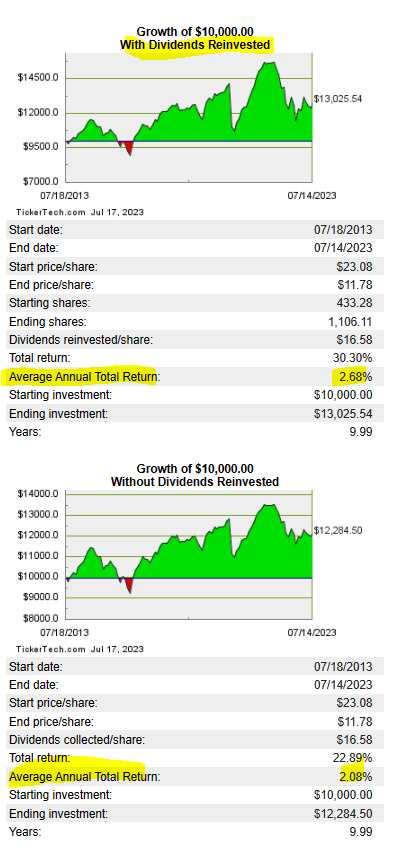

Longer term numbers get a bit better with the 10 year near 3%. The fund has managed 4.33% annually since inception including distributions. One thing we like to do is compare the “dividend reinvested” numbers to those without dividends reinvested. We do this as 99% of the crowd uses these vehicles for income and don’t reinvest. Whereas the stated returns are always with dividends reinvested. We used “Split History” website for this. Note that the numbers above from YYY are till June 30, 2023 whereas the numbers below run till July 18, 2023.

Split History

Without reinvestment your 10 year returns are just a shade above 2.0%. The good part here is that the two sets are equally good or rather equally bad. In some funds there are extreme differences between the two.

Outlook

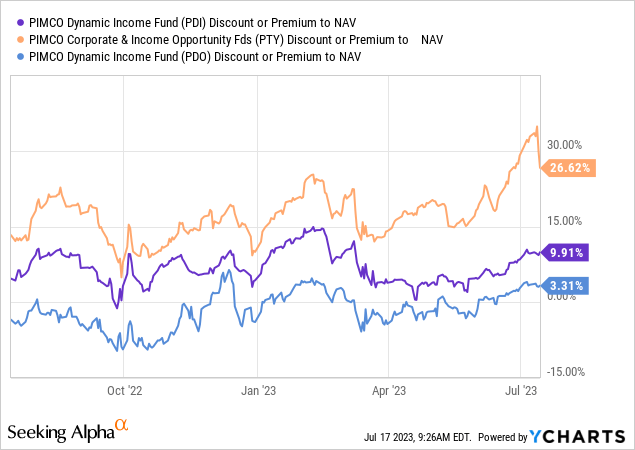

While the fund has a methodology in place to buy CEFs, there appears no checks in place to avoid paying hefty premiums. Here are three examples which the fund owns and still trade at premiums. These range from mild levels for PDO and extreme levels for PTY.

One might argue that only a relative premium (as in Z-score) is important, but even by that measure there is no reason to have PTY there through the last rebalancing. Premiums aside the methodology does not give us a lot of confidence. The criteria listed don’t seem to be focused on any fundamentals (unless you can call “yield” a fundamental criteria). Overall the returns from this method have tracked ISE High Income Index. YYY has outperformed that since inception and lagged by a similar amount over the last 10 years. We can call this a small win as the fund obviously has expenses which the index does not.

Verdict

Most fixed income CEFs have been generating poor total returns in the last 5 years. Most went in leveraged into poor yielding assets and completely missed the rate rise cycle. They still carry massive amounts of leverage and risk as a result. The expense ratio listed for YYY is likely understated at this point as rising interest rates have not completely fed into the numbers for the underlying CEFs. We also think the combination of this level of leverage and impact from a recession, will make most CEFs trade at wide discounts at some point. So for the most part we are completely avoiding leveraged CEFs and we see YYY as a risky proxy on that asset class.

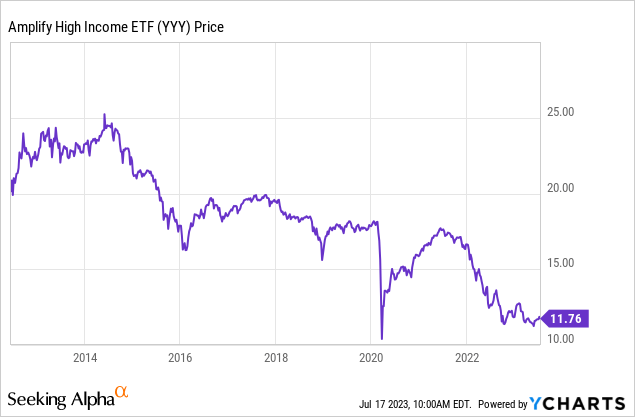

Of course for those only counting distributions and not total returns, there is always a chance to put off the calculation of what is going on for another day. But even from that perspective, the investor who got into YYY at the beginning was starting off with a 10.8% yield in 2013. The NAV has dropped and the current distribution is $1.44 or 7.2% on the original cost.

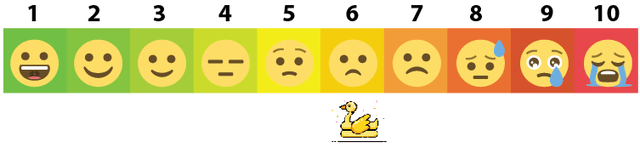

So over time the NAV erosion factors into your income. YYY holds a lot of funds that are not earning their distributions so more cuts are likely from them and YYY will pass that pain on to you. The equity funds are generally of a better quality relative to the S&P 500 (SPY) here, but that does not sway our overall opinion much as this is fixed income weighted ETF. YYY gets a 6 on our potential pain scale rating.

Author’s Pain Scale

Read the full article here