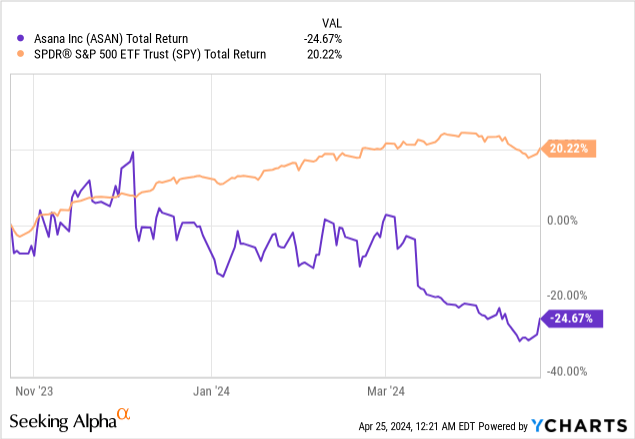

Asana Inc. (NYSE:ASAN) has recently encountered significant pressure regarding its stock prices. While the S&P 500 continues to reach all-time highs, Asana persistently approaches 52-week lows. Despite facing several evident challenges, the management team remains product-focused and long-term oriented. Their strategic emphasis on large enterprise deployments is anticipated to yield favorable outcomes eventually.

Business update

Asana’s Q4 performance in 2023 was not bad, with the company exceeding its revenue forecasts and showing a significant improvement in operating margin as it targets positive free cash flow by year-end. The Q4 revenue reached $171.1 million, a 14% increase year-over-year, contributing to full-year revenue of $652.5 million, up 19% from the previous year. The business expansion exceeded expectations, and Asana also reported strong retention rates: the overall dollar-based net retention rate for Q4 was over 100%, with core customers—those spending $5,000 or more annually—at 105%, and major clients—those spending $100,000 or more annually—at 115%.

Weak comparison to Competitors

Despite Asana’s ongoing business growth, it falls short when compared to competitors like Monday and Smartsheet. Here’s a breakdown for Q4:

- Q4 Revenue Growth: Asana 14%, Smartsheet 21%, Monday 35%

- Net Dollar Retention Rate (NDRR): Asana >100%, Smartsheet 116%, Monday 110%

- NDRR for 100K Annual Recurring Revenue (ARR): Asana 120% (580 customers), Smartsheet NA (1904 customers), Monday 114% (833)

- Customer Number with 5K ARR: Asana 21,346 (14% Year-over-Year), Smartsheet 19,819 (10% Year-over-Year), Monday NA

Asana is evidently losing market share to its competitors. However, it maintains a stronghold on larger enterprise customers with 100K ARR and core customers with 5K ARR. It outperforms Monday in NDRR for 100K ARR and surpasses Smartsheet in total customer number with 5K ARR.

Tech layoff is the major headwind, but temporary

Asana, with its strong ties to the tech industry due to its Bay Area location and a CEO who started his career in tech and co-founded Facebook, has historically been deeply integrated with this sector. Last quarter, the management noted signs of industry stabilization and potential growth. However, this quarter has seen significant layoffs from major tech corporations like Google, Apple, and Tesla, with a reported 263,180 employees laid off from 1,192 tech companies in 2023. This trend poses challenges for Asana, whose revenue is primarily seat-based.

Despite these layoffs, the good news, according to management, is that customers are generally reducing seats rather than dropping. The tech industry, I believe, remains poised for future growth, especially post-consolidation. CEO Dustin Moskovitz highlighted the resilience of the tech sector in the long term:

When you look at the tech sector specifically, I think we’re in the middle of what is still a rising tide of AI growth. Many of our core customers are key players in this space. Even as major companies scale back projects like Apple’s car initiative, they are reallocating those resources towards generative AI technologies.

Focus on large enterprise and wall-to-wall deployment

Unlike Smartsheet and Monday, which employ a go-to-market strategy in their sales and marketing efforts, Asana’s sales team adopts a more top-down approach, focusing on field interactions with CIOs. The management often highlights individual deals with some of the largest companies in the world during conference calls, emphasizing cross-departmental or wall-to-wall deployments. Although this method may not be the fastest route to revenue growth, it positions Asana advantageously in the large enterprise market. More corporations are seeking centralized solutions to manage operational goals across various departments. Large deployments, such as one involving 200k seats at a single customer, serve as strong, exemplary cases that enhance credibility and set a precedent for others. The addition of prominent companies to Asana’s client list not only drives innovation, as these clients often have complex needs and high expectations but also provides Asana with valuable cross-departmental data.

Sales capacity finally up

Additional positive developments for Asana include the recent completion of key management hires in marketing and the expansion of its global presence with a new office in Warsaw, Poland. This new location marks Asana’s 13th global office and its sixth within the EMEA region. The presence of staff on the ground and the ability to interact more deeply with local markets are critical to Asana’s business expansion. The CEO emphasized the strength of their position, noting

all of our revenue leadership roles are filled: a new General Manager of the Americas, a Global Head of Channel, and leaders across operations and field enablement. We are starting the year in a better position than 12 months ago.

Risk

A significant risk for Asana lies in the potential failure of its product deployment, which could lead to decreased retention among its large enterprise customers. Innovating in uncharted territory, as Asana is doing, carries inherent risks due to a lack of prior experience. It’s crucial for Asana to continue innovating and adapting to meet the evolving needs of its customers. The launch of the Asana Intelligence product represents a substantial gamble. Given the uncertainties surrounding the practical capabilities of AI in work management tools, there’s a real possibility that this initiative might not meet expectations. As Asana’s tools are critical for their customers, delivering tools that underperform or diminish in value is not an option.

Bottom Line

I believe the recent decline in Asana’s stock price can largely be attributed to the disappointing guidance for the full fiscal year 2025, with expected revenue ranging from $716 million to $722 million, reflecting only a 10% to 11% year-over-year increase. Dollar-based net retention rates are anticipated to hover around 100% through Q2, and the company does not expect to achieve positive free cash flow by year-end. This casts a somewhat pessimistic outlook for at least the next six months.

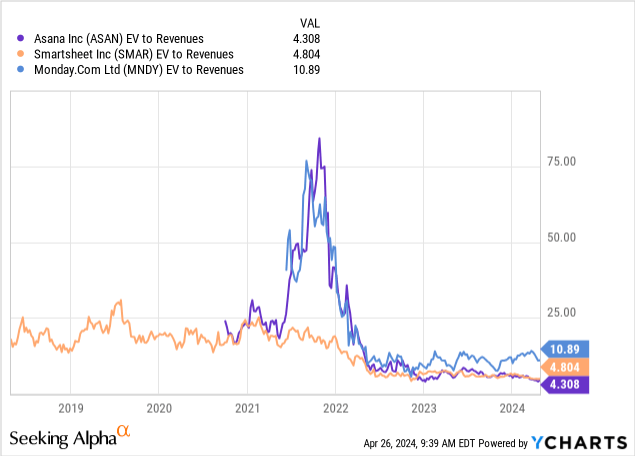

While Asana is facing these short-term challenges, its long-term prospects remain strong. It is currently trading at the lowest EV/Sales ratio of its peers (chart below). Given the unique product lines and high-quality customer portfolio, I think Asana should deserve higher valuations. Especially for 2024, if Asana’s sales can accelerate (as CEO indicated), the valuation will go even lower. Patient investors could potentially benefit from holding their shares, as there may be unexpected positive developments, given the current low expectations.

Read the full article here