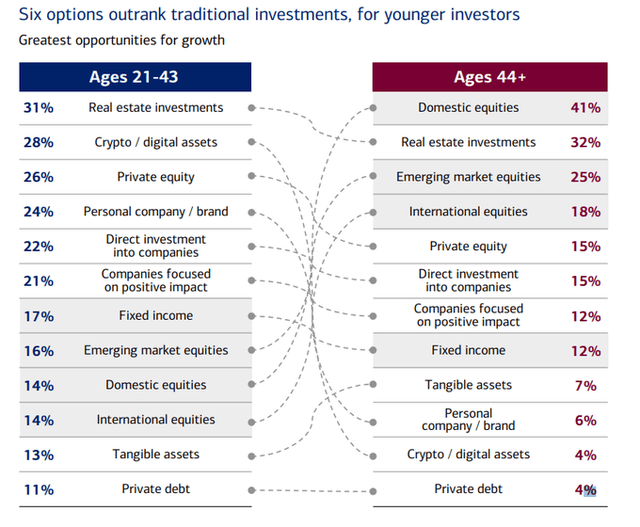

I came across a fascinating wealth report put together by Bank of America. One section of the survey underscored a theme that investors may not be surprised by given a general distrust among young investors of traditional financial markets.

It turns out that private equity investments are seen as a greater opportunity for long-term growth than typical stock-type choices. It remains to be seen if this will be a long-lasting trend, but there’s been general strength among private-equity companies in the past year-plus.

I reiterate a buy rating on Blue Owl Capital (NYSE:OWL). The $25 billion market cap Asset Management and Custody Banks industry company has performed decently since I initiated coverage on it earlier this year. Following a solid Q1 earnings report and technical breakout, shares have wavered despite optimistic earnings projections and a rising dividend.

New Generation, New Investment Trends?

BofA Global Research

According to Bank of America Global Research, Blue Owl is a market leader in direct lending and capital solutions to the alternatives industry. Through the combination of Dyal Capital and Owl Rock, Blue Owl was formed to offer attractive financing and capital solutions to investment management firms and their portfolio companies.

Back in May, Blue Owl reported a solid set of quarterly results. Q1 non-GAAP EPS of $0.17 topped the Wall Street estimate by a penny while revenue of $513 million, up more than 31% from year-ago levels, was a $40 million beat. The company reported total assets under management of $174 billion, a 21% jump from March 31, 2023, while fee-paying AUM increased 15% from the year before.

OWL is currently seeing strong organic revenue growth amid a healthy fundraising environment despite a restrictive interest rate policy by the Federal Reserve. Its private wealth management products are also helping to boost the top and bottom lines, and its recent expansion into insurance could help provide higher earnings in the quarters to come.

With a high yield and somewhat defensive portfolio (including high locked-up AUM and high fee-related earnings), I expect OWL to hold up better than some of its peers should we see volatility pick up across asset classes. As such, TD Cowen came out in defense of the stock earlier this month following a modest pullback.

Key risks include more competition in the private debt markets, a downturn in the tech sector, and the reality that OWL’s dividend is flexible – a payout dip would be seen as a negative. Unfavorable tax changes is also a possible peril.

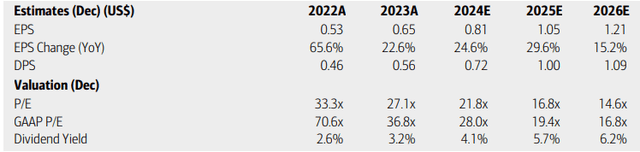

On earnings, analysts at BofA see EPS rising significantly this year with continued high per-share profit growth in the out year. By 2026, operating EPS is seen at $1.21. The current Seeking Alpha consensus numbers show comparable profit growth with just slightly less sanguine EPS amounts in 2025 and ‘26. OWL’s top line is expected to surge from $2.1 billion this year to $3.2 billion by 2026.

Dividends, meanwhile, are forecast to rise from $0.56 in FY 2023 to the firm’s $1 target next year. The quarterly payout was recently hiked. With earnings rising sharply, the payout ratio appears within reach in my view. That would result in a dividend yield potentially above 5.5% if the stock price holds current levels. What’s more, the earnings multiple is not all that high considering the high earnings growth rate.

OWL: Earnings, Dividends, Valuation Forecasts

BofA Global Research

If we assume a 20x multiple, which I view as fair given the high earnings growth rate in the quarter to come, on normalized EPS of $1.05 next year, then shares should trade a bit above $20. I see upside risk to that valuation, though.

If OWL earns $1.20 following this period of high growth, then the stock should be near $24 using the same 20x multiple. Given the 25% to 30% near-term earnings growth rate, a PEG of 1.5 would imply a significantly higher P/E, supporting the case for a mid-$20s stock. For now, I’ll keep it conservative with a $20 near-term intrinsic value target.

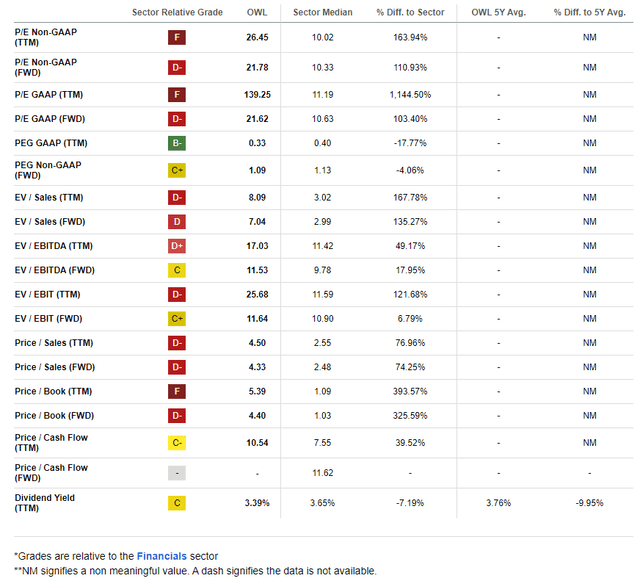

OWL: A High P/E, But A Very Reasonable Forward PEG Ratio

Seeking Alpha

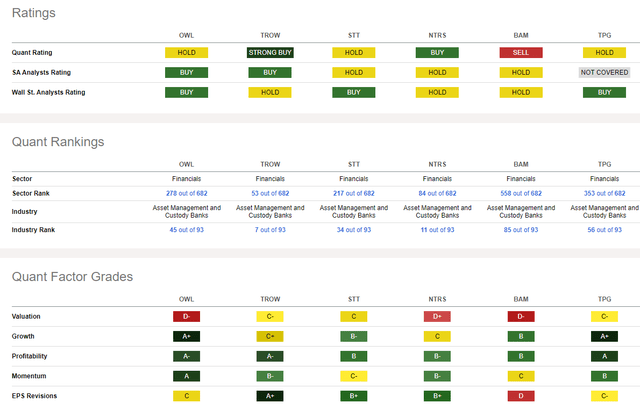

Competitor Snapshot

Compared to its peers, OWL sports a somewhat high valuation, but its growth trajectory is best in class. What’s more, the firm has very healthy profitability marks while its share-price momentum is also the strongest among its competitors. Though EPS revisions have been mixed, major earnings advancement is expected.

Seeking Alpha

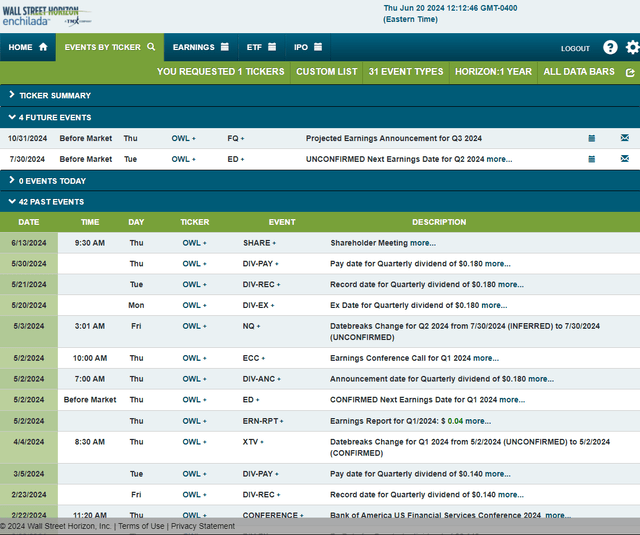

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2024 earnings date of Tuesday, July 30 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

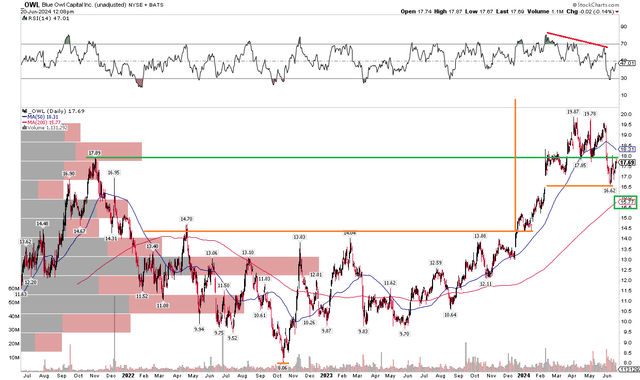

The Technical Take

OWL has performed well since shares notched a low in October 2022. Notice in the chart below that the stock nearly hit its upside measured move price target of $22 during the latest leg higher in the rally. The $8 range height from the early 2022 to late 2023 consolidation resulted in an upside breakout, triggering the $22 target. But the stock didn’t quite make it to an even $20, and shares turned lower amid a weakening in its RSI momentum oscillator (at the top of the graph).

Today, OWL’s long-term 200-day moving average comes into play just under $16, so maybe we see a bit more downside, but a drop to the 200dma would be an ideal buying opportunity in my view. Big picture, the stock managed to rally through its late 2021 peak which is a positive. Shares also recently filled an earnings-related gap from back in February, so the low could be in.

Overall, buying today appears to be a solid risk/reward idea but adding to the position under $16 would be even better.

OWL: Bullish Gap Fill, 200dma Seen As Support

Stockcharts.com

The Bottom Line

I have a buy rating on Blue Owl Capital. I see the Financials-sector stock as a compelling valuation candidate, while its technicals are generally healthy.

Read the full article here