Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the fourth week of May. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

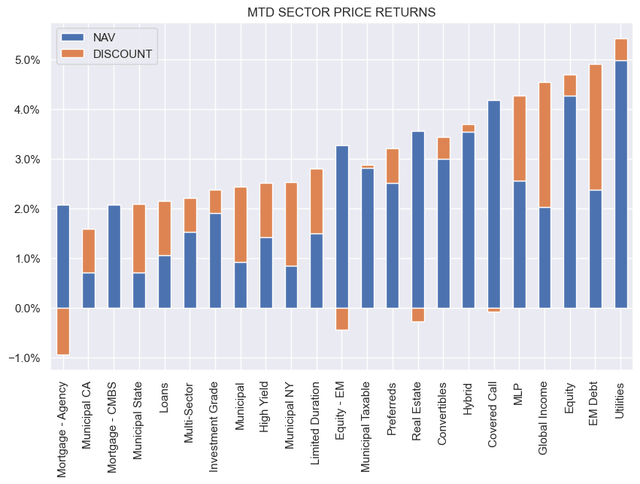

All CEF sector NAVs were lower this week because of rising Treasury yields save for loans which were flat. Discounts, however, were mostly tighter. Month-to-date, returns are very healthy with Utility CEFs in the lead.

Systematic Income

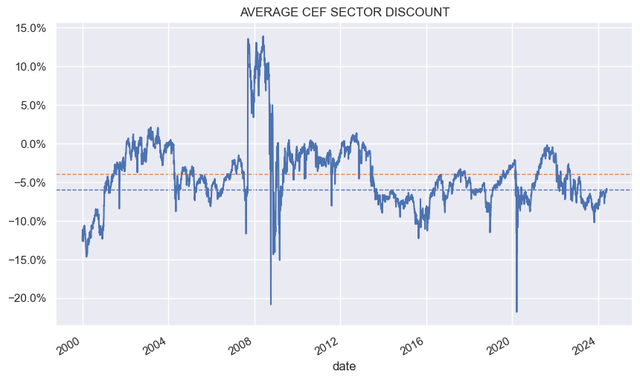

The average CEF sector discount has tightened this year and remains about 1% off its longer-term average level.

Systematic Income

Market Themes

CEF activists have been circling the market this year, attracted by wide fund discounts. CEF managers, however, have not been sitting still and have adopted a number of defenses which we discuss in this section.

The easiest defense mechanism which some managers have reached for is to raise distributions. There is an imperfect but positive relationship between distribution rates and discounts – the higher the distribution rate the tighter the discount, all else equal. The idea is that a distribution hike will tighten the discount and cause the activist to lose interest in the fund. We saw large distribution raises on a wide array of municipal CEFs from Nuveen, BlackRock, Invesco and others over the past year. So far this hasn’t worked particularly well, it has to be said, however we don’t know the counterfactual. Perhaps discounts would have moved even wider in the absence of distribution hikes.

Tender offers are another popular tool as well and we have seen at least a half-dozen tenders so far this year (ZTR, EIM, MUI, etc). Tender offers allow investors to sell shares at small discounts, generating gains on the shares they can sell back to the manager (particularly via oversubscription). That said, for tender offers to be effective in sustainably resetting discounts tighter they need to be run periodically, akin to interval funds like EGF which has a regular buyback schedule.

Another way to tighten discounts is to eliminate it altogether by converting the CEF to an open-end fund – First Trust just did this with their MLP CEFs, or less commonly to an unlisted CEF as BlackRock is doing with MUI.

Yet another way is to set up a share repurchase program, sometimes called “discount management programs”. Under these programs, the fund buys back its shares in the secondary market once a certain discount level is triggered. Many CEFs have these programs in place. BlackRock recently announced one for a dozen of its funds.

Finally, and somewhat unusually, BlackRock announced a management fee waiver program for their muni CEFs where the management fee is waived on assets financed with preferred shares if the income on those assets is less than the dividend on the preferred shares.

As background, recall that leveraged fixed-income CEF net income has generally struggled since 2022 when the Fed began to raise the policy rate – something we’ve been discussing ad nauseam on the service. The situation has been particularly bad because of the unusually inverted yield curve where the base rate on the leverage facility (typically Libor/SOFR) is higher than the base rate that the funds earn on their assets (3-10Y Treasury yields).

As a back-of-the-envelope, a typical taxable fixed-income leveraged CEF is paying something like 6% on its leverage (roughly 5.25% base rate + 0.75%) and earns 4.4% + bond credit spread on its assets. If we assume the fund holds BB-rated bonds (highest junk-rated bucket) with a spread of 1.8% as of this week, then it earns a yield of 6.2%, leaving 0.2% of income before fees (6.2% yield less 6% of leverage cost).

If we then subtract fund expenses (management fee + sundry fund expenses) of roughly 1% then net income on leveraged assets is -0.8%. Obviously, this number is going to depend on the assets of the fund and individual fee and leverage cost structure but the idea here is that most taxable fixed-income funds will struggle to generate positive net income on their leveraged assets (which are typically a third of total assets in the portfolio).

The situation for muni CEFs is even worse however because the credit spread of muni bonds is very tight as most muni bonds held in CEFs are very high-quality with ratings of AA/A. It’s nice that BlackRock is doing something that recognizes the fact that leveraged assets in its muni CEFs are not generating much additional income for shareholders.

Stance And Takeaways

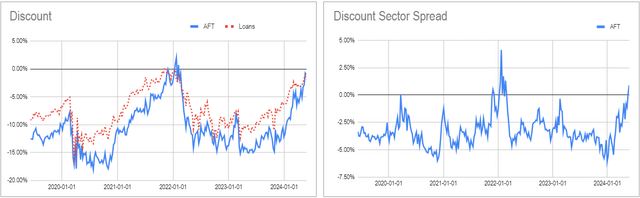

This week we fully sold our loan CEF AFT position in the High Income Portfolio. The fund was trading at a small premium – an unusual sight in both absolute and relative terms as the charts below show. As we discussed in a recent Weekly, loan CEFs offered great value in mid-2022 when their discounts were substantial, credit spreads were wide and net income was rising. Now we have the polar opposite situation. Potential rotation options include limited duration CEFs which trade at decent discounts, BDCs or ETFs.

Systematic Income CEF Tool

Read the full article here