Dear readers/followers,

If you recall, I’ve been a vocal proponent of investing in Chemours (NYSE:CC) for some time. I even added it after my last article, which was published a few months back and which you can find here.

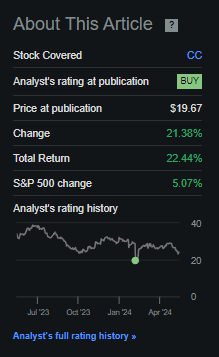

Sometimes the stars line up, and you manage to “catch” a company at exactly the right place. Such was the case with Chemours during my last piece. That is why despite the recent downturn, my position in the company, and especially the one I bought at the time, is up over 22% compared to a market only up 5%. And this was back in February of this year.

Seeking Alpha Chemours RoR (Seeking Alpha Chemours RoR)

I already spoke about the scandal and the results which started this at the time. Chemours CEO, CFO, and key personnel were placed on administrative leave pending internal review, and at the same time, the company disclosed potential weaknesses in internal controls, leading to delayed year-end reporting. The company then very quickly recovered, as you can see above, but has since seen more declines – slower ones.

It goes to show you, though, if you believe that there is no substance to allegations such as the one made here, that the reversal potential for any investment might be massive.

Less than a week ago, we got the news that the company went ahead and named a new CFO after the administrative leave mentioned here.

Also, few other news. So in this article, we’ll do an update on Chemours and give the company a new set of targets and estimates if warranted.

Let’s look at what we have here.

Chemours – An upside remains, even with the halted production

So, one of the things that happened not that long ago – a week actually – is that the company suspended production temporarily for TiO2 in Mexico – though this had more to do with government intervention due to water scarcity than anything else. Mexico is currently, like many areas, in a severe drought, and the production of TiO2 requires a great deal of water – so that makes sense.

That the crash following the news of the audit was an overreaction was proven by the bounce almost immediately after – which also vindicated my decision to put some money to work in Chemours at the time.

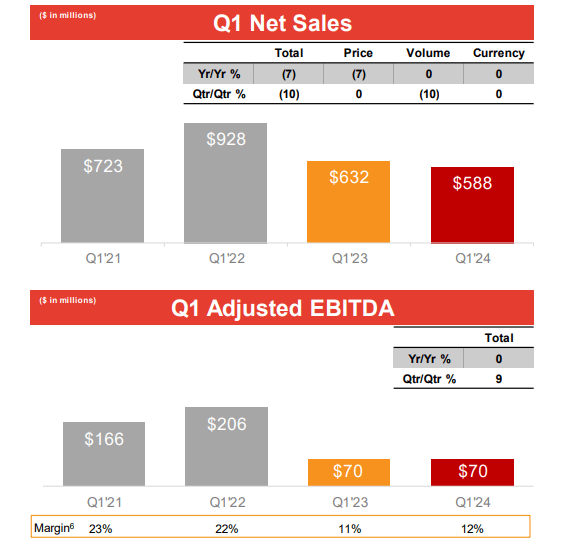

The last set of results we have are 1Q24. This period did not see an improvement for the company – instead recording a further decline in net sales, EPS, Adjusted EBITDA (37%), in margins, in operating cash flow while at the same time recording an increase in CapEx.

Not a good quarter insofar as numbers go, that much is clear.

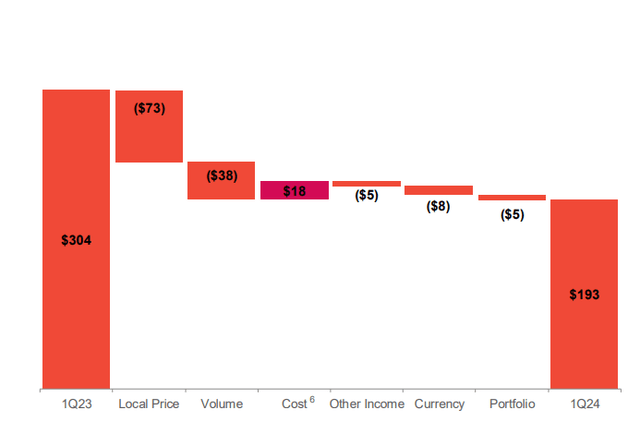

Chemours IR (Chemours IR)

Here you see some of the overall drivers for this. In this, the trends actually do not worry me all that much. Yes, some pricing changes, but a lot of volumes, some FX and others. The lower pricing within the TT segments as well as lower pricing in legacy refrigerants do sort of a combined “perfect storm” sort of scenario.

But as we have established before, this is a basic materials company. These companies are, by their very character, volatile – and if you invest in them, you shouldn’t be surprised by exactly that – volatility.

The volume changes you see here were driven by continued weaker demand – people are simply not stocking up, and there are some macro-sensitive end markets in the APM segment, with additional demand decline in things like Foam, propellants, and other sub-segments where Chemours happen to be a significant player.

Fundamentals?

Nothing really worrying as such. Chemours remains relatively cash-heavy with a net debt of $3.3B, which comes to leverage of 3.7x on a TTM net leverage basis. It’s not the best, but certainly also isn’t the worst. With over $1.4B in total cash available, the company isn’t in any near-term danger.

Segment performance is what’s interesting here, as I see it. The latest quarter was the latest in a line of declines since YoY 1Q22, which saw a height for the Titanium technologies of nearly a bullion worth of net sales. This is now down almost by half – but earnings/EBITDA is by far the worst here.

Chemours IR (Chemours IR)

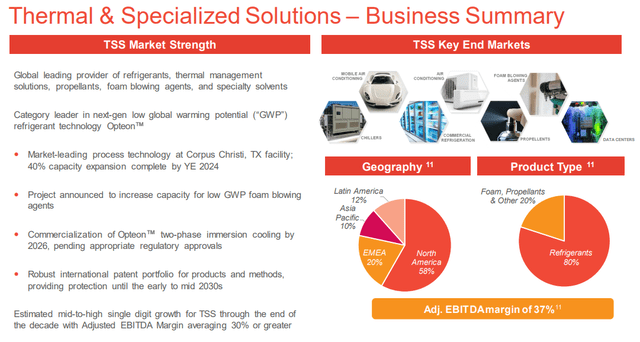

The TSS segment, including refrigerants, actually managed stability. Net sales were only down slightly, and EBITDA was down, but still over 33% EBITDA margin for the segment, which is good. The company also expects sequential growth from the segment in the mid-teens, as demand for Opteon refrigerants is expected to recover in the near term. The result is growth in adjusted EBITDA. Important to remember is that Chemours manufactures both the new refrigerants, but also focuses on legacy operations, which it is currently winding down.

This is also one of the main reasons for investing in Chemours, the company being a leader in refrigerants, thermal management solutions, specialty solvents, and the like.

Chemours IR (Chemours IR)

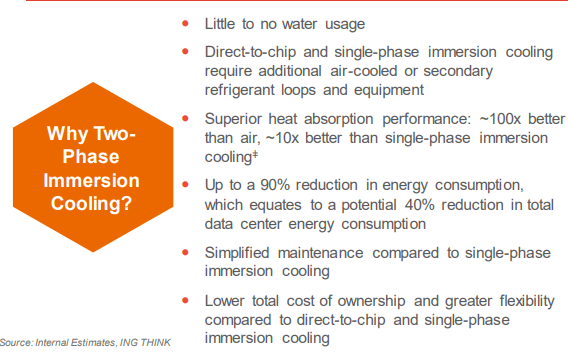

If you’re interested in investing in Chemours, this refrigerant segment needs to be on your radar – because this is where I believe the company actually shines quite a bit and where its future potential is revealed. Just to name an example of the applications (as seen above), data centers. These are still using traditional cooling tech, with high energy-intensive operations, and even a mid-sized US data centers consumes daily water for cooling of 300,000 on a daily basis. One of the key drivers is moving to liquid cooling, the reasons for which you can see here.

Chemours IR (Chemours IR)

With a combination of low water usage, low GWP, low asset footprint, low-energy usage, and low maintenance, there are a lot of advantages to using this sort of technology for cooling – and this is just the data center subsegment.

APM, or advanced performance materials, sort of remains the “odd man out” for the company here. EBITDA crashed despite sales not being “all that terribly”, and part of the reason for that was ongoing maintenance which is now resolved (not forecasted). Aside from that, end market pricing is down, which means lower cost absorption – but for the main part, the company needs a market recovery here for improvement.

So, as I said – not a great quarter – but for a basic materials company like Chemours, we should keep our eyes on the long-term prize for investors – which is the valuation-related upside that the company, to my mind, no doubt has.

Let’s look at what valuation tells us, and where the challenges lie.

Chemours – Plenty to like, though patience is a must here

There’s no doubt in my mind that despite the recovery we saw here, shares of the company are still at a bottom-type valuation. I think this is a superb exhibition of how much volatility can play with share price and valuation – in both ways – and what upside you could, or should, be able to garner from the situation.

There’s no doubt in my mind that Chemours is further declining during this year. The combination of soft-end markets, bad pricing, internal issues, and maintenance leaves me only doubtful of how exactly things are going to go this year, by which I mean “how deep” exactly.

But beyond that?

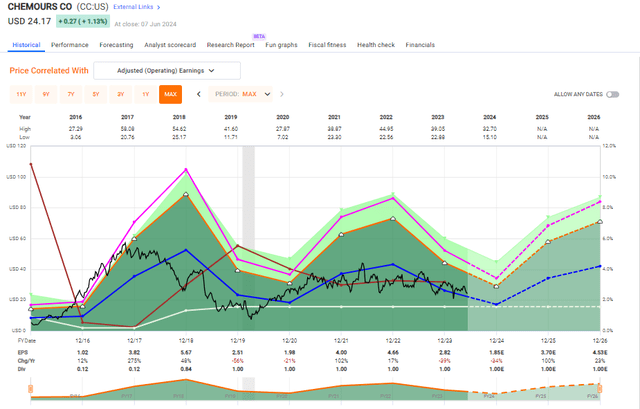

Chemours F.A.S.T Graphs Upside (Chemours F.A.S.T Graphs Upside)

The upside is very significant. We’re talking triple digits, if these numbers are anywhere close to being realistic. Yes, Chemours is still in high debt, and the company is BB-rated, which isn’t great. But the yield is more than 4.1%, which is decent, and the upside here, if we normalize the company to any sort of realistic degree, is massive.

At the low normalized 8x P/E level, we’re talking 22% per year. And this is using the 5-year average, during the last 5 years of volatility.

Because Chemours is expected to grow at a rate of 28% on average per year until 2026E, and the company has a 50% 1-year historical ratio of outperforming estimates by more than 10%, I am of a conviction that there exist reasons to be positive here. Estimating only at a 14x P/E brings us 48% per year, or 175% until 2026E, with an implied FV of $63 for CC. Even if we just use 10x P/E, that’s still over a 25% annualized upside with an implied share price of $42/share.

In my last article, I gave Chemours around $30/share, which implies below this – but still a 15% annualized RoR with the current share price of $24/share. Also, I am raising this share price target as of this article. With the new estimates, some new management in place, and the company in a better place now internally, I’m adding $5 and moving the estimate to $35, which comes to about 8.5x normalized to that 22% upside per year.

The company remains a play on destocking trends, demand trends, and overall macro. There are currently a lot of moving parts in the TT business, with the vast majority of the company’s business here being contractual, which means a contract lag in relation to pricing with changes that change about every 6 months or so. In terms of some of these trends, we can expect leverage to actually rise slightly during 2Q, and then trend down again – with more favorable trends across the board during the second half of the year.

As things are looking now, it’s back to “wait and see” for the company here. Given however the valuation position that we are currently in, I do see immense potential upside here, however, and that is why I consider the company a “BUY”. A spec buy, but a “BUY” nonetheless.

With that, here is my current thesis for Chemours, and my update for the summer of 2024.

Thesis

- The company is fundamentally appealing due to its chemical portfolio but is hounded by potential legal issues and risks – both future and historical, as well as an unappealing liability profile. The recent disclosure is only the latest example of this. This needs to be discounted, but it’s entirely possible to do so – just keep your targets below 10x P/E and a share price of $35/share, adjusted for the new information, but remove some of that discount due to a higher current upside.

- I keep CC as a “BUY” and “Bullish” rating, with an overall price target of $35, below the current analyst average, but considered fair on a peer and risk/reward comparison. As of June 2023, I am shifting my target here somewhat, and now expecting a good 2-3 year trend, with the recovery of TT and other parts towards the 2H of 2024.

- I do clearly maintain a “speculative” rating on the stock, however, and I would not make this a core position in any portfolio at this time. However, I am slightly adding to my position.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

As things stand now, the company is still a “BUY”, and it fulfills every criterion that I have except one – the quality, due to its non-IG-rating. However, it’s very “speculative”, and that needs to be kept in mind.

Read the full article here