Thesis

Global X MSCI China Consumer Discretionary ETF (NYSEARCA:CHIQ) is an equity portfolio focusing on the consumer discretionary sector. It has some high-quality and high-growth holdings with earnings growth being the main return driver while multiples have been stably depressed since 2022. From this period until now, the crisis of the property market and the uncertainty about secular economic growth within China have been heightened. Due to the prolonged period of disappointing performance of both the properties and equities market in China, the overall sentiment has been in a weak and sticky phase where a major paradigm shift is likely needed to reverse the current lacklustre valuations.

On the flip side, the current condition potentially suggests that the market is at a bottoming phase. Meanwhile, the earnings growth potential for CHIQ’s holdings is generally strong given each of the company’s market potential. Although there are plenty of short-term economic challenges, the risks generally do not weigh significantly against the upsides given the pessimistic market expectations as a status quo to begin with. As a result, my outlook for CHIQ is neutral for now, with a hold rating.

Introduction

Last week was the week of the Third Plenum in China, where it will set the tone of long-term policy agenda in response to China’s current situation. In the short term, the weak market sentiment continued amid downward pressure on housing, disappointing H1 GDP growth and retail sales performances. This is concerning because a cyclical downturn in the economy is particularly bad for consumer discretionary stocks. However, it is probably not as bad as it may seem. I will begin with a quick overview of CHIQ’s structure and then discuss the broader markets and economy in China that I think have more impact in this situation.

CHIQ Overview

Net Asset Value: $213.48 million

Dividend yield: 2.90%

Expense ratio: 0.65%

1-year price return: -11.36%

Year-to-date price return: -4.43%

Consumer-cyclical weight: 94%

Seeking Alpha

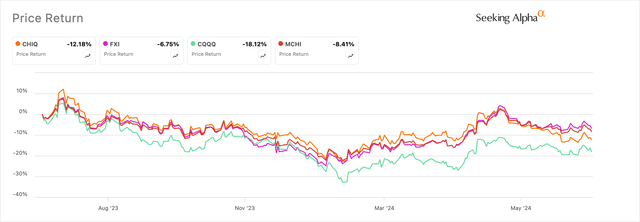

tickers: CHIQ, FXI, CQQQ, MCHI

In the 1-year period, performance for CHIQ has been in line with some of the major Chinese ETFs. However, its year-to-date price return is around -4% vs. +4.3% for MCHI. The difference is attributed to the sector exposure, where sentiment is more negative for consumer discretionary stocks in China, especially at the start of 2024. Meanwhile, MCHI and FXI have more exposure to Chinese banks, which lately enjoyed major rallies.

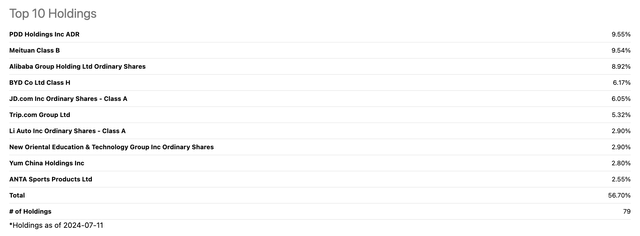

Seeking Alpha

Here are the top 10 holdings for CHIQ. My impression of these stocks is that overall, their quality and growth are robust despite broader macro concerns. Given their high-growth nature, the fund’s aggregated top 10 holdings weigh around 56% with a weighted P/E ratio of 23, and to balance things out, a PEG ratio of 0.7.

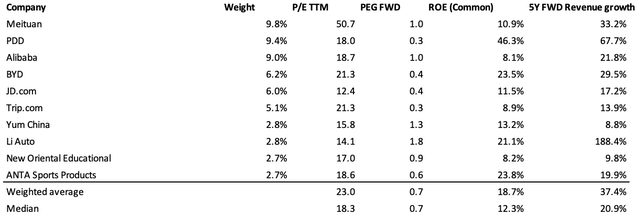

Seeking Alpha, Author’s calculation

Valuations are fairly attractive if we account for growth, which is the main driver of these stocks’ performance, as multiples in the China market are staying depressed. Here is a simple summary of some of the stocks:

Meituan (OTCPK:MPNGY): Consensus annual earnings growth is above 50% for FY24 and FY25. Revenue growth is expected to continue at a much moderate pace following the company’s aggressive expansion pace in the past few years. Valuation is slightly towards the expensive side with earnings growth depending on cost cuttings, which is challenging.

PDD (PDD): A good investment with strong financial performance and a favourable technical trend and valuations. A high-growth trend is expected given the strong cost advantage and appeal to its customers. Meanwhile, profitability remains robust.

BYD (OTCPK:BYDDY) and Li Auto (LI): Both companies have strong potential within the Chinese market due to the trend of vehicle electrification. BYD’s stock is performing well on a year-to-date basis, despite the Q1 revenue miss. Li Auto had also suffered an earnings and revenue miss in the recent quarter, with an overall downward trajectory of stock performance and earnings revisions. Unlike BYD, Li does not have a clear price advantage that allows the ability for aggressive expansion within and beyond China with less dependency on consumer confidence.

JD (JD) and Alibaba (BABA): Growth is fairly modest for the two companies, with no clear catalyst for outperformance. The companies are direct competitors in a consolidated e-commerce industry. Valuations are on the attractive side.

Yum China (YUMC): I have recently covered Yum China in another piece. Overall, I think that this is a company with a great moat and a fairly predictable business. The valuation of YUMC is fairly good, but the current entry point is still risky. Its expansion is still significant as it expands into China’s lower-tier cities.

These are the few largest holdings that can be important earnings growth drivers for CHIQ. Overall, the portfolio is still quite diversified, which makes the broader market and economic expectations to be the more important factors for now. Although the outperformance catalyst does not seem clear in the short term, the overall long-term growth potential is strong given the industries in which some of the companies operate. Economic and macro policies do have a substantial impact on valuations. However, they will unlikely impact the companies’ growth potential to the same extent. Much development is still needed in the Chinese economy considering issues such as electrification, urbanization, unleashing the consumption potential of lower-tier cities, etc. The companies will have much room to capitalize on them.

About The Broader Market And Economy

Now, we could look more into valuations and their broader context. I will first discuss more about the negative side. The year-to-date performance has been particularly weak for not only consumer stocks, but also across segments excluding banking. This is amid the recent decline of the 10-year yield for Chinese bonds as Chinese investors flock towards safer assets and gain preference for foreign exposure amid the “asset famine” environment. On a yearly basis, the slightly bearish trend of the CSI300 index (highly correlated with CHIQ) also concurs with that.

Outflow from the domestic markets weakens not only domestically traded equity valuations but also Chinese companies listed in the US, such as the holdings within CHIQ. Asset prices in China have been on a declining trend since 2021. This prolonged period of disappointment by Chinese consumers has a profound effect. I think, firstly, sentiment is artificially depressed. Secondly, the magnitude of policy surprise and effectiveness needs to be quite significant for the whole paradigm to reverse, with the key issues being the property segment in the short-term and economic growth in the long term as China shifts its growth model.

Here is where we are in terms of policies and broadly speaking. Firstly, on the monetary side, China is fairly clear about its intent to keep the Yuan strong. It is likely that there will not be significant loosening. On the fiscal side, the current housing package is still seen as insufficient given the large scale of inventory. Currently, the government focuses more of its attention on deleveraging the LGFVs with a more fiscally disciplined and long-term oriented stance. The Third Plenum’s result reflects that, which makes short-term policies still unclear. A long-term outlook is essential for China given that it is undergoing a major transition in its economic model towards one with “high-quality growth”, less dependency on the property market, and more consumption. Aside from domestic affairs, incremental protectionism subject to the potential Trump presidency will weigh heavily against economic performance, with roughly 2.5% GDP growth downside per a UBS estimate.

I know that the above points would offer quite a concerning outlook. On the flip side, there are reasons to be optimistic. They have to do with the current low valuation situation of the Chinese stock market (which I believe is the view of numerous banks), the resilience of CHIQ’s holdings, and also the limited extent of impact from the tariffs levied given the holdings are indirect exposure. The “excessively” negative movement of long-term yield to me indicates that sentiment is slightly getting ahead of fundamentals. Further information shock from markets and the economy will have a limited impact on the markets given the current expectations that are pessimistic to begin with. Although property prices have continued to decline since the start of 2024, equities performance has been relatively robust since then, reflecting that expectations on home prices are becoming adaptive towards the downward trend. As for the lack of policy clarity, I think the central government’s ability to support its fiscal stimulus is quite sufficient considering the excess inventory funding needed by estimate and some indications of investors’ optimism on local government finances. There is some extent of “safety net” on that front. Looking ahead and considering consumption stocks, key sources of growth include the current positive momentum in youth employment, a large savings base to be transferred into consumption, new energy and EVs adoptions, and still a large urbanization potential that can drive consumption and fixed assets investments once the local government and property developers deleverage sufficiently.

Summary of Downside Risks

Geopolitics: Updates in tariffs in primarily the US and the EU will have a considerable impact on economic growth. Tariffs have a strong impact on China’s economic performance. However, the extent of the impact it has on the equities market is unclear, including for stocks that are not directly impacted by trade.

Macro and policies: As mentioned, both short-term policies and the long-run growth pace for China are fairly uncertain. The extent of fiscal stimulus, which is much longed for by the market, comes off quite weak as of now. I think this is particularly complicated in China’s situation where it is constrained by the objective to shift towards the “high-quality growth” model which has much less dependency on investing in the housing sector, This challenges the policy stance of directly injecting into the housing market. Given the current situation, home prices are falling with excess inventory, and the situation can become worse.

Liquidity: The net asset for the fund is around $210 million, which is not particularly large. This along with a relatively low-volume results in a relatively risky rating from Seeking Alpha.

Conclusion

I have discussed my view on its portfolio compositions and on China’s equities market as a whole. The portfolio is 94% consumer cyclical and generally comprised of high-quality stocks with no clear outperformance catalyst given their “neutral” valuations. Chinese stocks typically trade cheaply and CHIQ is on the more expensive side given their justifiably high-growth and quality characteristics with earnings growth being a solid return driver.

Downside risks from valuation decline are limited, while earnings growth can continue to drive CHIQ’s performance strongly. The earnings potential concurs with expectations. Limited downside risks from valuation are based on a few predictions. Firstly, due to the pessimistic sentiment from investors, valuations are at a cheap level to begin with. This is true for China’s overall stock market and the majority of holdings within CHIQ. Despite the unresolved challenges for the Chinese economy and the lack of transparency, there are still considerable reasons to be optimistic. They range from long-term growth potentials to some of the short-term indications of policies’ ability and metrics on economic revival. Overall, the view is quite balanced, which gives it a “hold” rating for now. I will wait for more policy outcomes in the next few months for revision, given that it is something that the market weighs strongly on in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here