CONSOL Energy Inc. (NYSE:CEIX) is undertaking an expansion of the Itmann Mining Complex in West Virginia, and reported an impressive track record for the last ten years. Most clients form the metallurgy industry or the power generation will most likely buy the company’s product because of its high energy content. Besides, in my view, as soon as the problems in Baltimore, Maryland are solved, FCF growth may grow again. Under my financial model that was based on previous consistent FCF growth, the results indicate that CEIX appears quite undervalued. Other analysts also believe that CEIX could trade at higher marks.

CONSOL’s Business Model, And Recent Quarter

In the last quarter, the company presented itself as a low-cost producer of high-quality bituminous coal operating in the Appalachian Basin.

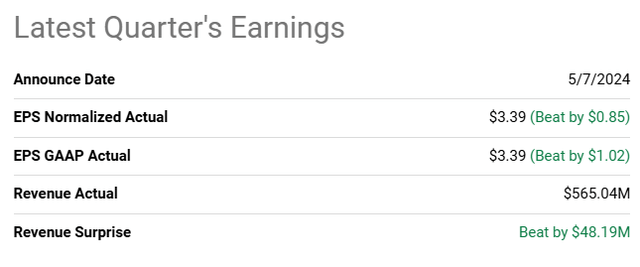

It is worth having at the most recent quarterly report, which included better than expected EPS GAAP of $3.39, and quarterly revenue of $565 million.

Source: Seeking Alpha

Expectations about the future seem beneficial. In 2025, analysts are expecting 19% EPS growth, and in 2026 EPS growth could reach 6%. It means that the company is currently trading at close to 6x forward 2026 earnings. CONSOL does look cheap.

Source: Seeking Alpha

Long-Term Growth

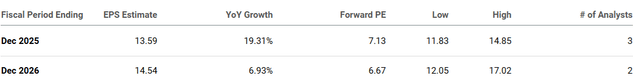

In my view, the most interesting part about CONSOL’s financial statements is the growth in the total amount of cash and the decrease in the net debt.

From 2015 to 2024, cash in hand increased from $6 million to more than $170 million. Net debt also went from about $280 million in 2015 to negative territory. Clearly, the company’s current financial statements show strong business growth, and the company appears in a position to make new investments or acquire other competitors.

Source: Seeking Alpha

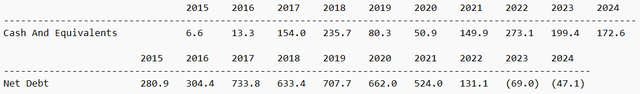

From 2015 to 2024, total liabilities decreased from $1.8 billion to less than $1.2 billion. In sum, the asset/liability ratio increased significantly. In my opinion, further increase in the asset/liability ratio will most likely enhance the fair price valuation, and may push the stock price up.

Source: Seeking Alpha

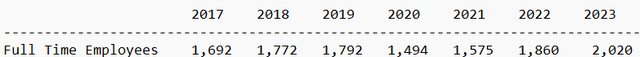

I also think that the recent increase in the headcount clearly indicates that CEIX expects its business to growth. According to my experience, companies hire more individuals when they expect production to increase.

Source: Seeking Alpha

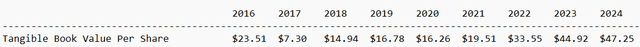

From 2016 to 2024, the tangible book valuation per share more than doubled. In 2023, the book value per share stood at close to $44 per share, which means that CEIX is trading at 2x-3x its tangible book value per share. I do not think that it is an expensive valuation.

Source: Seeking Alpha

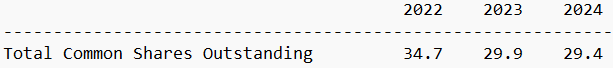

It is also worth noting that the company, from 2022, reduced its share count from close to 34 million to around 29.4 million. Further decrease in the share count may enhance the book value per share. I think that new investors could show up if the share continues its downward trend.

Source: Seeking Alpha

EBITDA Review

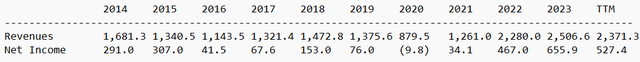

From the company’s income statement, I would highlight recent net sales growth from 2014 to 2024. Overall, CEIX reported net sales growth almost every year. The company’s net income growth also increased from $291 million in 2014 to close to $527 million in 2024. It is worth noting that the company only reported negative net income in 2020.

Source: Seeking Alpha

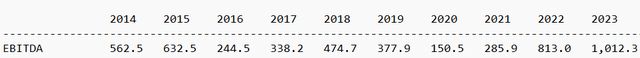

The company’s EBITDA looks even better than the net income. CEIX reported positive EBITDA all the time in the last decade. The EBITDA declined a bit in 2016 and 2020, however the EBITDA figure increased from 2014 to 2024.

Source: Seeking Alpha

FCF Review, And My DCF Model

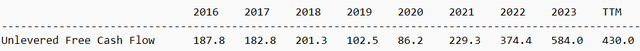

With regard to previous cash flow statements, the free cash flow always remained positive from 2016 to 2024, and I saw certain FCF growth in the last eight years. In my opinion, designing a DCF model would make a lot of sense.

Source: Seeking Alpha

Under my financial model, I assumed that CEIX will successfully report further net sales growth and FCF growth thanks to the quality of its coal from the PAMC. In my view, the current Btu per pound obtained by CEIX, diverse clients in the metallurgy sector, and power generation applications will most likely be drivers of future business growth.

In addition, I assumed that the company’s logistical network may play a role in delivering new operational synergies to enhance the FCF margin growth. The company discussed some of these aspects in the last quarterly report.

Coal from the PAMC is valued because of its high energy content (as measured in Btu per pound), relatively low levels of sulfur and other impurities, and strong thermoplastic properties that enable it to be used in metallurgical, industrial and power generation applications. Source: 10-Q

I think that the current undervaluation could be explained partly via a recent disaster that took place in Baltimore, Maryland. The company noted that vessel access in and out of the CONSOL Marine Terminal, which is located in the Port of Baltimore, was suspended. As a result, I think that we may see some decrease in the company’s financial figures in 2024, but I would expect this issue to be temporary. As soon as the company’s operations are restored, I would expect FCF growth to go north.

On March 26, 2024, a container ship struck a support column of the Francis Scott Key Bridge in Baltimore, Maryland causing it to collapse. The United States Coast Guard has established a safety zone for all navigable waters of the Chesapeake Bay within a 2,000-yard radius around the Francis Scott Key Bridge. As a result, vessel access in and out of the CONSOL Marine Terminal, which is located in the Port of Baltimore, has been suspended. We continue to work and communicate closely with the Coast Guard, transportation authorities and city officials to safely restore vessel access to and resume normal operations at our CONSOL Marine Terminal. While not definitive, the latest information provided to the Company by agency officials suggests the permanent 700-foot wide, 50-foot draft shipping lane may reopen and restore full vessel access by the end of May 2024. Source: 10-Q

I would also expect further net sales from the company’s new presence in the metallurgical coal market. The company’s Itmann Mining Complex that started its operations in 2022 could bring further net sales growth acceleration as the expansion continues in the future.

We are continuing to expand our presence in the metallurgical coal market through our Itmann Mining Complex in West Virginia. The Itmann Preparation Plant was constructed in 2022 and shipped its first train in October 2022. The plant includes a train loadout located on the Guyandotte Class I rail line, which can be served by both Norfolk Southern and CSX. Source: 10-Q

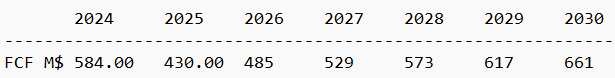

My discounted cash flow model includes moderate free cash flow increase from $584 million in 2024 to $661 million in 2030. With a WACC of 6% and a conservative exit multiple of 5x 2030 FCF, the total valuation obtained would be close to $4.9 billion.

I think that my figures are quite conservative. Note that other analysts out there used a WACC that is close to mine:

- Long-term bond rate: 3.9%-4.4%

- Equity market risk premium: 4.6%-5.6%

- Adjusted beta: 0.3-0.77

- Additional risk adjustments: 0.0%-0.5%

- Cost of equity: 5.3%-9.2%

- Tax rate: 11.2%-16.6%

- Debt/Equity ratio: 0.07-0.07

- Cost of debt: 4.6%-7.6%

- After-tax WACC: 5.2%-9.0%

Finally, the implied equity valuation would stand at $4.9 billion, and the target price would stand at $156 per share.

Source: Seeking Alpha

- NPV: $2,644.01 million

- NPV of TV (6.2%, and 5x 2030x FCF): $2,303.92 million

- Total Value: $4,947.93 million

- Net Debt: -$47.10 million

- Equity: $4,995.03 million

- Shares: 31.90 million

- Target Price: $156.58

I think that CONSOL knows well that their stock is quite undervalued. During the three months ended March 31, 2024 the company repurchased 615,288 shares at an average price of $90.82. The company is currently trading at close to $90-$95. It is not far from the point at which CONSOL buys its own shares.

The Company Is Significantly Undervalued As Compared To Peers

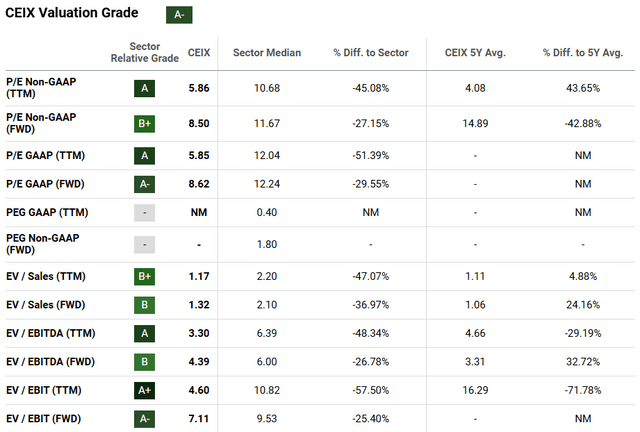

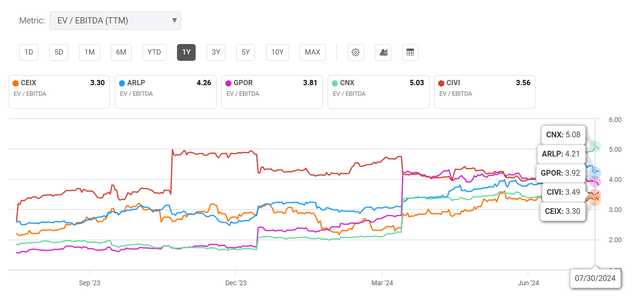

The company’s EV/Forward EBITDA is at 4.3x, and the PE FWD GAAP of 5.8x. The company’s multiples are significantly lower than the multiples reported by peers.

Source: Seeking Alpha

In 2023, the company’s EV/TTM EBITDA was higher than that of some peers. In 2024, competitors saw their EV/TTM EBITDA increase at a faster pace than that of CONSOL. In sum, CONSOL could trade at a higher valuations.

Source: Ycharts

Other Analysts Think That CONSOL Is Cheap

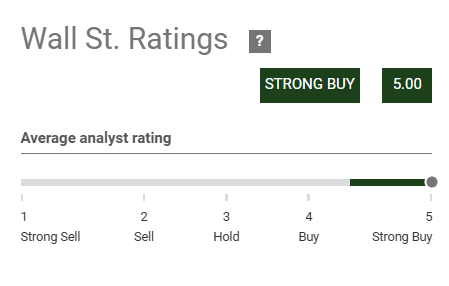

I did revise the opinion of other analysts. Wall Street analysts reported a strong buy note. In addition, the average price target is above the current price mark. SA analysts covering that stock also reported a buy note.

Source: Seeking Alpha

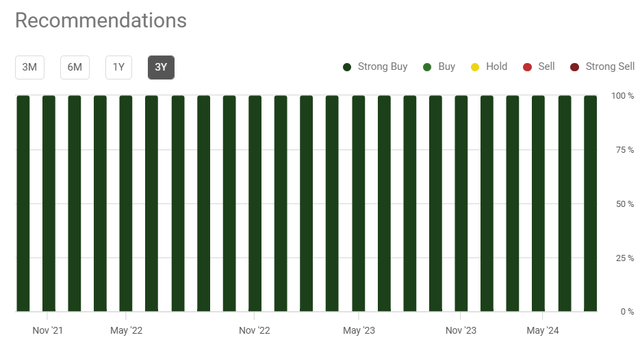

It is also worth noting that most analysts gave a strong buy note in 2024, 2023, and 2022. There is significant optimism about this name.

Source: Seeking Alpha

Risks

In my view, changes in the coal price, a deterioration of the business conditions in the metallurgy industry, or the power generation industry may push the company’s net income growth down. FCF growth expectations may also decline, which may drive the stock price lower.

Our margins reflect the price we receive for our coal over our cost of producing and transporting our coal. Prices and quantities under our multi-year sales contracts are generally based on expectations of future coal prices at the time the contract is entered into, renewed, extended or re-opened. Source: 10-K

I would also expect that changes in the regulations with respect to the coal industry, taxes applicable to the industry, or new environmental laws could lower the net income expectations. Additionally, the power generation industry could lower the use of coal, and may use other existing alternatives, which could become cheaper than coal. Industrial applications could also find alternatives to coal, or governments could limit its use. As a result of all these risks, I think that net income growth could be limited.

In 2020, the company saw a decrease in net income. In my view, the COVID-19 effects on the general economy, international supply chain issues, and issues with respect to logistics could occur again in the future.

Conclusion

Given previous FCF growth, growth in the total amount of cash, and reduction in net debt, CEIX’ business growth appears quite solid. In my view, the expansion of the Itmann Mining Complex in West Virginia and further production of quality coal with high energy content will most likely bring FCF growth. In addition, as soon as the situation in Baltimore, Maryland goes back to normal, I would expect further increase in coal being transported. In any case, my DCF model that was based on previous FCF growth and conservative growth indicated significant undervaluation. In sum, I think that CEIX is a buy.

Read the full article here