Investment thesis

My previous cautious thesis about Deere (NYSE:DE) aged well as the stock price declined by around 10% since last June, substantially lagging behind the broader U.S. market.

I prefer to remain cautious about Deere’s stock because the company’s financial performance significantly depends on interest rates. High interest rates make buying new agricultural machinery much less affordable for farm businesses, which is a big headwind for Deere. There are numerous reasons to believe that the Fed will not be cutting rates aggressively as the U.S. economy demonstrates strength. Net farm income in the U.S. is expected to decline significantly in 2024 compared to 2023, which is also a strong unfavorable factor for DE. Moreover, it is difficult to call Deere’s stock attractively valued given these strong headwinds. All in all, I reiterate a “Hold” for Deere’s stock.

Recent developments

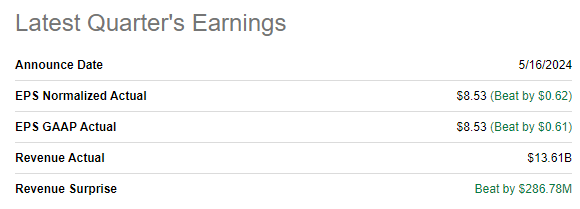

The latest quarterly earnings were released on May 16 when DE surpassed consensus estimates. Both revenue and EPS surprises were relatively wide. Revenue declined by 15.4% due to the softer demand, and the tight monetary environment remains a strong headwind for Deere.

Seeking Alpha

As a result of revenue softness, the operating margin decreased YoY from 23.3% to 20.9%. The decrease in operating margin has led to a notable YoY EPS compression, from $10.10 to $8.53.

Seeking Alpha

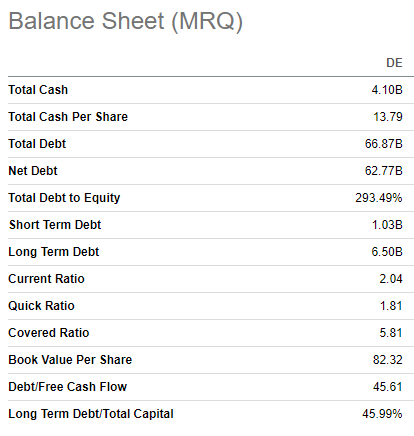

The upcoming earnings release is scheduled for August 15. Wall Street analysts expect fiscal Q3 revenue to be $11.1 billion, which will be 22% lower on a YoY basis. The adjusted EPS is expected to follow the top line and to shrink YoY from $10.20 to $6.04. Wall Street’s sentiment around Deere’s upcoming earnings release is quite pessimistic with 15 EPS downgrades over the last 90 days.

Seeking Alpha

The pessimism looks fair given the fact that interest rates remain very high across the developed world. Deere generates around 80% of its sales in North America and Europe. The Fed is still not cutting interest rates, while Canada and ECB started their cautious cuts just recently. According to the latest earnings call, high interest rates significantly affect purchasing behavior of Deere’s customers. As interest rates remain high it is difficult to expect improvements in financial performance.

The key risk is that interest rates in the U.S. [60% of DE’s sales] might remain higher for longer. The Fed expects only one rate cut in 2024. This approach looks fair given the fact that the U.S. economy demonstrates resilience, the unemployment rate is low, wages are growing faster than inflation, and growth in corporate profits.

Industry trends do not look favorable for DE. According to the U.S. Department of Agriculture, the net farm income is expected to dip by 25% in 2024 compared to 2023. To add context, the expected 2024 net farm income forecast of $116 billion is lower than its 20-year average of $118 billion.

Valuation update

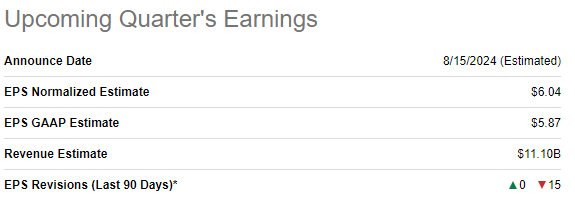

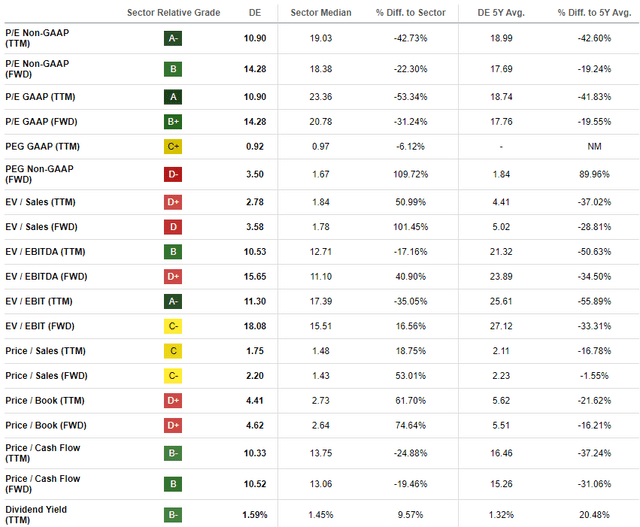

The stock declined by around 11% over the last twelve months, lagging behind the broader U.S. market. DE’s YTD performance is also quite disappointing with a -9% return. Most valuation ratios of DE look attractive, significantly below the last five years’ averages.

Seeking Alpha

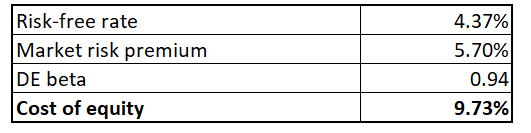

Since DE is a popular dividend play, I use the dividend discount model [DDM] approach to deepen my valuation analysis. Cost of equity is the required rate of return under the DDM approach, which I have to figure out using the CAPM formula below. DE’s cost of equity is 9.73% and all the below variables are easily available on the Internet.

Author’s calculations

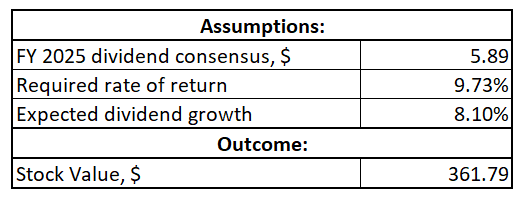

I am figuring out the target price for the next twelve months, meaning that I have to incorporate the FY 2025 dividend forecast. Dividend estimates from consensus project a $5.89 payout in FY 2025. Deere’s dividend growth history is stellar with a 10.46% CAGR over the last decade. On the other hand, Deere’s revenue and EPS growth are not expected to be far above inflation levels, according to consensus. Projecting constant dividend growth in circumstances when earnings are expected to be flat is difficult.

According to the below table, the market currently prices an 8.1% dividend growth rate. This assumption is very aggressive, in my opinion.

Author’s calculations

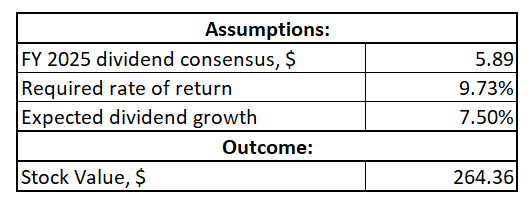

The model is extremely sensitive to changes in the dividend growth rate. For example, incorporating a 7.5% dividend growth rate diminishes the fair value to $264 per share. This is 27% lower than the last close.

Author’s calculations

To sum up, figuring out a fair share price is extremely difficult for DE. However, the fact that the stock’s fair value matches the current share price only with an 8.1% dividend growth rate suggests that DE is still not attractively valued.

Risks to my cautious thesis

Deere has a strong track record of dividend growth, which might be a crucial factor for investors in case of a massive rotation of capital from growth to value stocks. There are various opinions, but it is likely that after most of technological giants’ stocks hit new historical highs multiple times this year the probability of a correction in growth stocks is elevated. In case of a panic in growth, Deere’s stock might be one of key beneficiaries like it was in 2022 when it rallied by 25% while the broader market dipped.

As I mentioned, tight monetary environment is a big headwind for Deere. While I believe it is unlikely that the Fed’s rates cutting cycle will be aggressive, there is always a possibility of a sudden recession. In this case the Fed might start cutting rates faster than expected, which will highly likely be a big positive catalyst for Deere’s stock.

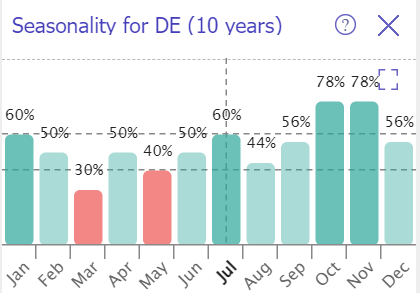

TrendSpider

The stock’s seasonality over the last ten years suggests that July is one of the most successful months for DE. Therefore, there might be a short-term rally, which might make my thesis irrelevant.

Bottom line

To conclude, Deere is still a “Hold”. There is no doubt that Deere dominates the market and is one of the most widely known brands in the agricultural industry. However, current macro environment is extremely unfavorable for Deere and the company’s financial performance is poised to soften further. Moreover, the valuation does not look good as the market currently prices an 8.1% dividend growth rate, which is very aggressive.

Read the full article here