Dear readers/followers,

Exchange Income Corporation (OTCPK:EIFZF) is a Canadian monthly, dividend-paying company that has been outperforming me, but that outperformance stopped towards the end of 2023 when the company saw a significant drop in valuations. I did some adding at the time, and the company has once again outperformed since, but overall the returns since my last article have not been great relative to the returns of the S&P 500.

So, in this article, we’ll take a closer look at what caused this company to perform less than stellar, and why I am still positive for this Canadian business.

I mentioned clearly in my last article that the valuation was starting to look stretched at that time. So when the company rose yet more from that valuation, I actually sold about 30% of my position and invested it into utilities. But my position now, after buying shares in late 2023, is significantly more than it was back when I last wrote about the business.

You can find that company article here.

In this article, I’ll focus on the Canadian ticker EIF, but also the ADR EIFZF, and give targets and estimates for both where they differ. But I do invest in EIF, and I think you should consider investing in the native here.

Exchange Income Corporation – Revisiting the company after 14 months

It’s actually been a long time since I wrote about the company. That has no specific reason – I’ve simply been focusing on other companies, and to be honest, the interest from readers for this business has always been quite low. I’m happy to “hold” this company at a low entry point and continue to earn what for me are over 8% YoC dividends paid monthly, with my total RoR still impressively over 50% in total.

These “paycheck” investments make up a non-trivial amount in my portfolio. Between EIF, Realty Income (O), Agree Realty (ADC), and some other monthly payors, I’m getting substantial monthly cash inflows, even not considering that all of my savings accounts also pay their annual interest on a monthly basis. Together, these monthly incomes make up over 100% of my monthly recurring expenses. While just a “math exercise”, it’s still a good feeling to have.

The business known as Exchange Income Corporation is an investment not because it’s a monthly dividend payor, but because it is an excellent business. The main challenge to this business is that comparing it to any other sort of business is a hard exercise – EIF simply lacks most comps. It’s a mixed manufacturing, mixed transport, mixed infrastructure, and mixed servicing company.

This makes it crucial to ensure that the company has profitability – and this is what Exchange Income Corp has in spades.

We don’t yet have 2Q24 – it’s around a week until then – so this will act both as a look back, but also an earnings preview, and a look at how EIF has actually been doing.

Part of the reason for the significant decline in valuation is obvious to me, given the timing of the decline. As the risk-free rate has increased, the appeal of a 5.5% dividend is no longer even close to as much as it once was. The decline has, if we look at earnings, actually nothing to do with the company’s earnings growth rate. That has remained relatively okay, even if it hasn’t been stellar. For 2023, the company reported a slight decline, but this was after a 71% growth in 2021, and another 35% in 2022. Furthermore, current analyst expectations for the company actually call for EIF to climb at least 5% this year, and double-digits for the years after. Another reason for the decline is equally obvious – the company announced and had an equity offering during 2Q23.

So, worries about EIF? Not really.

Why no worries?

Because 1Q24 pretty much confirms the continued positive trajectory for the company and also confirms the current undervaluation of the company. The revenue for 1Q24 continued to be at record levels, with the top line increasing 14%. EBITDA also wasn’t down, it was up 14% year-over-year, again at a record level for a first-quarter period. Same thing with FCF, up to $62M, once again breaking records for 1Q. The area where the company saw some challenges was in net adjusted earnings, down $2M – but at the same increase in FCF less maintenance capex, which is one of the metrics I look at (if you check out my previous articles on the company) the most, with a TTM ratio of sub-60%, meaning the dividend is more than safe here.

The company also, on the fundamental side, increased its credit facility to $2.2B, which included the addition of a new loan.

Segment-wise, aerospace, and aviation were up 13% and saw the best increase in company EBITDA. The core segment and operations for the company are, as such, what is continuing to drive the upside here. Company investments into things like new routes, load factors, better Medevac contracts, and more volume are what’s driving these increases.

Meanwhile, manufacturing continues to be a bit of an up-and-down story, with current trends continuing to show upside. Revenue increased by $32M for the segment, but EBITDA decreased – rev up due to M&A, but EBITDA down to a business line that saw adjustments in price, demand, and weather, coupled with some seasonal things.

The company’s view is that the business lines and the way that they work is that they provide complementary ups and downsides, when one is down, the other is up. There’s some truth to that, though the addition of manufacturing to the company’s business mix has not been without its challenges (as you can see in my previous articles).

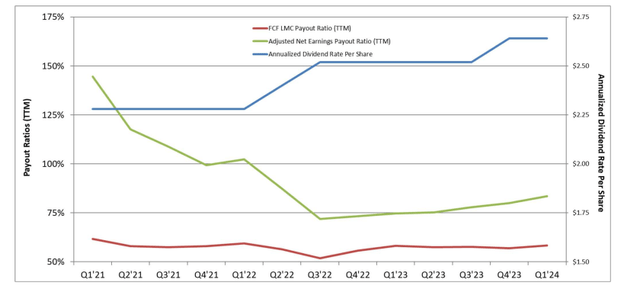

The two things I continue to look at for EIF is ensuring that business growth and earnings is either positive or stable, the second part is dividends and the safety ratio for the payout. Despite the numerous increases in SO due to M&A’s and equity offerings, the company’s safety ratio, meaning the FCF less maintenance CapEx payout, remains at 58%, which is the same TTM ratio it was in the YoY period. So EIF has not become materially less safe or more problematic since that last article. You can see this, among other places, in this graph.

EIF IR (EIF IR)

And while it’s true the company with a 5.5% current yield is nowhere near as attractive as it was when rates were below 1.5-2%, it’s equally true that there, at the right valuation, is a double-digit upside to the company.

And that is what I argue there still is here at this time.

Exchange Income Corporation – Company upside remains solid and over 15% per year here

As you may know, I primarily look for 15%+ annualized rates of upside in investments – and when I can find it, that’s what I invest in. When it comes to a company such as this, what I want to make sure of, is that I’m getting it at a price (first of all), and secondly that the company is likely to continue to grow.

Between the company’s new investments and continued execution of its business strategy, I see no reason for why EIF should not go up here. I forecast a continued growth rate of at least 8-9% annualized for the next 5 years in terms of earnings, as well as FFO. When it comes to this company, typically use FFO as a good valuation proxy – because the company has tended to trail that 6.8-7.5x P/AFFO for a fairly long time (Source: Paywalled F.A.S.T Graphs link).

The company is currently trading towards this metric at around 5.97x weighted average P/FFO – and sub-6x, that’s when I’ve found the company very worth adding. There’s some consideration here given that at 5.57% there are actually many other companies that don’t just offer as good yield, but even better yield.

But the safety, consistency, and what the company does is part of the reasoning that I have here, and for that reason, I consider the upside to be attractive.

ADR first of all. EIFZF is a listing, which means 1 share of EIFZF matches I share of EIF. My conservative PT for EIF translates, at this time, to $41/share for EIFZF, which gives a considerable upside – but it’s important to note that this is the highest possible PT that’s valid here. The upside for both tickers is the same. Using the FFO and giving the company a conservative 6.5x P/FFO, the implied upside for the company here is no less than 22.7% per year or 63% in 3 years. And that’s with dividends, and only at the 6.5x P/FFO level. I would allow for the company to trade as high as the 7.3x 7-year average, which would ratchet this upside to almost 30% annualized, or 84% in years, and an implied FV of around $80/share (in CAD, $58 for EIFZF).

As of this article, the company’s performance means that I raise my PT for EIF/EIFZF to a native $65 CAD, or around $46 for EIFZF, and consider the company a solid “Buy” here. I would not consider the company cheap – that would be if it were to drop below $32/share.

I consider the company to be an attractive play here, and I’m interested in adding it.

Risks are as follows for the company.

Exchange Income Corporation – The risks

Risks are primarily related to the interplay between the company’s various business segments, which might be complementary at times, but at other times do not work all that well together. One might drag the other one down. I don’t see the company ever going long-term negative due to this, but there could be extended periods of time (a recession), where the company sees its payout ratio rise to levels we haven’t seen for some years, which would likely put some pressure on the company’s share price.

Another risk worth mentioning is that the company remains at a comparatively elevated level of debt compared to most businesses. Unlike peers in REITs, EIF has continued to M&A and invest, and its long-term debt/cap lies at around 60%. This combined with equity issuances, combined with interest rate changes, combined with macro is what is pressuring the company here.

Those are the risks, and I say that the thesis is as follows.

Thesis

- This is a small operator with a big upside. Fundamentals are solid, and I like their operations and their niche. At an attractive price, and for the right investor, this is a definite “Buy” at a $65 PT for EIF, and around $45 for EIFZF.

- Risks do exist, but they’re on a more subjective and “what-if” level, with very few actual logical risks to the company’s balance sheet or operations.

- My stance is a “Buy”, and I believe the company is clearly under its fair-value price target as of August 2024.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

EIF is still not in a position to be called “cheap” but it’s still a very solid “Buy” at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here