Editor’s note: Seeking Alpha is proud to welcome Menlo Research as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Investment Thesis

I am recommending a Hold rating for Fast Retailing Co. (OTCPK:FRCOY), which is the parent company of Uniqlo. There are a lot of tailwinds for Uniqlo in this current economy, as the company is poised to benefit from its ability to offer high quality/low price products, as well as its efficiencies from technology and scale. The company has also performed very well in the recent quarter, with robust revenue growth alongside meaningful margin expansion. Despite these positives, I find that the stock’s valuation is fair based on my own DCF analysis. Consequently, I recommend investors to HOLD and wait until the valuation improves from current levels.

Company Overview

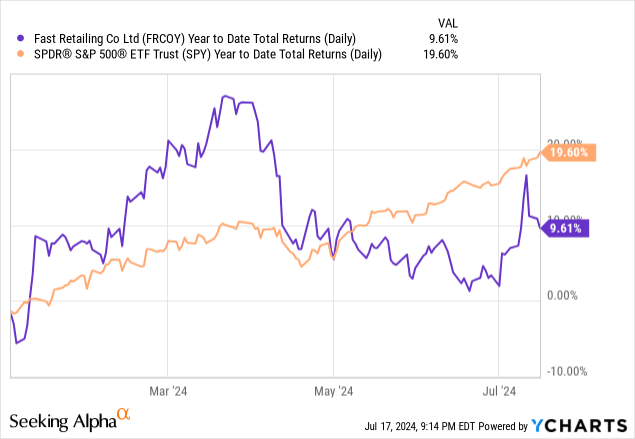

Fast Retailing’s Uniqlo is a Japanese clothing brand launched by Tadashi Yanai on June 2nd, 1984 with the mission of making high-quality clothing more sustainable. Uniqlo works in a space with other large fast fashion retailers such as Zara, Gap, H&M (OTCPK:HNNMY), Abercrombie & Fitch (ANF), and many more. Fast Retailing sells a wide range of clothing, including shirts, shorts, pants, jeans, outerwear, etc. Uniqlo is now an international clothing brand, with products sold in many countries around the world. Fast Retailing has underperformed the S&P 500 index as it has only returned ~9.6% YTD, while the overall market has returned 19.6% in that time frame.

Business Drivers

The main competitive advantage of Fast Retailing is its price point. Fast Retailing has affordable pricing when it comes to the clothing they sell. The lower price point does not indicate low-quality clothing; rather, it is quite the opposite – their shirts and jeans are both 100% cotton, and some jeans are even high quality Japanese selvedge. As discussed in this article, Fast Retailing’s focus on timeless classics that are affordable and have high quality helps the company differentiate from some of its competitor in the industry. In other words, Fast Retailing provides high quality for a low price through its capacity for mass production and product lineup that focuses on the basics and minimalist designs.

Fast Retailing also does a great job in improving the customer experience through technology and innovation. For example, Fast Retailing has a technologically advanced product checkout, implementing RFID chips into their system. These chips speed up the overall process to check out various items. Along with the new RFID system, Fast Retailing is also working toward trying to make shopping at their stores feel like a familiar experience, similar to Costco (COST) or Ikea. Management added a coffee shop to their flagship Tokyo location and in Europe, certain stores sell clothes that are made from natural materials to adapt to the preferences of European customers who favor more natural and environmentally friendly products.

Quarterly Update (i.e. Q3, 2024 Update)

Q3 2024 Presentation

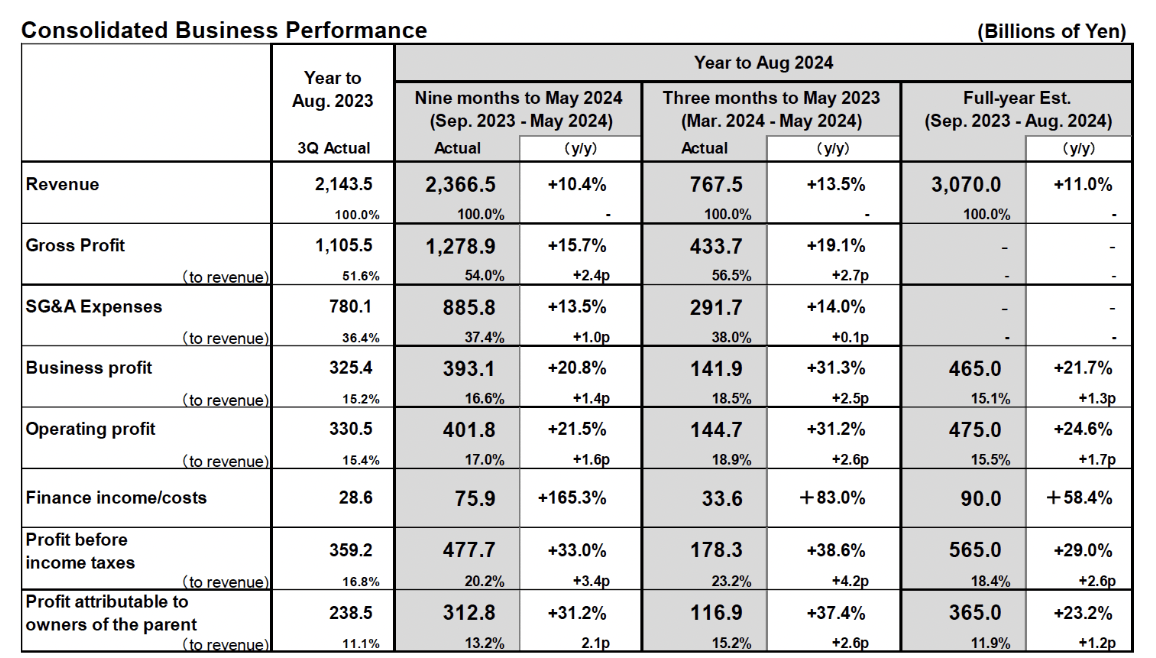

Fast Retailing recently announced its FY2024 Q3 Results, and its financial performance was admirable as the company was able to improve its financial performance on a year-over-year basis. Comparing “March – May 2024” to “May – March 2023”, Fast Retailing has grown their revenue at a respectable 13.5% YoY rate, but most notably, the company was able to improve its profitability even more as gross profit soared at nearly a 19.1% YoY rate. I find that these results are an indicator of Fast Retailing’s ability to grow its bottom line at a successful rate despite some of the uncertain Japanese economic conditions. In addition, this performance is much better than the average growth rate expected in the U.S. fast fashion market (~5.5%). Given the company’s position in the high-quality/lower-price segment, my view is that the company will be protected against an economic downturn and will benefit from pricing power/margins in an inflationary environment.

Business Segments

Fast Retailing’s international and Japan segments are interesting trends to note. In particular, the International Division has seen a 28.5% YoY growth in its revenue, all while only adding ~3% more stores (+49) in that same time frame. Now, sales in its International segment makes up more than half of the company’s net sales, and this portion will likely continue to increase as the number of stores increase and sales continue to expand at a higher pace.

Valuation

DCF Valuation Model

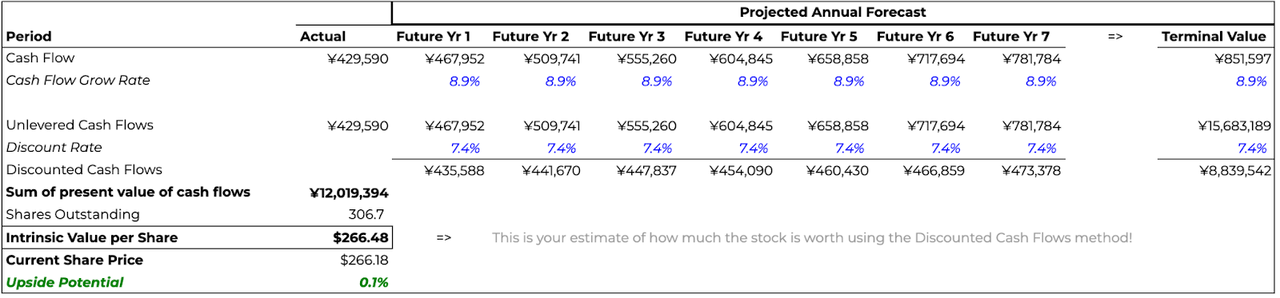

I conducted a DCF valuation in Japanese Yen to derive the value of the stock and then determine the value of the stock back in USD. I conservatively based my assumptions of cash flow growth rate to the 5 year CAGR of cash flow growth (8.9%) in the past five years. This growth rate seems reasonable given the attractiveness of its high quality, low price offerings, improvements in technology, and the continuous expansions in margins as discussed above. A terminal growth rate of 2% was chosen based on a conservative assumption that the stock will continue to grow in line with the expected long-term inflation goal of 2%. The upside potential is limited compared to its current share price.

Risks

Currency Risk

As a Japanese stock, Fast Retailing share price is subject to currency risks as exchange rates change with the USD and the Japanese Yen, which can impact Uniqlo’s financial gains and losses. Most recently, the Yen strengthened unexpectedly due to the BOJ decision to hike rates, though now BOJ seems to be walking back that statement. Currency risk can go either way: if the Japanese Yen weakens then, Fast Retailing can make more profit in Yen from its exports and be more competitive abroad, and if the Japanese Yen strengthens, its Yen profits will decline. Over the past 3 years, the Japanese Yen has been declining in value against the dollar, and such trends remain likely for the foreseeable future and do not pose immediate risk to the business.

Logistics Risk

Another risk that Fast Retailing faces is logistics risk that stems from fluctuations in prices of crucial inputs due changes in production; for example the production of cotton has been on the decline due to climate change and drought and this has been pushing the prices of such important inputs higher. Since cotton is such an important part of Fast Retailing’s clothing lineup, higher cotton prices will impact profitability or force Fast Retailing to raise prices. I believe that this risk can largely be mitigated by the fact that Fast Retailing is one of the biggest fast fashion retailers, and its scale will limit the impact of higher input costs compared to some of the smaller companies.

Recommendation / Conclusion

Despite the tailwinds, I recommend a “Hold” to Fast Retailing Co. as the valuation remains fair and better risk/reward propositions can be found elsewhere. I believe Fast Retailing is worth watching as the business is growing every year, and Uniqlo is quite well protected from potential risks concerning logistics and currency. Appropriately, I will continue to follow any new updates regarding Fast Retailing, and will provide readers ratings changes based on them.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here