Investment summary

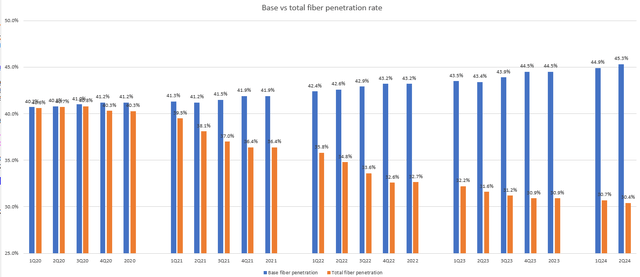

My previous investment thought for Frontier Communications Parent Inc. (NASDAQ:FYBR) (published on 25th June) was a buy rating because there was a visible growth outlook and a strong secular tailwind. I reiterated my buy rating as FYBR continued to show strong execution. Notably, the base fiber penetration rate has passed the 45% level, which means the growth runway is longer than expected.

2Q24 results update

Released early this month (August), FYBR reported revenue of $1.48 billion, beating the street estimate of $1.459 billion. Adj EBITDA saw $560 million, which was moderately above estimates of $557 million. By segment, Consumer saw revenue of $789 million, representing 1.8% y/y growth, while Business and wholesale saw revenue of $677 million, representing 3.7% y/y growth. For FY24 guidance, management raised the low end of their adj. EBITDA guide, driving the midpoint of the guided range from $2.23 billion to $2.24 billion. Specifically for 3Q24, management now expects fiber net adds to be up significantly year-over-year and is aiming to beat 2Q24’s record net adds.

Solid fiber growth momentum that should continue

FYBR’s 2Q24 performance was absolutely amazing. While 2Q24 adj EBITDA y/y growth tracked ~100bps below my FY24 growth estimate of 6% (1H24 avg adj EBITDA growth is 5.3%), I have gotten more bullish on the business because of the strong underlying execution. In the quarter, FYBR added 92,000 fiber broadband net adds, which was an acceleration from 1Q24 of 88,000 net adds. Notably, the 92,000 record was an all-time high for the business. I point this out specifically because the previous 88,000 net add figure has been a “threshold” that FYBR failed to breakthrough in 1Q23, and the concern was that FYBR is either: (1) not able to convert new fiber passings into customers quick enough and/or (2) the base fiber passing penetration rate has tapped out. Hence, this 92,000 net add level was a very important turning point, and other operating metrics back my view.

Redfox Capital Ideas

The business has managed to breakthrough the ~45% base fiber sub penetration rate, and this has huge implications for FYBR’s long-term growth outlook because it means that total fiber penetration can go even higher than the ~45% rate expected previously (the base expansion rate was at ~45% for the past 2 quarters, and the worry was that this is the peak). In other words, investors should not be worried that the total fiber penetration rate has gone down in 2Q24; rather, they should be glad because this means the growth runway is going to be much longer.

Redfox Capital Ideas

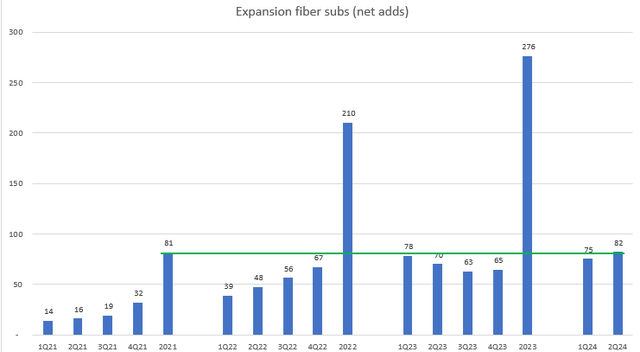

The next concern that an investor may have is whether FYBR is executing well in its expansion fiber passings, and I think FYBR results over the past 3 years speak for themselves. The execution was not only great, but it was also excellent. In 2Q24, FYBR accelerated the number of expansion fiber net adds from 75,000 in 1Q24 to 82,000, and this marked the business’s all-time high. To give investors a better sense of how well FYBR has executed on this front, 2Q24’s 82,000 net add was more than the entire year’s net add in FY21. As the spread between expansion fiber adds and base fiber adds sustains at this level, it is only a matter of time before the total fiber penetration rate goes up, and importantly, this will drive periods of fiber revenue growth acceleration (because of mix impact).

Redfox Capital Ideas

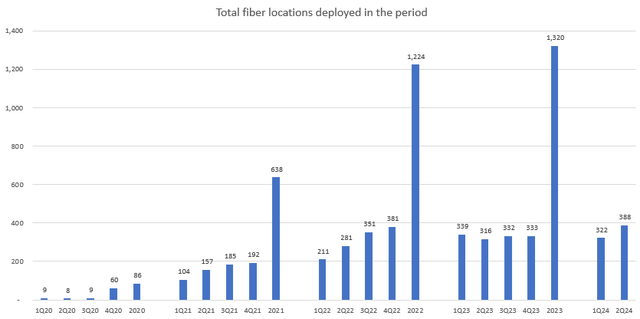

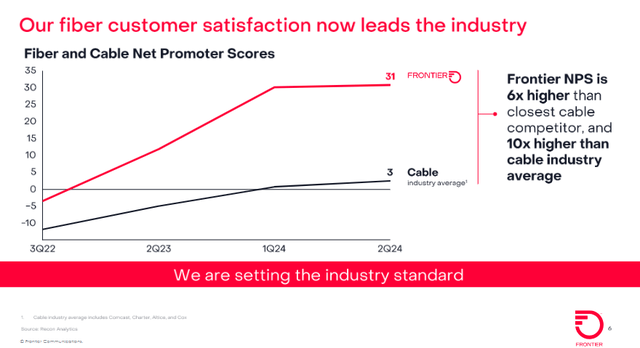

Cycling back to the top, FYBR has also accelerated its pace of fiber passings by adding 388,000 locations this quarter, and this marks an all-time high record as well. Using the same seasonality as the past years, this implies that FYBR is well on track to meet its annual target of 1.3 million passings. Given the execution track record so far (as noted above), I expect these additions to translate to fiber subs overtime. One additional datapoint shared during the presentation that deserves highlighting is FYBR’s NPS score, which is 6x higher than its closest competitors and 10x higher than the industry average. This is an important indication of FYBR product and service quality, which I see as a strong competitive advantage given that the underlying products are largely commoditized (i.e., every player offers a similar product, so service quality matters a lot).

FYBR

As for average revenue per unit (ARPU) (aka pricing), 2Q24 fiber ARPU continues to grow as expected at 3.5% (in line with the 3 to 4% ARPU growth range). In my opinion, management comments regarding flattish ARPU growth (sequentially) shouldn’t be a major cause of alarm for investors because it should be due to the sunset of ACP. Management did reiterate their view confidently that pricing will go back to the 3–4% range, which I am giving a benefit of doubt to so far given their track record.

We do expect Q3 to be roughly flat sequentially as we work through the ACP transition plans, and particularly the 200-meg plan, but then we expect more of an ARPU pickup in Q4 to end the year right in line in the 3% to 4% range that we’ve given as our long-term target. 2Q24 earnings transcript

Valuation

Redfox Capital Ideas

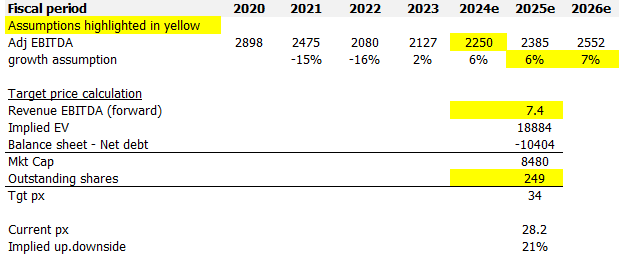

I model FYBR using a forward EBTIDA approach, and using my assumptions, I believe FYBR is worth $34. 2Q24 performance has reinforced my view that adj EBTIDA can grow at 6%–7% easily for the foreseeable future as FYBR continues to ramp up fiber passings and convert them to customers. In this model update, I included FY26 estimates as we are approaching the end of this year. I assumed 100 bps acceleration in FY26 as expansion fiber net adds grow faster than base fiber subs.

Importantly, I think the market is gradually recognizing FYBR’s adj. EBITDA growth quality and visibility as multiples have rerated upwards to 7.4x. This is still within the range I expected previously, and with the 2Q24 performance, I expect the stock to continue trading at this level.

Risk

FYBR’s balance sheet is still very levered, with net debt increasing from $9.7 billion to $10.05 billion. I do not see a risk to this as the business is growing its adj EBITDA nicely, but this is still a risk to be monitored. New fiber passings may not translate to customers as I expected, and if this is the case, the growth runway will be a lot shorter than I think.

Conclusion

My view for FYBR is a buy rating as it continues to impress with its robust execution. The main takeaway was that the growth runway was longer than I had previously expected, as base fiber penetration rate went past 45%. Notably, FYBR has demonstrated its ability to convert fiber passings into customers, wherein expansion fiber net adds are now at all-time-high (quarterly basis). I also think that the market’s upward multiple revaluation reflects growing recognition of FYBR’s quality and visibility.

Read the full article here