Visa Inc. (NYSE:V), a dominant player in the global financial technology ecosystem, continues to shape the future of digital payments. Despite the ever-changing market dynamics, Visa displays an impressive resilience and growth trajectory. This article provides an in-depth analysis of Visa’s consistent performance, its innovative strategies, and the potential risks it faces. We delve into the company’s robust payment volume, diversification into new flows and value-added services, and strategic moves in an increasingly competitive environment. Overall, we have a favorable view of the stock’s competitive advantages, growth prospects, and valuation and rate it a Buy.

Business Analysis

Visa Inc. is one of the leading financial technology companies globally that enables digital payments among consumers, merchants, financial institutions, and strategic partners. The company has demonstrated consistent growth and stability, exhibiting a positive trajectory despite the evolving market dynamics.

The company’s payment volume, a product of transaction times and ticket size, has shown remarkable stability over time. The growth in transactions has been stable, hovering around 7-8%, which indicates a steady long-term trend. While the ticket size has been influenced by inflation, it is still 15% higher than pre-COVID levels, suggesting a growth trend.

The company’s cross-border business is also on a recovery path. The Asian market, in particular, is showing promising signs of recovery. However, recovery in China has been slower than anticipated due to factors such as visa issues and air capacity restoration.

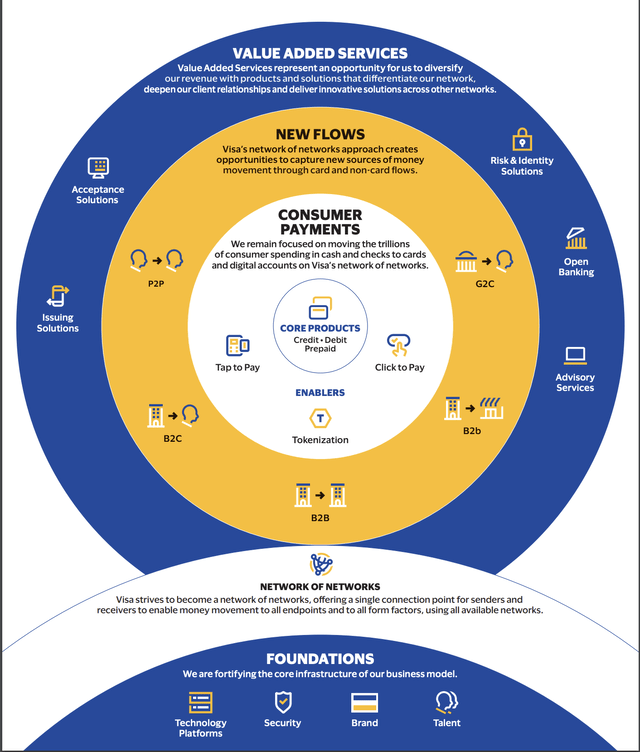

Visa has been successful in diversifying its growth engines from traditional consumer payments to include new flows and value-added services, which represent significant growth opportunities for the company.

Visa Direct, a platform that serves many different use cases, is a promising growth driver for Visa. With its global reach, reliability, security, fraud protection, and dispute resolution capabilities, Visa Direct offers a comprehensive solution for money transfers. It leverages existing payment rails, including ACH rails, RTP networks, and other proprietary networks, to facilitate money transfers anywhere. This platform can cater to various markets, including cross-border remittances, marketplace payouts, P2P payments, disbursements, and payroll. The broad applicability and flexible capabilities of Visa Direct position it as a significant player in these markets.

Visa

New flows and value-added services are other significant growth opportunities for Visa. By digitizing cash, checks, or wire transfers across different use cases, Visa is tapping into large total available markets. The company aims to layer on additional services to transactions in the value-added services business, thereby increasing their yield. This strategy includes expanding the number of services, making them available globally, and layering them onto as many transactions as possible. Such a diversified approach to growth catalyzes Visa’s potential to tap into new markets and revenue streams.

Visa’s strategy also includes enhancing its network. The company has expanded its network endpoints to include billions of debit cards, dozens of ACH and RTP systems, and digital wallets. This expansion is crucial in increasing the value of Visa’s network, as it allows for more nodes and interactions.

Analysis of Risks

Visa operates in a competitive environment, and the incentives provided to clients as a percentage of gross revenue have shown an upward trend. Large accounts, in particular, are competitive as they strive to secure the best pricing. However, Visa continues to assert its value proposition to maintain its merchant preference, even when they have a choice of routing. The company’s competitive edge lies in its unique offerings, including reliability, dispute resolution capabilities, and fraud protection.

Disruptions in payments, including account-to-account (A2A) transfers, regulation, and domestic schemes, pose considerable risks.

A2A or real-time payments could potentially accelerate pay-by-bank adoption. However, the existence of an A2A alternative doesn’t automatically translate to volume movement. The value proposition of the Visa network still holds considerable sway.

Regulation poses another significant risk, particularly as governments and regulators take an active interest in the financial services sector. Regulatory challenges, such as provisions within the Dodd-Frank Act, have already seen Visa’s interchange fee rate halved from 1.5% to 0.76% between 2011 and 2021. Further legislation could impose additional restrictions on credit card transactions, which currently comprise a third of Visa’s operations and are exempt from the Durbin Amendment.

Furthermore, the company’s M&A activities are under increasing scrutiny by regulators and consumer protection agencies, as seen in the failed attempt to acquire Plaid. Technological hurdles also pose a risk, with emerging technologies such as peer-to-peer transactions and open banking potentially undermining Visa’s role as a middleman in the payments industry. The development of Central Bank Digital Currencies(CBDCs) and the launch of new payment systems like FedNow further highlight the transformative changes currently taking place in the payments industry.

Financial & Valuation

Note: All historical data in this section comes from the company’s 10-K filings, and all consensus numbers come from FactSet.

Our analysis of V’s latest earnings reveals several noteworthy points. The company’s FY Q2 earnings showed a modest y/y revenue growth of 11.1%, meeting consensus estimates. The gross margin sat impressively at 97.8%, maintaining its substantial profitability, while the operating margin slightly contracted to 67.5% from 67.6% a year ago. The reported EPS for the quarter was $2.09, a robust 17% y/y increase that beat consensus by 5%, demonstrating the company’s ability to deliver earnings growth.

V’s financial trends indicate a healthy growth trajectory. The company’s revenue has grown by a CAGR of 8.5% over the past three years is commendable. The sell-side consensus is forecasting revenues to keep up this pace, growing by 11.1% this fiscal year to reach $32.6 billion and maintaining the same growth rate to reach $36.2 billion the following year. This consistency in revenue growth is a good sign.

The company’s EBIT margin has increased by 1.5% points over the past three fiscal years, indicating improved operational efficiency. However, the slight contraction forecasted this fiscal year is a concern, although the expected expansion in the following fiscal year does somewhat offset this.

The management’s strategy of using share repurchases to offset shareholder dilution is commendable. The decrease in diluted outstanding common shares by 4.3% over the past three years reflects this strategy. The EPS growth at a CAGR of 11.3% over the past three fiscal years, outpacing revenue growth, strongly indicates the company’s ability to grow earnings.

The forecast of free cash flow reaching $17,415 million this fiscal year, reflecting a 53.5% FCF margin, is highly encouraging. This marked an increase from four fiscal years ago when it was $12,194 million with a 53.1% FCF margin. It’s also worth noting that over the past four years, the company generated an average of $13,644 million in free cash flow, maintaining an average FCF margin of 54.4%. This strong and steady free cash flow generation is a testament to V’s financial health.

V’s capital expenditure as a percentage of revenue averaging at 3.0% suggests a business of moderate capital intensity. The strong return on invested capital at 25.6% is indicative of the company’s efficient use of capital.

V’s leverage with net debt of $1.8 billion is minimal compared to its expected current-year EBITDA of $22.9 billion. This low leverage level should provide some comfort to investors. The stock’s current dividend yield is 0.7%, which is significantly below the S&P 500’s yield. This indicates that V might not be the best choice for income-focused investors.

V’s performance over the past year has been slightly underwhelming, with a return of 2% points below the S&P 500. However, the stock is trading 11.6% above its 200-day moving average, suggesting an overall upward trend. The relatively low short interest of 1.8% indicates that there’s not much negative sentiment around the stock.

In terms of valuation, V is currently trading at a significant premium relative to the S&P 500. Specifically, V’s EV/Sales multiple is 13.8, which represents a 477.1% premium over the S&P 500. Its EV/EBIT multiple stands at 20.2, marking an 18.6% premium. The P/E multiple for V is 24.8, a substantial 35.4% premium over the S&P 500. Additionally, with a FCF multiple of 24.2, V holds a 13.8% premium. These higher valuation multiples could suggest that V is currently overvalued compared to the broader market. Nonetheless, it’s important to note that V’s PEG ratio of 1.5 is on par with the S&P 500’s PEG ratio, which implies that the company’s growth is priced in line with the market’s growth expectations.

In the context of historical valuations, V’s current forward 12-month P/E is 25.5, which is below its 5-year mean of 28.1 and within its 2-standard deviation range of 19.8 to 36.4, suggesting a medium valuation relative to its 5-year range. When compared to its peer Mastercard’s (MA) forward 12-month P/E of 29.9, V appears to be relatively cheaper.

Conclusion

The financial health, innovative strategies, and strong growth trajectory of Visa Inc. position it well in the dynamic global financial technology landscape. Despite the potential risks and uncertainties, Visa’s diversified business model and commitment to staying ahead of the curve are noteworthy. The company’s expansion into new flows and value-added services, coupled with the enhancement of its network, underscores its ability to seize growth opportunities and adapt to changing market conditions.

However, it is crucial to note that the company operates in a fiercely competitive environment and faces potential disruptions in payments. The company’s success will largely depend on how effectively it navigates these challenges and maintains its competitive edge.

Visa appears to be an appealing long-term investment option for shareholders due to its solid financial position, strong growth engines, innovative strategies, and attractive valuation.

Read the full article here