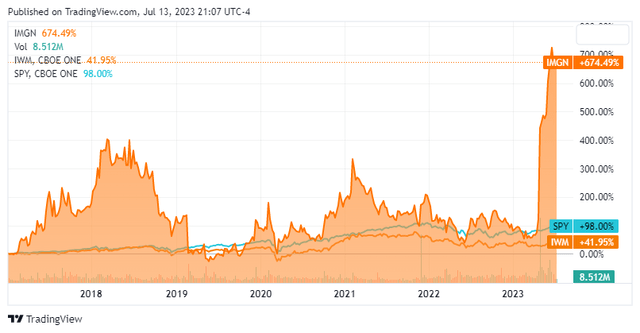

ImmunoGen (NASDAQ:IMGN) is a large biopharmaceutical company (market cap of $4.8 billion) that uses antibody-drug conjugate (‘ADC’) technology to develop novel therapeutics against cancer. Previous coverage was an ultra-long look at the stock and rated it Buy for a possible double or triple, before Wall Street came to its senses, on the strength of KADCYLA’s blockbuster potential and strong pipeline progress, including that of mirvetuximab soravtansine-gynx (the future ELAHERE), which the market wrongly shrugged off. Indeed, shares rode KADCYLA’s hot hand for the next two years until the company sold the residual rights to its first ADC in 2019. ImmunoGen then survived the COVID-19 pandemic on license and milestone fees and royalties until rebounding in 2021 with topline results for SORAYA, ELAHERE’s pivotal trial. As with many biotech stories, investor patience is rarely seen, but Longs who stuck around were rewarded as IMGN has vastly outperformed its biggest holder, the iShares Russell 2000 ETF (IWM), as well as the broad market, many times over (Figure 1).

Figure 1. ImmunoGen Price Chart

Seeking Alpha

In November 2022, the US Food and Drug Administration (FDA) granted accelerated approval for ELAHERE for the treatment of adult patients with folate receptor alpha (FRα)-positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer who have received one to three prior systemic treatment regimens based on objective response rate (‘ORR’) and duration of response (‘DOR’) data from the pivotal SORAYA trial. Shares more than doubled (+135%) on May 3 on positive top-line data from ELAHERE’s Phase 3 confirmatory MIRASOL trial (aka GOG 3045/ENGOT OV-55). Investors should now expect the conversion to full approval from the FDA, and the eventual positive decision to a Marketing Authorization Application (‘MAA’) in Europe.

ELAHERE Clinical Experience

ELAHERE is a first-in-class ADC comprising a folate receptor alpha-binding antibody, cleavable linker, and the maytansinoid payload DM4, a potent tubulin inhibitor designed to kill the targeted cancer cells. The 453-patient MIRASOL was a randomized Phase 3 trial of ELAHERE versus investigator’s choice (‘IC’) of single-agent chemotherapy (weekly paclitaxel, pegylated liposomal doxorubicin, or topotecan) in FRα-high platinum-resistant ovarian cancer (‘PROC’). In the primary endpoint of progression-free survival (‘PFS’) by investigator assessment, the median PFS in the ELAHERE arm was 5.62 months, compared to 3.98 months in the IC chemotherapy arm. This represents a statistically significant and clinically meaningful 35% reduction in the risk of tumor progression or death (hazard ratio of 0.65, p<0.0001). In the key secondary endpoint of overall survival (‘OS’) that is most understood by the market, the median OS was 16.46 months in the ELAHERE arm, compared to 12.75 months in the IC chemotherapy arm. This represents a 33% reduction in the risk of death in the ELAHERE arm (HR of 0.67, p=0.0046). Finally, in the key secondary endpoint of ORR, ELAHERE recorded 12 complete responses (‘CRs’) and a 42.3% ORR, compared to 15.9% with no CRs in the IC chemotherapy arm. The safety profile of ELAHERE was reinforced compared to chemo, demonstrating lower rates of Grade 3 or greater treatment-emergent adverse events (TEAEs) (42% vs 54%); serious AEs (24% vs 33%); and TEAEs leading to discontinuation from the study (9% vs 16%).

While obviously great as monotherapy, it could even be better in a combo regimen. The Phase 1b/2 FORWARD II trial (aka KEYNOTE PN409, Study 402) also established ELAHERE as the combination agent of choice in ovarian cancer. The ELAHERE + bevacizumab doublet in 94 patients demonstrated 43.6% ORR with 5 CRs. PFS was an impressive 8.2 months and median DOR was 9.7 months.

ELAHERE Formulary Review and Place in Therapy

Nine months have passed since ELAHERE launched. President & Chief Executive Officer Mark Enyedy claimed that ELAHERE ended the first quarter with 55% of Medicare and 70% of commercial lives covered. Thus, coverage was explored from official websites at the 15 largest health insurance companies in the U.S. overall. Combined, they control 59% market share, with 38 million covered lives as of 2021. The most common plan was examined when possible and are specified in Table 1. If the insurer offered non-Medicare plans in a state Marketplace (Obamacare), the most populous state was chosen (California > Texas > Florida). Humana (HUM) doesn’t even do those, so their Medicaid plan and that of Blue Cross and Blue Shield of Texas are the only ones in the survey.

How to read Table 1:

Tier # Higher Tiers have higher cost share. Drugs in Tier 4 or higher (in 5+-Tier plans) are non-preferred brands and may also include drugs recently approved by the FDA or specialty drugs and may need special handling.

Sp Specialty drugs are used to treat difficult, long-term conditions and may need to get filled through a specialty pharmacy.

PA Prior authorization is the process of obtaining approval of benefits before certain prescriptions may be filled.

NF A non-formulary drug is not included on a plan’s Drug List. Exception processes such as PA or Step Therapy (“ST”) could be available to request coverage for a NF drug.

X Not Covered drugs are specifically excluded from coverage by the terms of the plan. Patients likely won’t get any reimbursement will have to pay out-of-pocket for these drugs.

Table 1. 2023 Coverage of ELAHERE at 15 Largest Health Insurance Companies in the U.S.

|

Rank |

Commercial health insurance plans |

ELAHERE |

|

1 |

Kaiser Permanente [Southern CA Commercial HMO 3-Tier] |

x |

|

2 |

Elevance Health (Anthem) National Drug List 5-Tier |

NF PA |

|

3 |

Health Care Service Corporation |

|

|

BCBS Illinois Basic Drug List |

x |

|

|

BCBS Montana Basic Drug List |

x |

|

|

BCBS New Mexico Basic Drug List |

x |

|

|

BCBS Oklahoma Basic Drug List |

x |

|

|

BCBS Texas Basic Drug List |

x |

|

|

4 |

UnitedHealth [CA Traditional 4-Tier] |

x |

|

5 |

Centene [Health Net Essential Rx Drug List] |

x |

|

6 |

CVS Health (Aetna Standard Opt Out) |

x |

|

7 |

GuideWell (Florida Blue) ValueScriptRx |

x |

|

8 |

Blue Cross Blue Shield of Michigan [BCN HMO] |

x |

|

9 |

Highmark Healthcare Reform Comprehensive 3-Tier Incentive |

x |

|

10 |

Blue Cross of North Carolina Enhanced 5 Tier |

x |

|

11 |

Humana Rx5 |

medical? |

|

12 |

Blue Cross and Blue Shield of Alabama Blue Saver Bronze |

x |

|

13 |

Blue Cross Blue Shield of Massachusetts |

x |

|

15 |

Independence Health Group [Value formulary 5-tier] |

x |

|

Rank |

Health Insurance Marketplace plans |

ELAHERE |

|

1 |

Kaiser Permanente [CA Marketplace] |

x |

|

2 |

Elevance Health (Anthem) CA Select Drug List |

NF PA |

|

3 |

Health Care Service Corporation |

|

|

BCBSIL 6 Tier HIM Drug List |

x |

|

|

BCBSMT 6 Tier HIM Drug List |

x |

|

|

BCBSNM 6 Tier HIE Drug List |

x |

|

|

BCBSOK 6 Tier HIM Drug List |

x |

|

|

BCBSTX STAR & STAR Kids |

x |

|

|

4 |

UnitedHealth Group [TX QHP Standard] |

x |

|

5 |

Centene [Health Net CA Essential Rx Drug List] |

x |

|

6 |

CVS Health (Aetna Health Exchange Plan: CA) |

x |

|

7 |

GuideWell (Florida Blue) ValueScriptRx |

x |

|

8 |

BCBS Michigan [BCN HMO] |

x |

|

10 |

BCBS North Carolina Essential Q |

x |

|

11 |

Humana [FL Medicaid Preferred Drug List] |

x |

|

12 |

BCBS Alabama Blue Saver Bronze |

x |

|

14 |

Molina Healthcare [CA Marketplace] |

x |

|

Rank |

Medicare Prescription Drug Plans |

ELAHERE |

|

1 |

Kaiser Permanente |

5 |

|

2 |

Anthem Blue Cross MedicareRx [B5] |

x |

|

3 |

Health Care Service Corporation |

|

|

BCBS Illinois Blue Cross MedicareRx Basic |

x |

|

|

BCBS Montana Medicare Advantage Classic PPO |

x |

|

|

BCBS New Mexico MedicareRx Basic |

x |

|

|

BCBS Oklahoma MedicareRx Basic |

x |

|

|

BCBS Texas MedicareRx Basic |

x |

|

|

4 |

UnitedHealth [AARP MedicareRx Walgreens PDP] |

x |

|

5 |

Centene [Wellcare Value Script PDP] |

x |

|

6 |

CVS (Aetna) [SilverScript Choice PDP] |

x |

|

7 |

GuideWell (Florida BlueMedicare Premier Rx) |

x |

|

8 |

BCBS Michigan Prescription Blue PDP Select |

x |

|

9 |

Highmark Performance Formulary |

x |

|

10 |

BCBS North Carolina Blue Medicare Rx Standard |

x |

|

11 |

Humana Basic Rx Plan PDP |

x |

|

12 |

BCBS Alabama BlueRx Essential |

x |

|

13 |

Blue Cross Blue Shield of Massachusetts |

x |

|

14 |

Molina Medicare Choice Care (HMO) |

x |

|

15 |

Independence Keystone 65 Basic Rx HMO |

x |

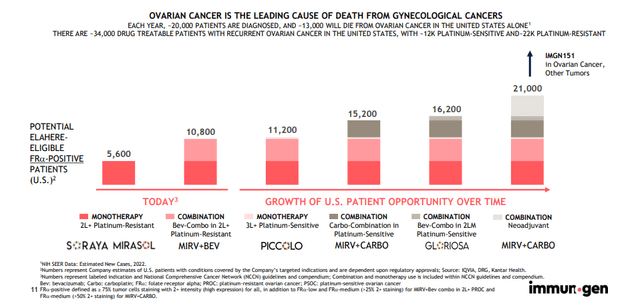

For the Top 10 payors, ELAHERE is only available to Anthem members who are below 65 years old, and to Kaiser Permanente seniors, at least according to official website documents. The sparse coverage could be explained away with the fact that drugs granted accelerated approval are not considered “available therapy” until their clinical benefit for the specific indication has been verified. ImmunoGen plans to submit a supplemental Biologics License Application (‘sBLA’) to the FDA and the MAA in the second half of 2022. ELAHERE is the only targeted therapy for FRα-expressing tumors as monotherapy or in combination with bevacizumab, per National Comprehensive Cancer Network guidelines, but cytotoxic chemotherapies are still acceptable options. When the company presents the full MIRASOL data at a medical meeting later this year and word spreads, prescribers will likely not wait for the FDA formalities and will stop considering chemo for FRα-positive tumors. Thus, ELAHERE will likely corner the platinum-resistant FRα-positive market of 10,800 patients (Figure 2).

Figure 2. Ovarian Cancer Market Opportunity

ImmunoGen

Financials

ELAHERE generated $29.5 million in net sales for the quarter ended March 31, 2023, the first full quarter of launch following approval. Operating expenses were $91.6 million, broken down as $51.6 million of research and development expense and $40 million of selling, general and administrative expenses. Total revenues were $49.9 million and net loss was $41 million. Revenue guidance for 2023, excluding ELAHERE product sales, was updated to $45-$50 million and operating expenses to $320-$335 million. In April, ImmunoGen received the initial $75 million tranche of the non-dilutive credit facility with Pharmakon Advisors, with an additional $100 million available. At the start of the price spike in May, the Company sold 26 million shares at $12.50 per share to raise a gross $325 million, plus a likely $48.75 million. These additional funding strengthened the $201.2 million cash position at the end of Q1.

Other Progress

The Q1 call highlighted several positive developments as well as catalysts in the second half of 2023:

- In April, ImmunoGen appointed Isabel Kalofonos as Senior Vice President and Chief Commercial Officer. As the former head of Takeda’s (TAK) Hereditary Angioedema franchise, Ms. Kalofonos led the launch of blockbuster monoclonal antibody, TAKHZYRO.

- Partner Huadong Medicine will be submitting a BLA to the National Medical Products Administration (NMPA) of China for ELAHERE in FRα-high PROC.

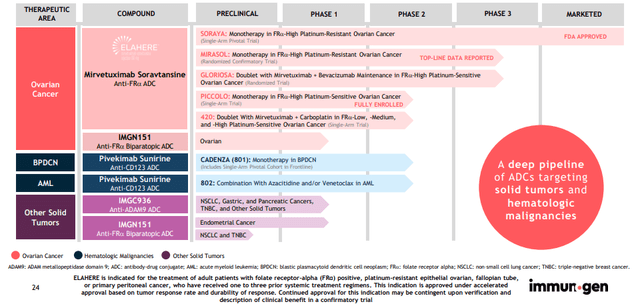

- Clinical data readouts (Figure 3) include topline for PICCOLO, a single-arm Phase 2 trial of mirvetuximab in FRα-high platinum-sensitive ovarian cancer (PSOC); two cohorts evaluating the pivekimab triplet with Roche’s (OTCQX:RHHBY) Venclexta and Bristol Myers Squibb’s (BMY) Vidaza in frontline AML at the American Society of Hematology Annual Meeting in December; and the interim analysis of the IMGC936 non-small cell lung cancer cohort.

- Enrollment in the pivotal Phase 2 CADENZA trial of pivekimab monotherapy (including frontline) for blastic plasmacytoid dendritic cell neoplasm is expected to be complete.

Figure 3. ImmunoGen Pipeline

ImmunoGen

Takeaways

I believe ImmunoGen is on the cusp of being rated a Buy from Seeking Alpha’s Quant system, with bad grades on Valuation and Profitability always being a problem among biotechs as product adoptions may be inaccurately covered. Valuation has been in the C to F range since Quant debuted and won’t improve until sales get better, in my opinion. The major risks in biotech involve mostly clinical (e.g. trial failures, safety concerns) or financial aspects. ELAHERE has so far been exemplary in PROC but could falter in PSOC (PICCOLO). The pivekimab trials aren’t sure things, either. There are fewer concerns financially, as the cash runway extends into 2026 without help from ELAHERE revenues. Traditional chemo no longer appears to be a threat, and other agents targeting FRα are years away from approval.

To conclude, ImmunoGen is an attractive biotech with a new earning drug and high growth potential. The opportunity is comparable to TG Therapeutics (TGTX), which is touted as a Strong Buy for a likely stellar launch for its first product, Briumvi. Another similarity is in Briumvi’s competitive advantages that could take away market share from established rivals. I expect ELAHERE to monopolize FRα-positive PROC. Finally, both drugs have little coverage to date this early in their launch cycles, but that will undoubtedly change. With a monthly cycle cost of $18,500-$25,000, today’s U.S. market is at least $2.4 billion. How soon the ADC achieves these revenues depends on insurers coming on board. Kaiser Medicare is leading the way, and that’s always a good sign.

Read the full article here