Investors Still Impatient

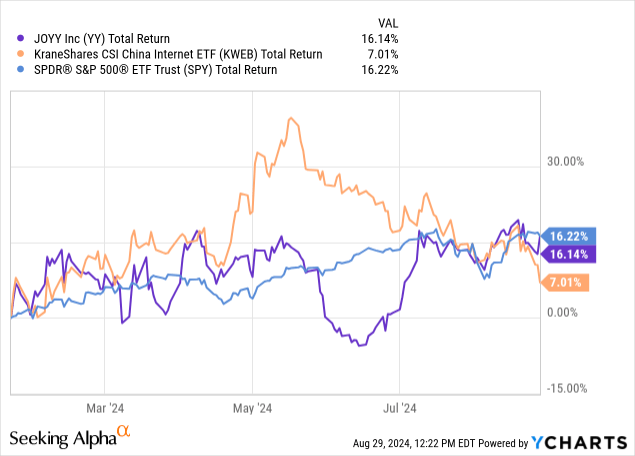

I’m sure investors have grown impatient with JOYY (NASDAQ:YY) because the stock is languishing in the mid $30s, the company doesn’t pay a dividend anymore, and management hasn’t given us an update on the YY Live sale reversal Baidu (BIDU) initiated in January. Most stocks in the China tech sphere have been decimated in this multi-year bear market. As you can see from the chart, JOYY’s stock has done fine relative to Chinese tech stocks (KWEB) and the S&P 500 since my last article. However, nothing major has changed; it still has about $2.7 billion more in assets than liabilities (excluding goodwill) which is above its $2 billion market cap (using basic shares outstanding).

In my last article, I stated Baidu could give JOYY $700 million in cash to make up for the profits YY Live earned in the time Baidu controlled it. Plus, I said JOYY could spin off the division for $500 million. If this was an American company, we might at least have a timeline on when this legal battle over YY Live’s cash flow will be resolved. Since it’s a Singapore company dealing with a Chinese one, we get nothing. My only solace in this uncertain situation, is that we are dealing with Baidu instead of the Chinese government which stalled the deal for years. Baidu decided to reverse the deal because it knew it would never get approved.

My conservative estimate is the situation will be resolved 18 months from the cancellation announcement in January which would give us a resolution mid-next year. Baidu will likely argue the improvements it made to YY Live need to be subtracted from the cash YY Live generated under its ownership when determining how much money JOYY receives. However, the likely decline of the division’s profitability over that period due to Chinese government intervention might make that argument unconvincing. JOYY can say, “If you made so many improvements to YY Live, why is it making less of a profit now than when we sold it to you?”

Baidu probably made fewer improvements to the livestreaming website/app in recent quarters due to the likely decline in its earnings and the increasingly likely scenario that the government wouldn’t accept the deal. This potential debate doesn’t change how much money I think JOYY will get. I’m just detailing what could make a simple decision, where Baidu just adds up all the profits YY Live has made since the deal closed, take longer than we think.

Unless the cash JOYY gets is way below my estimate, any type of clarity on the situation is going to be viewed positively by investors since this offshore cash will likely go straight to buybacks. Investors never like to bet on a potential positive when the timeline is unknown. If someone told you they will give you $100, 2 years from now, it’s very easy to figure out what that’s worth today. If someone else said they might give you $150 or some other amount in anywhere from 1-5 years, it’s impossible to figure out what that’s worth. Therefore, impatient investors haven’t priced a solution to this YY Live situation into the stock.

New CEO & Busted Convertible Note Bought Back

Before I discuss the Q2 results, I’ll review the 2 intra-quarter news items. Firstly, JOYY’s co-founder, chairman, and CEO, David Xueling Li stepped down. Ting Li, the firm’s director and COO, is taking his role as chair of the board and CEO. Xueling Li will stay on the board. Ting Li has been the COO since 2016 and has been with the firm since 2011.

Investors own JOYY for its cash position, which can be used for buybacks, and its profitable stable social media business. As long as Ting Li continues on the current path of profitable growth and returning cash to investors, there isn’t much execution risk. My one ask is that she doesn’t start spending a lot of money on marketing to drive user growth which causes losses. As I will detail in the next section, in Q2 JOYY bought back more shares than Q1 and lowered sales & marketing expenses due lower spending on user acquisition. I’m not worried that she will lead the firm in a different direction.

Separately, in June JOYY bought back its busted convertible note 2 years early at a discount. In June 2019, JOYY issued a $500 million 1.375% senior convertible note that expired in 2026. The conversion price was $95.9. The stock price was $71.04 on the day the note was issued. Expecting 35% price appreciation in 7 years didn’t seem like a crazy thing at the time, but anything related to Chinese tech has been decimated in recent years. The KraneShares China internet ETF is down 43% since this deal was made.

A busted convertible note is when the stock price is more than 50% below the conversion price. It became common for tech firms to buy them back during the 2022 tech bear market. JOYY was able to buy its $500 million convertible note for $405 million. The firm previously bought back its other $500 million note in June 2023 which would have expired in 2025. The company lowered its cash position and its debt with these deals. It could issue new debt to buyback stock, but I think management will want to resolve the Baidu situation first. Obviously, that will give them cash. It would also allow JOYY to borrow money at a lower rate, since its balance sheet would be strengthened.

Strong Headline Numbers: EPS & Sales Estimates Beat

JOYY reported $1.17 in non-GAAP diluted EPS (converted to ADS (American Depositary Shares)). This beat estimates by $0.25 and was down from $1.29 in Q2 2023. However, it was up from $1.02 in Q1. I think investors should care more about the cash situation because this is a buyback story. The firm produced $71.1 million in net cash from operating activities which was up from last year’s $61.8 million, but down from Q1’s $75 million. Operating expenses were up from $191.7 million last year to $198.7 million this quarter. However, this was due to general and administrative expenses rising $11.7 million to $40.7 million which was mainly caused by impairment losses from equity investments which have no reflection on operations.

Q2 cost of revenues were up 4.8% to $366.2 million year over year which was down slightly from $369.2 million in Q1. That gave them slight operating leverage sequentially because sales were up from $564.6 million to $565.1 million. This 3.3% year over year sales growth led to a $6.1 million estimate beat. On the call, management pointed out that BIGO’s 10.1% sequential increase in operating profit (overall Group up 10.2%) was due to optimizing Bigo Live’s content costs.

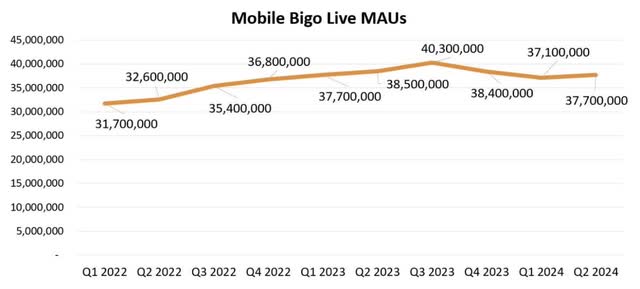

Furthermore, BIGO’s sales and marketing expense was down 9% quarter over quarter to $67.7 million. BIGO includes Bigo Live, Likee, and imo, but the most important app is Bigo Live. It’s impressive that despite content optimization and lower sales & marketing expenses, the firm reversed the decline in Bigo Live’s monthly active users. As you can see from my chart, MAUs (monthly active users) fell 1.9 million and 1.3 million in the prior 2 quarters before increasing 600k this quarter. Bigo Live is the profit center of the business and the only app that has been consistently adding users in the past couple years. It’s great to see that declining user trend reverse.

Author’s Calculations

The best way to grow the user base without increasing marketing costs is to add new features. On the call, management highlighted Bigo Live’s Real Match feature which came out last year. Real Match creates a space for users to meet new people. The feature’s DAU penetration doubled in the past 6 months to 20%. This drove a 4.2% sequential increase in streamers and a 6.5% rise in users going live. This increased user registration and payment conversion. Specifically, BIGO’s total paying users were up from 1.53 million last year to 1.66 million (down 10k sequentially). Remember, BIGO includes 3 apps, not just Bigo Live. BIGO’s revenue per paying user was $233.5 in Q2 which was down from $248 last year and down from $235.4 last quarter. BIGO’s advertising business is countering this decline which I will discuss later.

Developed Country Growth Helped Make This A Sneaky Good Quarter

There were two main reasons this was a sneaky good quarter. The results under the hood were better than what the headline numbers suggest even though sales and earnings beat estimates. Firstly, developed markets vastly outperformed the other regions. These are higher quality earnings since earnings in this region can be returned to shareholders (unlike mainland China) and are more likely to be stable (unlike the Middle East & southeast Asia). The US has greater political stability and more of a commitment to the rule of corporate law than Saudi Arabia (JOYY’s largest Middle Eastern market) for example. Furthermore, the US economy is more diversified, making it less impacted by something like falling oil prices.

Starting in Q1 of this year, JOYY made it easier to see how each region did via its new reporting method. It’s 4 regions are developed counties, Middle East, mainland China, and Southeast Asia. JOYY’s main focus in recent quarters has been on improving its developed markets region. On the call, management said it is relocating advertising budgets and operational resources to regions with high monetization potential which include the US, Great Britain, Japan, South Korea, and Australia.

Developed countries had a 32% year over year increase in sales (up 5% sequentially). These countries are now 54% of overall sales. Specifically, Bigo Live had a strong performance in this region. The app had 9.4% yearly growth in MAUs, 20.3% growth in paying users, and 11% sales growth. That’s a pretty large increase in paying users since BIGO only had 8.5% growth. Furthermore, global Bigo Live MAUs were down 2%, which shows rest of world MAUs were down significantly.

The rest of world is still useful to JOYY especially outside of mainland China where the money can be used to buyback shares. Supporting this point, 35% to 50% of developed country purchased virtual gifts went to creators in other regions. For example, a US viewer can give a creator in Indonesia a gift which JOYY gets a cut of.

If it wasn’t for the firm eventually getting the YY Live business back, JOYY would have a very small Chinese business. In Q2, mainland China was only 11% of sales. Its sales in China were down 23% year over year. To be clear, YY Live isn’t included in these numbers. Once YY Live is spun-off/sold, investors will have a stronger argument that JOYY is unfairly grouped with Chinese tech stocks. At that point, it might get a higher multiple. The current multiple on 2025 EPS estimates is only 10.9. JOYY has consistently beaten estimates, so results may make it look even cheaper.

Besides China, the Middle East was also very weak. Sales in this region were down 32% year over year and 14% quarterly. This is probably unrelated to the Israel-Gaza conflict since Saudi Arabia is JOYY’s primary Middle Eastern market. Furthermore, management guided for a sequential improvement in the Middle East in Q3. If developed markets can stay strong next quarter, JOYY could have a solid topline result, with the biggest declining region returning to growth.

Shopline Unexciting, But BIGO Audience Network Emerges

Shopline is the ecommerce platform JOYY has a 70.4% stake in. It’s like Shopify for Southeast Asia. In my last article, I valued JOYY’s portion of the business at $800 million, but I suggested it needed to quickly grow to reach profitability. Q4 is the most important quarter for online spending, so I’ll focus on Q4 2023. JOYY doesn’t exactly say what Shopline’s sales were and investor relations didn’t answer my recent question about it yet. The best estimate comes from the non-livestreaming category of “All Other” sales which was about $52 million in Q4 (down about 3%). It had even weaker results in the first 2 quarters of this year (down 15% year over year in both quarters).

It’s hard for me to value Shopline, but if we assume it’s losing money and not growing, it’s no longer interesting to investors. At minimum, I need to cut my estimated valuation in half. That sounds like a severe cut, but I have had to analyze this majority investment stake with very little information and no commentary from the firm. Usually, firms highlight when business lines are doing well. If Shopline accelerates, management might tell us. For now, this isn’t an exciting aspect of investing in JOYY.

The 2nd reason this was a sneaky good quarter was the emergence of the BIGO Audience Network. This nascent advertising network replaces my prior excitement for Shopline. This is reported as non-livestreaming BIGO revenue. Lucky for investors, management is willing to discuss this new business line unlike Shopline which it ignores completely on the calls. Specifically, non-livestreaming BIGO sales were $67.8 million in Q2 which was up 162% from last year and up 7.5% sequentially. This category isn’t entirely made up of the BIGO Audience Network, but the network is the main reason for its growth. The network’s revenue was up 12.8% quarter over quarter. It now has positive gross and operating margins. It’s expected to grow sequentially in the 2nd half which includes the holiday shopping season. I’m curious how strong Q4 will be. It could be big enough to drive topline Group sales higher year over year.

This new business line diversifies the Group away from relying on paying users. I’d argue it’s easier to deliver ads to free users than to get payers. That’s why social networks like Snapchat, Twitter, and Instagram only recently started selling subscriptions. JOYY has done this in reverse. Having more users in developed countries will help advertising since they have higher ad rates (consumers in this region have more purchasing power).

Likee is JOYY’s short form video app that has done well in India because India banned TikTok. The app’s MAUs fell from to 37.5 million in Q1 to 35.6 million in Q2. While it has been in decline for a while, sequential DAU growth in Europe and advertising inventory optimization catalyzed a 34.7% yearly increase in Likee’s sales. Remember, Likee’s advertising counts as non-livestreaming BIGO sales. JOYY added AI-powered filters and effects to Likee in Q2 which helped DAU time spent increase 1.3% quarterly.

JOYY Is A Buyback Machine

JOYY’s profits have had a very low correlation with the stock in the past couple years during the China tech bear market, which is why investors are so focused on the buyback program. If the market is pressuring anything related to Chinese tech, the only hope JOYY investors have is a large buyback. The good news for investors is the buyback increased sequentially. It rose from $54.5 million to $71.4 million which is a remarkable 3.9% of ADS. If an American firm bought back 3.9% of its shares in a quarter, investors would be marveling over how great management is to shareholders.

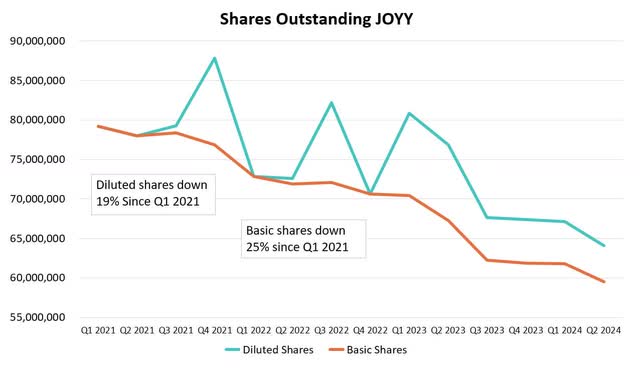

I manually tabulated the historical decline in basic and diluted shares outstanding. There was a discrepancy in Q3 2021 diluted shares outstanding. It’s listed at 79.2 million in one spot and 89.9 million in another spot. I put 79.2 million in the chart because it made more sense. This quarter wasn’t the starting point of this analysis, so it’s not that important.

As you can see below, diluted shares outstanding are down 19% since Q1 2021 and basic shares are down 25% in that period. Recently, the diluted share count has been falling quicker. That might be related to the $1 billion in total convertible notes the firm purchased in Q2 2023 and Q2 2024. Using the basic share count, the firm has a $2.06 billion market cap. It has a $2.22 billion market cap using diluted shares.

Author’s Calculations

The firm extended the expiration date of the $400 million it has left in its buyback from this November to November 2025. This makes sense because it can’t complete the buyback within a few months. $400 million is 19.4% of the company if you use basic shares and 18.2% of the diluted shares. If JOYY buys back $71.4 million in each of the next 5 quarters it has left in the buyback, it will repurchase $357 million. That would provide plenty of support for the stock in the next few quarters. The average daily volume is 357k shares which is $12.3 million ($3.1 billion annual). $71.4 million is about 9.2% of the shares traded last quarter. It’s very hard for the stock to fall with that level of support even with relentless selling from China tech ETFs.

Guidance, Stock Price Expectations, & Risks

JOYY guided for $555 to $569 million in Q3 sales. The mid-point of that guidance is $562 million, which is down 0.5% from last quarter and down 0.9% from last year. I expect the firm to get near the high end of its guidance since management is usually conservative. According to Seeking Alpha, in the past 2 years prior to this recent report, JOYY had beaten EPS estimates 100% of the time and beaten sales estimates 63% of the time. The sales beat percentage will look better after it includes the Q2 beat. The firm said BIGO’s sales would be up in 2024, but that’s not surprising because its sales are already up 7.8% on the year.

In accordance with its cost cutting measures, JOYY is making adjustments to BIGO’s non-core audio livestreaming product, which will cut costs and have a modest negative impact on BIGO’s topline sales in Q3. Management suggested Bigo Live’s profit margin might increase slightly in Q3, but this audio headwind will overtake Bigo Live’s improvement, leading to a slight decline in non-GAAP BIGO operating profits. The firm said these changes to its audio product are to enhance risk controls. This might be a safety feature, but it’s too vague to tell. Finally, the firm said its non-GAAP loss in its “All Other” segment will narrow slightly in Q3. This implies the losses from Shopline will decline. I’m not surprised because if sales aren’t growing, costs need to be taken out.

Given the firm’s solid Q2 results, its shift to developed country sales, and its large buyback, I think JOYY stock will outperform the Chinese tech sector in the near term. However, it probably won’t rally sharply unless we get a solution to the YY Live legal battle. The stock only has a 2.5% short interest which is a far cry from the elevated short interest it had following the Muddy Waters short report in November 2020. JOYY no longer pays a dividend, but at least investors don’t have to deal with the heightened volatility which often occurs in stocks with a high short interest.

The biggest risk to the stock is weakness in the Chinese tech sector. The biggest risk to the company is competition in the mobile livestreaming and short form video industries. Competition is always high. I don’t see the competitive landscape changing substantially in the next 12 months. The other risk is macroeconomic in nature. Virtual gifts are highly discretionary. If job losses spike in the areas JOYY operates in, revenue per paying user will fall (advertising is also cyclical). The good news is inflation has come down. Central banks now need to execute on a soft landing for the global economy which is easier said than done.

Read the full article here