Introduction

Auto manufacturers have been beat up pretty bad lately, with shares of most companies in the space trading at 52-week lows. With growth concerns, and a slowdown in manufacturing as consumers put that new car purchase on hold, companies like Linamar (TSX:LNR:CA) (OTCPK:LIMAF) have been experiencing weakness, which has hurt their near-term profitability. As shares have gotten hammered, I wanted to review the company’s latest results post-Q2 to see if shares represent good value today.

Company Overview

Linamar is a manufacturer that specializes in the design and production of precision-engineered components and systems for the automotive, industrial, and agricultural sectors. Their products include powertrain systems, driveline components, and various complex parts for machinery. Founded nearly 60 years ago, the company has become a leading manufacturer that auto brands can trust to deliver consistent results.

Linamar has grown into a major player in the manufacturing industry with operations around the world. The company is known for its expertise in advanced manufacturing technologies and innovation in engineering.

Linamar can be thought of into two primary segments: the Mobility segment and the Industrial segment. In the Mobility segment, the company is involved in developing and manufacturing propulsion systems, structural and chassis systems, energy storage and power generation for both the global electrified and traditionally powered vehicle markets.

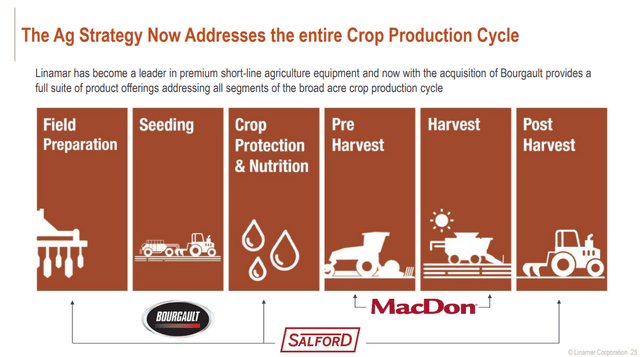

In the Industrial segment, the company owns Skyjack and the newly formed Linamar Agriculture operating group, which consists of the MacDon, Salford and Bourgault brands. Skyjack serves the aerial work platform industry and manufactures scissors, boom and telehandler lifts.

Recent Results

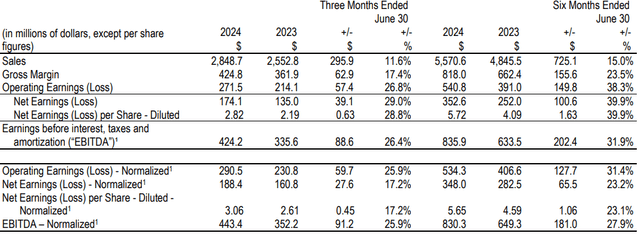

When looking at the second quarter results out of Linamar last week, the company reported results that were largely in line with consensus, with the highlight being the ongoing sequential margin expansion within the Mobility segment. The margin outperformance in both segments was offset by modestly lower sales growth within the Industrial segment, specifically at Salford/tillage products. Overall, normalized EBITDA and EPS came in at $443 million and $3.06, respectively and compared favorably with consensus estimates of $432 million and $3.05, respectively (source: S&P Capital IQ).

Company Filings Company Filings

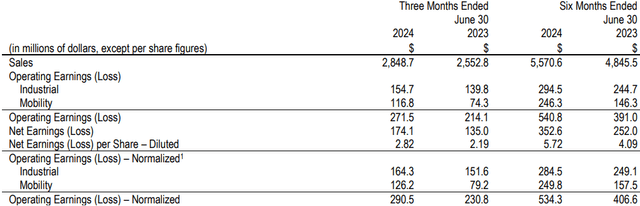

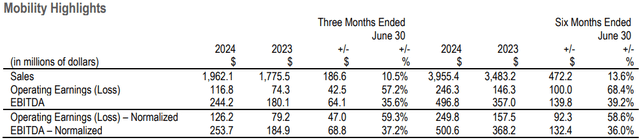

Digging into the results a bit deeper by segment, in the Mobility segment, sales increased 11% year over year, which fell short of expectations. This was largely attributable to the marginal shortfall to the industry trend of slower adoption rates of EV volumes. The year-on-year double-digit growth was driven largely by acquisition contributions from Durah-Shiloh (August 2023) and Mobex (November 2023), along with heightened CPV on modest global light-vehicle production volume growth. In the Mobility segment, margins continued to demonstrate sequential improvement, increasing about 200bps compared to last year to 6.4%. This was driven by margin increments on volumes, along with the maturation of acquisition and launch platforms.

Company Filings

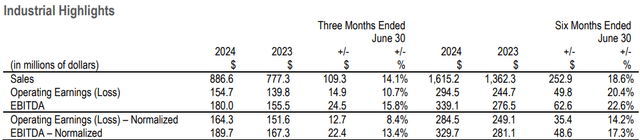

In the Industrial segment, performance during the quarter highlighted some demand softness in my view, particularly in Linamar’s agriculture segment (tillage). In Q2’24, the year over year sales growth of 14.1% was largely due to acquisition contribution of Bourgault, with organic growth contributing 1% during the quarter. The operating margin, although down compared to last year, wasn’t a major drop as we’ve seen previously. This decrease was as a result of outsized performance in Q2’23 and heightened launch costs related to Skyjack’s new facilities in Mexico/China. I think it’s also likely that the acquisition contribution from Bourgault was also as anticipated, a modest margin headwind.

Company Filings

Outlook

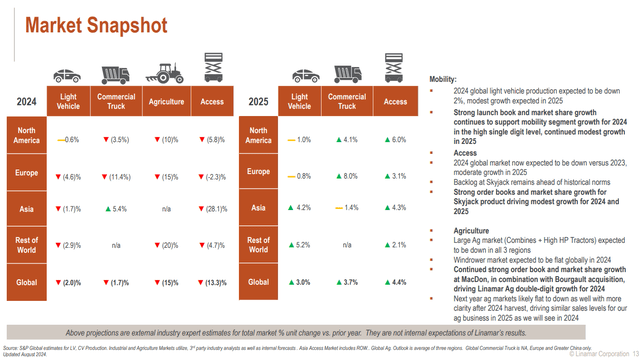

While this quarter was nothing to write home about in my opinion, I think guidance was pretty favorable and shows that the outlook is modestly improving for the industry as a whole. As such, the company updated its 2024-25 guidance, with the key revision being a softer industry and sales outlook, largely for its Industrial segment. So while I’d note the red downwards arrows for 2024, what really matters is that 2025 is expected to be better than this year.

Investor Presentation

Unpacking the guidance a bit, in the Mobility segment, management slightly lowered its sales outlook for 2024-25, attributable to slowing adoption rate for EVs. For this year, management is forecasting high-single digit growth due to acquisitions and increasing CPV to offset a modest decline in the market. In my view, I think that this should mean that we could see some pretty meaningful margin expansion as a result of higher operating income. While management didn’t chance the margin outlook for the Mobility segment, keeping a return to its normal range of 7%+ in 2025, I believe it’s fairly likely that we could overshoot given acquisition synergies.

In the Industrial segment, with declining commodity prices and softer demand conditions prevailing at major OEMs earlier in the year, I think it seemed logical that this would filter down to the short-line manufacturers. So as a result, Linamar revised guidance for lower Agriculture segment sales. That said, my long-term view on this segment is pretty bullish. Despite near-term challenges, with cross-selling brand opportunities, geographic expansion, and acquisition synergies, I think Linamar Agriculture sales can outpace the industry long-term. So while this part of the business is under a cloud today, I see sunny days ahead.

Investor Presentation

Finally, management also forecasts more modest growth assumptions at Skyjack in the years ahead. We have seen this increasingly competitive trend recently from its peers, but I’d note that Skyjack should benefit from geographic expansion, particularly in Mexico and China, in addition to the broadening of its product offering. The Industrial margin outlook is also unchanged, with it forecast to remain within its target range of 14-18%.

Financials and Valuation

From a balance sheet perspective, Linamar has leverage of 1.2x, which, I think, has a good chance of getting below 1.0x by the end of the year, and maybe even 0.5x by 2025 year-end. With a ramp up in free cash flow attributable to margin expansion, I suspect the company will allocate a strong portion of its free cash flow towards debt reduction. Linamar has a target ceiling of 1.5x, and I think this provides tremendous balance sheet optionality.

On the earnings call, Linamar’s management team was pestered with questions on the company’s capital allocation and buyback strategy and overall, based on management commentary on the call, I believe they are receptive based on the buildout of its Agriculture portfolio largely complete, its strong FCF outlook, and the punitive valuation.

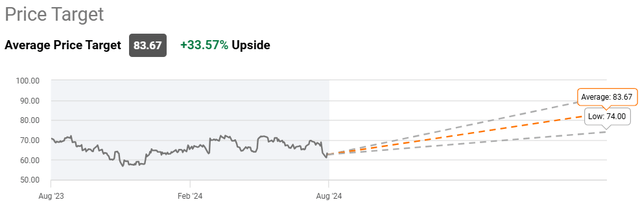

At current levels, I don’t think Linamar’s price reflects its future outlook. And it would seem that most analysts would agree. When we look at the sellside expectations for the company’s stock, there are currently 5 ‘buy’ ratings’ and 1 ‘hold’ rating. The average price target is $74.00, which implies about 34% upside from the current price.

Seeking Alpha

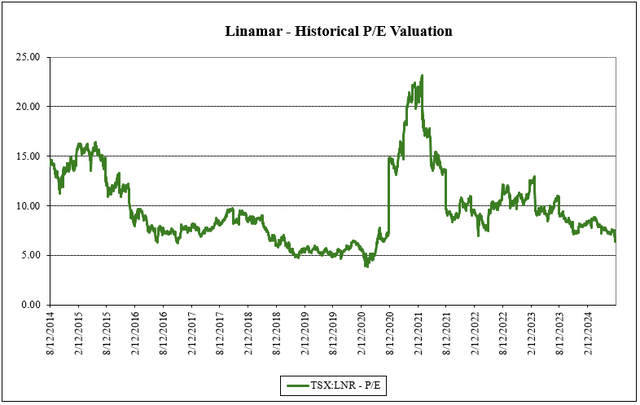

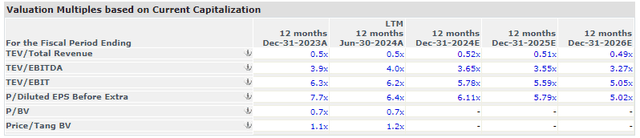

On valuation, Linamar trades at a bargain-basement valuation. Historically, the company has traded within a range of 3.8x and 23.1x, at an average P/E multiple of 9.6x P/E (source: S&P Capital IQ). At 6.4x P/E, the company has rarely been this cheap before, so I’d say that shares represent good value, especially when we consider EPS is expected to grow 16.8%, 5.6%, and 15.3% from 2024 through 2026.

Author, based on data from S&P Capital IQ Author, based on data from S&P Capital IQ

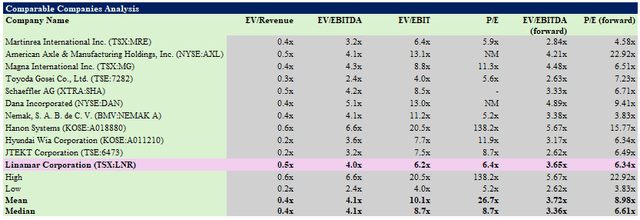

Compared to its peers like Martinrea (MRE:CA) and Magna (MG:CA), among others, Linamar appears to offer compelling value. At 6.3x forward earnings, the company trades at a discount to both the mean and median multiple at 9.0x and 6.6x, respectively (source: S&P Capital IQ). For a company with better EBITDA margins and lower leverage, I think Linamar deserves to trade at least in line with the peer group.

Author, based on data from S&P Capital IQ

Conclusion

In summary, I think Linamar presents an attractive set-up for long-term investors, who can look past current challenges. Despite facing short-term headwinds, particularly in the Industrial segment and amid broader industry slowdown, Linamar’s robust margin expansion in the Mobility segment and strategic acquisitions suggest a solid foundation for recovery and growth. I believe the company’s strong balance sheet, favorable valuation, and positive long-term outlook further enhance its appeal. With shares trading at historically low multiples and an anticipated uptick in earnings, Linamar appears undervalued compared to its peers. As the industry rebounds and Linamar continues to leverage its strategic advantages, the stock offers significant upside potential, making it a compelling investment opportunity for those with a longer-term horizon who are able to ignore the short-term noise today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here