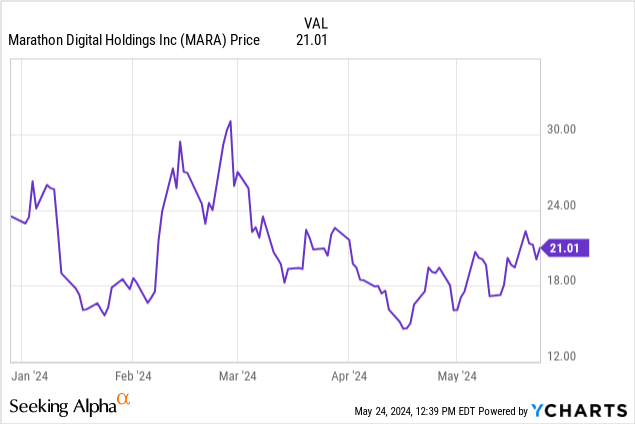

Since I covered Marathon (NASDAQ:MARA) on February 19, it went up from $24.5 to $31 one week later which was in line with my bullish position, but subsequently slid to $15. As charted below, it has partly recovered since the Bitcoin (BTC-USD) halving event dating April 19 and is trading around $21, but this upside is not likely to be sustained in the short term given crypto supply coming from miners likely to put prices under pressure.

However, this thesis aims to show that it remains a fundamentally strong miner as progress is being made on the efficiency front to tackle halving which will dent revenues and profits. Also, it has enough capital to scale rapidly to attain growth objectives.

Therefore, I have a Buy position and start by detailing why my initial bullish thesis was not sustained in the medium term.

Volatility Caused by Mining Difficulty and ETF-Related Demand

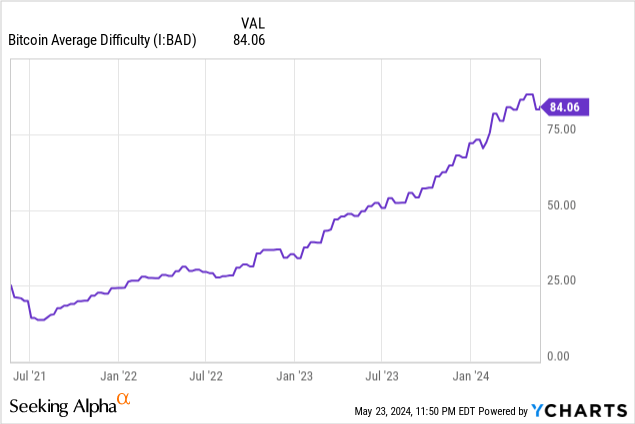

First, I had warned about the increasing mining difficulty likely to result in volatility. The reason for this is since halving reduces mining rewards by half, or from 6.25 BTC to 3.125 BTC for each new block produced and added to the blockchain, miners generally boosted production in the period before the event. Now, given this is a highly competitive space where miners use the Proof of Work mechanism to solve an encryption puzzle, the mining process only got more difficult (or time-consuming). Thus, as shown in the chart below, average difficulty peaked at 87 in early May, a new record compared to 77.6 in February.

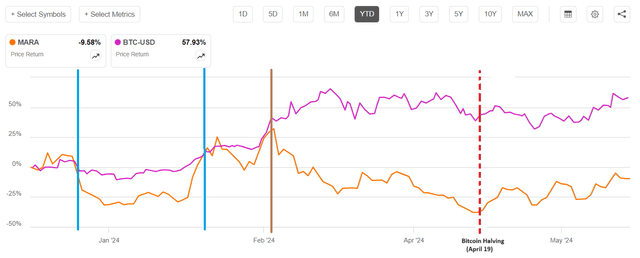

For investors, each time a peak is reached, there is volatility, both for crypto and miners as shown in the charts below which illustrate such an episode that occurred in December-January. This was a relatively short period as demarked by the two blue lines with Marathon recouping its losses versus BTC within a month. Based on this, I had anticipated the volatility period for February to be of a short duration too. However, I was proved wrong as the volatility episode whose start is marked by the brown line has persisted even today with the stock still underperforming BTC.

Charts were prepared using data from (seekingalpha.com)

The reason seems related to the pent-up demand for ETFs as investment vehicles since the Security and Exchange Commission approved ten spot ETFs in January. Thus, with investors benefiting from more choice, there was some rotation out of miners into the ETF space which is also likely to continue as more wealth advisers offer crypto products to clients like retirement pension accounts.

The question is whether, after the assets (under management) held by ETFs increase over time, money flows could again normalize benefiting the miner. For this to happen, Marathon needs to have solid finances that enable it to increase production capacity while at the same time exhibiting efficiency gains, These are important to face halving, which, depending on what extent the miner boosts production, could see its revenues decrease by half. Also, from the profitability standpoint, the industry average break-even and post-halving price for Bitcoin mining is expected to surge to around $43K compared to only $23K in March.

Focusing on Efficiency Gains

First looking at the income statement for the first quarter of 2024 (Q1) which ended in March, the miner reported a net income of $337 million or an 184% YoY increase. Noteworthily, this increase does not reflect the effects of Bitcoin halving that occurred on April 19. It was mainly driven by a favorable Bitcoin price which reached a record 73K at the end of March, combined with higher production. However, during the same period, G&A (General and administrative) expenses increased by 91% YoY to $21 million, incurred mostly to scale up the business.

This means that the margin gain was achieved mostly on the back of strong revenue growth of 223% YoY, but, looking ahead, the company has been taking the following measures to increase efficiency.

First, it has been shifting away from an asset-light strategy as it acquires more data center capacity rather than leasing. In this way, it has increased energized capacity from 584 megawatts to 1.1 gigawatts, with the primary benefit of such a move being a reduction in operating costs, namely in terms of the energy required for mining rigs. This can be potentially reduced from 0.02 KW-hour to $ 0.01-$0.015 KW-hour, resulting in 25% to 50% of cost savings, and this is for 54% of its mining portfolio. This depends on factors including location and the cooling method used where Marathon has developed the 2PIC immersion technology.

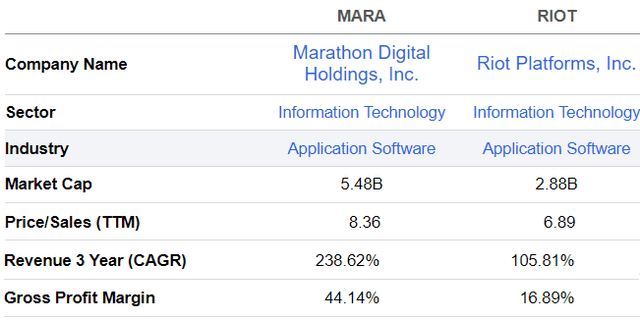

Second, it plans to add more compute power to the mining pool or 50 exahash by year-end compared to the 27 exahash at the end of Q1 which means a larger scale of operations to spread fixed costs resulting in higher gross margins. For this purpose, its gross margin of 44% is already 2.5 times higher than Riot Platforms (NASDAQ:RIOT), another large miner, while it has grown revenue faster during the last three years.

Comparison of Metrics (seekingalpha.com)

Third, more efficient mining rigs like S21 machines from Bitmain could be available at “essentially” the same price (as older ones). The reason is the halving paves the way for reduced mining participation caused by smaller miners who have not cut costs on time being forced out thereby causing an oversupply in mining rigs.

Fourth, it has restructured operations to grow in a more agile way with its core business to be known as Utility-Scale Mining. At the same time, to better monetize its expertise, two other business units have been created. One of them is Technological Innovations involving the development and sales of advanced technologies like 2PIC. The other is Energy Harvesting which aims to use renewable energy like collecting methane from landfills to power Bitcoin miners.

Now, as the world’s largest Bitcoin miner, both on a market cap and production capacity (hash rate) basis, scaling further while at the same time, gaining in operational efficiency puts it in a strong position to tackle halving, but, having a strong balance sheet is key.

Ability to Finance Expansion

Now to finance the expansion of its energized facilities and acquisition of new sites, it had recourse to its ATM program in Q1 which saw it offering securities worth $200 million. In this respect, it acquired two sites in Texas and Nebraska for $179 million to more than double its hash rate from 11 exahash to 27.8 exahash. This aggressive acquisition strategy also distinguishes it from other miners in an industry where the tendency is to lease compute.

Now, its treasury held 7,320 Bitcoin worth around $512.4 million considering a price of $70K per coin. Additionally, the balance sheet boasted $324.3 million of cash. Also, as per the CFO, it disposes of its crypto assets only to fund operating expenses. Therefore, during Q2 which will cover halving, one can expect the sale of more Bitcoins than usual to cover the revenue deficit, especially since it will have to incur more operating expenses after scaling rapidly.

Still, for risk-averse investors, according to Marathon’s CEO during Q1’s earnings call on May 9, there was ample capital to scale to 50 exahash, implying that there was neither need to tap the debt market nor raise capital for the purpose. To achieve its production target, the company can also rely on the energized space left when the leases of hosted customers currently occupying the newly acquired expire in Q2, and they vacate.

Now, the company expansion strategy may be helped by smaller miners ceasing activities as they find it impossible to cover operational costs because of lower Bitcoin prices, which puts pressure on them to dispose of their assets. They may also be insufficiently capitalized and find it difficult to refinance at the higher prevailing interest rates. In consequence, troubled assets would represent an opportunity for Marathon to expand at a relatively lower cost, but there have been no signs of miner capitulation yet and Bitcoin only briefly touched the $57K level.

A Buy Amid Crypto Volatility

Now, miners not yet capitulating or ceasing operations means that the production level has not been impacted, signifying that supply has not been reduced. On the contrary, depending on their cash positions, miners will most probably have to sell more coins on the open market to make up for their post-halving revenue deficit. This possibly explains why despite a much-anticipated surge in the price of Bitcoin driven by ETF-related demand, it has remained largely range-bound since March as illustrated below. This means that the supply has risen enough to balance the demand from fund managers for the newly launched ETFs in January, a possibility confirmed by analysts at 10x Research who also predict that around $5 billion worth of BTC could be liquidated by miners after the halving.

Chart prepared using data from (seekingalpha.com)

As a result, and depending on the speed with which miners dispose of their HODLed coins, the demand-supply equation could tilt more toward supply thereby pressuring Bitcoin’s price. This is why Marathon could suffer from further volatility in the short term.

However, looking at the longer term, it is a buy. In this case, while Marathon’s trailing price-to-sales exceeds RIOT, it still deserves better thanks to its superior growth and profitability metrics. Another reason is it trades at a trailing price-to-sales of 8.84x, much lower than 16.5x in February, or a 46% ((8.84-16.5)/8.84) discount. Therefore, after miners have adjusted to the 2024 halving, supply levels have normalized, and they again start to HODL coins, there could be an upside. Considering a 15% upside out of the 46% possible, I estimate the stock could rise to $24.15 based on the current share price of $21. This target is about the same as Wall Street’s average rating and factors in that much of the upside in crypto that was to take place has already occurred, led by the January ETF approval.

Also, news that U.S. regulators have approved the first spot Ether (ETH-USD) ETF, has been galvanizing cryptocurrencies, but this may only be a temporary upside as it does not favor the demand for Bitcoin itself.

In conclusion, this thesis has shown that Marathon is progressing on efficiency gains while disposing of enough cash to expand its mining infrastructure. Also, with $837 million of liquidity (cash plus crypto) versus $340.5 million in debt, it can weather the volatility provided that BTC stays above the $43K level. Still, beware of volatility risks.

Read the full article here