Overview

My recommendation for Nordstrom, Inc. (NYSE:JWN) is a hold rating, as I am no longer confident in the earnings growth outlook of the business given how management has guided for FY24. It appears to me that the growth contribution from the Rack business is going to continue to pressurize margins. Importantly, the off-price retail space is competitive with three large players. That said, I note the potential deal from the Nordstrom family that could drive attractive upside. Investors who like to play in special situations may find this stock attractive. Note that I previously rated a buy rating for JWN as I expected JWN to meet its FY24 guidance, and by doing so, its valuation multiple should see a positive revision.

Recent results & updates

JWN’s recent results are in its 4Q23 quarter, where it reported an adjusted EPS of $0.96, ahead of consensus at $0.88. Total retail sales grew 2.2%, driven by a full-price sales decline of 3% and off-price sales growth of 14.6%. Because of the mix, gross margins came in at 34.4% below consensus expectations for 34.8%, but SG&A saw better leverage due to volume, thereby driving an EBIT margin beat of 50bps. My high-level view of the headline results is that while earnings beat my expectations ($383 million vs. $325 million estimate), the underlying business operations do not seem to be moving in the right direction, and management has sent mixed signals on the forward outlook.

Firstly, I do give credit that rack improved throughout the year, driven by the strong rack comparable store growth of a high single-digit percentage (noted in the 4Q23 call); however, the management guide for FY24 suggests that this momentum is not going to support a positive FY24 outlook. Specifically, they commented on the following:

we expect to digital to grow as the market is, but we’re going to grow the market’s growth as we move from this year into next

Nordstrom banner stores expected to be in the flattish range, noting an offset

we’re all expecting, I think, for AURs to start to come down, but that’s going to be a little bit more difficult to predict. from: 4Q2023 earnings call

This also makes me wonder about the long-term value proposition of Rack. The concept seems to be great for consumers, as they get to buy higher-quality brands at relatively lower price points. The problem is competition. In the lower price point spectrum, there are a lot of off-price retailers that are competing for tight-budget consumers’ wallets. Among them are three very big players: TJX Companies, Ross Stores, and Burlington Stores, where they collectively have more than $80 billion of sales (>5x JWN size). If JWN becomes heavily dependent on this for growth, I would be a lot less comfortable about the long-term earnings growth prospect because margins are unlikely to improve a lot given the nature of offering off-price items.

On the point of margins, management’s guidance sort of gave a pre-look into my concerns. Given the strong growth in the Rack business, I would have expected margin expansion in 2024, especially considering supply chain efficiencies and inventory management. However, the FY24 guidance noted 3.5 to 4% EBIT margins, which implies a flattish or declining EBIT margin vs. FY23. What I infer from this is that the pressure on gross margin (from the growing mix of off-price items) is going to continue impacting the business, so much so that it offsets any operational efficiencies and growth from Rack. Another piece of evidence that gross margin pressure is real is that if we look back at the FY21 investor day, management expected 4.5% EBIT margins with $14.5 billion of revenue, but as of FY23, JWN has already had $14.69 billion of revenue, yet the EBIT margin is nowhere near 4.5%.

Our third priority of 2023 was to optimize our supply chain capabilities, a continuation of efforts that began in 2022. In Q4, for the sixth consecutive quarter, the team delivered another 50-plus basis points of improvement in variable supply chain expense savings, while at the same time improving our click-to-delivery speed.

Our second priority for 2024, operational optimization, builds upon the success that we’ve had in optimizing our supply chain capabilities. from: 4Q2023 earnings call

An interesting development that took place two weeks ago was when the news of members of the Nordstrom family exploring taking the business private went public. In my opinion, this is major good news for shareholders. For background context, the family owns about 30% of the business, so they are really incentivized to make the business worth a lot more than it is today. Notably, back in 2018, they wanted to privatize the business for $50 per share (this gives a sense of how much they value the business if we remove all the macro uncertainties over the past few years). At the current share price of ~$19, it makes even more sense for them to be more aggressive in privatizing, settle all the operations issues (without the noise from public investors), and likely re-IPO the business again at some point. Previously, when the $50 offer was made, it got rejected because an agreement on valuation couldn’t be made, and I believe the reason was because the shares were worth $40+ at that point, so it was not attractive to shareholders (the premium was 24%). Also, the share price was >$80+ just a few years ago in 2015, and the market was fairly bullish back then (S&P was 1 way up and the interest rate was still at near 0%), so shareholders were more likely to be in “risk-on” mode. I think a deal is more likely to happen this time around, as shareholders that held the shares since are now in deep losses, making them more likely to accept a deal that can help them recoup some losses.

Valuation and risk

Author’s valuation model

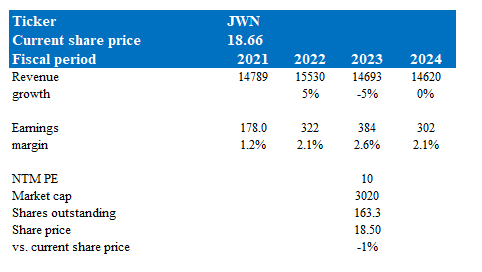

According to my model, JWN is valued at $18.50. This target price is based on my revised growth forecast that JWN will see flattish growth for FY24 and earnings declining to $302 million as guided at the midpoint. This is the opposite of what I was expecting previously (positive 5% sales growth with improving margins); as such, I am a lot less favorable on the business and valuation today. I previously expected valuation to go up to 12x forward PE, but because of the outlook and my concern about Rack sales becoming the growth driver for JWN, I am no longer expecting any revisions in valuation multiples.

That said, I want to highlight the potential upside of the deal with the Nordstrom family. If we use the same 24% premium provided previously, the stock could be worth ~$23 per share. And as I discussed above, insiders are well incentivized to make the shares worth more, given that they hold 30% of the equity (this is close to $1 billion at stake). So, I am quite positive they will come out with an offer soon, especially since they have already instructed their financial advisors to evaluate private equity firm interest in a potential deal.

Summary

Summarizing this post, the recommendation for JWN is a hold rating as I have become less optimistic on the fundamental outlook. While recent earnings beat expectations, the growth contribution from the lower-margin Rack business raises concerns. Notably, management’s FY24 guidance implies flattish or declining margins, despite supply chain improvements. While the potential deal with the Nordstrom family presents upside, the core business fundamentals are concerning.

Read the full article here