Investment Thesis

I am rating this tock a hold as I keep close tabs on its turnaround measures as well as observing any confirmatory signal of a bullish trend such as the MACD moving above the zero line and the stock price moving above the moving averages [MAs].

On Dec 2023, I reiterated my hold rating on Piedmont Lithium Inc. (NASDAQ:PLL) since from a technical point of view the short-term trend was bearish. Since then, the stock has lost more than 60% underperforming the S&P 500 by a margin of about 80%. In my previous article, I expressed my optimistic view of the company’s long-term performance stemmed from the company’s experienced management and recommended patience because the short-term outlook was pessimistic which has proven right given the more than 63% share price slump.

In this updated article, I find the stock to be at its 5-year support zone where I believe a trend reversal is likely. Further, the management which I fully trust (refer to my previous coverage) has been implementing turnaround strategies which I think could steer the onset of a bullish momentum and this is supported by the bright outlook on its financials. While I recommend more patience here as we wait for some of the ongoing measures to conclude as well as assess their impacts, I believe we are closer to a buy decision.

Technical Analysis: Potential Bullish Onset

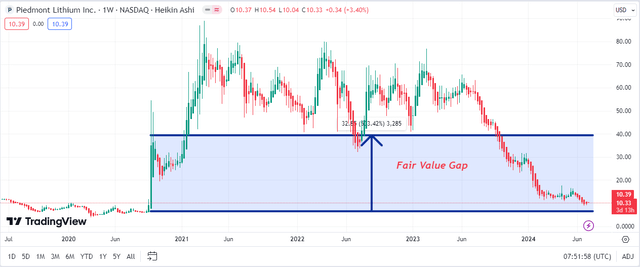

In my previous technical point of view, I had expressed by bearish outlook of this stock where the price has dipped from $28.12 to $11.21 currently. In my assessment, the stock is trading at its 5-year strong support zone where I expect a trend reversal.

Trading View

Looking at the technical indicators for a clear outlook, the MACD is slightly above the signal line and rising since Feb 2024 indicating a potential onset of a bullish trend. Further, the RSI appears to have bounced back from the oversold region of as low as 17 and it has been rising an indication that PLL could be entering a bullish phase.

Trading View

In summary, PLL has entered a decisive moment where there are signs of a potential bullish trend onset which is yet to show confirmatory signals. A possible confirmatory signal would be the MACD crossing above the zero line and the price crossing above its MAs. Until then, I am patient. Should the bullish trend gain momentum as would be confirmed by a divergence between the MACD and the signal line as well as a rising OBV indicator, I see a significant upside potential of more than 200% with a price target of about $40 as marked by my fair value gap presented below.

Trading View

Turn Around Initiatives

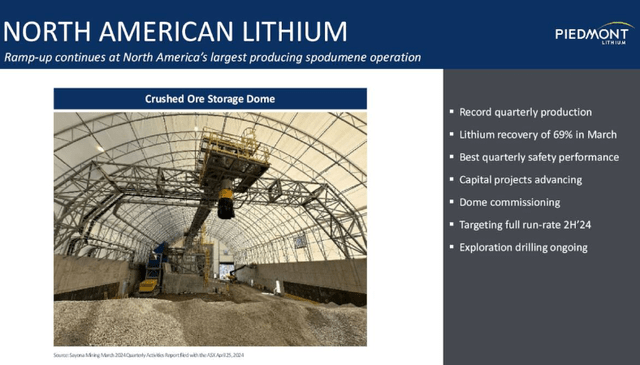

While I expressed my confidence in PLL’s management team in my previous article, it has embarked on a comprehensive turnaround strategy aimed at stabilizing its operations and enhancing shareholder value. To begin with are the optimization operations and capital projects. Piedmont is focusing on operational efficiencies majorly in its North American Lithium (NAL) joint venture. The company seeks to improve productivity significantly through this project.

PLL Q1 2024 Presentation

The most notable aspects of this imitative are the estimated production levels. After Carolina Lithium is fully integrated, it is anticipated that it will produce 30,000 metric tons of lithium hydroxide annually. Additionally, their Tennessee Lithium operation, which has been granted permission, seeks to process spodumene concentrate from the Ewoyaa project, NAL, or other market sources to generate 30,000 metric tons of domestic lithium hydroxide annually.

Compared to the current total anticipated annual lithium hydroxide production capacity in the United States of 20,000 metric tons, upon production, they anticipate having an estimated manufacturing capacity of 60,000 metric tons.

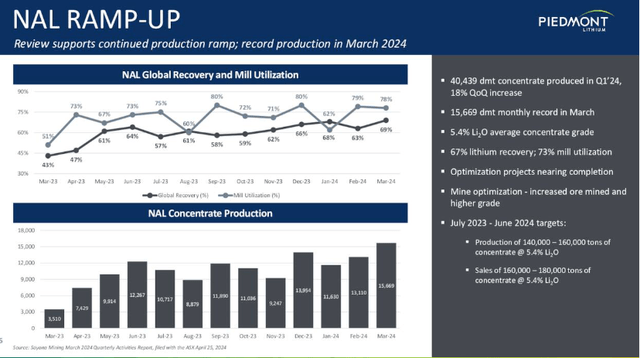

With this anticipated ramp-up in production, PLL is set to have a triple effect on its output from the project which I expect to have an impact of equal measure on its financials when the project is fully executed in the second half of 2024. Based on previous performances, the project has shown promising signs which instills confidence that is moving in the right trajectory.

PLL Q1 2024 Presentation

The other key turnaround strategies worth noting are the off-take agreement and the cost-saving plans. PLL is implementing a shift towards long-term strategy contracts in a bid to mitigate the impact of the volatile spot market. Market volatility was a major headwind in my previous coverage and this could be eradicated through the offtake agreements. In my view, through the stabilized prices, the company’s revenue streams will stabilize as well as offer visibility which in turn I expect to stabilize its financial performance and mark the onset of a potentially sustainable growth trajectory.

Lastly is the cost-saving plan. The company is aiming for roughly $10 million in annual run rate savings and plans to cut its capital investment in 2024. It will also control operating expenses through careful expense management, which includes a completed 27% reduction in force. Should the company manage to save the $10 million that would imply a cost saving of about 23% of its trailing total operating expense of $44 million, something that would have a tremendous positive effect on its profit margins.

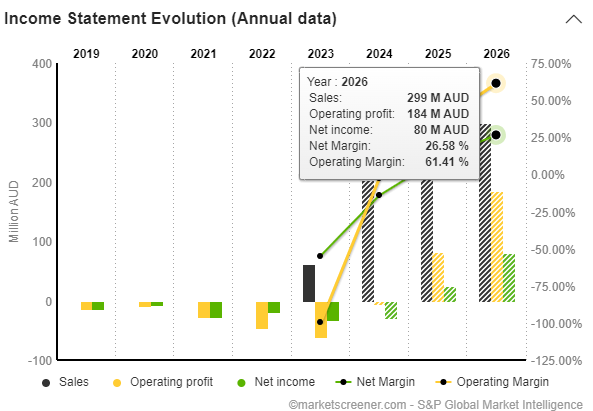

Guided by these promising turnaround initiatives, I believe the company’s bright outlook marked by consistent growth in top and bottom lines in the coming FYs is justified.

Market Screener

In summary, although the past has been challenging, the management is implementing what I believe are sound strategies aimed at higher efficiency, improved productivity, and stable prices. I think that the improved productivity coupled with stable prices will see significant growth in the company’s revenue while the bottom lines will receive a double boost from potentially soaring revenue a significantly reduced expenses. Piedmont is currently facing its financial liberation which will be a solid foundation for bullish sentiments and an onset of an upward trajectory at the support zone discussed earlier. Given that what I would consider the major initiative, the NAL ramp-up, is scheduled to be fully operational in H2 2024, we need a little more patience here before things turn rosy. In my view, this major project could be a game changer for this company.

What Other Analysts Think Of PLL

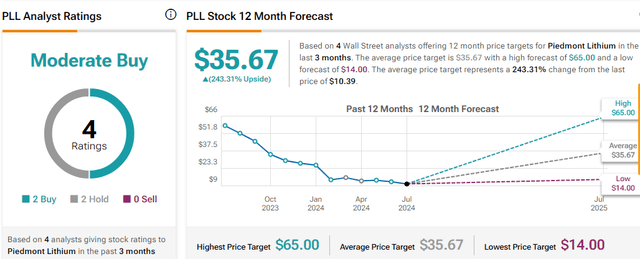

According to 4 Wall Street analysts, the consensus price target for PLL is $35.67 which is slightly below my price target of $40 mentioned in the technical analysis section.

Tips Rank

Their recommendation is a moderate buy despite their significant upside potential outlook. I believe this recommendation reflects my optimism about the company’s turnaround strategies as well as my cautious approach to the support zone which calls for patience as we wait for a confirmatory signal for bullish trajectory.

How About The Volatile Lithium Prices?

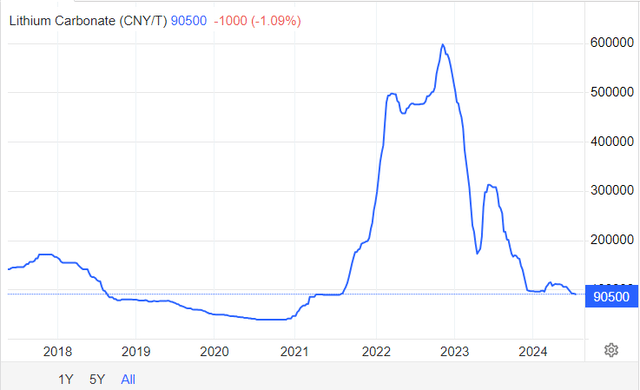

In my last article, I highlighted my concern about falling lithium prices, which will undoubtedly impact the company’s financials. The prices have crashed by more than 80% since last year.

Trading Economics

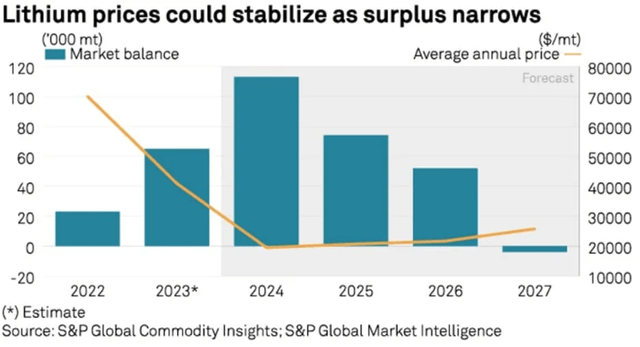

While this was a concern in my previous coverage, I view it as not a major concern currently due to the following reasons. First off, the company’s offtake agreements discussed above are seeking to implement long-term contracts that will cushion the company from price volatility and hence make its revenue generation more stable and predictable. Secondly, the massive price drop has been a corrective trend after an explosive price rise in 2022 steered by supply deficits. Looking at the current price level, it is apparent that it has come to its historical normal range where fluctuation will be relatively stable. My assertions are in line with the S&P Global Commodity Insight estimates that lithium prices will stabilize as the surplus supply arose due to massive responses to the 2022 deficit narrows.

S&P Global Commodity Insight

Following this forecast and the long-term contracts in place, I believe the company’s increased production will be the main growth lever since prices appear to be stabilizing from a micro and macro point of view.

My Final Thoughts

In conclusion, PLL is on the verge of a potential financial liberation which I think will trigger a long-term share price growth. While I hold this optimism, I call for forbearance as we wait for a bullish confirmation signal. Further, its turnaround initiatives are still being implemented and I would recommend more patience as we monitor what the effect would be on its financials.

Read the full article here